Betting On Natural Disasters: The Los Angeles Wildfires And The Changing Times

Table of Contents

The Rising Risk of Los Angeles Wildfires

The threat of Los Angeles wildfires is escalating at an alarming rate. This increase in risk is driven by a confluence of factors, primarily fueled by climate change and exacerbated by urban development patterns.

Climate Change and Increased Fire Frequency

Climate change is significantly impacting the frequency and intensity of Los Angeles wildfires. We're seeing a clear trend towards:

- Increased average temperatures: Leading to drier vegetation and longer fire seasons. Data from the National Oceanic and Atmospheric Administration (NOAA) shows a consistent upward trend in average temperatures across Southern California over the past several decades.

- Longer fire seasons: The period of high wildfire risk is extending, increasing the overall probability of ignition and uncontrolled spread.

- Drier vegetation: Prolonged droughts and higher temperatures create highly flammable conditions, providing ample fuel for wildfires.

- Increased Santa Ana wind intensity: These powerful, dry winds accelerate the spread of wildfires, making them harder to control. Studies have indicated a potential link between climate change and increased Santa Ana wind intensity.

These factors combine to create a perfect storm for devastating wildfires, making the “bet” on avoiding catastrophic fire increasingly risky.

Urban Sprawl and Wildland-Urban Interface

The expansion of urban development into wildland areas, creating a wildland-urban interface (WUI), dramatically increases the risk of wildfire damage and associated insurance claims.

- Examples of communities built in high-risk areas: Many communities in the foothills surrounding Los Angeles are situated in close proximity to chaparral and other flammable vegetation.

- Challenges of fire prevention in these areas: Protecting homes in the WUI is incredibly difficult, requiring proactive measures such as defensible space creation and regular brush clearance.

- Increased property values at risk: The high concentration of valuable properties in these areas means the financial impact of a wildfire can be catastrophic.

[Insert relevant map or image showing urban sprawl near wildfire-prone areas here]

The Insurance Industry's Response to Wildfire Risk

The escalating risk of Los Angeles wildfires is forcing a significant response from the insurance industry. Companies are grappling with how to balance profitability with their responsibility to provide coverage.

Rising Insurance Premiums and Denials

The increased risk is directly translating into higher insurance premiums and, in some cases, complete denial of coverage in high-risk areas.

- Examples of increased premiums in wildfire-prone zones: Homeowners in areas with high wildfire risk are facing substantial increases in their insurance premiums, making homeownership increasingly unaffordable.

- Instances of insurance denials: Some insurance companies are refusing to renew policies or provide new coverage in areas deemed too risky.

- Difficulties for homeowners in obtaining affordable coverage: This creates a significant challenge for homeowners, leaving many uninsured and vulnerable to substantial financial losses.

Development of Specialized Wildfire Insurance Products

In response to the growing need, the insurance industry is developing specialized products to address wildfire risks more effectively.

- Examples of specialized policies: These policies often include features tailored to wildfire risk.

- Features of these policies (e.g., higher deductibles, specific coverage for wildfire damage): Higher deductibles might be required to make the policies more affordable. Coverage might be limited to specific types of damage.

- Advantages and disadvantages: While these specialized policies offer coverage, they often come with higher premiums and stricter conditions.

Predictive Modeling and Risk Assessment for Los Angeles Wildfires

Advances in technology and data analysis are significantly improving wildfire prediction and risk assessment, allowing for better preparedness and mitigation strategies.

Advances in Technology and Data Analysis

Technology plays a crucial role in improving wildfire risk assessment.

- Use of satellite imagery: Provides real-time monitoring of vegetation conditions, fire detection, and the spread of wildfires.

- Weather modeling: Advanced weather models can predict the likelihood of extreme weather events, such as Santa Ana winds, which increase wildfire risk.

- AI-powered prediction systems: Artificial intelligence is being used to analyze vast datasets to predict fire behavior and identify high-risk areas more accurately.

The Role of Government Agencies and Community Preparedness

Government agencies and community initiatives play a critical role in mitigating wildfire risk and improving preparedness.

- Community wildfire protection plans: These plans outline proactive steps to reduce wildfire risk at the community level.

- Evacuation strategies: Effective evacuation plans are crucial to ensure the safety of residents in high-risk areas.

- Public awareness campaigns: Educating the public about wildfire risks and preparedness measures is vital.

Conclusion

The increasing risk of Los Angeles wildfires, the insurance industry's evolving response, and the advancements in predictive modeling and community preparedness paint a complex picture. Understanding the complexities of "betting on natural disasters," particularly concerning Los Angeles wildfires, is crucial. The rising frequency and intensity of these events underscore the urgent need for proactive measures. Take proactive steps to protect your property and community by researching wildfire preparedness and insurance options today. Don't gamble with your future; invest in wildfire safety and secure appropriate insurance coverage to mitigate the risks associated with these increasingly frequent and destructive Los Angeles wildfires.

Featured Posts

-

Hinch Seeks Replay Evidence After Controversial Tigers Plate Call

Apr 23, 2025

Hinch Seeks Replay Evidence After Controversial Tigers Plate Call

Apr 23, 2025 -

Remembering Bob Uecker Cory Provuss Heartfelt Tribute

Apr 23, 2025

Remembering Bob Uecker Cory Provuss Heartfelt Tribute

Apr 23, 2025 -

Cy Young Winner Reflects On Aprils 9 Run Game And Key Strikeout

Apr 23, 2025

Cy Young Winner Reflects On Aprils 9 Run Game And Key Strikeout

Apr 23, 2025 -

Marc Fiorentino L Impact De Sa Carte Blanche

Apr 23, 2025

Marc Fiorentino L Impact De Sa Carte Blanche

Apr 23, 2025 -

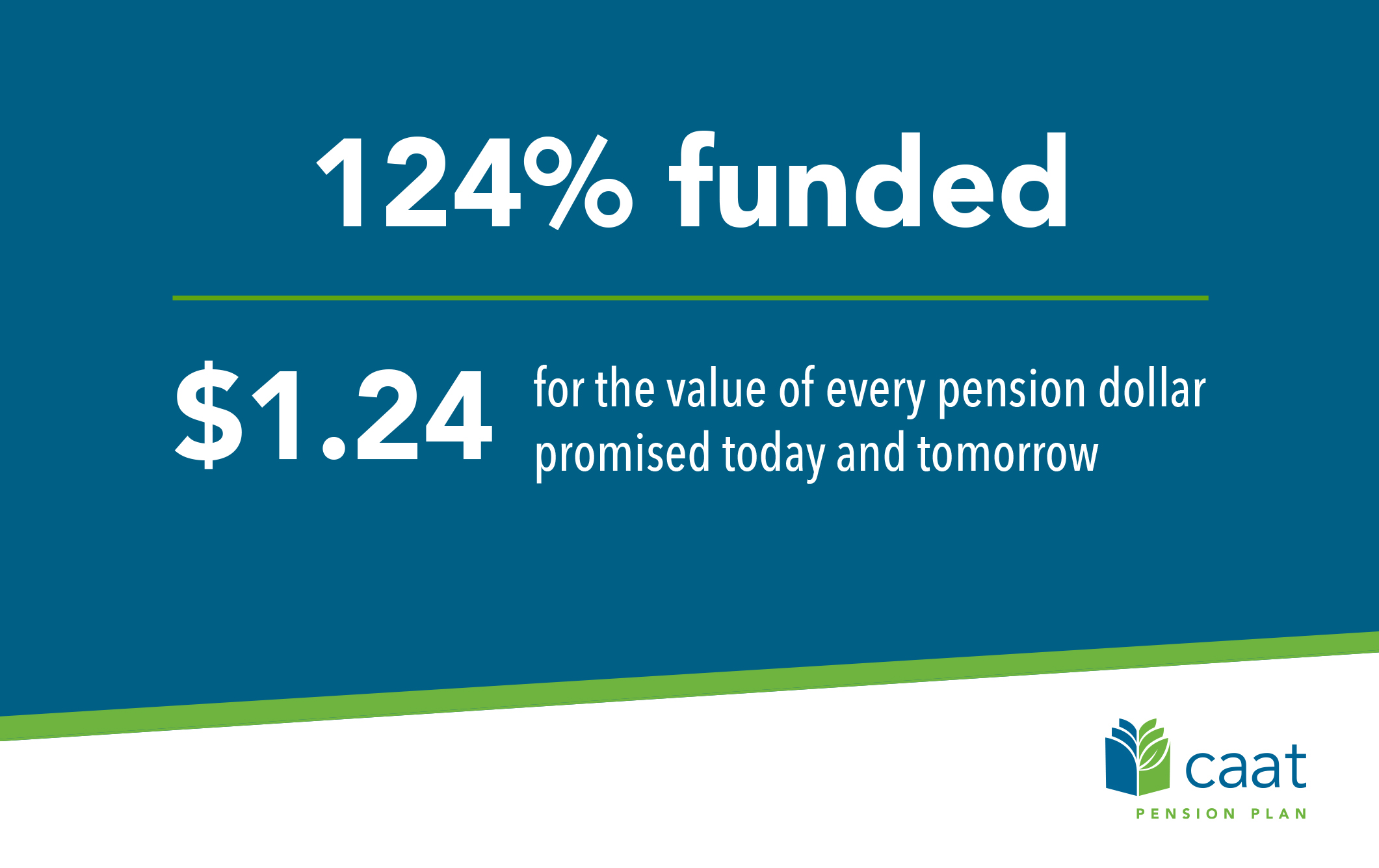

Caat Pension Plan Seeks Increased Canadian Private Investment

Apr 23, 2025

Caat Pension Plan Seeks Increased Canadian Private Investment

Apr 23, 2025