Bitcoin Price Prediction 2024: Impact Of Trump's Announcements On BTC Value.

Table of Contents

Trump's Potential Policies and Their Impact on Bitcoin

A Trump presidency in 2024 could bring significant changes impacting Bitcoin's price. His approach to economic and regulatory matters will play a crucial role.

Regulatory Changes:

- Stricter Regulations: A more conservative approach could lead to increased regulatory scrutiny of cryptocurrencies, potentially hindering innovation and adoption, and thus negatively impacting BTC's price.

- More Lenient Approach: Conversely, a less restrictive approach might stimulate growth and investment, pushing Bitcoin's price upwards.

- Unclear Stance: Uncertainty itself is a powerful market mover. An ambiguous stance on crypto regulation could create volatility, making accurate Bitcoin price prediction extremely challenging.

Historically, Trump's administration showed mixed signals towards cryptocurrencies. While there weren't outright bans, there was a lack of clear regulatory frameworks, leading to uncertainty in the market. Depending on his future stance, the impact on BTC could be either positive or negative.

Economic Policies and Bitcoin:

- Fiscal Stimulus: Large-scale fiscal stimulus could lead to inflation, potentially driving investors towards Bitcoin as a hedge against inflation.

- Tax Policies: Changes to capital gains taxes could significantly affect investment decisions related to Bitcoin, potentially boosting or dampening demand.

- Trade Wars: Escalation of trade tensions could create global economic uncertainty, making Bitcoin a more attractive safe haven asset.

Inflation is a crucial factor in Bitcoin price prediction. Historically, periods of high inflation have seen increased interest in Bitcoin due to its limited supply and decentralized nature.

Geopolitical Instability and Bitcoin:

- International Relations: A more isolationist foreign policy could introduce geopolitical instability, driving investors towards Bitcoin as a decentralized, less susceptible asset.

- Trade Disputes: Renewed trade disputes could disrupt global markets, pushing investors towards less correlated assets like Bitcoin.

- Global Conflicts: Increased geopolitical tensions and potential conflicts could increase the demand for Bitcoin as a safe haven asset.

Throughout history, periods of increased geopolitical uncertainty have shown a positive correlation with Bitcoin’s price as investors seek refuge in decentralized assets.

Market Sentiment and Bitcoin Price Prediction 2024

Predicting Bitcoin's price in 2024 requires careful consideration of market sentiment, which will be significantly influenced by Trump's actions and announcements.

Predicting Investor Behavior:

- FUD (Fear, Uncertainty, and Doubt): Negative news and uncertain regulatory environments can fuel FUD, leading to sell-offs and price drops.

- FOMO (Fear of Missing Out): Positive news and rapid price increases can trigger FOMO, pushing prices even higher.

- Investor Confidence: Trump's pronouncements and policies will heavily influence investor confidence, directly impacting Bitcoin's price.

Understanding the psychology of investors and how they react to political events is critical for any Bitcoin price prediction.

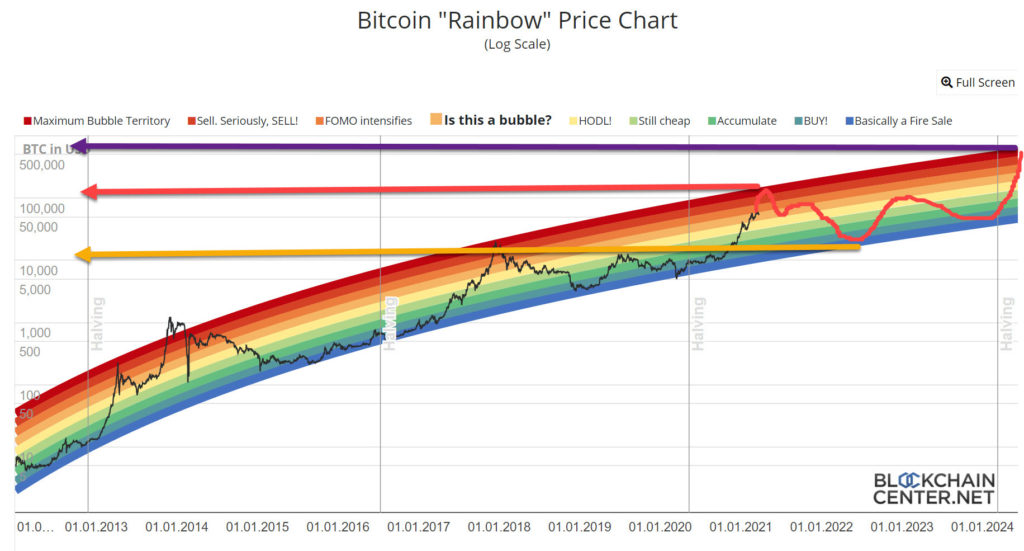

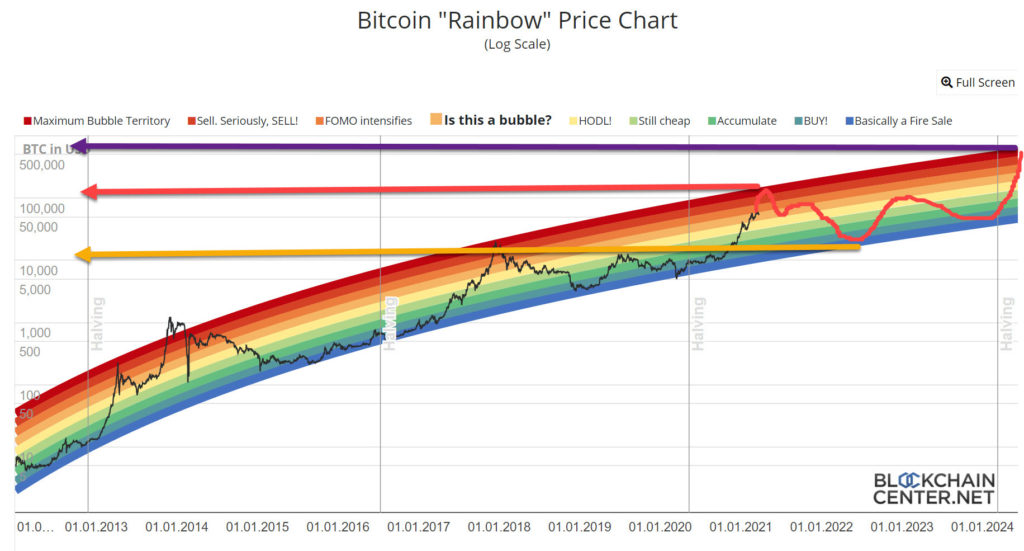

Technical Analysis and Bitcoin Price:

Technical analysis employs various indicators (moving averages, RSI, MACD) to predict price movements. While not foolproof, these tools, when considered alongside political factors, offer valuable insights. Political events often introduce significant deviations from traditional technical analysis patterns.

On-Chain Data and Bitcoin Price:

On-chain metrics, such as transaction volume, active addresses, and mining difficulty, provide insights into network activity and can be used to gauge market sentiment and predict price trends. These metrics, however, need to be analyzed alongside political and economic contexts for a comprehensive Bitcoin price prediction.

Alternative Scenarios and Risk Factors

Predicting the Bitcoin price is inherently challenging due to the market's volatility and susceptibility to unforeseen events.

Unexpected Events and their Impact:

- Black Swan Events: Unforeseen events, like global crises or unexpected policy changes, can drastically impact Bitcoin's price.

- Market Manipulation: The possibility of market manipulation, whether through coordinated selling or regulatory intervention, should always be considered.

- Technological Disruptions: New technologies or significant advancements in the crypto space could also have a large impact on Bitcoin’s dominance and price.

The inherent volatility of the cryptocurrency market should not be underestimated.

Regulatory Uncertainty:

- Global Regulations: Different countries' approaches to regulating cryptocurrencies create uncertainty.

- Legal Challenges: Legal challenges to existing or proposed regulations could impact Bitcoin's price.

- Tax Implications: Tax policies around the globe vary considerably and influence investment decisions related to Bitcoin.

Staying updated on regulatory developments is crucial for anyone invested in or interested in Bitcoin.

Conclusion: Bitcoin Price Prediction 2024: A Cautious Outlook

Predicting Bitcoin's price in 2024, considering the potential impact of Trump's announcements, is a complex endeavor. Factors like regulatory changes, economic policies, market sentiment, technical analysis, and on-chain data all play a significant role. The inherent volatility of the cryptocurrency market and the possibility of unforeseen events add further complexity. While we've explored potential scenarios, remember that this is not financial advice. It's crucial to conduct your own research and develop your own Bitcoin investment strategy. Stay updated on Bitcoin price prediction 2024 and monitor the impact of Trump's announcements on BTC to make informed decisions.

Featured Posts

-

Comprehensive Ethereum Price Prediction 2024 And Beyond

May 08, 2025

Comprehensive Ethereum Price Prediction 2024 And Beyond

May 08, 2025 -

The Future Of Xrp Etf Potential Sec Scrutiny And Ripples Next Chapter

May 08, 2025

The Future Of Xrp Etf Potential Sec Scrutiny And Ripples Next Chapter

May 08, 2025 -

Expect Partly Cloudy Conditions Weather Outlook And Planning

May 08, 2025

Expect Partly Cloudy Conditions Weather Outlook And Planning

May 08, 2025 -

The Potential Of Xrp Ripple A Practical Analysis For Long Term Investors

May 08, 2025

The Potential Of Xrp Ripple A Practical Analysis For Long Term Investors

May 08, 2025 -

Lahwr Py Ays Ayl Mychwn Ke Dwran Askwlwn Ky Chhtyan

May 08, 2025

Lahwr Py Ays Ayl Mychwn Ke Dwran Askwlwn Ky Chhtyan

May 08, 2025