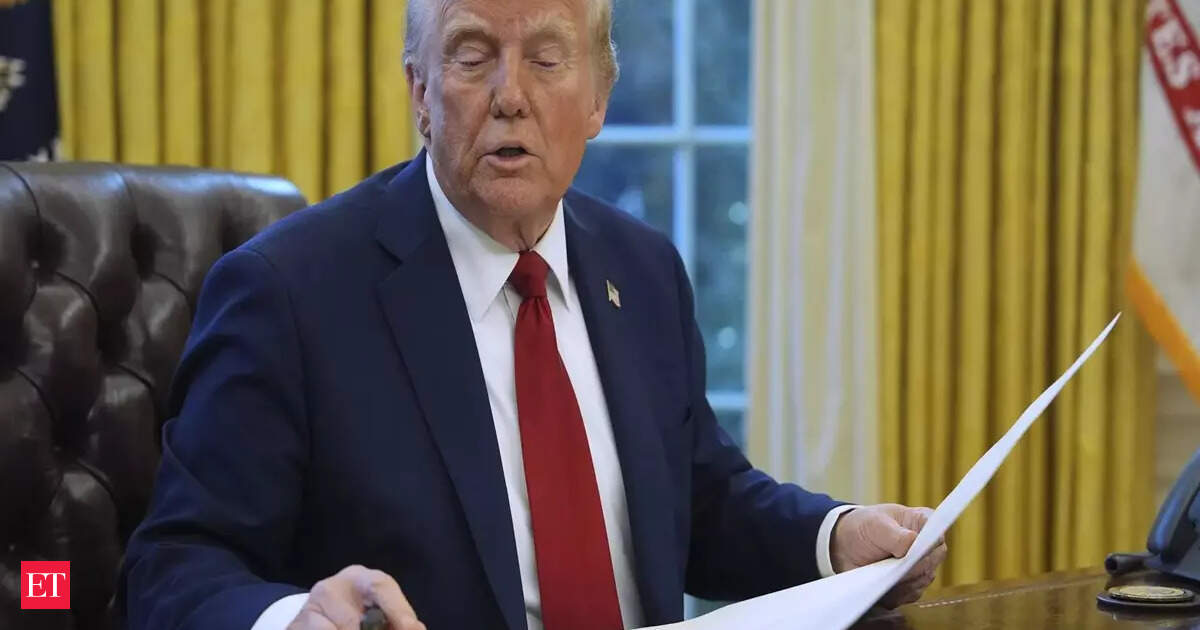

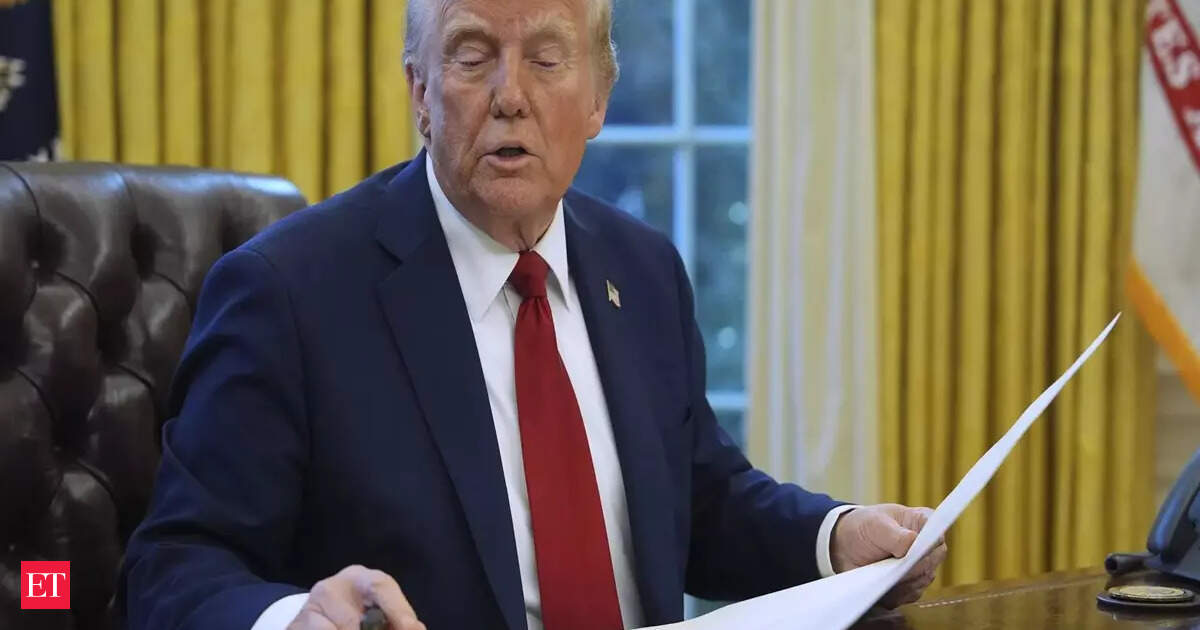

The Economic Fallout Of 'Liberation Day' Tariffs: Stock Market Predictions And Strategies

Table of Contents

Understanding the 'Liberation Day' Tariff Implications

The historical context of "Liberation Day" – let's assume, for the sake of this example, it refers to a hypothetical day marking the implementation of significant new tariffs – needs to be understood to grasp the full implications. These tariffs, let's assume they were imposed to protect domestic industries, significantly increased import duties on various goods. This action, while intended to boost local production, carries substantial economic consequences.

Direct Impact on Specific Sectors

Several sectors are particularly vulnerable to the direct impact of these tariffs.

-

Manufacturing: The manufacturing sector, heavily reliant on imported components and raw materials, faces significant price increases. This reduced competitiveness impacts profitability and potentially leads to job losses. For example, a 20% tariff on imported steel could increase production costs by X%, leading to a Y% decrease in export competitiveness (replace X and Y with hypothetical but realistic statistics).

-

Agriculture: The agricultural sector is also vulnerable, particularly if the tariffs target imported agricultural products or key inputs like fertilizers. Increased costs for farmers may result in lower yields, reduced exports, and higher food prices for consumers.

-

Technology: The tech sector, reliant on global supply chains for components and manufacturing, could face disruption and higher costs for electronic goods, impacting consumer prices and corporate profits.

-

Retail: Increased import costs translate directly into higher prices for consumers. Reduced consumer spending could trigger a domino effect throughout the economy.

Indirect Economic Ripple Effects

Beyond the direct impact, the "Liberation Day" tariffs trigger a chain reaction of indirect economic consequences.

-

Inflation: Increased import costs contribute to inflation, eroding purchasing power and dampening consumer spending. This inflationary pressure could lead to higher interest rates by central banks attempting to control inflation.

-

Job Losses: Reduced competitiveness and decreased production in affected sectors could lead to significant job losses, impacting overall economic growth and consumer confidence.

-

Supply Chain Disruptions: Tariffs can disrupt global supply chains, causing shortages and further increasing prices. This disruption could impact multiple industries beyond those directly targeted by the tariffs.

-

Reduced Investment: Uncertainty caused by the tariffs can discourage both domestic and foreign investment, further hindering economic growth.

Stock Market Predictions in the Wake of the Tariffs

Predicting stock market behavior with complete accuracy is impossible, but analyzing historical data and expert opinions allows for informed predictions.

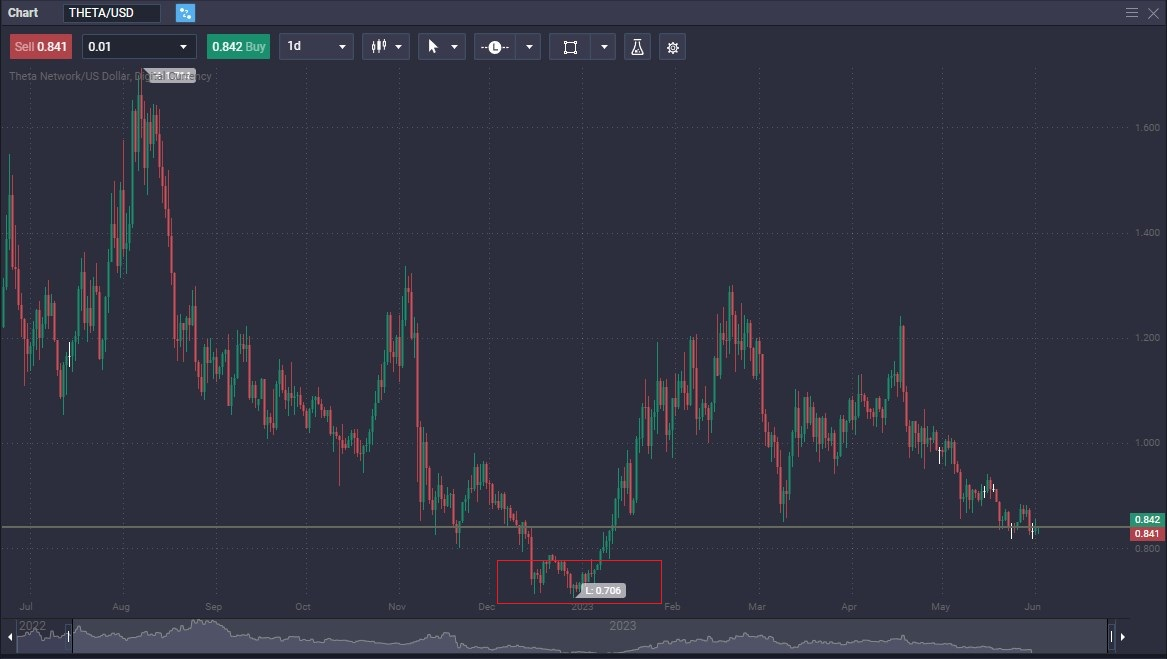

Short-Term Market Volatility

Immediately following the implementation of "Liberation Day" tariffs, we can anticipate significant short-term market volatility.

-

Market Corrections: The market may experience corrections as investors react to the uncertainty and reassess their portfolios.

-

Investor Sentiment Shift: Investor sentiment is likely to shift towards caution, potentially leading to a sell-off in affected sectors.

-

Increased Uncertainty: The market’s behavior will largely depend on the scale and scope of the tariffs and the reaction of consumers and businesses. Historical data on similar tariff implementations can offer valuable insights into potential market reactions.

Long-Term Economic Outlook

The long-term economic outlook depends heavily on several factors.

-

Government Response: Government policies aimed at mitigating the negative economic impacts of the tariffs will heavily influence the long-term outlook. Stimulus packages, for example, could partially offset the negative effects.

-

Global Economic Conditions: The global economic climate plays a vital role. A strong global economy might cushion the blow, while a weak global economy could exacerbate the negative consequences.

-

Adaptation and Innovation: The ability of businesses to adapt to the new tariff environment and innovate to reduce reliance on imports will influence the long-term recovery.

Strategies for Navigating Market Uncertainty

Navigating the market uncertainty requires a well-defined investment strategy that emphasizes risk management and adaptability.

Diversification and Risk Management

Diversification is key to mitigating risk.

-

Asset Allocation: Diversify investments across different asset classes (stocks, bonds, real estate, etc.) to reduce dependence on any single sector.

-

Hedging Strategies: Consider hedging strategies to protect against potential losses in affected sectors.

-

Portfolio Rebalancing: Regularly rebalance your portfolio to maintain your desired asset allocation and manage risk.

Identifying Opportunities Amidst Volatility

While the overall outlook might seem negative, opportunities exist for those who can identify them.

-

Undervalued Sectors: Some sectors may become undervalued due to the market's initial negative reaction. Careful research may reveal opportunities to invest in fundamentally strong companies at discounted prices.

-

Contrarian Investing: Contrarian investment strategies can be profitable in times of market uncertainty. Investing in sectors perceived as negatively impacted may yield high returns if the market eventually recovers.

-

Sectors Less Affected: Sectors less reliant on imports or those benefiting from increased domestic demand could experience growth.

Staying Informed and Adapting

Continuous monitoring of economic indicators and market trends is crucial.

-

Reliable Sources: Rely on credible sources of financial information and economic data such as reputable financial news outlets, government publications, and economic forecasting institutions.

-

Adaptability: Be prepared to adjust your investment strategy based on evolving economic conditions and market reactions. Regularly review and update your investment plan.

Conclusion

The potential economic fallout of the "Liberation Day" tariffs is significant, posing considerable challenges to several key economic sectors and the overall economy. Understanding the direct and indirect impacts, including inflation, job losses, and supply chain disruptions, is crucial. Careful stock market analysis, coupled with robust diversification strategies, is essential for mitigating risks and identifying opportunities in this evolving market. Understanding the implications of the 'Liberation Day' tariffs is crucial for navigating the current economic uncertainty. Develop a robust investment strategy to manage risks and capitalize on opportunities in the evolving market. Learn more about effective strategies to weather the economic fallout of 'Liberation Day' tariffs.

Featured Posts

-

Ethereum Price To Reach 2 700 Wyckoff Accumulation Signals

May 08, 2025

Ethereum Price To Reach 2 700 Wyckoff Accumulation Signals

May 08, 2025 -

Xrp Price Surge 400 Increase Is Now The Time To Buy

May 08, 2025

Xrp Price Surge 400 Increase Is Now The Time To Buy

May 08, 2025 -

Copa Libertadores Pronostico Liga De Quito Flamengo Fecha 3 Grupo C

May 08, 2025

Copa Libertadores Pronostico Liga De Quito Flamengo Fecha 3 Grupo C

May 08, 2025 -

Analysis Ripple Xrps Future After Brazil Etf Approval And Trumps Post

May 08, 2025

Analysis Ripple Xrps Future After Brazil Etf Approval And Trumps Post

May 08, 2025 -

Saturday Night Live A Turning Point For Counting Crows

May 08, 2025

Saturday Night Live A Turning Point For Counting Crows

May 08, 2025