BBAI Stock: A Deep Dive Into BigBear.ai's Potential For Growth

Table of Contents

H2: BigBear.ai's Business Model and Core Offerings

BigBear.ai is a leading provider of AI-powered solutions, catering to both the government and commercial sectors. Their core offerings leverage advanced analytics and cutting-edge technologies to solve complex problems.

H3: AI-Powered Solutions for Government and Commercial Sectors

BigBear.ai offers a diverse range of services, including:

- Data analytics: Transforming vast datasets into actionable insights for improved decision-making.

- Cybersecurity: Providing advanced threat detection and response capabilities to protect critical infrastructure.

- Geospatial intelligence: Leveraging satellite imagery and other geospatial data for analysis and prediction.

- Mission support: Offering specialized AI solutions for various government and defense applications.

BigBear.ai boasts a strong client base, including several key government agencies and prominent commercial organizations. Successful projects have demonstrated their ability to deliver tangible results, solidifying their position in the market. Their competitive advantages stem from their proprietary technologies, deep expertise in data science, and a strong focus on delivering customized solutions. Revenue streams are diversified across their various service offerings, leading to a more resilient financial model. While precise market share figures are difficult to obtain, BigBear.ai is recognized as a significant player in the niche markets it serves.

H3: Technology and Innovation

BigBear.ai's technological edge is built upon continuous R&D investments and strategic partnerships. They actively pursue innovative solutions, developing proprietary algorithms and techniques to stay ahead of the competition. This commitment to innovation is evident in their patents and intellectual property portfolio, creating a significant barrier to entry for potential rivals. Their focus on advanced AI capabilities, such as machine learning and deep learning, positions them favorably for long-term growth within the evolving AI landscape.

H2: BBAI Stock Performance and Valuation

Understanding BBAI stock requires careful examination of its historical performance and current valuation.

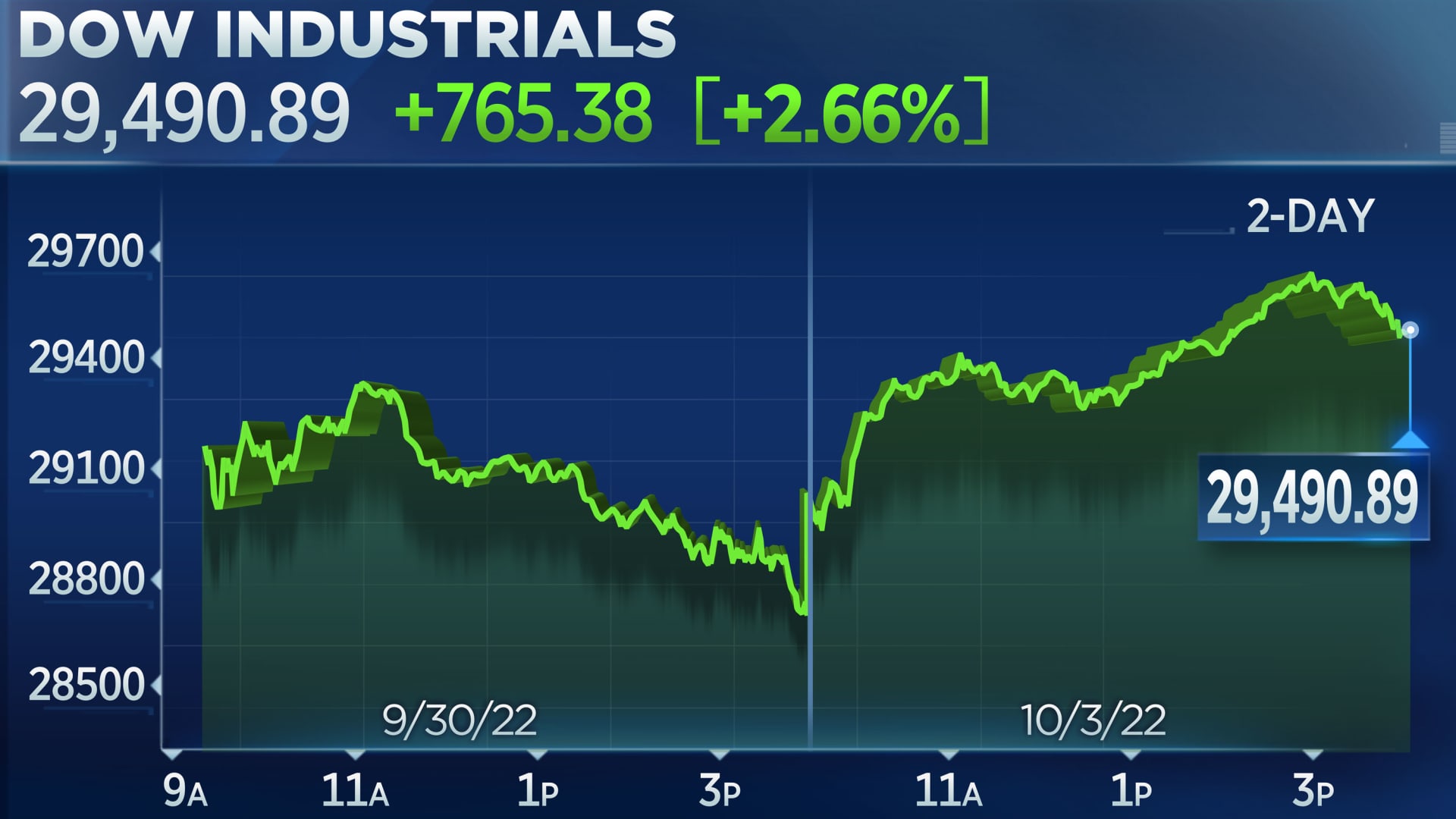

H3: Historical Stock Price Analysis

(Insert chart visualizing BBAI's historical stock price)

BBAI's stock price has experienced significant fluctuations, mirroring the inherent volatility of the technology sector. These fluctuations can often be attributed to various factors, including news announcements regarding contracts, technological breakthroughs, and broader market trends. Careful analysis of these historical trends can offer insights into potential future price movements, although past performance is not indicative of future results.

H3: Financial Performance and Key Metrics

Analyzing BigBear.ai's financial statements, including revenue growth, earnings, and debt levels, is crucial for assessing its financial health. Key metrics such as revenue per employee, operating margins, and debt-to-equity ratio provide a more nuanced understanding of the company's financial strength and sustainability. Comparing these metrics against competitors in the AI market offers a valuable benchmark for performance evaluation.

H3: Valuation and Future Projections

Projecting the future value of BBAI stock requires careful consideration of several factors, including revenue growth projections, profit margins, and market capitalization. Analyst ratings and price targets can offer some guidance, but these should be viewed with caution, as they are subject to change based on evolving market conditions. Assessing the potential risks associated with investing in BBAI, such as the competitive landscape and overall market volatility, is essential before making any investment decision.

H2: Risks and Challenges Facing BigBear.ai

Despite its potential, BigBear.ai faces several challenges.

H3: Competition in the AI Market

The AI market is highly competitive, with established tech giants and numerous startups vying for market share. This competitive pressure necessitates continuous innovation and a strong focus on maintaining a technological edge.

H3: Financial Risks and Uncertainty

BigBear.ai's financial performance is subject to uncertainty, particularly given its stage of growth and the inherent volatility of the AI sector. Potential losses and debt levels need to be carefully considered.

H3: Regulatory and Geopolitical Risks

Government regulations and international political situations can significantly impact BigBear.ai's business, particularly given its focus on government contracts and sensitive data.

H2: Investment Strategies for BBAI Stock

Investing in BBAI requires a well-defined strategy.

H3: Long-Term vs. Short-Term Investment

A long-term investment approach may be more suitable for investors willing to withstand short-term price fluctuations and benefit from BigBear.ai's potential long-term growth. Short-term trading involves higher risk.

H3: Risk Tolerance and Diversification

Investors should assess their risk tolerance and ensure their investment portfolio is adequately diversified to mitigate potential losses.

H3: Due Diligence and Research

Thorough research and due diligence are crucial before investing in BBAI stock. Understanding the company's financials, competitive landscape, and risk factors is paramount.

3. Conclusion:

BBAI stock presents a compelling investment opportunity within the rapidly expanding AI market. BigBear.ai's innovative technology, diverse service offerings, and strong client base offer significant growth potential. However, investors must acknowledge the risks associated with investing in a relatively young company in a competitive sector. This analysis highlights the importance of conducting thorough due diligence before making any investment decisions. Remember to consider your risk tolerance and diversify your portfolio. To further your research on investing in BBAI stock, consider exploring financial news sources, analyst reports, and BigBear.ai's investor relations materials for a more comprehensive understanding of BBAI stock analysis and the BigBear.ai stock outlook. Investing in BBAI stock requires careful consideration of the information presented here and further independent research.

Featured Posts

-

Nigeria Pragmatism Vs Idealism The Kite Runners Moral Dilemma

May 20, 2025

Nigeria Pragmatism Vs Idealism The Kite Runners Moral Dilemma

May 20, 2025 -

Recent D Wave Quantum Inc Qbts Stock Market Activity A Detailed Look

May 20, 2025

Recent D Wave Quantum Inc Qbts Stock Market Activity A Detailed Look

May 20, 2025 -

How Will Qbts Stock Perform After The Next Earnings Announcement

May 20, 2025

How Will Qbts Stock Perform After The Next Earnings Announcement

May 20, 2025 -

Us Army Deploys Second Typhon Missile Battery To The Pacific

May 20, 2025

Us Army Deploys Second Typhon Missile Battery To The Pacific

May 20, 2025 -

Port Autonome D Abidjan Analyse Du Trafic De 2022

May 20, 2025

Port Autonome D Abidjan Analyse Du Trafic De 2022

May 20, 2025