BlackRock ETF: A Billionaire Investment Predicted To Surge 110% By 2025

Table of Contents

Understanding BlackRock ETFs and Their Market Position

Exchange-Traded Funds (ETFs) offer investors a diversified portfolio in a single investment, providing access to a basket of securities, often at a lower cost than mutual funds. Their ease of trading and transparency are key advantages. BlackRock, a global investment management corporation, is a titan in the ETF industry, commanding a significant market share. Their expertise, vast resources, and proven track record make their ETFs particularly attractive to investors.

- Market Share Statistics: BlackRock boasts a substantial portion of the global ETF market, consistently ranking among the top providers. Precise figures fluctuate, but their dominance is undeniable.

- Examples of Successful BlackRock ETFs: iShares Core S&P 500 ETF (IVV) and iShares CORE US Aggregate Bond ETF (AGG) are prime examples of BlackRock's successful and widely-held ETFs, demonstrating their ability to deliver consistent returns.

- Specific BlackRock ETFs in the 110% Prediction: While the specific BlackRock ETF(s) driving the 110% prediction aren't publicly specified in all forecasts, analysts often point to ETFs focused on high-growth sectors as potential candidates.

- BlackRock's Expertise and Resources: BlackRock's extensive research capabilities, global reach, and experienced investment professionals give them a competitive edge in identifying and capitalizing on market opportunities.

Factors Contributing to the Predicted 110% Surge

Several factors contribute to the optimistic forecast of a 110% surge in selected BlackRock ETFs by 2025.

Market Trends and Growth Potential

Significant market trends are expected to fuel this growth. Technological advancements, particularly in areas like artificial intelligence and renewable energy, are poised for explosive growth. Demographic shifts, such as the rise of the millennial and Gen Z investor populations, are also expected to drive investment in specific sectors.

BlackRock's Investment Strategies

BlackRock employs sophisticated investment strategies that contribute to the anticipated returns. Their active management approach, combined with thematic investing focused on high-growth sectors, allows them to capitalize on emerging opportunities. Their ability to adapt to evolving market conditions also plays a crucial role.

Expert Opinions and Analyst Predictions

Several financial analysts and industry experts support the 110% surge prediction, citing the confluence of favorable market conditions and BlackRock's proven track record. [Insert links to reputable sources supporting the prediction here]. While these predictions should be treated with caution, they highlight the significant potential upside.

- Specific Market Sectors: Technology, renewable energy, and healthcare are among the sectors expected to experience significant growth, impacting the performance of related BlackRock ETFs.

- Key Strategies: Active management, thematic investing, and strategic asset allocation are key strategies contributing to BlackRock's success.

- Analyst Quotes: "BlackRock's positioning in key growth sectors makes their ETFs a compelling investment opportunity," – [Analyst Name, Source]

- Economic Factors: Favorable economic growth, low interest rates (in certain scenarios), and increased investor confidence can all contribute to the predicted surge.

Risks and Considerations Involved in Investing in BlackRock ETFs

While the potential for high returns is enticing, it's crucial to acknowledge the associated risks.

- Potential Market Risks: Market volatility, economic downturns, and geopolitical events can all negatively impact ETF performance. The predicted 110% surge is not guaranteed.

- Strategies for Mitigating Risk: Diversification across different asset classes and BlackRock ETFs, rather than concentrating investments in a single ETF, is crucial for risk management. Regular portfolio reviews and adjustments based on market conditions are also recommended.

- Alternative Investment Options: Before investing in BlackRock ETFs, consider other investment options, comparing risks and potential returns to create a well-balanced portfolio tailored to your individual risk tolerance and financial goals.

- Importance of Due Diligence: Thoroughly research each BlackRock ETF before investing, understanding its underlying holdings, investment strategy, and associated fees.

Conclusion

The predicted 110% surge in the value of specific BlackRock ETFs by 2025 is a bold prediction, driven by a confluence of factors including favorable market trends, BlackRock's strategic investment approaches, and expert opinions. While the potential for substantial returns is undeniable, it’s crucial to remember that investment in any ETF carries inherent risks. Market volatility and unexpected economic events can significantly impact performance.

Investing in BlackRock ETFs presents a compelling opportunity, but it's vital to conduct thorough due diligence, diversify your portfolio, and consider your own risk tolerance. Before making any investment decisions, consult with a qualified financial advisor to create a personalized financial plan that aligns with your goals and risk profile. Explore the world of BlackRock ETF opportunities carefully and thoughtfully – the potential for significant returns is real, but informed decision-making is paramount.

Featured Posts

-

Pakistan Super League 10 Ticket Purchase Information

May 08, 2025

Pakistan Super League 10 Ticket Purchase Information

May 08, 2025 -

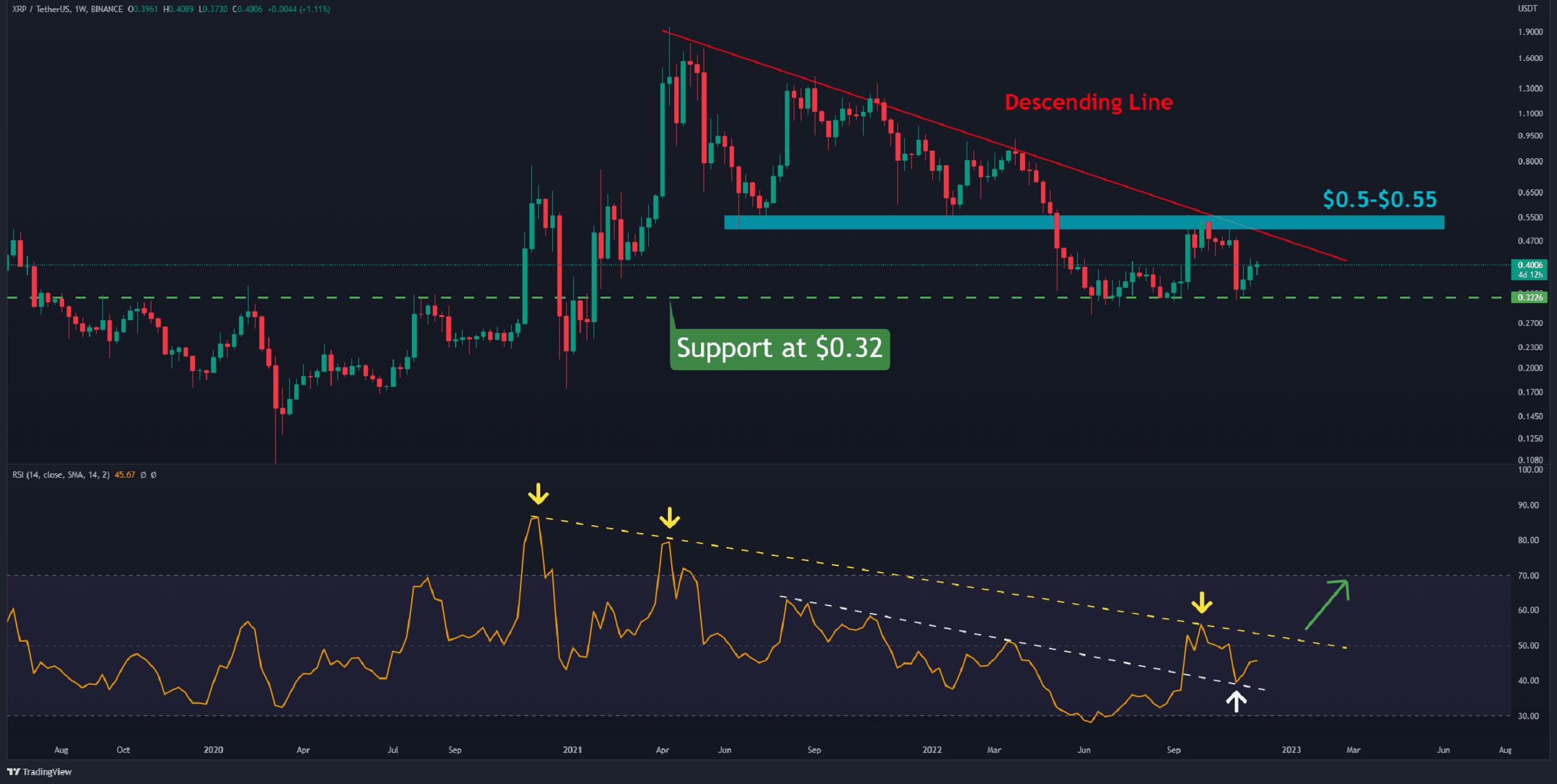

Xrp Price Analysis Is 3 40 Achievable For Ripple

May 08, 2025

Xrp Price Analysis Is 3 40 Achievable For Ripple

May 08, 2025 -

Toronto Housing Market Slowdown Sales Down 23 Prices Down 4

May 08, 2025

Toronto Housing Market Slowdown Sales Down 23 Prices Down 4

May 08, 2025 -

Crypto Coms Cro Price Surge Following Trump Media Etf Collaboration

May 08, 2025

Crypto Coms Cro Price Surge Following Trump Media Etf Collaboration

May 08, 2025 -

Uber Kenya Announces Cashback Rewards For Customers And Increased Orders For Drivers And Couriers

May 08, 2025

Uber Kenya Announces Cashback Rewards For Customers And Increased Orders For Drivers And Couriers

May 08, 2025