Understanding XRP (Ripple): Is It A Viable Investment For Financial Security?

Table of Contents

What is XRP and How Does Ripple Technology Work?

XRP, the native cryptocurrency of the Ripple network, serves as a bridge currency facilitating faster and cheaper international transactions. Unlike Bitcoin, which relies on a decentralized network of miners, Ripple uses a unique consensus mechanism, making transactions significantly quicker and less expensive. This is achieved through RippleNet, a global payment network utilized by banks and financial institutions worldwide. RippleNet leverages blockchain technology to streamline cross-border payments, bypassing traditional banking systems and their associated delays and high fees. As a digital asset, XRP operates on a cryptocurrency exchange, allowing for quick buying and selling.

- XRP's speed advantage: XRP transactions are processed in seconds, a stark contrast to Bitcoin's minutes or even hours.

- Low transaction fees: XRP transactions boast significantly lower fees compared to other cryptocurrencies.

- Major financial partnerships: Ripple has established partnerships with numerous banks and financial institutions globally, bolstering its credibility and adoption.

XRP's Price Volatility and Market Sentiment

XRP's price history is a testament to the volatile nature of the cryptocurrency market. It has experienced significant highs and lows, influenced by various factors. Regulatory developments, particularly the ongoing SEC lawsuit, have heavily impacted XRP's price. Positive news regarding partnerships or technological advancements tends to drive the price up, while negative news can lead to sharp declines. Analyzing trading volume and market cap provides valuable insights into current market sentiment. Understanding this sentiment is crucial before making any investment decisions.

- Impact of SEC lawsuits: The SEC's legal action against Ripple has created significant uncertainty and volatility in XRP's price.

- Influence of positive news: Announcements of new partnerships or technological upgrades often result in positive price movements.

- Market trend correlation: XRP's performance frequently mirrors broader trends within the overall cryptocurrency market.

Risks Associated with Investing in XRP

Investing in XRP, like any cryptocurrency, carries inherent risks. The potential for significant losses due to price volatility is substantial. Regulatory uncertainty surrounding XRP adds another layer of risk, with the ongoing legal battles presenting an unpredictable future. Effective financial risk management is crucial when considering an XRP investment. Diversification is key to mitigating risk within a broader investment strategy.

- Exchange vs. personal wallet risks: Holding XRP on exchanges exposes investors to potential hacking or exchange insolvency. Personal wallets offer greater security but require technical knowledge.

- Scams and fraud: The cryptocurrency space is susceptible to scams, and XRP is no exception. Investors should be vigilant and only use reputable exchanges and platforms.

- Technological obsolescence: Technological advancements could render XRP or the Ripple network obsolete in the future.

XRP as Part of a Diversified Investment Strategy

XRP can be a component of a diversified investment portfolio, but it shouldn't be the sole focus. Your risk tolerance plays a crucial role in determining the appropriate allocation of funds to XRP. Only invest what you can afford to lose. A well-rounded investment strategy considers various asset classes, reducing overall portfolio risk. Understanding asset allocation and risk management principles is essential for successful investing.

- Invest responsibly: Never invest more than you can comfortably afford to lose.

- Risk mitigation strategies: Diversification, thorough research, and setting stop-loss orders can help mitigate risks.

- Consider other assets: Balance XRP investment with other asset classes like stocks, bonds, and real estate.

Conclusion: Is XRP Right for Your Financial Security?

XRP presents both potential and significant risks. Its speed and low transaction fees make it attractive, and its adoption by financial institutions is promising. However, the price volatility and regulatory uncertainty cannot be ignored. Thorough research and a clear understanding of the risks are paramount. While XRP might offer potential returns, it's not a guaranteed path to financial security. Before investing in XRP or any cryptocurrency, conduct further independent research, assess your risk tolerance, and consider seeking advice from a qualified financial advisor. Informed decisions are crucial when it comes to XRP investment and your overall financial security.

Featured Posts

-

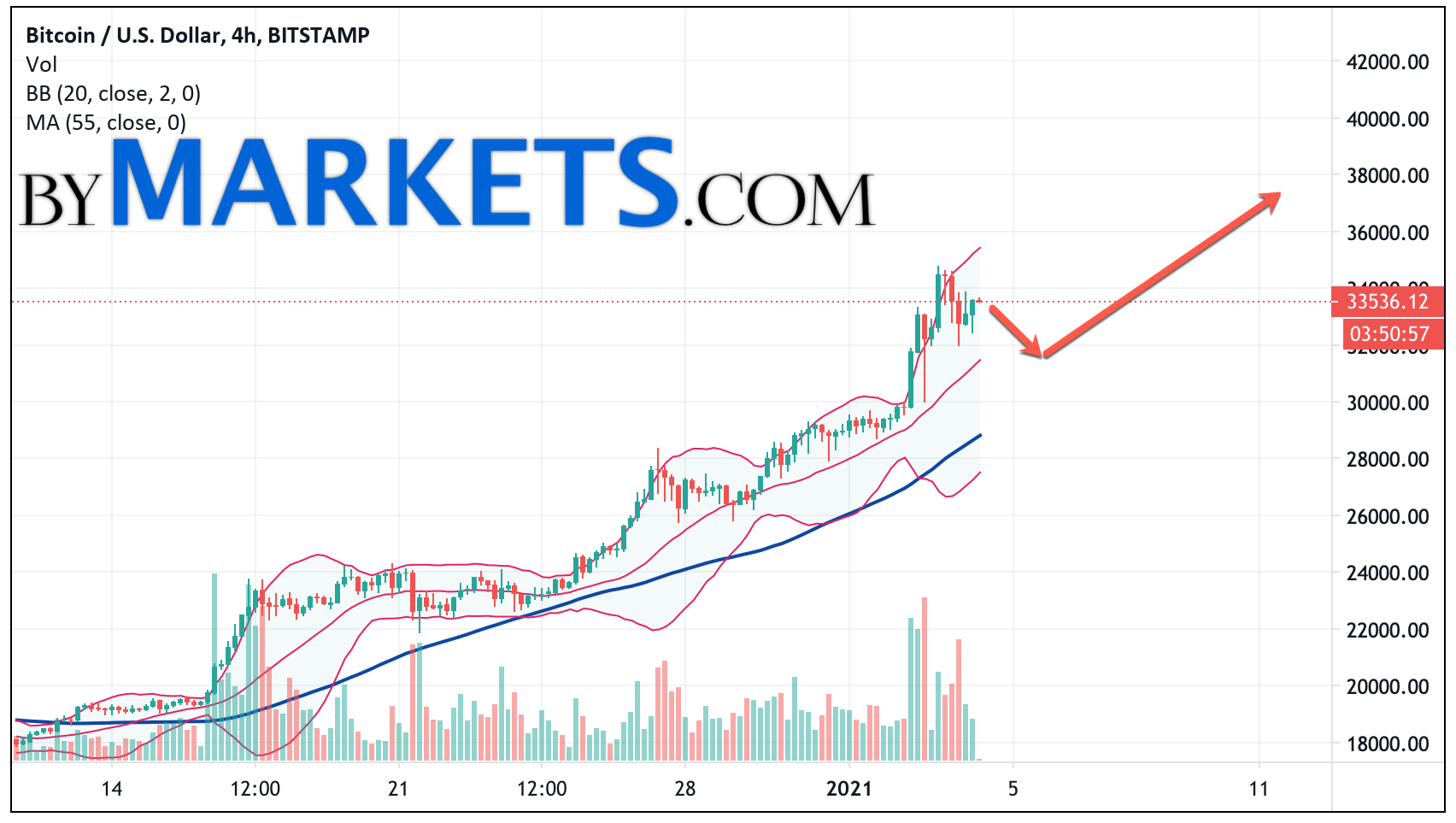

Bitcoin Price Rally Analysts Chart Indicates Start Of Uptrend May 6th

May 08, 2025

Bitcoin Price Rally Analysts Chart Indicates Start Of Uptrend May 6th

May 08, 2025 -

A Rogue One Star Shares Surprising Thoughts About A Beloved Character

May 08, 2025

A Rogue One Star Shares Surprising Thoughts About A Beloved Character

May 08, 2025 -

Will Bitcoin Soar 1 500 In 5 Years Analyzing The Investment Outlook

May 08, 2025

Will Bitcoin Soar 1 500 In 5 Years Analyzing The Investment Outlook

May 08, 2025 -

Dembele Injury Arsenals Potential Lineup Changes And Challenges

May 08, 2025

Dembele Injury Arsenals Potential Lineup Changes And Challenges

May 08, 2025 -

Thunder Vs Pacers Updated Injury Report For March 29th

May 08, 2025

Thunder Vs Pacers Updated Injury Report For March 29th

May 08, 2025