Best Tribal Loan Options For Individuals With Bad Credit Scores

Table of Contents

Understanding Tribal Loans and Their Advantages for Bad Credit

What are Tribal Loans?

Tribal loans are short-term loans offered by lenders who are either owned by or have significant ties to Native American tribes. These loans operate under the legal framework of tribal sovereignty, which means they may be subject to different regulations than traditional lenders.

- Definition of tribal loans: Short-term loans issued by entities associated with Native American tribes.

- Lending practices: Tribal lenders often have different lending practices compared to banks or credit unions.

- Involvement of Native American tribes: The involvement of tribes varies, from direct ownership to licensing agreements.

- Regulatory differences: The regulatory landscape for tribal loans is complex and differs significantly from state to state and federal regulations governing traditional lenders. This can lead to varying degrees of consumer protection.

Benefits of Tribal Loans for Borrowers with Bad Credit:

Tribal loans can offer several advantages for borrowers with bad credit:

- Higher approval rates: Tribal lenders may have less stringent credit requirements compared to traditional banks, increasing the likelihood of loan approval.

- Less stringent credit checks: Credit checks might be less thorough, allowing individuals with poor credit history a better chance of securing funds.

- Faster funding: The application and approval process can be quicker than with traditional lenders, offering faster access to needed funds.

- Flexible repayment options (potentially): Some tribal lenders may offer flexible repayment options, although this isn't always the case.

- Potential for credit rebuilding (with responsible use): Responsible repayment of a tribal loan can, in some cases, help improve your credit score over time. However, this is not guaranteed.

Potential Drawbacks of Tribal Loans:

While tribal loans offer potential benefits, it's crucial to understand the potential downsides:

- Potentially higher interest rates: Interest rates on tribal loans can be significantly higher than those offered by traditional lenders, leading to a higher total cost of borrowing.

- Risk of debt traps: If not managed carefully, the high interest rates and short repayment periods can create a debt trap, leading to repeated borrowing and escalating debt.

- Fees and charges: Tribal lenders may impose various fees, such as origination fees, late payment fees, and prepayment penalties, adding to the overall cost.

- Predatory lending practices: Some tribal lenders engage in predatory lending practices, targeting vulnerable borrowers with unfair terms. It's essential to compare loan offers carefully and avoid lenders with questionable reputations.

Finding Reputable Tribal Lenders:

Finding a trustworthy lender is crucial when considering a tribal loan.

Research and Due Diligence:

Thorough research is paramount before choosing a tribal lender:

- Checking online reviews: Read reviews from previous borrowers on independent review sites to assess the lender's reputation and customer service.

- Verifying licensing and registration: Ensure the lender is properly licensed and registered to operate in your state.

- Comparing interest rates and terms: Compare offers from multiple lenders to find the most favorable terms and interest rates.

- Identifying red flags: Watch out for unrealistic promises, hidden fees, high-pressure sales tactics, and aggressive debt collection practices.

Avoiding Predatory Lending Practices:

Protect yourself from predatory lenders by:

- Recognizing unrealistic promises: Be wary of lenders who promise guaranteed approval or excessively low interest rates.

- Understanding fees and charges upfront: Clearly understand all fees and charges before signing any loan agreement.

- Reviewing contracts carefully: Read the loan contract thoroughly before signing to ensure you understand all terms and conditions.

- Utilizing resources: Consult consumer protection agencies and financial literacy organizations for help in identifying predatory lending tactics.

Comparing Loan Offers:

Before making a decision, compare multiple loan offers:

- Using online comparison tools: Leverage online tools to compare interest rates, fees, and repayment terms from various lenders.

- Considering APR (Annual Percentage Rate): The APR reflects the total cost of the loan, including interest and fees.

- Total repayment cost: Calculate the total amount you'll repay, including interest and fees, to get a clear picture of the loan's cost.

- Loan terms: Consider the loan term and repayment schedule to ensure they align with your budget and financial capabilities.

Alternative Loan Options for Bad Credit:

Explore alternatives before settling on a tribal loan.

Credit Unions and Community Banks:

Credit unions and community banks may offer more favorable terms:

- Potential for lower interest rates: These institutions sometimes provide lower interest rates than tribal lenders.

- Personal service: You'll likely receive more personalized service and support.

- Credit building opportunities: Responsible borrowing can help improve your credit score.

Secured Loans:

Secured loans require collateral, reducing the lender's risk:

- Lower interest rates: The reduced risk often translates to lower interest rates.

- Collateral requirement: You'll need to pledge an asset, such as a car or savings account, as collateral.

- Risk of asset repossession: Failure to repay the loan can lead to the repossession of your collateral.

Debt Consolidation Loans:

Consolidating existing debts can simplify payments:

- Simplifying payments: Combining multiple debts into a single loan can make payments more manageable.

- Potentially lower monthly payments: A debt consolidation loan might offer lower monthly payments, but the overall interest paid might be higher.

- Careful planning required: Debt consolidation requires careful planning and budgeting to ensure successful repayment.

Responsible Borrowing Practices:

Responsible borrowing is key to avoiding financial hardship.

Creating a Budget:

Before applying for any loan, create a realistic budget:

- Tracking income and expenses: Monitor your income and expenses to understand your financial situation.

- Prioritizing essential spending: Focus on essential expenses, such as housing, food, and transportation.

- Identifying areas to reduce spending: Look for ways to cut back on non-essential spending to free up funds for loan repayment.

Understanding Loan Terms:

Thoroughly understand the loan terms and conditions:

- APR: Know the annual percentage rate (APR) to understand the total cost of borrowing.

- Fees: Be aware of all associated fees, such as origination fees and late payment penalties.

- Repayment schedule: Understand the repayment schedule and ensure it aligns with your financial capabilities.

- Penalties for late payments: Understand the consequences of late or missed payments.

Building Credit:

Improve your credit score over time through responsible financial habits:

- Paying bills on time: Consistent on-time payments are crucial for building credit.

- Maintaining low credit utilization: Keep your credit utilization ratio low (ideally below 30%).

- Checking credit reports regularly: Monitor your credit reports for errors and inconsistencies.

Conclusion:

Tribal loans can offer a quicker route to funds for individuals with bad credit, but they come with potentially high interest rates and fees. Thorough research, careful comparison shopping, and responsible borrowing are crucial. Understand the potential risks and benefits before proceeding. Explore alternative options like credit unions, secured loans, or debt consolidation loans. Responsible financial management is key to avoiding debt traps and building a strong financial future. Find the best tribal loan option for your needs by researching carefully and comparing offers. Don't rush the process. Make informed decisions when considering tribal loans or other bad credit loan solutions.

Featured Posts

-

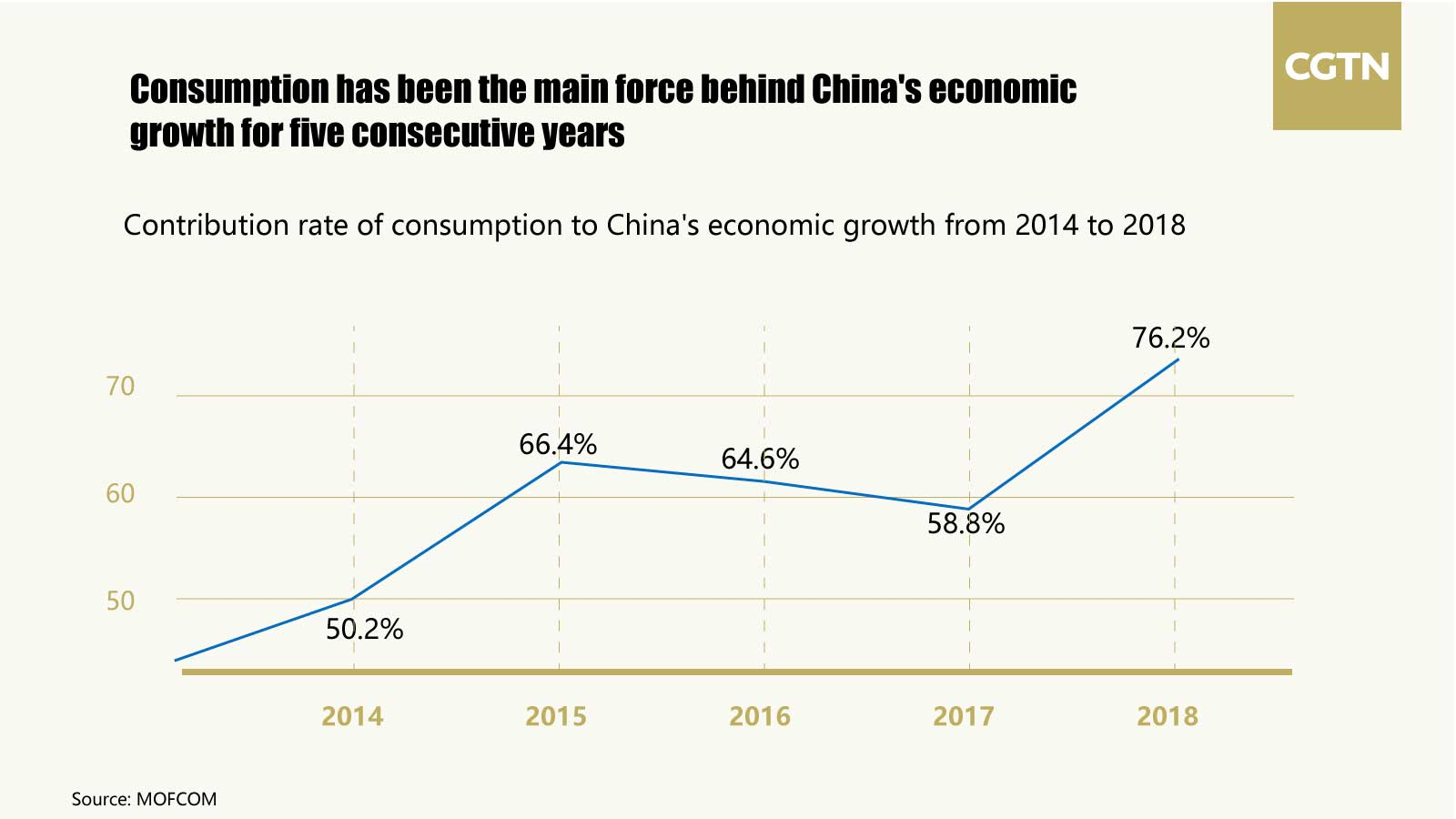

Boosting Chinas Economy The Challenges Of Increasing Household Consumption

May 28, 2025

Boosting Chinas Economy The Challenges Of Increasing Household Consumption

May 28, 2025 -

Roland Garros Update Musetti Sabalenka Win Nadal Receives Tribute

May 28, 2025

Roland Garros Update Musetti Sabalenka Win Nadal Receives Tribute

May 28, 2025 -

Pirati A Zeleni Domaci Politika A Cesta Do Snemovny

May 28, 2025

Pirati A Zeleni Domaci Politika A Cesta Do Snemovny

May 28, 2025 -

Lavender Milk Nails So Stylen Sie Den Trendlook Im Fruehling Sommer

May 28, 2025

Lavender Milk Nails So Stylen Sie Den Trendlook Im Fruehling Sommer

May 28, 2025 -

Manchester Uniteds Garnacho Transfer Rumours And Predicted Fee

May 28, 2025

Manchester Uniteds Garnacho Transfer Rumours And Predicted Fee

May 28, 2025