Are Uber's Self-Driving Cars The Next Big ETF Investment Opportunity?

Table of Contents

The Promise of Autonomous Vehicle Technology and its Market Potential

The autonomous vehicle market is poised for explosive growth. Market research firms project a massive expansion, driven by advancements in artificial intelligence, sensor technology, and mapping capabilities. This burgeoning market isn't just about self-driving cars; it encompasses robotaxis, autonomous delivery services, and even self-driving trucks, revolutionizing transportation and logistics. Key players beyond Uber, such as Waymo, Tesla, and Cruise, are also heavily invested, further solidifying the market's potential.

- Market size projected to reach $2 trillion USD by 2030. (Source: [Insert credible source here])

- Reduction in accidents and increased efficiency leading to significant cost savings for businesses and consumers.

- Potential for new revenue streams in ride-sharing, autonomous delivery (food, packages), and logistics.

Analyzing Uber's Position in the Autonomous Vehicle Race

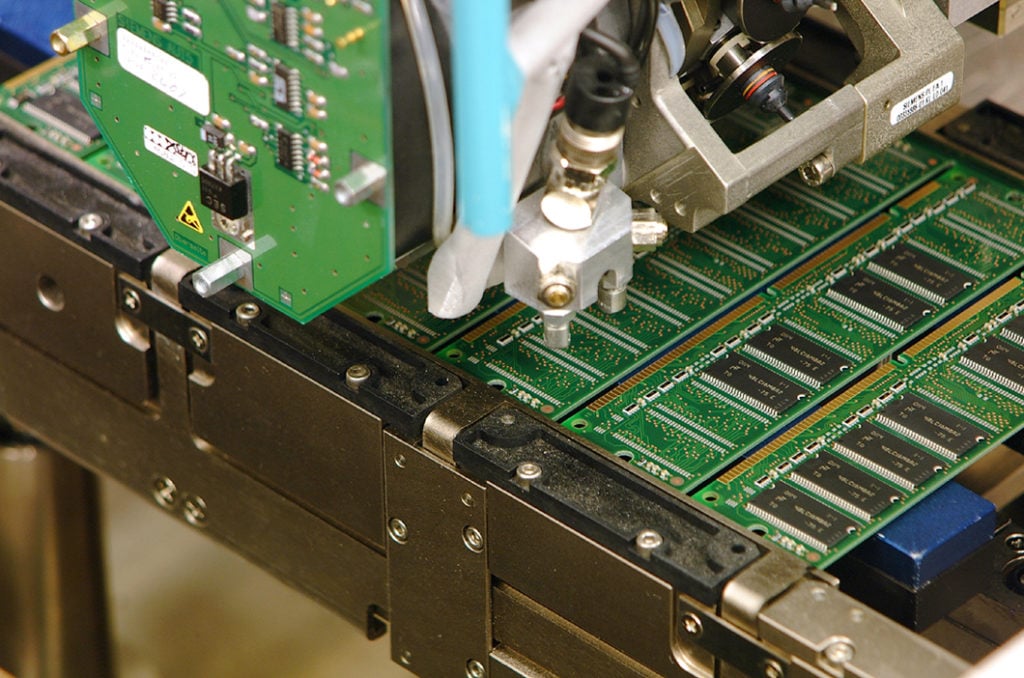

Uber's Advanced Technologies Group (ATG) has been a key player in the development of self-driving technology. While facing challenges such as accidents and regulatory hurdles, Uber continues to make progress. Its strategic partnerships with auto manufacturers and technology companies provide access to crucial resources and expertise. However, significant financial investments are required for R&D and infrastructure development, impacting Uber's overall financial performance.

- Recent milestones achieved in testing and development: [Insert specific examples, e.g., number of autonomous miles driven, expansion into new cities].

- Key partnerships: [List key partners, e.g., with automakers for vehicle integration, with tech companies for software and AI].

- Financial investments: [Cite Uber's reported spending on autonomous vehicle technology].

- Regulatory hurdles and potential legal liabilities: [Discuss legal and regulatory challenges, e.g., liability in accidents, data privacy concerns].

Existing ETFs and Investment Vehicles for the Autonomous Vehicle Sector

Several ETFs offer exposure to the autonomous vehicle market, allowing investors to diversify their portfolios and gain access to this rapidly growing sector. These ETFs often invest in a range of companies involved in various aspects of the industry, from software and sensor technology to vehicle manufacturers and ride-sharing services. However, it's vital to compare their underlying holdings, expense ratios, and past performance before investing. Investing in ETFs offers diversification benefits compared to investing in individual stocks, mitigating some risks.

- List of relevant ETF tickers and their underlying holdings: [Insert examples of ETFs focused on technology, transportation, or autonomous vehicles, including their tickers. Include disclaimers stating this is not financial advice].

- Comparison of expense ratios and performance metrics: [Briefly compare the expense ratios and historical performance of the selected ETFs, again with disclaimers].

- Discussion of diversification benefits and risk mitigation: [Explain how diversification through ETFs can reduce risk compared to individual stock investments].

Risks and Considerations for Investing in Autonomous Vehicle ETFs

Investing in autonomous vehicle ETFs comes with inherent risks. Technological challenges, such as unexpected software glitches or sensor failures, could delay the widespread adoption of self-driving technology. Furthermore, the regulatory landscape is constantly evolving, with potential policy changes that could impact the industry's growth. Market volatility and broader economic factors also influence ETF performance.

- Risk of technological failure and unforeseen setbacks: [Discuss the inherent risks of new technology and the potential for delays].

- Potential for regulatory changes to hinder progress: [Mention potential regulations and their impact on the market].

- Market fluctuations affecting ETF pricing and performance: [Explain how overall market conditions can influence ETF value].

Conclusion

Investing in the autonomous vehicle sector, potentially through ETFs focused on companies like Uber and related technologies, presents both significant opportunities and considerable risks. While the long-term potential for growth is undeniable, investors must carefully weigh the technological, regulatory, and market uncertainties before committing capital. Thorough due diligence and a diversified investment strategy are crucial.

Call to Action: Ready to explore the potential of Uber's self-driving car technology as an investment opportunity? Research autonomous vehicle ETFs carefully, considering your risk tolerance and long-term financial goals. Don't miss out on this potentially revolutionary sector – start your research today on self-driving car ETFs and robotaxi ETFs! Remember to consult a financial advisor before making any investment decisions.

Featured Posts

-

Premiile Gopo 2025 Nominalizari Complete Pentru Anul Nou Care N A Fost Si Morometii 3

May 17, 2025

Premiile Gopo 2025 Nominalizari Complete Pentru Anul Nou Care N A Fost Si Morometii 3

May 17, 2025 -

Plei Of Nba 2024 Pliris Odigos Me Imerominies And Apotelesmata

May 17, 2025

Plei Of Nba 2024 Pliris Odigos Me Imerominies And Apotelesmata

May 17, 2025 -

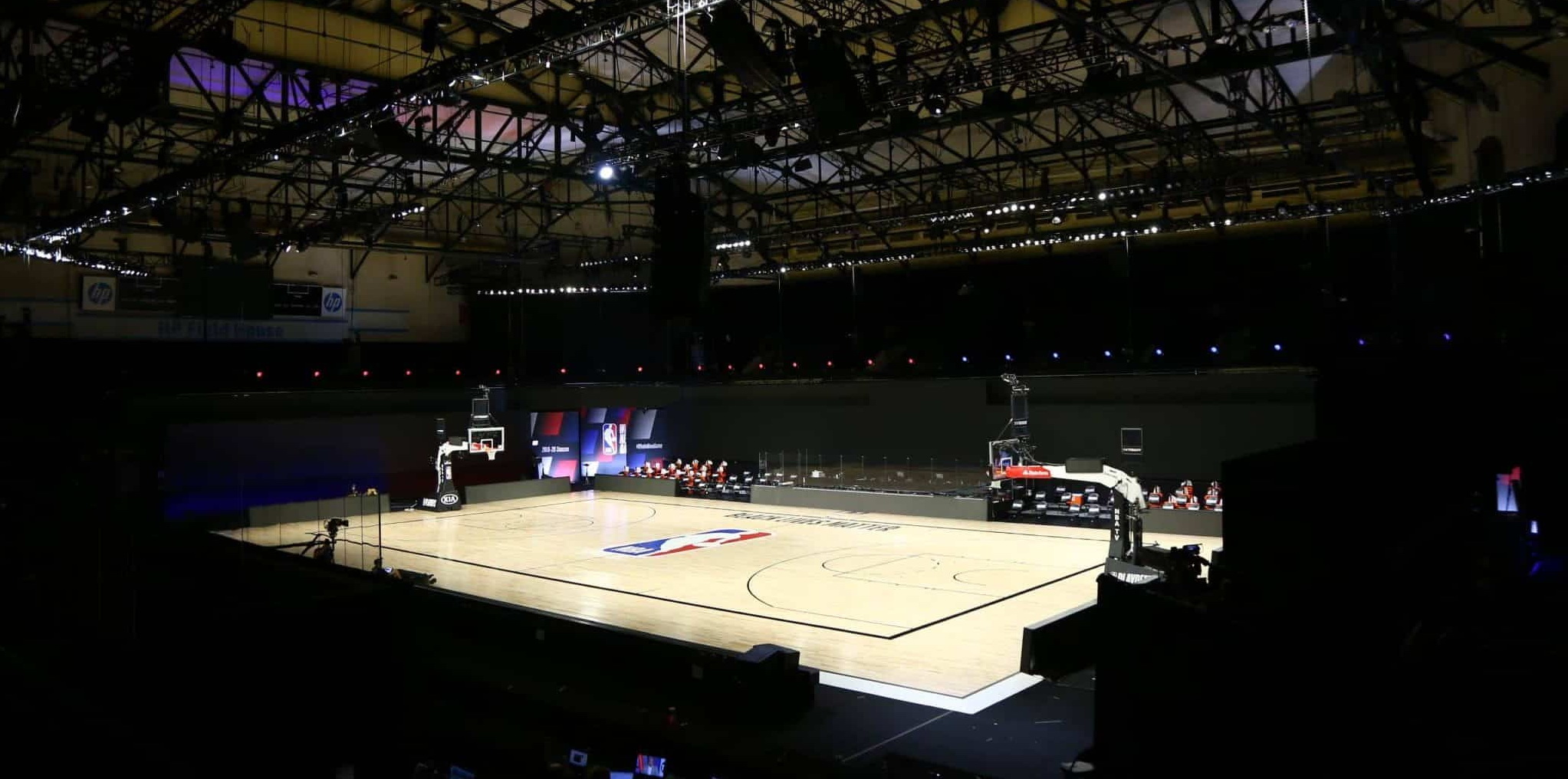

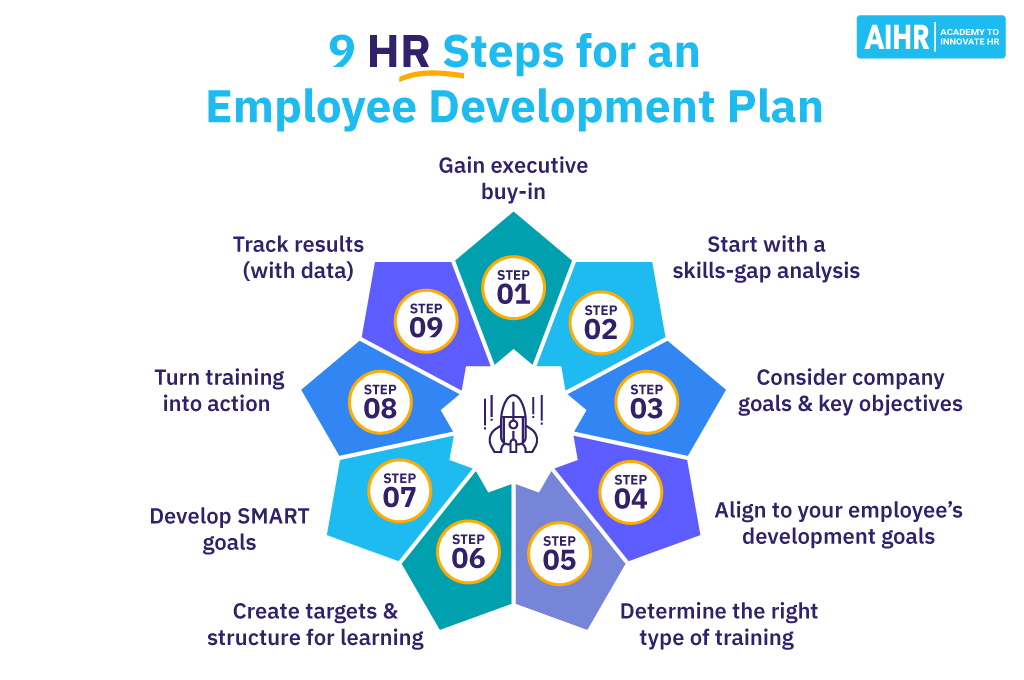

Investing In Middle Management A Strategic Approach To Business Growth And Employee Development

May 17, 2025

Investing In Middle Management A Strategic Approach To Business Growth And Employee Development

May 17, 2025 -

47 Spike In India Real Estate Investments Q1 2024 Report

May 17, 2025

47 Spike In India Real Estate Investments Q1 2024 Report

May 17, 2025 -

How Zuckerbergs Meta Will Navigate The Return Of Trump

May 17, 2025

How Zuckerbergs Meta Will Navigate The Return Of Trump

May 17, 2025