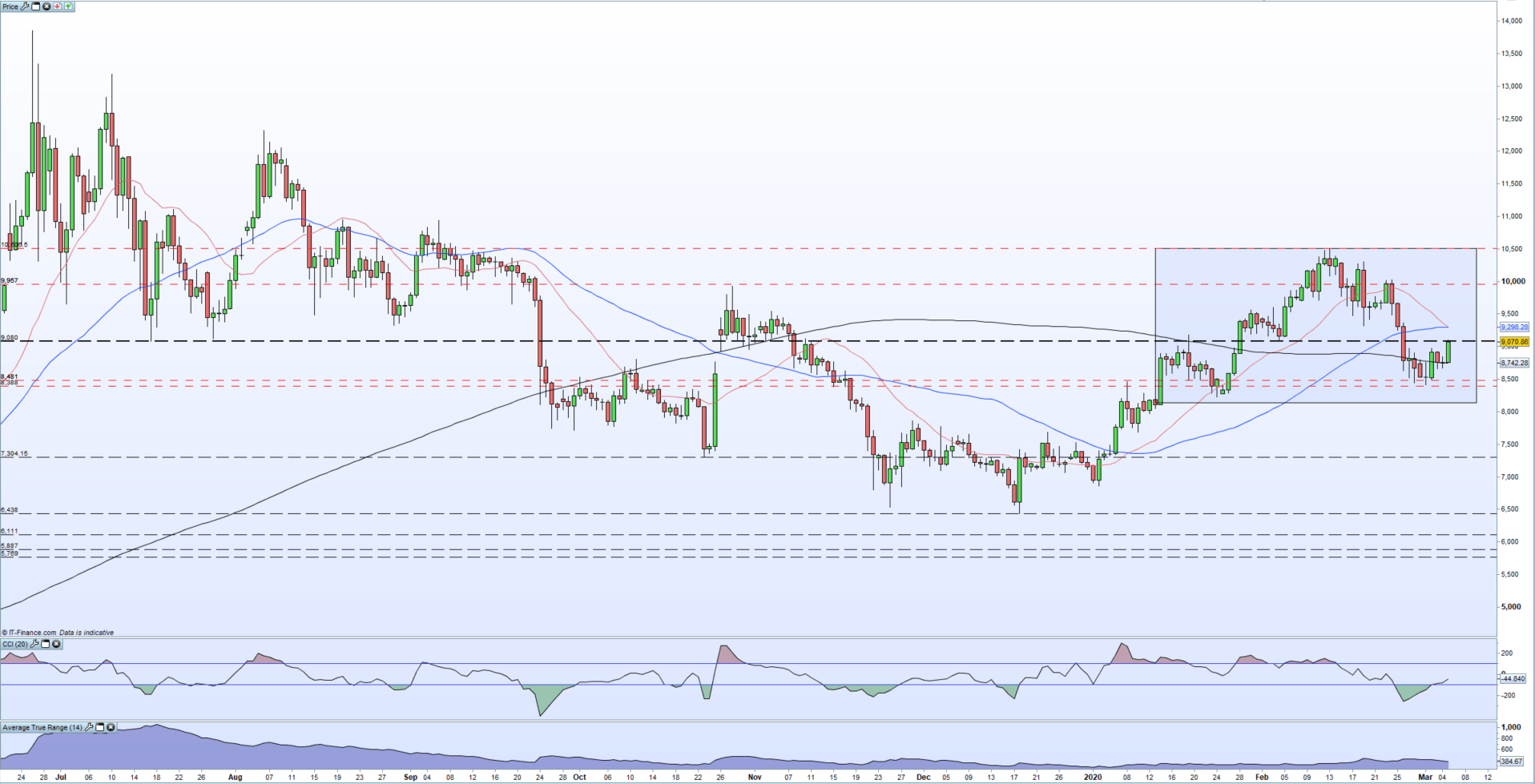

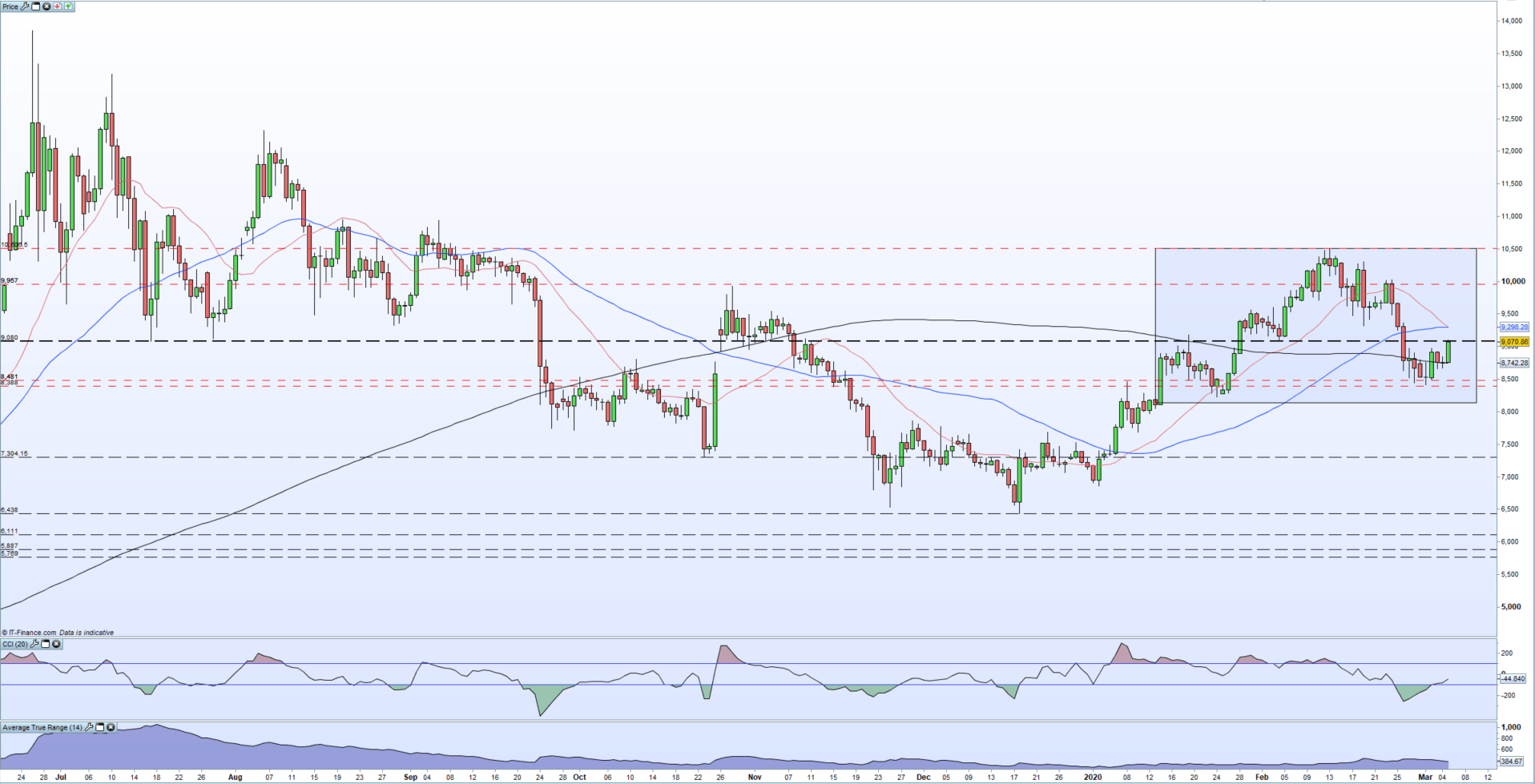

Bitcoin Price Rebound: Factors Driving The Current Uptick

Table of Contents

Institutional Investment and Adoption Fueling the Bitcoin Price Rebound

The increased participation of institutional investors is a significant driver of the recent Bitcoin price rebound. Hedge funds, corporations, and even some pension funds are increasingly allocating assets to Bitcoin, viewing it as a potential hedge against inflation and a diversification tool within their portfolios. This institutional Bitcoin investment is injecting substantial capital into the market, creating upward pressure on the BTC price.

Examples of this institutional involvement are numerous and impactful:

- Grayscale Bitcoin Trust's growth: The Grayscale Bitcoin Trust (GBTC) has seen substantial growth in its assets under management, reflecting the growing demand from institutional investors seeking exposure to Bitcoin without the complexities of directly managing private keys.

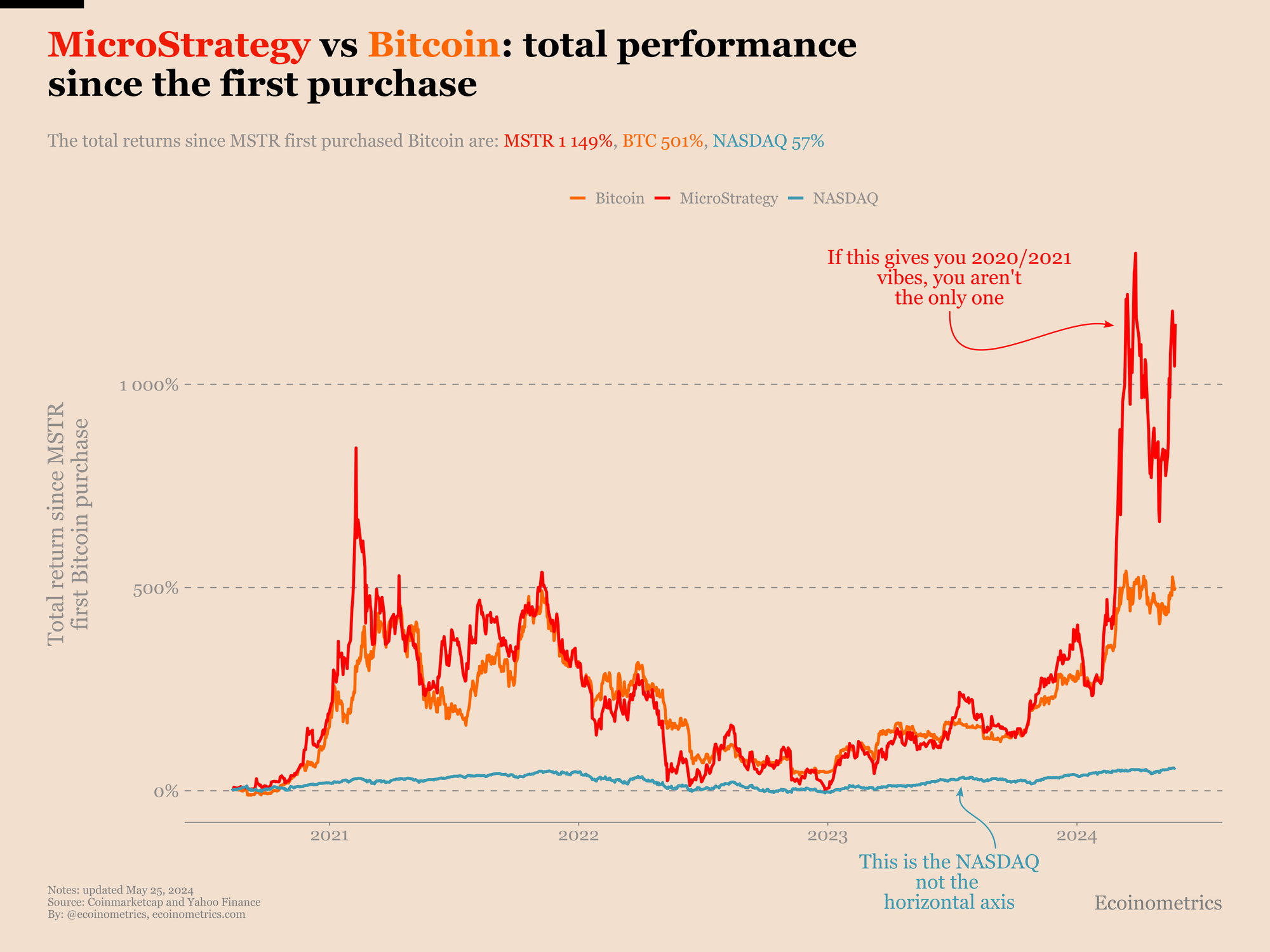

- MicroStrategy's significant Bitcoin holdings: MicroStrategy's bold strategy of accumulating a large Bitcoin reserve has signaled to other corporations that Bitcoin can be a viable asset for treasury management.

- Increased interest from pension funds and endowments: The growing interest from traditionally conservative institutional investors like pension funds and endowments demonstrates a shift in perception, suggesting Bitcoin is gaining legitimacy as a long-term investment.

These developments are fueling the narrative of Bitcoin as a mature asset class, attracting further institutional Bitcoin investors and supporting the current price surge. The potential approval of a Bitcoin ETF could further amplify this effect.

Growing Regulatory Clarity and Positive Developments

Regulatory clarity, or at least a lessening of uncertainty, is another crucial factor impacting the Bitcoin price. More defined regulatory frameworks in certain jurisdictions are boosting investor confidence, making it easier for institutions and individuals to participate legally and securely in the cryptocurrency market. Positive statements from regulators, while not necessarily full endorsement, contribute to a more favorable environment.

Positive developments include:

- Easing of regulatory restrictions in specific countries: Some countries are adopting more favorable stances towards cryptocurrencies, streamlining registration processes and clarifying tax implications.

- Positive statements from regulators about cryptocurrencies: Statements from regulatory bodies acknowledging the potential of cryptocurrencies and suggesting a willingness to work with the industry can significantly impact market sentiment.

- Development of clear regulatory guidelines: The establishment of clearer rules and guidelines reduces uncertainty and helps legitimize the crypto space.

This growing regulatory clarity is a significant factor in the Bitcoin price rebound, enhancing investor confidence and promoting wider adoption.

Macroeconomic Factors Influencing Bitcoin's Price

Macroeconomic factors play a significant role in Bitcoin's price movements. Global inflationary pressures, economic uncertainty, and the weakening of fiat currencies are driving increased demand for Bitcoin. Bitcoin's inherent characteristics – its decentralized nature and limited supply – make it an attractive alternative asset during times of economic turmoil.

Several macroeconomic trends are supporting this price surge:

- Inflationary pressures in global economies: As traditional currencies lose purchasing power due to inflation, investors are seeking assets that are considered to be a hedge against inflation, such as Bitcoin.

- Geopolitical uncertainty driving safe-haven demand: During times of geopolitical instability, investors often seek safe-haven assets. Bitcoin's decentralized nature and relative independence from government control make it attractive as a safe haven.

- Weakening of traditional currencies: The weakening of several fiat currencies against the US dollar further strengthens Bitcoin's position as an alternative store of value.

Technological Advancements and Network Upgrades

Technological advancements within the Bitcoin network also play a supporting role in the price rebound. Improvements in scalability, transaction speed, and overall usability are making Bitcoin more attractive to a broader range of users and investors.

Key technological developments include:

- Lightning Network adoption rates: The increased adoption of the Lightning Network, a layer-2 scaling solution, is enhancing Bitcoin's transaction speed and reducing fees, making it more practical for everyday use.

- Improved transaction speeds and lower fees: These improvements are essential for wider adoption and increased usage, which can positively influence investor sentiment.

- Development of new Bitcoin-related technologies: Ongoing innovation within the Bitcoin ecosystem continues to drive improvement and attracts further investment.

Conclusion: Understanding the Bitcoin Price Rebound and What it Means for Investors

The recent Bitcoin price rebound is a result of a confluence of factors: increased institutional adoption, growing regulatory clarity, significant macroeconomic pressures, and ongoing technological advancements. These elements have combined to boost investor confidence and drive significant price increases.

While this Bitcoin price rebound is encouraging, it’s crucial to remember the inherent volatility of the cryptocurrency market. This price surge should not be interpreted as a guarantee of continued growth. Conduct thorough research, diversify your portfolio, and understand your own risk tolerance before investing in Bitcoin. Only invest what you can afford to lose. The future of the Bitcoin price, and indeed the cryptocurrency market, is subject to many variables. Careful consideration and responsible investment are paramount.

Featured Posts

-

Check Lotto And Lotto Plus Results Wednesday April 2 2025

May 08, 2025

Check Lotto And Lotto Plus Results Wednesday April 2 2025

May 08, 2025 -

Minecraft Superman 5 Minute Thailand Theater Sneak Peek

May 08, 2025

Minecraft Superman 5 Minute Thailand Theater Sneak Peek

May 08, 2025 -

Bitcoin Rebound Market Trends And Future Outlook

May 08, 2025

Bitcoin Rebound Market Trends And Future Outlook

May 08, 2025 -

Oklahoma Citys Tough Road Ahead Facing Memphis

May 08, 2025

Oklahoma Citys Tough Road Ahead Facing Memphis

May 08, 2025 -

Micro Strategy Stock Vs Bitcoin A 2025 Investment Comparison

May 08, 2025

Micro Strategy Stock Vs Bitcoin A 2025 Investment Comparison

May 08, 2025