Batistas Exit Banco Master Asset Discussions: A JBS (JBSS3) Update

Table of Contents

The Batista Family's Departure: Reasons and Implications

The Batistas' exit from the Banco Master asset discussions leaves many wondering about the underlying reasons and the subsequent impact on JBS (JBSS3). Understanding these factors is crucial for assessing the future outlook of this major player in the Brazilian meatpacking industry.

Potential Reasons for Withdrawal

Several factors could explain the Batista family's decision to withdraw from negotiations. Speculation points towards a confluence of circumstances rather than a single decisive factor.

- Valuation discrepancies between the Batistas and Banco Master: Differing opinions on the fair market value of the assets under consideration could have led to an impasse, ultimately resulting in the Batistas' withdrawal. Sources suggest significant gaps in valuations may have been insurmountable.

- Emergence of more attractive investment opportunities: The dynamic nature of the investment world means more lucrative opportunities may have presented themselves to the Batista family, leading them to redirect their resources elsewhere. This is a common occurrence in high-stakes investment scenarios.

- Strategic realignment of the Batista family's investment strategy: The Batistas may have undergone a reassessment of their overall investment portfolio, deciding that the Banco Master assets no longer align with their long-term strategic goals. This strategic shift could involve a refocus on core businesses or exploration of new sectors.

Impact on JBS (JBSS3) Stock

The Batistas' departure is likely to create short-term volatility in JBS (JBSS3) stock. Market reaction will depend on several factors, including investor sentiment towards the company's future prospects following this development.

- Potential for short-term volatility in JBSS3 stock: The news could lead to uncertainty in the market, resulting in price fluctuations in the short term. Investors will need time to analyze the full implications of the withdrawal.

- Long-term implications for JBS's financial stability and growth: The long-term impact will depend on JBS’s ability to navigate this development and secure alternative financial strategies. A lack of transparency could negatively impact investor confidence.

- Analyst predictions and ratings changes (if any): Financial analysts will be closely monitoring the situation, likely adjusting their predictions and ratings for JBS (JBSS3) based on the unfolding developments and new information.

Banco Master's Next Steps and Alternative Strategies

Banco Master now faces the challenge of finding alternative solutions after the Batistas' withdrawal. This necessitates a swift and strategic response to mitigate potential financial losses and maintain stability.

Searching for New Investors/Strategies

Banco Master will likely explore several options to manage the assets previously intended for sale to the Batista family. These may include:

- Seeking new investors or strategic partners: Banco Master may actively pursue other potential investors or strategic partners interested in acquiring the assets. This will require a renewed marketing and due diligence process.

- Exploring alternative asset sale mechanisms: Different sales strategies, such as auctions or private placements, might be explored to achieve the best possible outcome given the changed circumstances.

- Internal restructuring or asset management strategies: Banco Master may choose to internally restructure its holdings or adopt alternative asset management strategies if finding a buyer proves challenging.

Impact on the Brazilian Financial Market

The Batistas' withdrawal from Banco Master’s asset sale has wider implications for the Brazilian financial market, influencing investor confidence and market stability.

- Potential ripple effects on investor confidence: This event could affect the perception of risk and returns within the Brazilian financial market, particularly in corporate restructuring deals.

- Implications for other similar corporate restructuring cases: The outcome of this situation could set a precedent for future corporate restructuring efforts in Brazil, influencing how similar deals are negotiated and structured.

- Influence on the overall credit market in Brazil: The event might impact credit availability and lending terms within the Brazilian credit market, especially for companies facing similar financial challenges.

JBS's Future Outlook in Light of Recent Developments

The Batista family's exit from Banco Master discussions significantly impacts the long-term outlook for JBS (JBSS3). Careful analysis of JBS's financial health and strategic plans is necessary to understand the potential consequences.

Financial Health and Strategic Plans

JBS's future success hinges on its ability to adapt and thrive in light of these recent developments. A thorough assessment of the company's financial standing and strategic plans is essential.

- Review of JBS's recent financial performance: Analyzing JBS’s recent financial statements, including profitability, debt levels, and cash flow, will provide insights into its financial resilience.

- Analysis of its current strategic initiatives: Evaluating JBS’s existing strategies – expansion plans, diversification efforts, and cost-cutting measures – will help determine their continued viability.

- Potential future investment plans and diversification strategies: JBS may need to adjust its investment plans and explore further diversification strategies to mitigate future risks and secure its long-term growth.

Conclusion

The Batista family's withdrawal from Banco Master negotiations represents a significant development for JBS (JBSS3) and the broader Brazilian financial scene. The long-term consequences remain uncertain, but several factors—including valuation disputes, market conditions, and alternative investor interest—will play a crucial role in shaping the future. The implications for JBS's stock price (JBSS3), the Brazilian financial market, and the future of similar corporate restructuring efforts are all subjects of ongoing analysis.

Call to Action: Stay informed about the ongoing developments surrounding JBS (JBSS3) and the implications of the Batistas' exit from Banco Master asset discussions. Continue to monitor our updates on this important story for further analysis and insights into the future of this key player in the Brazilian business landscape. Follow us for more in-depth coverage on JBS and other crucial Brazilian financial news.

Featured Posts

-

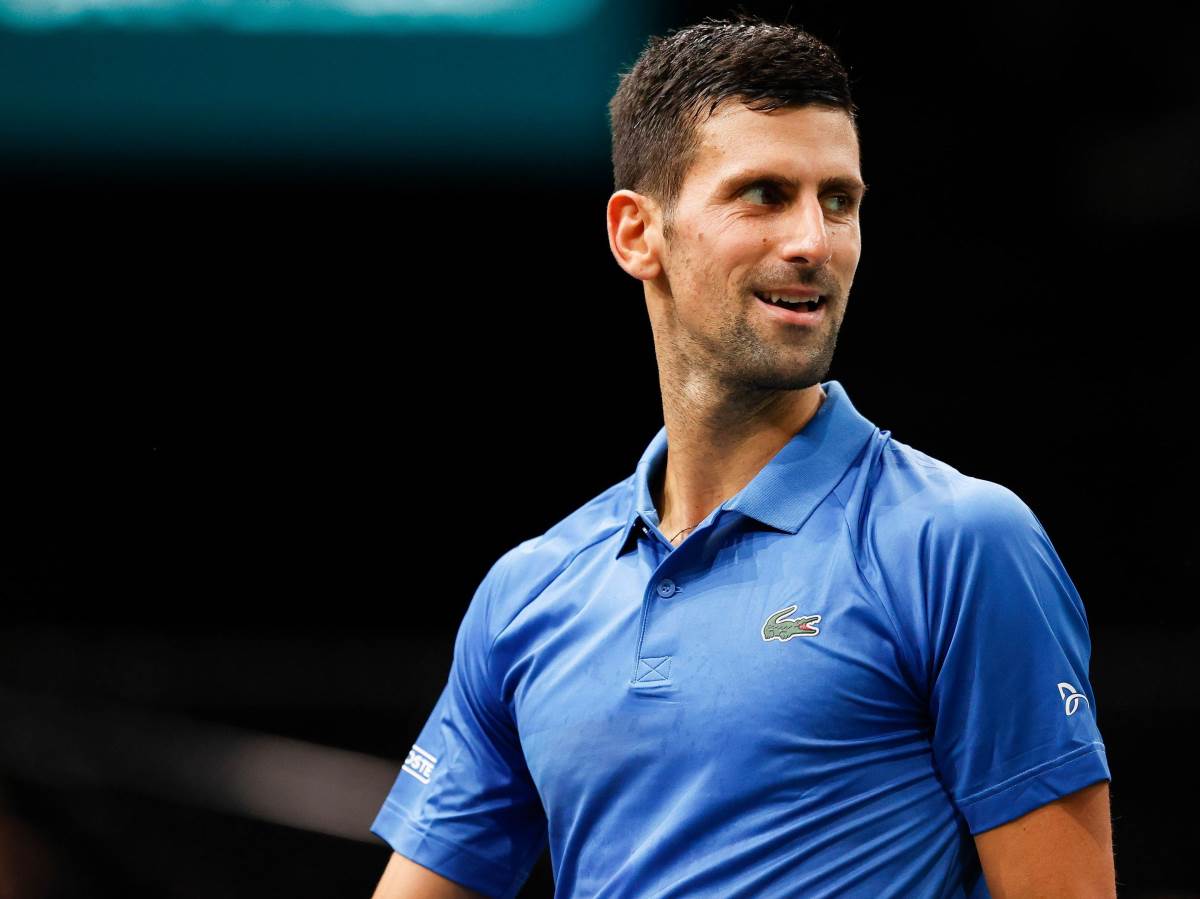

Neverovatno Podatak O Novaku Dokovicu Iznenaduje Posle 19 Godina

May 18, 2025

Neverovatno Podatak O Novaku Dokovicu Iznenaduje Posle 19 Godina

May 18, 2025 -

Piec Najbardziej Czytanych Tekstow Jacka Harlukowicza Na Onecie 2024

May 18, 2025

Piec Najbardziej Czytanych Tekstow Jacka Harlukowicza Na Onecie 2024

May 18, 2025 -

The Division 2 Sixth Anniversary Reflecting On The Past And Embracing The Future

May 18, 2025

The Division 2 Sixth Anniversary Reflecting On The Past And Embracing The Future

May 18, 2025 -

Ywrp Mshrq Wsty Awr Afryqa Ke Lye Pakstan Se Kntynr Shpng Ky Lagt Myn Adafh

May 18, 2025

Ywrp Mshrq Wsty Awr Afryqa Ke Lye Pakstan Se Kntynr Shpng Ky Lagt Myn Adafh

May 18, 2025 -

Kardashian Censori And The Kanye West Fallout An Analysis

May 18, 2025

Kardashian Censori And The Kanye West Fallout An Analysis

May 18, 2025