Bank Of Canada Rate Expectations: Rosenberg's Interpretation Of The Latest Jobs Data

Table of Contents

The Latest Canadian Jobs Report: Key Highlights and Rosenberg's Initial Reaction

The latest Canadian jobs report revealed a complex picture. Understanding this report is crucial for predicting Bank of Canada rate expectations. Let's break down the key figures:

- Employment Change: [Insert actual data from the latest report, e.g., "The Canadian economy added X thousand jobs in [Month, Year]."] This figure was [positive/negative/as expected] by market analysts.

- Unemployment Rate: [Insert actual data, e.g., "The unemployment rate stood at X%,"] representing a [increase/decrease/no change] from the previous month.

- Participation Rate: [Insert actual data, e.g., "The labour force participation rate was X%."] This indicates [positive/negative/neutral] signals regarding the labor market's health.

David Rosenberg, a prominent economist known for his contrarian views, reacted to the report with [summarize Rosenberg's initial reaction, positive, negative, cautious. Include a link to his commentary or analysis]. He highlighted [mention specific points he emphasized, e.g., the strength/weakness of job creation in specific sectors]. The initial market response was [describe the market's reaction - stock market movements, bond yields, etc.]. The unexpected trend in [mention any surprise in the data, e.g., a significant increase in part-time jobs] warrants further scrutiny.

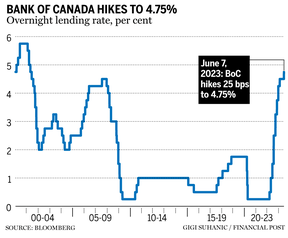

Rosenberg's Analysis: Inflationary Pressures and Their Impact on Interest Rates

Rosenberg's analysis focuses on the implications of the jobs data for inflationary pressures. His key arguments include:

- Wage Growth: Rosenberg likely assesses whether the jobs data suggests accelerating or decelerating wage growth. High wage growth fuels inflation, potentially prompting the Bank of Canada to take a hawkish stance (raising interest rates).

- Consumer Spending: He would analyze whether the employment figures suggest robust or weakening consumer spending. Increased spending can contribute to inflation.

- Bank of Canada's Approach: Based on his interpretation of these factors, Rosenberg would likely predict whether the Bank of Canada will adopt a hawkish (raising interest rates to combat inflation) or dovish (maintaining or lowering interest rates to stimulate the economy) approach. He may anticipate a [hawkish/dovish] approach based on [mention specific supporting evidence].

For example, Rosenberg might point to [insert a specific example from his analysis connecting job growth to inflation]. He may emphasize the potential for [mention a specific risk related to inflation, e.g., a wage-price spiral].

Alternative Interpretations and Market Consensus on Bank of Canada Rate Expectations

While Rosenberg offers a valuable perspective, it's crucial to consider alternative interpretations. Other economists may highlight:

- Different Metrics: They might focus on different aspects of the jobs data, such as the quality of jobs created or the geographic distribution of employment changes.

- Global Economic Factors: They may emphasize the influence of global economic conditions on the Bank of Canada's decision-making.

- Market Consensus: The market consensus, as reflected in trading activity and analyst predictions, may differ from Rosenberg's outlook. Current predictions range from [mention a range of rate hike/cut predictions]. The Bank of Canada's own statements and forecasts, available on their website, should also be consulted.

Considering these diverse viewpoints provides a more comprehensive understanding of Bank of Canada rate expectations.

Implications for Investors and the Canadian Economy

The Bank of Canada's interest rate decisions significantly impact the Canadian economy and investors. Different scenarios have various implications:

- Housing Market: Higher interest rates could cool the housing market, while lower rates could stimulate it.

- Consumer Spending: Interest rate changes influence borrowing costs, affecting consumer spending and overall economic growth.

- Business Investment: Businesses' investment decisions are also affected by interest rate changes.

- Investors: Bond yields and stock market performance are directly impacted by interest rate movements. Currency exchange rates are also sensitive to these changes.

Based on Rosenberg's analysis and market expectations, investors might consider [suggest practical investment strategies, e.g., diversifying portfolios, adjusting bond holdings].

Conclusion: Navigating Bank of Canada Rate Expectations Based on Rosenberg's Insights

David Rosenberg's analysis of the latest Canadian jobs data provides valuable insights into Bank of Canada rate expectations. While his perspective is insightful, it's crucial to consider alternative interpretations and the broader market consensus. Understanding the interplay between employment figures, inflation, and the Bank of Canada's policy response is critical for navigating the complexities of the Canadian economy. Stay updated on Bank of Canada rate expectations by regularly reviewing economic reports and expert analyses like Rosenberg’s. Understanding these fluctuations is key to making informed financial decisions. Subscribe to our newsletter for regular updates on Canadian economic trends and Bank of Canada policy.

Featured Posts

-

Life Changing Impact Duncan Bannatynes Philanthropy In Morocco

May 31, 2025

Life Changing Impact Duncan Bannatynes Philanthropy In Morocco

May 31, 2025 -

Riyadh Rematch Munguia Edges Out Surace On Points

May 31, 2025

Riyadh Rematch Munguia Edges Out Surace On Points

May 31, 2025 -

Rbc Earnings A Look At The Impact Of Souring Loans

May 31, 2025

Rbc Earnings A Look At The Impact Of Souring Loans

May 31, 2025 -

Kaitlyn Devers Breakout Role A Crime Drama Masterpiece Before The Last Of Us

May 31, 2025

Kaitlyn Devers Breakout Role A Crime Drama Masterpiece Before The Last Of Us

May 31, 2025 -

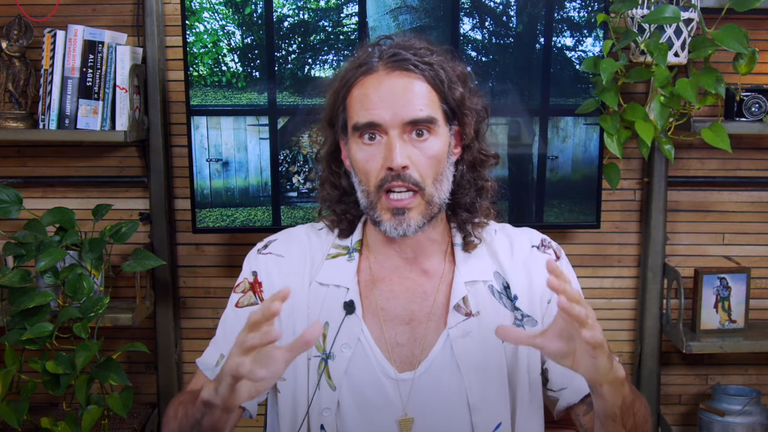

Russell Brand Denies Rape And Sexual Assault Allegations

May 31, 2025

Russell Brand Denies Rape And Sexual Assault Allegations

May 31, 2025