Australian Market Outlook: Asset Performance Following The Election

Table of Contents

Impact on the Australian Economy

The winning party's economic policies will significantly shape the Australian economy's trajectory. Keywords like economic growth, fiscal policy, government spending, inflation, and interest rates are central to understanding this impact.

- GDP Growth Projections: The government's proposed fiscal policies, including spending commitments and tax reforms, will directly influence GDP growth. A focus on infrastructure spending, for example, could stimulate economic activity and boost GDP, while tax cuts might increase consumer spending but potentially lead to higher inflation. Detailed analysis of the budget and economic forecasts from reputable sources will be critical to predicting the impact.

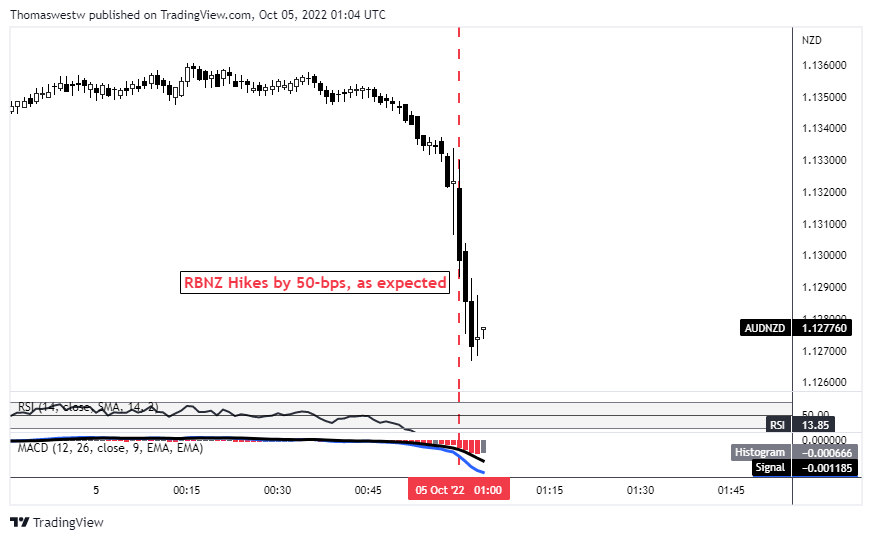

- Inflation and the RBA: The Reserve Bank of Australia (RBA)'s monetary policy response will be crucial in managing inflation. Higher government spending could contribute to inflationary pressures, potentially leading the RBA to increase interest rates to cool the economy. Conversely, fiscal restraint might allow the RBA to maintain or even lower interest rates. Closely monitoring RBA statements and economic data releases will be key to assessing the situation.

- Fiscal Policy Shifts: Significant changes in government spending and taxation will have ripple effects across various sectors. Increased investment in renewable energy, for instance, could boost the renewable energy sector while impacting the fossil fuel industry. Analyzing the government's detailed policy proposals will be critical in understanding these sector-specific impacts.

Stock Market Performance Post-Election

The Australian share market (ASX 200) is expected to experience some volatility in the short term following the election. However, the long-term outlook depends largely on the government's policy implementation and the global economic environment.

- Short-Term Volatility: Uncertainty surrounding new policies often leads to market fluctuations. Investors may adopt a "wait-and-see" approach, leading to increased market volatility in the initial period post-election.

- Sectoral Performance: Certain sectors are expected to benefit more than others. For example, infrastructure investment could boost companies in the construction and engineering sectors. Similarly, policies supporting renewable energy might favor companies in the green technology sector. Conversely, sectors reliant on government subsidies might face headwinds if those subsidies are reduced.

- Investment Opportunities: Understanding the potential winners and losers based on policy priorities is critical for identifying investment opportunities. Thorough due diligence and careful portfolio diversification are essential strategies to manage risk and capitalize on post-election market dynamics.

Specific Sector Analysis (Examples)

Let's consider some key sectors:

- Resource Sector: The mining and resource sector is highly sensitive to global commodity prices and government policies related to resource extraction and environmental regulations. Changes in mining royalties or environmental approvals could significantly affect profitability.

- Technology Sector: The technology sector's performance will depend on government support for innovation, digital infrastructure development, and the broader global tech market trends. Investment in digital infrastructure, for example, could be a significant positive driver.

- Financial Sector: The financial sector's performance is influenced by interest rate changes, consumer confidence, and regulatory adjustments. Changes in financial regulations or interest rate policies by the RBA could significantly impact profitability.

Property Market Outlook

The Australian property market's performance is highly sensitive to interest rate changes and government policies.

- Interest Rate Impact: Increased interest rates generally lead to a cooling of the property market, impacting both property prices and rental yields. Conversely, lower interest rates can stimulate property investment and drive up prices.

- Government Policies: Government policies such as changes in stamp duty, foreign investment restrictions, or first-home buyer incentives can significantly impact the housing market.

- Property Investment Strategy: Investors need to carefully consider interest rate forecasts and government policies when developing their property investment strategy. Diversification across different property segments and locations is a crucial risk-mitigation strategy.

Bond Market Response

The Australian bond market will react to changes in interest rates and the overall economic outlook.

- Interest Rate Risk: Changes in interest rates significantly affect bond yields. Rising interest rates generally lead to lower bond prices and higher yields, while falling rates lead to higher bond prices and lower yields.

- Government vs. Corporate Bonds: Investors will need to assess the relative attractiveness of government bonds (considered less risky) versus corporate bonds (offering potentially higher returns but with higher risk) based on their risk tolerance and the overall economic environment.

- Fixed-Income Investment Strategies: Post-election, careful consideration of the overall risk profile of the bond market and adjustments to fixed-income investment strategies based on interest rate expectations and risk tolerance will be necessary.

Conclusion

This analysis has provided an overview of the expected Australian market outlook following the recent election. We explored the potential impact on the economy, stock market, property market, and bond market, offering insights into potential investment opportunities and risks across different asset classes. The post-election landscape presents both challenges and opportunities for investors, demanding careful consideration of the newly established government's economic policies.

Understanding the Australian market outlook and its implications for asset performance is crucial for making informed investment decisions. For expert advice on navigating this post-election environment and tailoring your investment strategy to maximize returns, contact us today for a consultation. Let us help you optimize your portfolio in the evolving Australian market.

Featured Posts

-

Mjmwet Shrkae Alymn Tjtme Lbhth Sbl Altnmyt Waliemar Bdem Albrnamj Alsewdy

May 06, 2025

Mjmwet Shrkae Alymn Tjtme Lbhth Sbl Altnmyt Waliemar Bdem Albrnamj Alsewdy

May 06, 2025 -

Membedakan Batu Yaman Habasyi Asli Dan Palsu Panduan Lengkap

May 06, 2025

Membedakan Batu Yaman Habasyi Asli Dan Palsu Panduan Lengkap

May 06, 2025 -

Is The Australian Dollar Poised To Outperform The New Zealand Dollar

May 06, 2025

Is The Australian Dollar Poised To Outperform The New Zealand Dollar

May 06, 2025 -

Land Your Dream Private Credit Job 5 Essential Dos And Don Ts

May 06, 2025

Land Your Dream Private Credit Job 5 Essential Dos And Don Ts

May 06, 2025 -

Cosmo Quiz Cole Escolas Unexpected Answers

May 06, 2025

Cosmo Quiz Cole Escolas Unexpected Answers

May 06, 2025