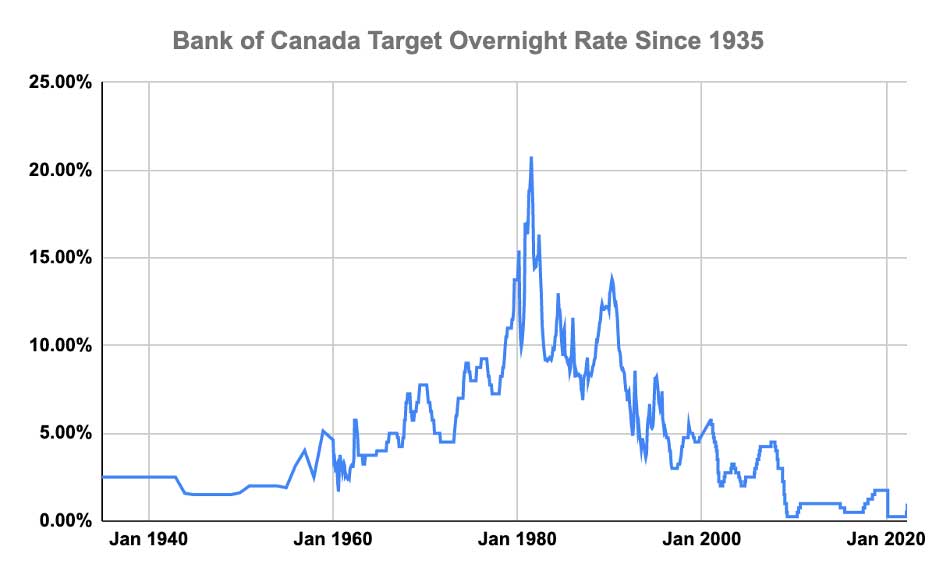

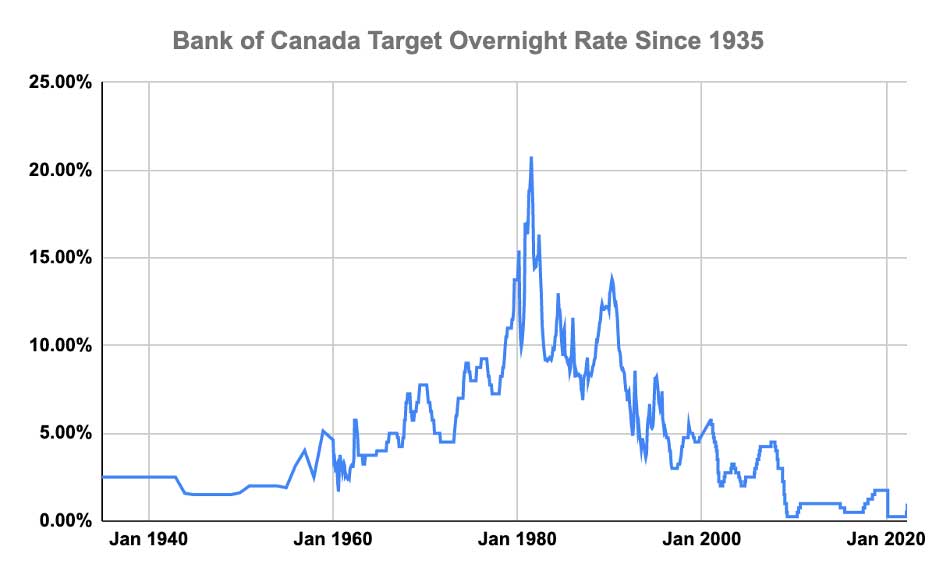

Bank Of Canada Interest Rates: Desjardins Sees Potential For Three More Reductions

Table of Contents

Desjardins' Rationale for Predicted Rate Reductions

Desjardins' prediction of three more Bank of Canada interest rate cuts is likely based on a careful assessment of several key economic indicators. Their analysis probably incorporates data on inflation, employment rates, GDP growth, and the performance of the housing market. Let's delve into the specific factors likely influencing their forecast:

-

Falling Inflation Rates: Inflation, the rate at which prices for goods and services rise, is a primary concern for the Bank of Canada. If inflation is falling below the Bank's target rate, it could signal the need for further stimulus through interest rate cuts.

-

Slowing Economic Growth or Recessionary Pressures: Concerns about slowing economic growth, or even a potential recession, could prompt the Bank of Canada to lower interest rates to stimulate economic activity. This would aim to encourage borrowing and spending, boosting overall demand.

-

Weakening Labor Market Data: A decline in employment numbers or a rise in unemployment could indicate a weakening economy, prompting calls for lower interest rates to support job creation.

-

Impact of Global Economic Uncertainty: Global economic headwinds, such as geopolitical instability or international financial crises, can impact the Canadian economy. These uncertainties could lead Desjardins (and potentially the Bank of Canada) to favor a more cautious approach with lower interest rates.

These factors, taken together, suggest a potential scenario where further easing of monetary policy – in the form of interest rate cuts – might be deemed necessary to support the Canadian economy.

Potential Impact of Further Interest Rate Cuts on the Canadian Economy

Further interest rate cuts by the Bank of Canada could have significant consequences for the Canadian economy, both positive and negative.

Positive Impacts:

-

Increased Borrowing and Investment: Lower interest rates make borrowing cheaper for both consumers and businesses, potentially stimulating increased spending and investment.

-

Lower Mortgage Payments, Freeing Up Consumer Spending: Reduced mortgage rates would leave more disposable income for homeowners, potentially boosting consumer spending and overall economic activity.

-

Potential for Increased Business Investment and Job Creation: Cheaper borrowing costs can encourage businesses to invest in expansion, leading to increased job creation and economic growth.

Negative Impacts:

-

Risk of Reigniting Inflation: If interest rate cuts are too aggressive, they could potentially reignite inflation, negating the intended benefits.

-

Potential for Reduced Investor Confidence in the Canadian Dollar: Lower interest rates can make the Canadian dollar less attractive to foreign investors, potentially leading to a devaluation of the currency.

-

Increased National Debt Burden: Lower interest rates can increase the cost of servicing Canada's national debt over the long term.

Navigating the potential trade-offs between stimulating economic growth and managing inflation is a key challenge for the Bank of Canada when considering further interest rate cuts.

Alternative Perspectives and Market Reactions

It's crucial to remember that economic forecasting is inherently uncertain. While Desjardins predicts three more interest rate reductions, other financial institutions and economists may hold differing views. Some might argue that the current economic conditions don't warrant further rate cuts, citing potential inflationary risks or concerns about the long-term sustainability of such a policy.

Market reactions to further interest rate cuts could include:

- Changes in Bond Yields: Lower interest rates generally lead to lower bond yields.

- Canadian Dollar Exchange Rate Fluctuations: The Canadian dollar could depreciate against other major currencies.

- Stock Market Performance: The stock market's reaction would be complex and depend on various factors, including investor sentiment and the overall global economic climate.

Considering the Bank of Canada's Mandate

The Bank of Canada operates under a dual mandate: maintaining price stability (controlling inflation) and achieving full employment. Further interest rate cuts could help achieve full employment by stimulating the economy, but they could also risk undermining price stability if inflation rises too quickly. Balancing these competing objectives is a central challenge for the Bank in its decision-making process regarding interest rates.

Conclusion: Navigating the Future of Bank of Canada Interest Rates

Desjardins' prediction of three more Bank of Canada interest rate reductions highlights the ongoing uncertainty surrounding the Canadian economy. The factors considered—inflation, economic growth, employment, and global uncertainty—will heavily influence the Bank of Canada's decisions. While lower interest rates could boost economic activity and consumer spending, they also carry risks, including potential inflationary pressures and currency devaluation. It's vital to remember that economic forecasting is complex, and the actual path of Bank of Canada interest rates remains subject to considerable uncertainty.

Stay informed about upcoming Bank of Canada interest rate decisions and consult with a financial advisor to discuss how these changes might impact your personal financial strategy. Understanding the potential implications of Bank of Canada rate changes is crucial for effective financial planning in the current economic climate.

Featured Posts

-

Koersverschillen Europese En Amerikaanse Aandelenmarkten Een Diepgaande Analyse

May 24, 2025

Koersverschillen Europese En Amerikaanse Aandelenmarkten Een Diepgaande Analyse

May 24, 2025 -

Bangladesh Businesses In Europe Collaboration For Future Success

May 24, 2025

Bangladesh Businesses In Europe Collaboration For Future Success

May 24, 2025 -

Kak Leonid Brezhnev Povliyal Na Sudbu Filma Garazh Ryazanova

May 24, 2025

Kak Leonid Brezhnev Povliyal Na Sudbu Filma Garazh Ryazanova

May 24, 2025 -

Kermit The Frog As Umd Commencement Speaker The Online Response

May 24, 2025

Kermit The Frog As Umd Commencement Speaker The Online Response

May 24, 2025 -

Euronext Amsterdam Market Reaction 8 Stock Increase After Trumps Tariff Announcement

May 24, 2025

Euronext Amsterdam Market Reaction 8 Stock Increase After Trumps Tariff Announcement

May 24, 2025