Asian Currency Markets In Turmoil: The Dollar's Role

Table of Contents

The US Dollar's Strength and its Impact on Asian Currencies

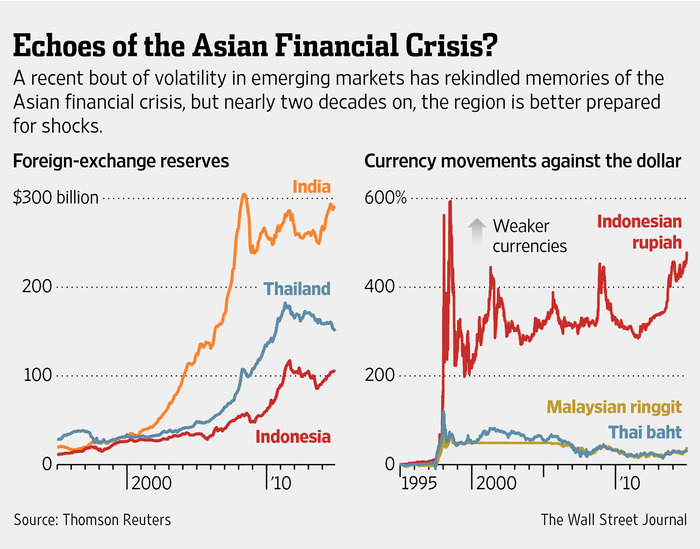

The current strength of the US dollar is a primary driver of instability in Asian currency markets. A strong dollar makes imports more expensive for Asian nations, impacting their trade balances and competitiveness. This is particularly true for economies heavily reliant on exports, as higher prices in dollar terms reduce demand for their goods and services.

- Increased import costs: A strong dollar increases the cost of imported goods and raw materials for Asian businesses, squeezing profit margins and fueling inflationary pressures within the region.

- Reduced export demand: The higher price of Asian exports in dollar terms makes them less competitive in the global market, leading to a decline in demand and impacting export-oriented economies.

- Central bank intervention: Facing pressure from weaker currencies and potential inflation, many Asian central banks are forced to intervene in foreign exchange markets, depleting their foreign currency reserves in an attempt to support their local currencies.

[Insert relevant chart here showing USD index vs. key Asian currencies (e.g., JPY, CNY, KRW) over the past year.]

[Insert data table here showing trade balance statistics for key Asian economies, highlighting changes since the dollar's strengthening.]

Inflationary Pressures and Monetary Policy Divergence

Differing inflationary pressures between the US and Asian countries are further exacerbating currency fluctuations. The US Federal Reserve's aggressive interest rate hikes, aimed at combating inflation, are attracting capital flows away from Asia. This capital flight weakens Asian currencies and creates challenges for Asian central banks.

- Capital flight: Higher US interest rates make dollar-denominated assets more attractive to investors, leading to capital outflows from Asian markets and putting downward pressure on Asian currencies.

- Balancing act for Asian central banks: Asian central banks face a difficult balancing act. They need to control inflation while simultaneously supporting economic growth, a task made more challenging by the outflow of capital and a stronger dollar. Raising interest rates to match the US could stifle economic growth.

- Examples: For instance, [mention specific country examples and their monetary policy responses, e.g., how the Bank of Japan has responded differently to the Bank of Korea].

Geopolitical Risks and their Influence on Asian Currency Markets

Geopolitical uncertainty plays a significant role in shaping investor sentiment and influencing currency values. The ongoing US-China trade tensions and the war in Ukraine create significant uncertainty, prompting a "flight to safety" phenomenon. Investors often flock to the US dollar, considered a safe-haven asset during times of global instability, further strengthening the dollar and weakening Asian currencies.

- Investor sentiment: Geopolitical instability erodes investor confidence, leading to reduced investment in Asian markets and capital outflows.

- Risk aversion: Increased risk aversion among global investors results in a shift towards safer assets, including the US dollar.

- Specific examples: The [mention specific geopolitical events and their immediate impact on Asian currency markets, for example, the impact of escalating US-China tensions on the Chinese Yuan].

Strategies for Navigating the Turmoil in Asian Currency Markets

Businesses and investors operating in Asian markets need robust risk management strategies to navigate the current turmoil. Careful planning and diversification are crucial.

- Currency hedging: Implementing effective currency hedging strategies is paramount to mitigate the risks associated with currency fluctuations. Options, forwards, and futures contracts can be used to protect against losses.

- Diversification: Diversifying investments across different Asian currencies and asset classes can reduce overall portfolio risk and exposure to fluctuations in any single currency.

- Market monitoring: Closely monitoring key economic indicators, geopolitical developments, and central bank policies is crucial for making informed investment decisions.

Conclusion: Understanding the Dollar's Role in Asian Currency Market Instability

The significant influence of the US dollar on the current instability in Asian currency markets is undeniable. The strength of the dollar, coupled with inflationary pressures, divergent monetary policies, and geopolitical risks, creates a complex and challenging environment. Understanding these factors is crucial for businesses and investors operating in the region. Stay informed about future fluctuations in the Asian currency markets and the continuing influence of the US dollar by following our expert analysis and subscribing to our newsletter for regular updates.

Featured Posts

-

Gazze Kanalizasyon Krizi Anadolu Ajansi Nin Analizi

May 06, 2025

Gazze Kanalizasyon Krizi Anadolu Ajansi Nin Analizi

May 06, 2025 -

Priyanka Chopras Controversial Miss World Outfit The Untold Story

May 06, 2025

Priyanka Chopras Controversial Miss World Outfit The Untold Story

May 06, 2025 -

Fortnite Sabrina Carpenters New Emotes Are Here

May 06, 2025

Fortnite Sabrina Carpenters New Emotes Are Here

May 06, 2025 -

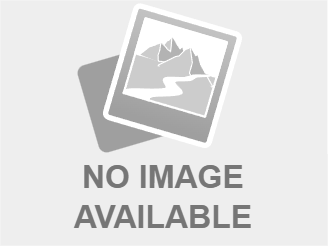

Gold Road Sold To Gold Fields In A 3 7 Billion Transaction

May 06, 2025

Gold Road Sold To Gold Fields In A 3 7 Billion Transaction

May 06, 2025 -

Dylan Beard A Day In The Life Of A Walmart Employee And Track Athlete

May 06, 2025

Dylan Beard A Day In The Life Of A Walmart Employee And Track Athlete

May 06, 2025