Assessing The Impact Of Trump's Trade Actions On US Financial Power

Table of Contents

Tariffs and their Economic Ripple Effects

The cornerstone of Trump's trade strategy was the imposition of tariffs – taxes on imported goods. The rationale was ostensibly to protect domestic industries from foreign competition, address perceived trade imbalances, and ultimately "Make America Great Again." However, these protectionist measures triggered a complex web of economic consequences.

-

Short-term effects: The immediate impact included increased prices for consumers, contributing to inflation. Furthermore, retaliatory tariffs from other countries, often referred to as a "trade war," severely hampered US exports and disrupted established supply chains. Specific sectors, like agriculture, felt the brunt of these actions immediately.

-

Long-term effects: The long-term consequences of these tariffs remain a subject of ongoing debate, but several concerning trends have emerged. Reduced US competitiveness in global markets, coupled with shifts in global supply chains away from reliance on US goods, pose significant challenges. This has led to uncertainty and a decreased attractiveness to foreign investors seeking stability and predictability. Analysis of key economic indicators like GDP growth, inflation rates, and unemployment reveals mixed results, but the overall trend points towards a dampening effect on long-term economic prosperity. This highlights the complexities of protectionism and its unintended consequences, which can outweigh the intended benefits in the long run.

Keywords: tariffs, trade war, protectionism, economic sanctions, global trade, import tariffs, export tariffs, trade deficit.

Impact on US Trade Relationships and Alliances

Trump's trade actions significantly strained relationships with key trading partners, including China, the European Union, Canada, and Mexico. The confrontational approach to trade negotiations damaged long-standing alliances and international cooperation.

-

Strained relationships: The imposition of tariffs and the withdrawal from or renegotiation of major trade agreements, such as NAFTA (replaced by USMCA), created uncertainty and distrust among allies. This damaged international goodwill and fostered antagonism rather than collaboration.

-

Impact on trade agreements: The undermining of multilateral trade agreements and organizations like the World Trade Organization (WTO) weakened the global rules-based trading system. This lack of predictability and stability negatively impacted investor confidence and overall global economic growth.

-

Foreign Policy Implications: The focus on bilateral trade deals over multilateral agreements diminished US influence and leadership in global economic governance. This created power vacuums that other nations, particularly China, actively sought to fill.

Keywords: bilateral trade, multilateral agreements, trade negotiations, international relations, global power, WTO, USMCA, trade alliances.

The Role of the Dollar in a Changing Global Landscape

Trump's trade policies also had implications for the US dollar's standing as the world's reserve currency. While the dollar's dominance remains largely intact, the trade actions raised questions about its long-term stability and the US's overall financial leadership.

-

Reserve Currency Status: The increased trade tensions and uncertainty fostered by Trump's actions led some countries to diversify their foreign exchange reserves, reducing their dependence on the dollar. This created a ripple effect across the global financial system.

-

Shift in Global Financial Power: While not a complete shift, the aggressive trade policies did arguably contribute to a gradual erosion of the US's undisputed dominance in global finance. Other nations and currencies are increasingly seen as viable alternatives.

-

Implications for US Institutions: The uncertainty in global trade impacted the stability of US financial institutions and capital markets. The resulting volatility negatively impacted investor confidence and long-term investment strategies.

Keywords: US dollar, reserve currency, global finance, capital markets, financial stability, foreign exchange reserves, currency devaluation.

Investment and Capital Flows

The uncertainty created by the trade disputes significantly affected foreign direct investment (FDI) in the US.

-

Reduced FDI: Companies became hesitant to invest heavily in the US due to concerns about unpredictable tariffs and trade policies. This led to a reduction in FDI flows and slowed economic growth.

-

Capital Flight: While not a massive exodus, some capital did flow out of the US, seeking safer and more stable investment opportunities in other countries. This contributed to market volatility and economic uncertainty.

Keywords: foreign investment, capital flows, economic uncertainty, market volatility, FDI, capital flight.

Conclusion: Assessing the Lasting Legacy of Trump's Trade Policies on US Financial Power

In conclusion, while some proponents argued that Trump's trade actions aimed to protect American industries and renegotiate unfair trade deals, the overall impact on US financial power appears largely negative. The short-term gains were often offset by long-term economic damage. The imposition of tariffs, the strained relationships with key trading partners, and the increased uncertainty in global markets all contributed to a less favorable economic environment. The lingering consequences, including damaged international relationships, reduced investor confidence, and a potential weakening of the dollar's global dominance, are likely to continue shaping the US economy for years to come. To fully understand the continuing repercussions of these policies, further research and ongoing monitoring of relevant economic indicators are crucial. Stay informed by following reputable economic news sources and exploring in-depth analyses of Trump's trade actions and their evolving implications for the US and the global economy.

Featured Posts

-

Google Faces Renewed Legal Challenge Over Search Dominance

Apr 22, 2025

Google Faces Renewed Legal Challenge Over Search Dominance

Apr 22, 2025 -

Activision Blizzard Merger Faces Ftc Appeal

Apr 22, 2025

Activision Blizzard Merger Faces Ftc Appeal

Apr 22, 2025 -

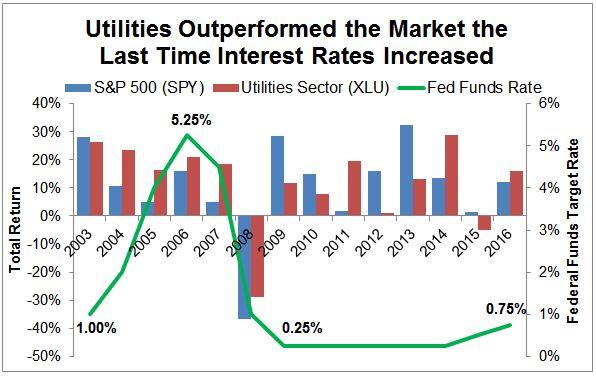

Higher Stock Prices Higher Risks What Investors Need To Know

Apr 22, 2025

Higher Stock Prices Higher Risks What Investors Need To Know

Apr 22, 2025 -

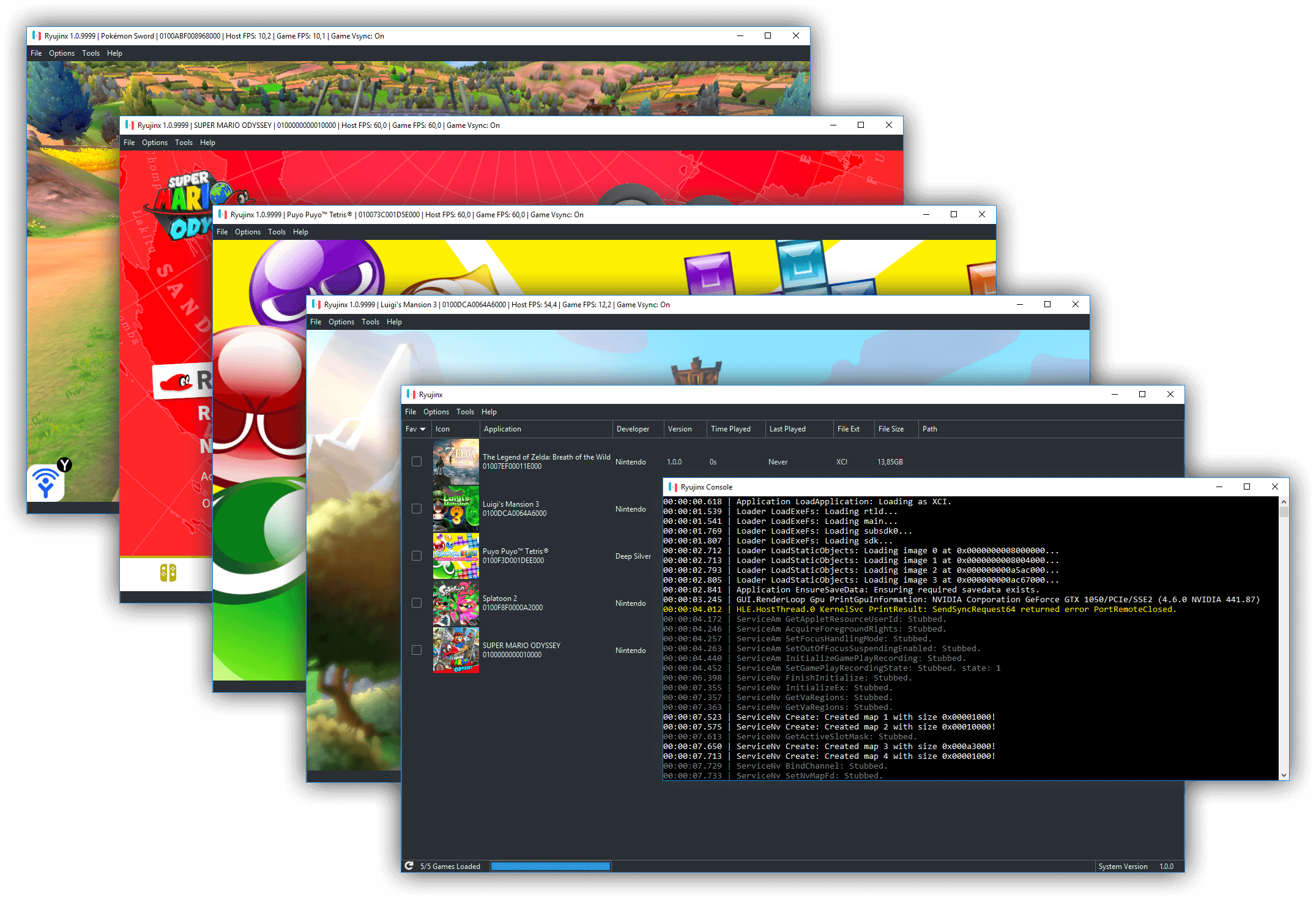

Nintendos Action Ryujinx Switch Emulator Development Ceases

Apr 22, 2025

Nintendos Action Ryujinx Switch Emulator Development Ceases

Apr 22, 2025 -

Federal Investigation Millions In Losses From Office365 Executive Hacks

Apr 22, 2025

Federal Investigation Millions In Losses From Office365 Executive Hacks

Apr 22, 2025