BigBear.ai Stock: Investment Pros And Cons For Today's Market

Table of Contents

Potential Upsides of Investing in BigBear.ai Stock

BigBear.ai stock presents several potential upsides for investors willing to accept the inherent risks of the technology sector. Its position within the burgeoning AI market, combined with its innovative solutions and stable government contracts, makes it an interesting proposition.

Strong Growth Potential in the AI Market

The global AI market is projected to experience explosive growth in the coming years. BigBear.ai is well-positioned to capitalize on this expansion through its focus on several key areas:

- National Security and Intelligence: BigBear.ai provides crucial AI-powered solutions for national security agencies, a market with consistent demand.

- Data Analytics and Fusion: Their advanced data analytics capabilities help organizations make sense of complex datasets, a critical need across various sectors.

- Recent Contract Wins: BigBear.ai has secured several significant contracts recently, demonstrating confidence from key clients in the government and commercial sectors. (Specific examples of contract wins and their financial impact should be inserted here, if available, with proper citation)

- Market Growth Projections: Analysts predict substantial growth in the AI market, with some forecasting a [insert projected market size and growth rate with source] increase by [year]. This growth trajectory bodes well for companies like BigBear.ai that are at the forefront of AI innovation.

Innovative Technology and Solutions

BigBear.ai differentiates itself through its proprietary technology and innovative solutions:

- AI-Powered Analytics: Their cutting-edge AI algorithms provide unparalleled insights from massive datasets, enabling better decision-making.

- Data Fusion: Their expertise in integrating data from diverse sources provides a holistic view, crucial for complex problem-solving.

- Patented Technologies: BigBear.ai holds several patents related to their core technologies, giving them a competitive edge. (Specific examples of patents should be included here with relevant links)

- Industry Recognition: BigBear.ai has received several awards and recognitions for its innovative contributions to the AI field. (List any awards or recognitions here with sources)

Government Contracts and Revenue Stability

A significant portion of BigBear.ai's revenue stream comes from government contracts. This provides a degree of revenue stability that can be attractive to investors seeking less volatile investments within the tech sector.

- Major Government Clients: BigBear.ai works with numerous government agencies, securing long-term contracts. (List major clients if public information)

- Long-Term Potential: The ongoing need for advanced AI solutions in government and defense ensures a consistent demand for BigBear.ai's services.

- Risks Associated with Government Contracts: While offering stability, reliance on government contracts also carries risk. Budget cuts, shifting priorities, or delays in contract approvals can impact revenue. Diversification of their client base is crucial for mitigating this risk.

Potential Downsides of Investing in BigBear.ai Stock

While the potential upsides are significant, investing in BigBear.ai stock involves considerable risk. A thorough understanding of these potential downsides is essential before making any investment decision.

High Volatility and Risk

Investing in a smaller, rapidly growing company in the technology sector inherently involves high volatility. The stock price can fluctuate significantly based on various factors:

- Market Fluctuations: Overall market conditions can dramatically impact the stock price of tech companies.

- Financial Performance: BigBear.ai's financial performance, including revenue growth and profitability, directly influences its stock price.

- Possibility of Losses: Investors should be prepared for the possibility of significant losses.

Competition in the AI Industry

The AI industry is incredibly competitive, with many established players and numerous startups vying for market share.

- Key Competitors: BigBear.ai faces competition from both large tech companies and specialized AI firms. (Mention key competitors and their strengths)

- Competitive Advantages: BigBear.ai's competitive advantages lie in its specialized focus on national security and its unique technological offerings.

- Competitive Disadvantages: The company's smaller size compared to industry giants could be a disadvantage in terms of resources and market reach.

Dependence on Specific Contracts

The reliance on a relatively small number of large contracts creates vulnerability:

- Impact of Contract Losses: Losing a major contract could significantly impact BigBear.ai's revenue and stock price.

- Contract Delays: Delays in contract awards or renewals can negatively affect financial performance.

- Need for Diversification: BigBear.ai needs to actively diversify its client base to mitigate the risks associated with contract dependence.

Conclusion

Investing in BigBear.ai stock (BBAI) presents a compelling opportunity for investors interested in the growth potential of the AI sector, particularly in national security and intelligence. However, it is crucial to acknowledge the significant risks involved, including high volatility, intense competition, and dependence on a limited number of large contracts. A thorough analysis of BigBear.ai's financial performance, competitive landscape, and future prospects is essential before considering any investment. This analysis should also consider a diversified investment strategy to mitigate risk. We strongly recommend conducting your own thorough research and consulting with a qualified financial advisor before making any investment decisions regarding BigBear.ai stock. For further insights, consider exploring resources like detailed BigBear.ai stock analysis reports and developing a robust BBAI investment strategy.

Featured Posts

-

Private Credit Jobs 5 Dos And Don Ts To Boost Your Chances

May 20, 2025

Private Credit Jobs 5 Dos And Don Ts To Boost Your Chances

May 20, 2025 -

Celebrity Fallout David Walliams And Simon Cowells Public Dispute

May 20, 2025

Celebrity Fallout David Walliams And Simon Cowells Public Dispute

May 20, 2025 -

Biarritz Parcours De Femmes Trois Journees Dediees Aux Femmes

May 20, 2025

Biarritz Parcours De Femmes Trois Journees Dediees Aux Femmes

May 20, 2025 -

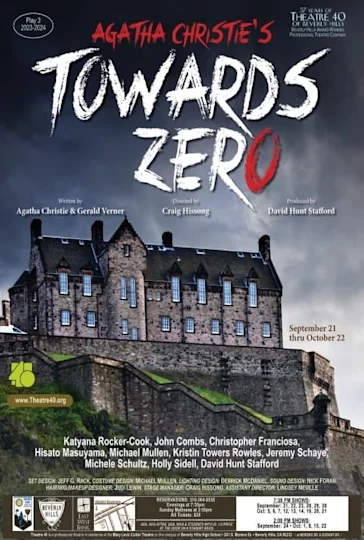

The Curious Case Of Missing Murder In Towards Zero Episode 1 An Agatha Christie Analysis

May 20, 2025

The Curious Case Of Missing Murder In Towards Zero Episode 1 An Agatha Christie Analysis

May 20, 2025 -

Ferrari And Leclerc Imola Grand Prix Update

May 20, 2025

Ferrari And Leclerc Imola Grand Prix Update

May 20, 2025