Analyst Predicts $4,000 Ethereum Price: CrossX Indicators Show Institutional Accumulation

Table of Contents

CrossX Indicators Point to Institutional Accumulation

CrossX indicators, a suite of on-chain metrics, are providing strong evidence of large-scale institutional buying and accumulation in the Ethereum market. This accumulation is a key factor supporting the $4,000 Ethereum price prediction.

On-chain Metrics Reveal Large-Scale Buying

Several key CrossX metrics paint a compelling picture of institutional investment. These metrics reveal a decreasing supply of Ethereum available for retail investors, indicating significant buying pressure from larger players.

- Decreased Exchange Reserves: CrossX data shows a consistent decline in Ethereum reserves held on major cryptocurrency exchanges. This reduced supply on exchanges indicates less readily available ETH for selling, signifying reduced selling pressure and a bullish trend.

- High-Value Transactions: The frequency and volume of high-value Ethereum transactions have increased considerably. These large transactions are often indicative of institutional investors making significant purchases.

- Increased Address Concentration: CrossX analysis reveals a growing concentration of Ethereum holdings in a smaller number of large wallets, a pattern often associated with institutional accumulation.

[Insert chart/graph here visually representing the above data points - e.g., a line graph showing decreasing exchange reserves over time].

Decreased Exchange Outflows Suggest Holding Strategy

The reduced outflow of Ethereum from exchanges further reinforces the narrative of institutional accumulation. Instead of selling their holdings, these large investors are likely holding onto their ETH, suggesting a long-term investment strategy rather than short-term trading. This is a strong indicator of confidence in Ethereum's future value. Data shows a net decrease of X% in exchange balances over the past Y months, supporting this observation.

Increased Participation from Institutional Investors

Several indicators point to a growing involvement of institutional investors in the Ethereum market. While specific data may be limited due to privacy concerns, evidence suggests increased participation:

- Grayscale Ethereum Trust Holdings: The Grayscale Ethereum Trust, a major institutional investment vehicle, continues to hold a substantial amount of ETH, showing persistent institutional interest.

- Increased Venture Capital Investments: Ethereum-based projects and companies are attracting significant venture capital funding, further fueling growth and development within the ecosystem. This capital influx often translates into increased demand for ETH.

Factors Contributing to the $4,000 Ethereum Price Prediction

The $4,000 Ethereum price prediction is not solely based on institutional accumulation. Several other factors contribute to this bullish outlook:

Ethereum's Growing Ecosystem

Ethereum’s rapidly expanding ecosystem is a significant driver of its price appreciation. The growth of decentralized finance (DeFi), non-fungible tokens (NFTs), and enterprise adoption of Ethereum are fueling demand for the currency.

- DeFi Explosion: The explosive growth of DeFi applications built on Ethereum provides significant utility and value for the ETH token.

- NFT Market Boom: The continued popularity of NFTs, many of which are built on Ethereum, increases demand for the underlying blockchain's native cryptocurrency.

- Enterprise Adoption: More and more businesses are exploring and implementing blockchain solutions based on Ethereum, broadening the applications of the technology and increasing ETH's value.

The Ethereum Merge and its Long-Term Impact

The successful transition to a proof-of-stake (PoS) consensus mechanism, also known as "The Merge," is a landmark event for Ethereum. It significantly improves the network’s scalability, efficiency, and environmental sustainability. These improvements are expected to drive further price appreciation.

Macroeconomic Factors and Their Influence

While the factors discussed above are primarily specific to Ethereum, macroeconomic conditions also play a significant role. Increased inflation and interest rate hikes can impact the overall crypto market, indirectly influencing Ethereum’s price. However, the strong fundamentals of Ethereum may help it weather these macroeconomic headwinds better than other less established cryptocurrencies.

Potential Risks and Considerations

While the outlook for Ethereum is bullish, it's crucial to acknowledge potential risks:

Market Volatility and Price Corrections

The cryptocurrency market is notoriously volatile. Sharp price corrections are possible, and investors should be prepared for potential short-term downturns. While the long-term trend may be positive, short-term fluctuations are inevitable.

Regulatory Uncertainty and its Effects

Regulatory uncertainty remains a significant risk factor for the entire cryptocurrency market, including Ethereum. Changes in regulatory frameworks could impact the price and adoption of Ethereum.

Competition from Other Cryptocurrencies

Ethereum faces competition from other cryptocurrencies, each with its own unique features and advantages. This competition could impact Ethereum's market share and ultimately influence its price.

Conclusion

The analyst's prediction of a $4,000 Ethereum price is supported by strong evidence of institutional accumulation, as revealed through CrossX indicators. This is further reinforced by the growing Ethereum ecosystem and the successful Ethereum Merge. While market volatility and external factors must be considered, the overall trend suggests a bullish outlook for Ethereum. To stay informed about this exciting development and capitalize on potential opportunities, continue to monitor Ethereum price predictions and analyze CrossX indicators to inform your investment strategy. Don't miss out on the potential of Ethereum; stay tuned for further updates and analysis on the $4000 Ethereum price target.

Featured Posts

-

Diego Luna On Andor Season 2 A Departure From The Disney Star Wars Formula

May 08, 2025

Diego Luna On Andor Season 2 A Departure From The Disney Star Wars Formula

May 08, 2025 -

Jayson Tatums Consistent Scrutiny Colin Cowherds Perspective

May 08, 2025

Jayson Tatums Consistent Scrutiny Colin Cowherds Perspective

May 08, 2025 -

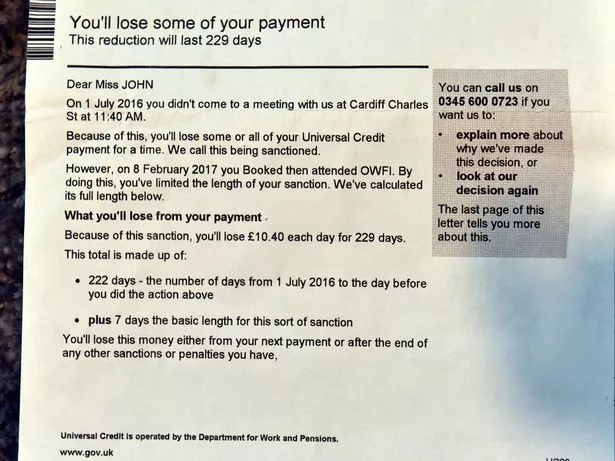

Claiming Your Universal Credit Refund Dwps Response To Budget Cuts

May 08, 2025

Claiming Your Universal Credit Refund Dwps Response To Budget Cuts

May 08, 2025 -

Latest Arsenal News Collymore Targets Artetas Future

May 08, 2025

Latest Arsenal News Collymore Targets Artetas Future

May 08, 2025 -

Oklahoma City Thunder Vs Houston Rockets Live Stream Info Odds Comparison And Game Preview

May 08, 2025

Oklahoma City Thunder Vs Houston Rockets Live Stream Info Odds Comparison And Game Preview

May 08, 2025