Big Oil's Production Stance Ahead Of OPEC+ Meeting

Table of Contents

Current Global Oil Market Dynamics

Supply and Demand Imbalance

The global oil market is a complex interplay of supply and demand. Currently, a delicate balance exists, influenced by several factors. Demand for crude oil is driven primarily by global economic growth, particularly in emerging markets. Seasonal variations, such as increased demand during winter months in the northern hemisphere, also play a role. On the supply side, geopolitical events and production capacity constraints from major oil-producing nations significantly impact availability.

- Recent Production Figures: OPEC+ members, including Saudi Arabia and Russia, have seen varied production levels in recent months, influenced by individual national policies and agreements. Non-OPEC producers, such as the United States, have also experienced fluctuations due to factors like technological advancements and investment decisions.

- Geopolitical Instability and Sanctions: The ongoing conflict in Ukraine, along with sanctions imposed on Russia, has significantly disrupted global oil supply chains and contributed to price volatility. Other geopolitical tensions in various regions further exacerbate the instability.

- Inventory Levels: Global oil inventories act as a buffer against supply shocks. Current inventory levels, coupled with demand forecasts, play a crucial role in shaping market sentiment and influencing price movements. Low inventory levels can signal potential supply shortages and drive prices upwards.

Price Volatility and Market Sentiment

Oil prices are notoriously volatile, influenced by speculation, market expectations, and unforeseen global events. Investor sentiment towards the energy sector significantly impacts price movements. News headlines, geopolitical developments, and analyst predictions all contribute to this volatility.

- Recent Price Fluctuations: The recent period has witnessed significant price fluctuations in the crude oil market, reflecting the ongoing uncertainty. These swings directly impact Big Oil's profitability and their strategic production decisions.

- Futures Contracts and Options Trading: Futures contracts and options trading allow investors to speculate on future price movements, adding another layer of complexity and volatility to the market. This speculative activity can amplify price swings.

- Analyst Predictions and News: Constant monitoring of news sources, analyst reports, and economic forecasts is essential for understanding the prevailing market sentiment and potential future price trends. These predictions influence investor behavior and ultimately oil prices.

Big Oil's Production Strategies and Challenges

Profitability and Investment Decisions

Big Oil's production decisions are heavily influenced by profitability. High oil prices generally encourage increased production and investment in new projects. However, low prices may lead to production cuts and reduced capital expenditure. Shareholder pressure also plays a significant role, pushing companies to maximize returns.

- Capital Expenditure Plans: Major oil companies regularly announce their capital expenditure (CAPEX) plans, outlining investments in exploration, production, and infrastructure development. These plans directly reflect their production outlook.

- Shareholder Pressure: Publicly traded oil companies are subject to significant shareholder pressure to maintain profitability and deliver strong returns. This can influence production decisions, sometimes overriding long-term strategic considerations.

- ESG Factors: Growing concerns about environmental, social, and governance (ESG) factors are increasingly impacting Big Oil's strategies. Companies are facing pressure to reduce their carbon footprint and adopt more sustainable practices.

Operational Constraints and Capacity

Big Oil faces several operational challenges that can constrain their production capacity. Aging infrastructure requires significant maintenance, and labor shortages in skilled areas like engineering and drilling can hinder operations.

- Aging Oil Fields: Many of the world's major oil fields are aging, leading to declining production rates and increased maintenance costs. This requires significant investment to maintain production levels.

- Workforce Challenges: The oil and gas industry faces challenges in attracting and retaining skilled workers. This shortage can impact production efficiency and limit expansion plans.

- Technological Advancements: Technological advancements in exploration and production techniques, such as enhanced oil recovery (EOR) methods, can offset some of the challenges related to aging infrastructure and declining oil fields.

OPEC+ Meeting Expectations and Potential Outcomes

Potential Production Adjustments

The OPEC+ meeting is expected to discuss potential production adjustments. Several scenarios are possible, ranging from production cuts to increases or maintaining current levels. The final decision will depend on a complex interplay of factors.

- Differing Interests: OPEC+ members have differing interests and priorities. Some may favor production cuts to support higher prices, while others might prefer to maintain or increase production to meet domestic needs.

- Global Economic Forecasts: Global economic growth forecasts significantly influence the OPEC+ decision-making process. Strong economic growth usually translates to higher oil demand, justifying increased production.

- Impact on Oil Prices: Any production adjustment decided at the OPEC+ meeting is likely to have a significant impact on global oil prices. Production cuts usually result in higher prices, while increases lead to lower prices.

Long-Term Implications for the Energy Market

The OPEC+ meeting's decisions have significant long-term implications for the global energy market. The ongoing transition to renewable energy sources and the push for energy security will be impacted.

- Energy Security: The decisions made at the OPEC+ meeting have implications for the energy security of various nations, particularly those heavily reliant on oil imports.

- Renewable Energy Investment: Oil price fluctuations influenced by OPEC+ decisions can affect investment decisions in renewable energy sources. High oil prices may incentivize greater investment in renewables.

- Long-Term Price Outlook: The OPEC+ meeting's outcomes will contribute significantly to the long-term price outlook for crude oil, influencing investment strategies across the energy sector.

Conclusion

Big Oil's production stance ahead of the OPEC+ meeting is shaped by a complex interplay of global market dynamics, including supply and demand imbalances, price volatility, and geopolitical events. Operational constraints and strategic considerations within Big Oil companies, along with shareholder pressure and ESG factors, further complicate the equation. The potential outcomes of the OPEC+ meeting—production adjustments or maintaining current levels—will significantly impact global crude oil prices and the long-term energy landscape. The meeting's decisions will influence energy security, investment in renewable energy, and the long-term price outlook for oil.

Call to Action: Stay informed about the crucial developments surrounding Big Oil's production stance and the OPEC+ meeting to make informed decisions in the volatile energy market. Continue to monitor this space for updates on Big Oil's production stance and its impact on global oil prices.

Featured Posts

-

Risk Mitigation In Financing A 270 M Wh Bess Project Within The Belgian Energy Market

May 04, 2025

Risk Mitigation In Financing A 270 M Wh Bess Project Within The Belgian Energy Market

May 04, 2025 -

Georgetown Resident Crowned 2025 Kentucky Derby Festival Queen

May 04, 2025

Georgetown Resident Crowned 2025 Kentucky Derby Festival Queen

May 04, 2025 -

Lizzo Compares Britney Spears To Janet Jackson Fans React

May 04, 2025

Lizzo Compares Britney Spears To Janet Jackson Fans React

May 04, 2025 -

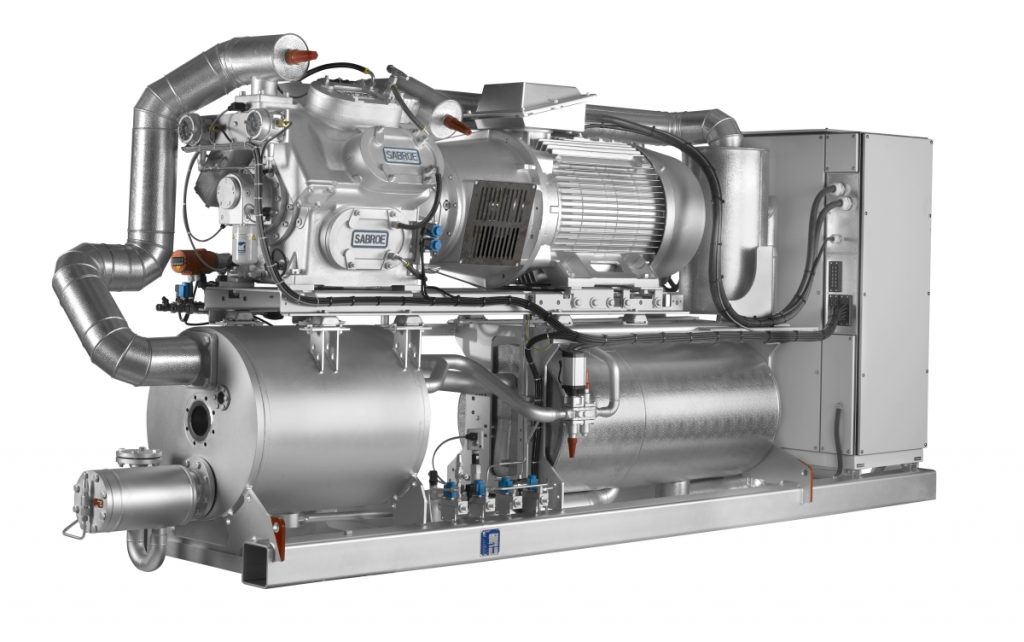

Largest Heat Pump System Launched By Innomotics Eneco And Johnson Controls

May 04, 2025

Largest Heat Pump System Launched By Innomotics Eneco And Johnson Controls

May 04, 2025 -

Britains Got Talent Childs On Air Panic

May 04, 2025

Britains Got Talent Childs On Air Panic

May 04, 2025