Bitcoin (BTC) Rally: How Trump's Actions And Fed Decisions Are Affecting The Market

Table of Contents

Donald Trump's Influence on Bitcoin (BTC) Price Volatility

Donald Trump's presidency was characterized by unpredictable policy shifts and pronouncements, creating significant uncertainty in traditional financial markets. This uncertainty often pushed investors to seek alternative assets perceived as less susceptible to political whims – such as Bitcoin.

Trump's Political Rhetoric and Market Uncertainty

Trump's rhetoric and policies, particularly regarding trade and regulation, introduced considerable volatility into the global economy. For example, the initiation of trade wars led to market anxieties, while unexpected regulatory changes caused uncertainty among investors. These events often correlated with significant price swings in Bitcoin.

- Increased market volatility due to political uncertainty: Trump's unpredictable style created a climate of fear and uncertainty, driving investors towards haven assets like Bitcoin.

- Safe-haven asset appeal of Bitcoin during political turmoil: Bitcoin's decentralized nature and lack of reliance on government policies made it an attractive safe haven during periods of political upheaval.

- Potential impact of Trump's policies on the US dollar and its effect on Bitcoin: Fluctuations in the value of the US dollar, influenced by Trump's policies, often had a knock-on effect on Bitcoin's price, as it's often traded in USD pairs.

The "Trump Bump" and its Effect on Cryptocurrencies

Some analysts have observed a correlation between certain events during the Trump administration and surges in Bitcoin's price. However, establishing a direct causal link is complex. The "Trump bump," if it exists, likely stems from a combination of factors.

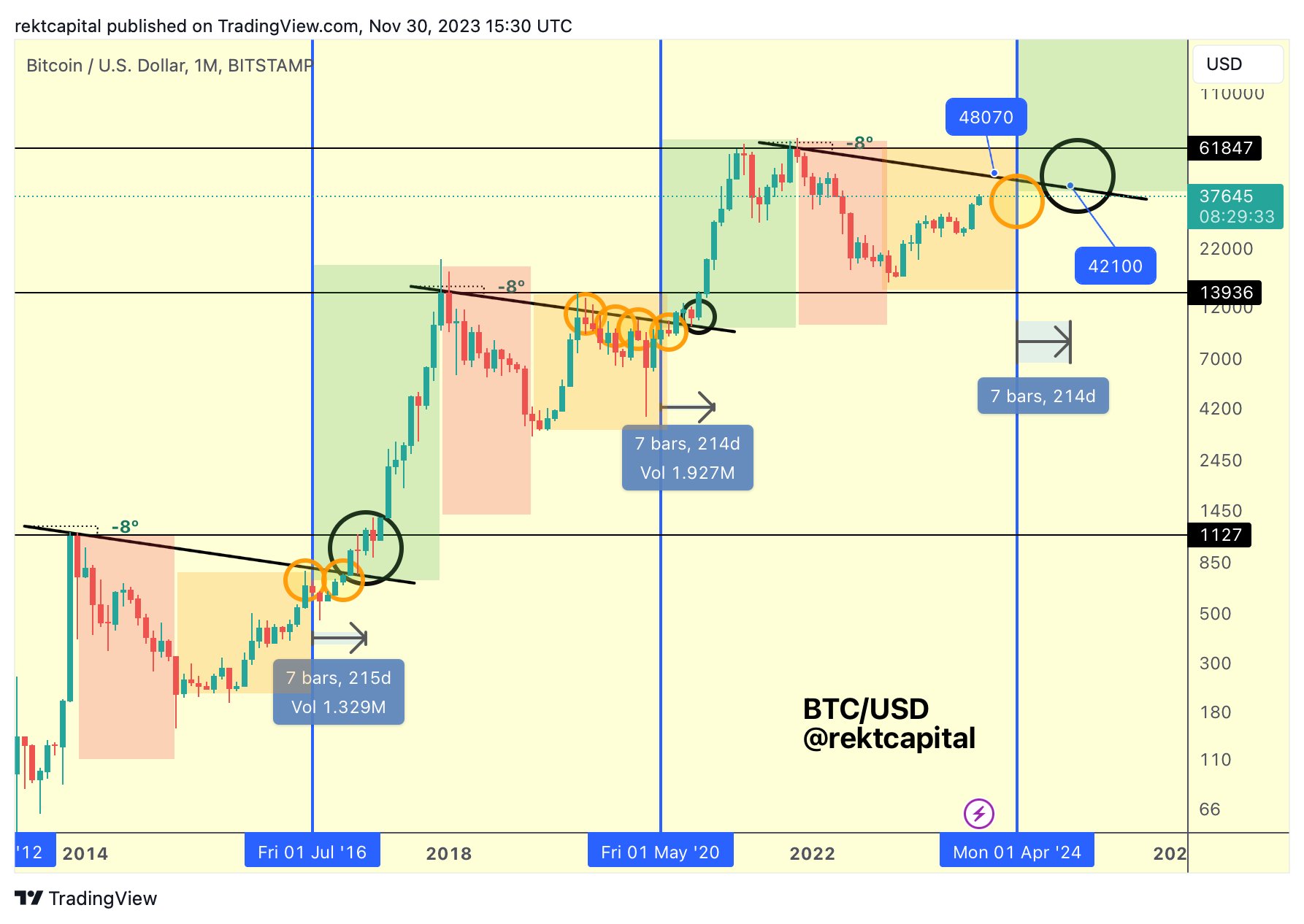

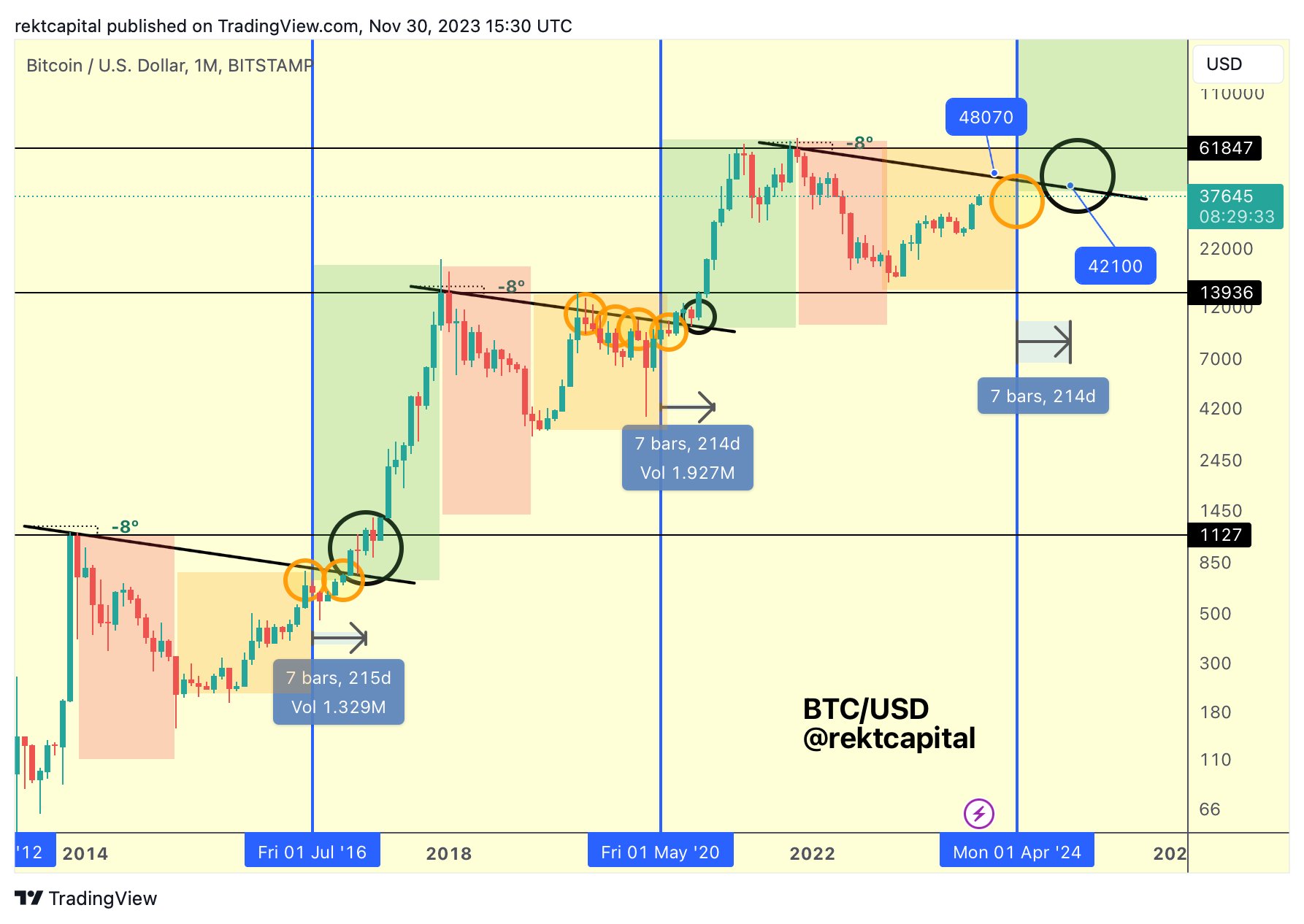

- Analysis of past Bitcoin price movements during key Trump administration events: Examining Bitcoin's price during key political moments can reveal potential correlations, although correlation does not equal causation.

- Correlation versus causation: It's crucial to differentiate between a simple correlation and a genuine causal relationship between Trump's actions and Bitcoin's price changes. Other factors were undoubtedly at play.

- Investor sentiment and media coverage influencing Bitcoin's price: Media coverage of Trump's actions and its impact on investor sentiment significantly influenced the perception and value of Bitcoin.

The Federal Reserve's Monetary Policy and its Impact on Bitcoin (BTC)

The Federal Reserve's monetary policy decisions profoundly affect global financial markets, including the cryptocurrency market. Changes in interest rates and quantitative easing (QE) programs can influence the value of the dollar and, consequently, Bitcoin's price.

Interest Rate Hikes and Bitcoin's Safe-Haven Status

Interest rate hikes by the Fed often strengthen the US dollar, potentially putting downward pressure on Bitcoin's price (as it's often priced in USD). However, in times of economic uncertainty spurred by these hikes, Bitcoin can regain its appeal as a hedge against inflation.

- Impact of interest rate changes on the US dollar and global markets: Interest rate adjustments affect global capital flows, indirectly impacting the value of cryptocurrencies.

- Bitcoin as a hedge against inflation: Some investors view Bitcoin as a hedge against inflation, believing its limited supply protects it from the devaluation of fiat currencies.

- Analysis of Bitcoin's price performance during periods of monetary policy tightening: Historical data can reveal how Bitcoin has reacted to previous instances of the Fed tightening monetary policy.

Quantitative Easing (QE) and its Effect on Bitcoin Investment

Quantitative easing, where the Fed injects liquidity into the market by purchasing assets, can weaken the dollar and potentially fuel inflation. This can drive investors toward alternative assets like Bitcoin, seeking to protect their purchasing power.

- Impact of QE on inflation and investor behavior: Increased money supply through QE can lead to inflation, making Bitcoin a more attractive investment for some.

- The flow of capital from traditional markets to crypto markets: QE can encourage investors to seek higher returns in alternative markets, potentially boosting Bitcoin's price.

- Analysis of Bitcoin's price movements during periods of QE: Examining historical data shows how Bitcoin reacted to past periods of quantitative easing.

Conclusion: Understanding the Bitcoin (BTC) Rally's Drivers

Both Donald Trump's political actions and the Federal Reserve's monetary policy decisions have significantly impacted the Bitcoin (BTC) rally. Understanding these external factors is crucial for predicting future Bitcoin price movements. The interplay between political uncertainty, monetary policy, and investor sentiment creates a complex dynamic that shapes the cryptocurrency market. To successfully navigate this volatile landscape, stay updated on Bitcoin (BTC) price fluctuations, monitor the impact of future Fed decisions on BTC, and understand how political events influence the Bitcoin (BTC) market. For further reading on this complex interplay, explore resources dedicated to macroeconomic analysis and cryptocurrency market trends.

Featured Posts

-

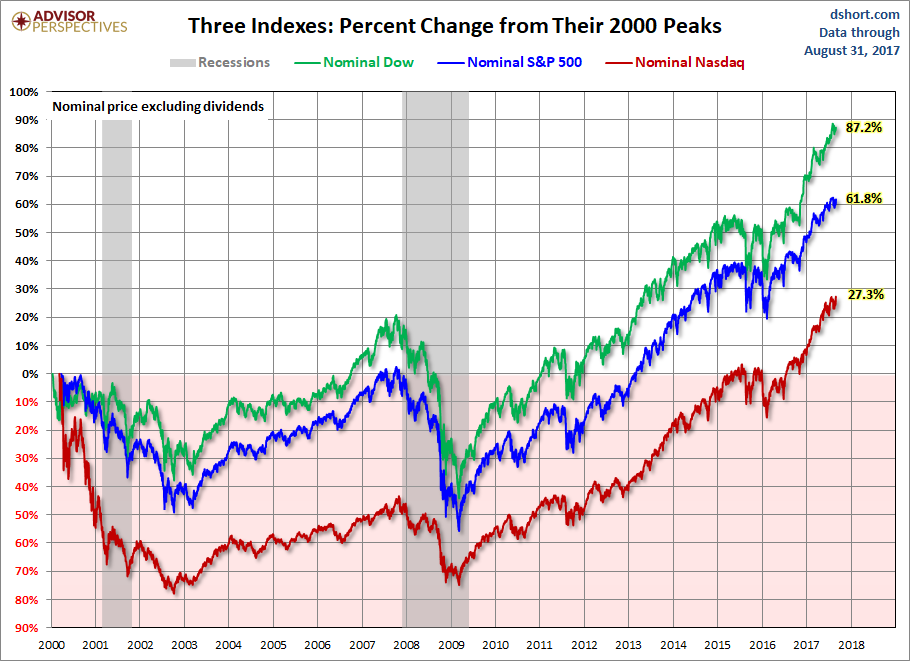

Stock Market Today Dow Jumps 1000 Points Nasdaq And S And P 500 Surge On Tariff Hopes

Apr 24, 2025

Stock Market Today Dow Jumps 1000 Points Nasdaq And S And P 500 Surge On Tariff Hopes

Apr 24, 2025 -

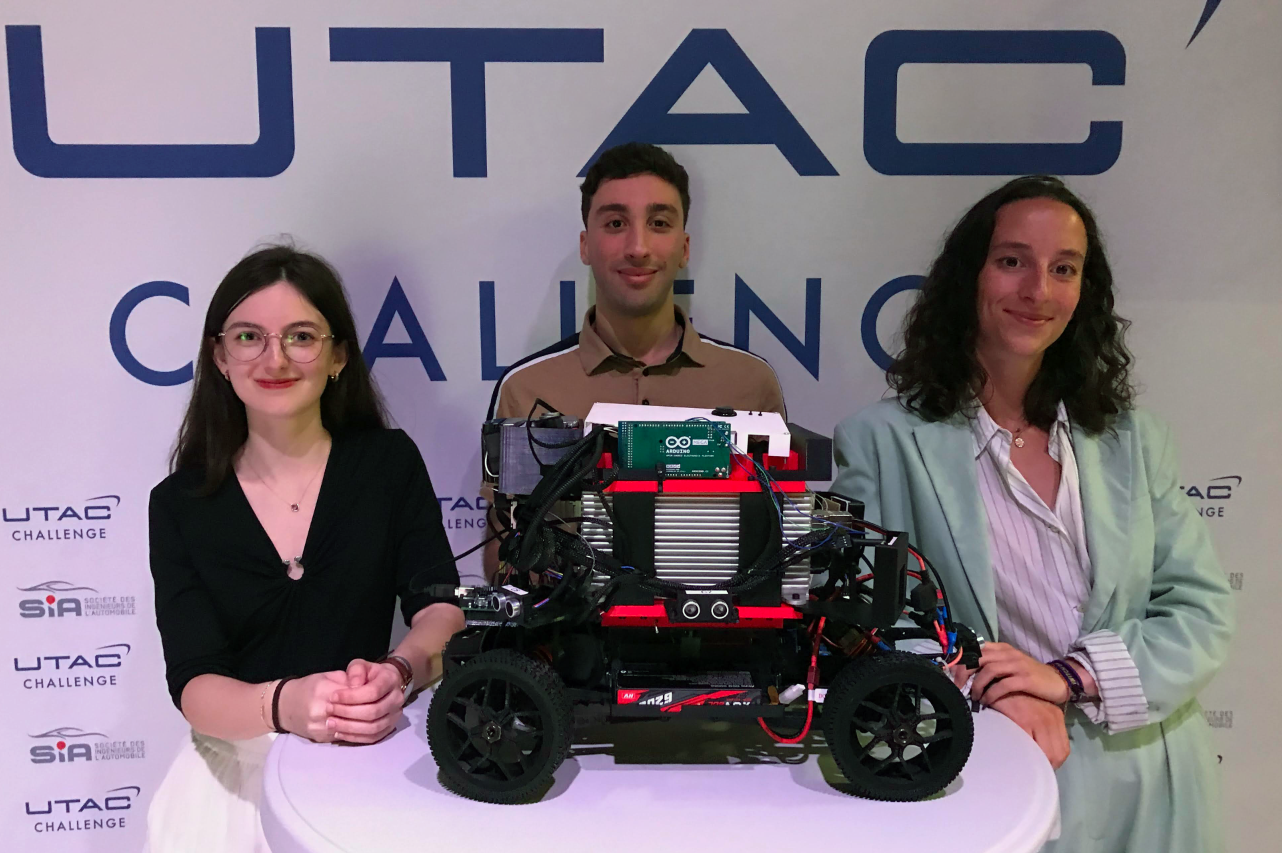

Future Of Utac Chip Tester A Chinese Buyout Firms Decision

Apr 24, 2025

Future Of Utac Chip Tester A Chinese Buyout Firms Decision

Apr 24, 2025 -

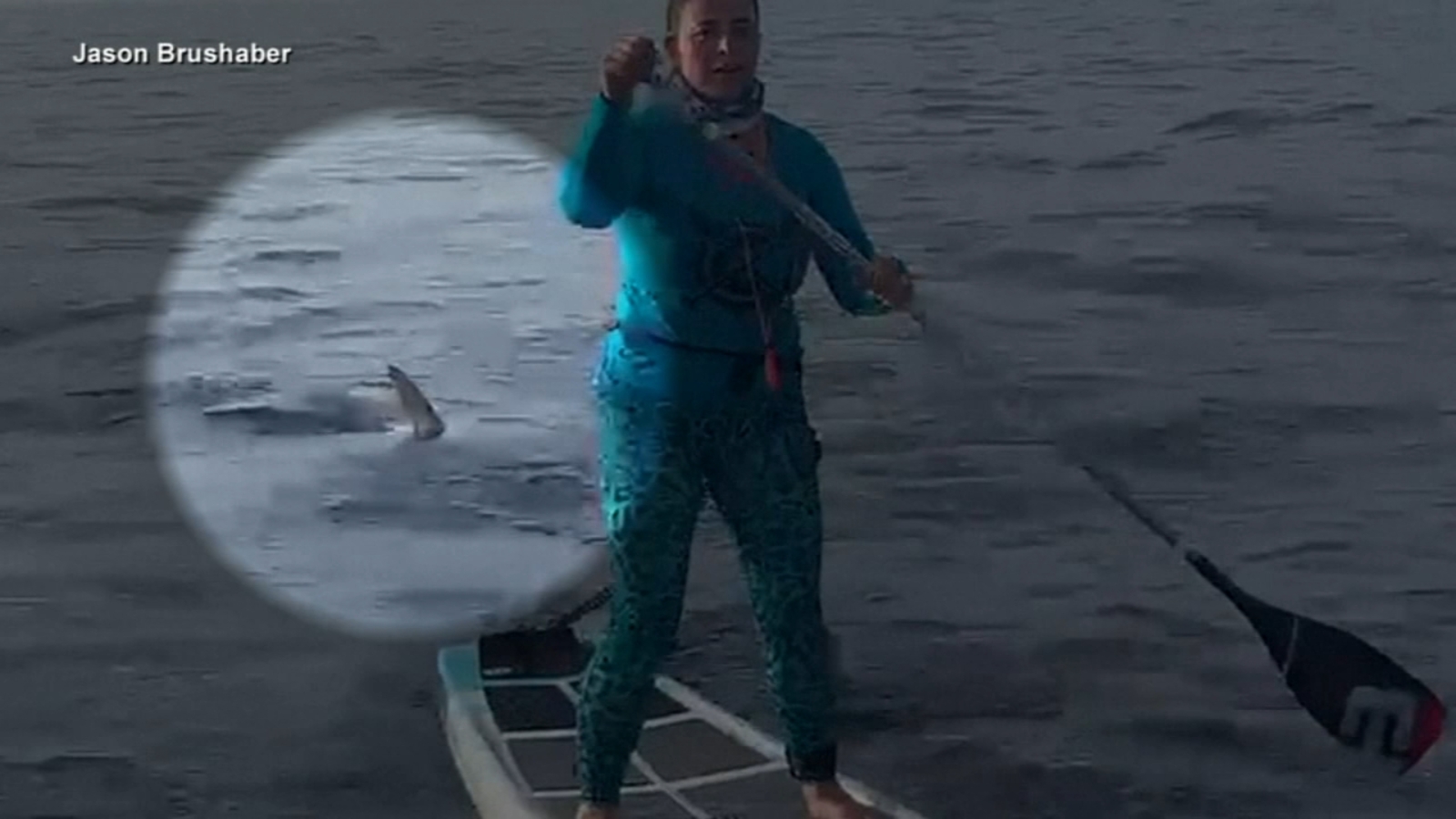

Israeli Beach Years Of Shark Sightings Culminate In Tragedy

Apr 24, 2025

Israeli Beach Years Of Shark Sightings Culminate In Tragedy

Apr 24, 2025 -

Understanding Indias Market Momentum Factors Boosting The Nifty

Apr 24, 2025

Understanding Indias Market Momentum Factors Boosting The Nifty

Apr 24, 2025 -

Deportation Flights A New Revenue Stream For A Budget Airline

Apr 24, 2025

Deportation Flights A New Revenue Stream For A Budget Airline

Apr 24, 2025