As Markets Swooned, Pros Sold—and Individuals Pounced: A Market Analysis

Table of Contents

The Professional Sell-Off: Identifying the Reasons Behind Institutional Liquidation

Professional investors, with their access to sophisticated data and analytical tools, often act as leading indicators of market trends. Their actions during a market swoon are particularly insightful. Several key factors likely contributed to the widespread institutional liquidation we witnessed.

Profit-Taking and Risk Aversion

Facing heightened market uncertainty, many professional investors prioritized profit-taking and risk mitigation. This is a standard response to periods of volatility.

- Specific Strategies: Institutions employed various strategies, including hedging using derivatives like put options, and portfolio rebalancing to reduce exposure to riskier assets.

- Supporting Data: Data from fund flows and trading volumes during the market swoon showed substantial outflows from equity funds and increased trading activity indicative of large-scale selling. For example, [Insert citation to relevant financial data here, e.g., a report from a financial news source].

Algorithmic Trading and Programmatic Selling

The role of algorithmic trading cannot be overstated. Automated trading systems, designed to react to market signals in real-time, often amplify selling pressure during a downturn.

- Algorithmic Reactions: These algorithms are programmed to react to negative indicators like declining price momentum and increased volatility, triggering pre-programmed sell orders.

- Exacerbating Declines: The speed and scale at which algorithms execute trades can exacerbate market declines, creating a self-reinforcing feedback loop. This effect is commonly referred to as a "flash crash" and can be particularly pronounced during periods of heightened uncertainty.

Economic Indicators and Predictions

Macroeconomic factors played a significant role in influencing professional investor decisions. Concerns about inflation, rising interest rates, and potential economic slowdown all contributed to the sell-off.

- Influential Indicators: Key indicators like inflation rates (CPI and PCE), interest rate hikes by central banks (e.g., the Federal Reserve), and declining consumer confidence indices all played significant roles in shaping professional investor sentiment.

- Expert Opinions: Forecasts from leading economists and financial analysts predicting a recession or prolonged period of economic weakness further fueled the sell-off. [Insert citation to expert opinions here, e.g., a Bloomberg article or a report from a reputable financial institution].

The Individual Investor Surge: Understanding the Retail Buying Spree

While professionals were selling, a significant portion of individual investors appeared to be buying, defying conventional wisdom. This behavior warrants close examination.

Fear of Missing Out (FOMO) and Contrarian Investing

Psychological factors, such as the fear of missing out (FOMO), likely played a significant role. Some retail investors may have perceived the market downturn as a buying opportunity, employing contrarian investment strategies.

- FOMO's Impact: The fear of missing out on potential gains in a subsequent market rebound can incentivize investors to buy low, even during periods of high risk.

- Contrarian Investing: Contrarian investors bet against the prevailing market trend, believing that asset prices will eventually recover. The market swoon might have been perceived by some as an attractive entry point.

Increased Retail Participation in the Market

The dramatic increase in retail investor participation in recent years has altered market dynamics. The ease of access to trading platforms has significantly lowered the barrier to entry.

- Growth of Retail Trading: The number of retail trading accounts has surged in recent years, fueled by the rise of commission-free brokerage apps and user-friendly trading interfaces. [Insert statistics on the growth of retail trading accounts here, citing reputable sources].

- Role of Brokerage Apps: The proliferation of mobile trading apps has made it easier than ever for individuals to participate in the market, regardless of their level of financial expertise.

Long-Term Investment Strategies vs. Short-Term Speculation

It's important to distinguish between long-term investors and short-term speculators within the retail investor segment. Their approaches and motivations differ significantly.

- Portfolio Diversification: Some retail investors may have diversified their portfolios, viewing the market swoon as an opportunity to acquire assets at discounted prices as part of a long-term strategy.

- Short-Term Risks: However, others may have engaged in short-term speculative trading, attempting to profit from short-term price fluctuations, thereby exposing themselves to greater risks.

Analyzing the Market Swoon's Impact and Future Implications

The market swoon had significant, multifaceted impacts across asset classes, with both short-term and long-term consequences.

Market Volatility and its Effect on Asset Prices

The period of heightened volatility caused significant price fluctuations in various asset classes.

- Price Movements: Charts illustrating the price movements of stocks, bonds, and cryptocurrencies during the market decline would effectively demonstrate the impact of the market swoon. [Insert charts and graphs here].

- Market Recovery: An analysis of the market's subsequent recovery (if any) is crucial to fully understand the long-term effects of the volatility.

Long-Term Investment Strategies in a Volatile Market

Navigating market uncertainty requires a robust, well-defined investment strategy.

- Diversification and Risk Management: Diversification across different asset classes remains paramount for mitigating risk during periods of market volatility. Sophisticated risk management techniques are also crucial.

- Weathering Market Swings: Long-term investors should focus on their investment horizon and avoid impulsive decisions driven by short-term market fluctuations.

Conclusion

The contrasting responses of professional and individual investors during the recent market swoon highlight the complex dynamics of market behavior. Professionals, driven by risk aversion and macroeconomic concerns, engaged in significant selling. In contrast, individual investors, influenced by factors like FOMO and increased market accessibility, engaged in buying, creating a fascinating dichotomy. Understanding the motivations and strategies employed by both groups is crucial for navigating future market uncertainty.

Key Takeaways:

- Professional investors prioritized profit-taking and risk mitigation, influenced by macroeconomic factors and algorithmic trading.

- Individual investors, driven by FOMO and increased market access, engaged in a buying spree.

- The market swoon highlighted the importance of long-term investment strategies and robust risk management.

Call to Action: Learn more about managing risk during a market swoon and building a resilient investment portfolio by exploring our [link to relevant resource, e.g., investment guides or educational materials]. Subscribe to our newsletter for further market analysis and insights into navigating future market volatility.

Featured Posts

-

Marv Albert Vs Mike Breen Who Is The Better Basketball Announcer

Apr 28, 2025

Marv Albert Vs Mike Breen Who Is The Better Basketball Announcer

Apr 28, 2025 -

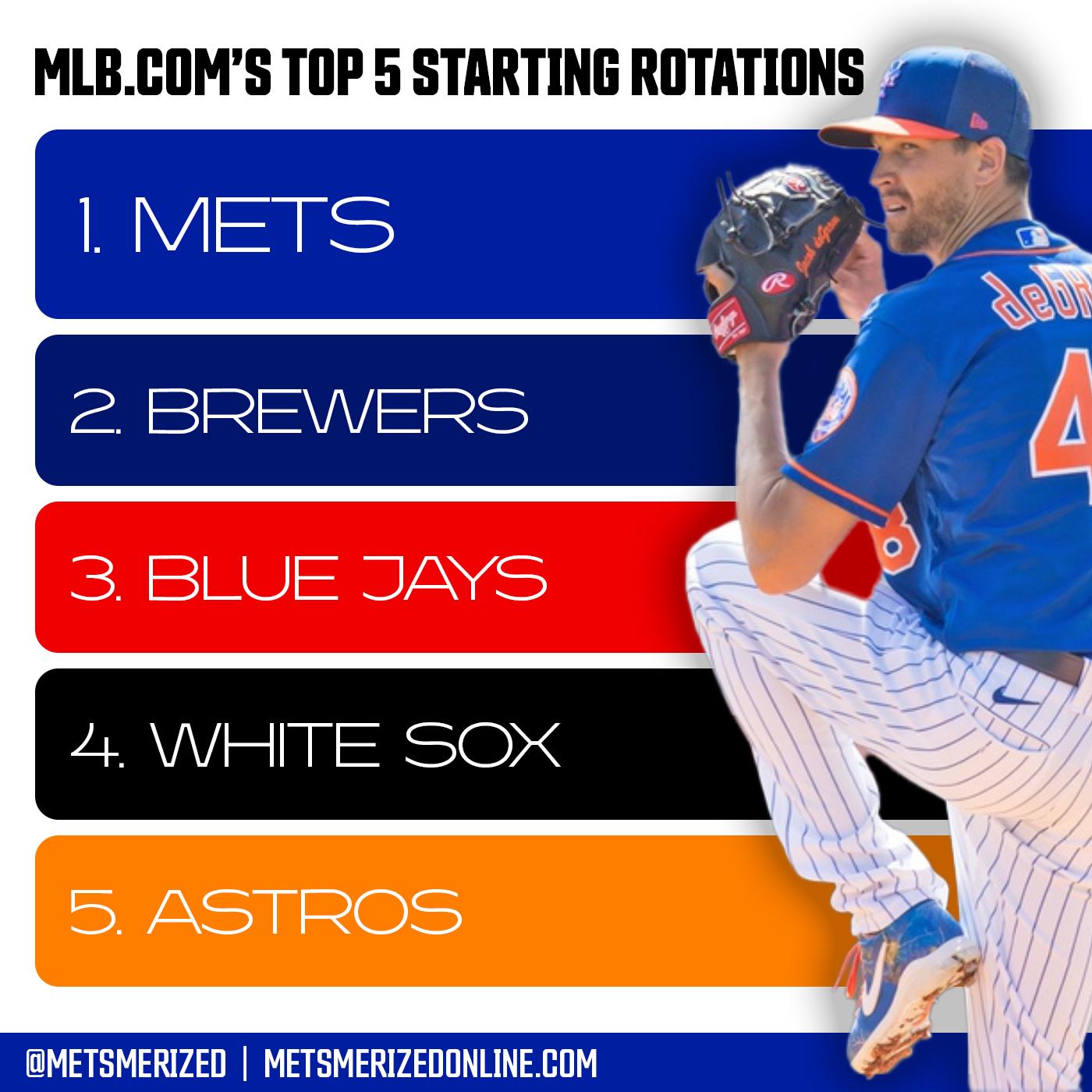

Has Mets Pitcher Shown Enough For A Rotation Spot

Apr 28, 2025

Has Mets Pitcher Shown Enough For A Rotation Spot

Apr 28, 2025 -

Gpu Price Increases Predictions And Future Outlook

Apr 28, 2025

Gpu Price Increases Predictions And Future Outlook

Apr 28, 2025 -

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025

Individual Charged With Millions In Losses From Office365 Executive Account Hacks

Apr 28, 2025 -

Richard Jeffersons Espn Promotion Nba Finals Analyst Role Uncertain

Apr 28, 2025

Richard Jeffersons Espn Promotion Nba Finals Analyst Role Uncertain

Apr 28, 2025