BOE's Future QE Policy: Greene Calls For A More Cautious Approach

Table of Contents

Greene's Criticism of the BOE's QE Strategy

Catherine Greene, a prominent economist (replace with actual name and credentials if available), has voiced significant concerns regarding the BOE's past and potential future QE strategies. Her critique centers around the potential long-term risks associated with large-scale asset purchases. Greene argues that the BOE's approach has been insufficiently targeted and may have exacerbated existing economic imbalances.

- Inflationary Pressures: Greene highlights the link between QE and rising inflation, arguing that the injection of vast sums of money into the financial system has fueled increased consumer prices, leading to a rising cost of living for UK citizens. This concern is particularly relevant given the current high inflation environment.

- Long-Term Economic Stability: She expresses concerns that the current QE strategy could undermine long-term economic stability by creating asset bubbles and distorting market signals. This could lead to future economic instability and hinder sustainable growth.

- Need for a More Targeted Approach: Greene advocates for a more targeted approach to QE, suggesting that the BOE should focus on specific sectors or industries in need of support, rather than broadly injecting liquidity into the entire financial system. This would minimize the risk of unintended consequences.

- Comparison with Other Central Banks: Greene's criticism also involves comparisons with the QE strategies employed by other central banks, such as the Federal Reserve. She argues that the BOE's approach has been less cautious and less strategically focused than those of some of its international counterparts.

The Current Economic Landscape and its Impact on QE Decisions

The UK's economic situation significantly influences the BOE's QE decisions. Currently, the UK is facing high inflation rates, relatively low unemployment (though still above pre-pandemic levels), and moderate GDP growth. This complex scenario presents a difficult balancing act for the BOE.

- Inflationary Pressures: The persistent high inflation significantly restricts the BOE's ability to continue or expand QE programs. High inflation necessitates a focus on monetary tightening to cool down the economy, potentially conflicting with the expansionary nature of QE.

- Growth vs. Inflation Trade-off: The BOE faces a classic trade-off: stimulating economic growth through QE risks further fueling inflation, while tightening monetary policy to control inflation could stifle economic growth. This delicate balance requires careful consideration.

- Government Policy Influence: Government fiscal policies also impact the BOE's decisions. Expansionary fiscal policies might necessitate a more accommodative monetary policy (potentially involving QE), while austerity measures could allow for a more restrictive approach.

Alternative Approaches to Monetary Policy

The BOE could explore alternative monetary policy tools beyond QE to manage the economic situation. These alternatives offer different mechanisms for influencing economic activity.

- Interest Rate Hikes/Cuts: Adjusting interest rates remains a primary tool. Raising rates combats inflation but slows economic growth, while lowering rates stimulates growth but risks increased inflation.

- Targeted Lending Programs: These programs provide direct financial support to specific sectors, potentially achieving more targeted stimulus than broad-based QE. Examples include supporting small and medium-sized enterprises (SMEs).

- Other Unconventional Tools: Other unconventional tools, such as negative interest rates (although their effectiveness is debated), could also be considered, although their implementation poses significant challenges.

- Pros and Cons Analysis: Each alternative approach has its own set of advantages and disadvantages. Careful analysis of these trade-offs is crucial for the BOE's decision-making.

The Potential Consequences of Different QE Approaches

The choice between continuing with existing QE policies or adopting a more cautious approach carries significant consequences for the UK economy.

- Impact on Inflation: Continued QE risks further exacerbating inflationary pressures, while a more cautious approach might help to curb inflation but could also slow economic growth.

- Impact on Economic Growth: A cautious approach to QE might lead to slower economic growth in the short term, but it could lead to more sustainable growth in the long term by avoiding asset bubbles and promoting greater economic stability.

- Impact on the Value of the Pound: Changes in QE policy can significantly influence the exchange rate of the pound. A more restrictive policy might strengthen the pound in the long run, but could also lead to short-term volatility.

- Impact on Government Debt: QE policies can impact government debt levels, as the BOE's purchases of government bonds can influence interest rates and borrowing costs.

The Future of BOE's QE Policy – A Need for Prudent Management

In summary, the BOE's future QE policy requires careful consideration. Greene's cautious approach highlights the potential risks associated with large-scale asset purchases, particularly in the current inflationary environment. The current economic landscape necessitates a balanced approach, weighing the trade-offs between stimulating growth and controlling inflation. Exploring alternative monetary policy tools is essential. The potential consequences of different approaches are significant, impacting inflation, growth, the value of the pound, and government debt. A prudent and well-considered approach is crucial for navigating the challenges ahead. Stay informed about the future of BOE's QE policy and its impact on the UK economy. Learn more about the debate surrounding BOE's Quantitative Easing strategies and their implications for your financial well-being.

Featured Posts

-

D Backs Stage Epic Comeback Five Run Ninth For Walk Off Win Against Brewers

Apr 23, 2025

D Backs Stage Epic Comeback Five Run Ninth For Walk Off Win Against Brewers

Apr 23, 2025 -

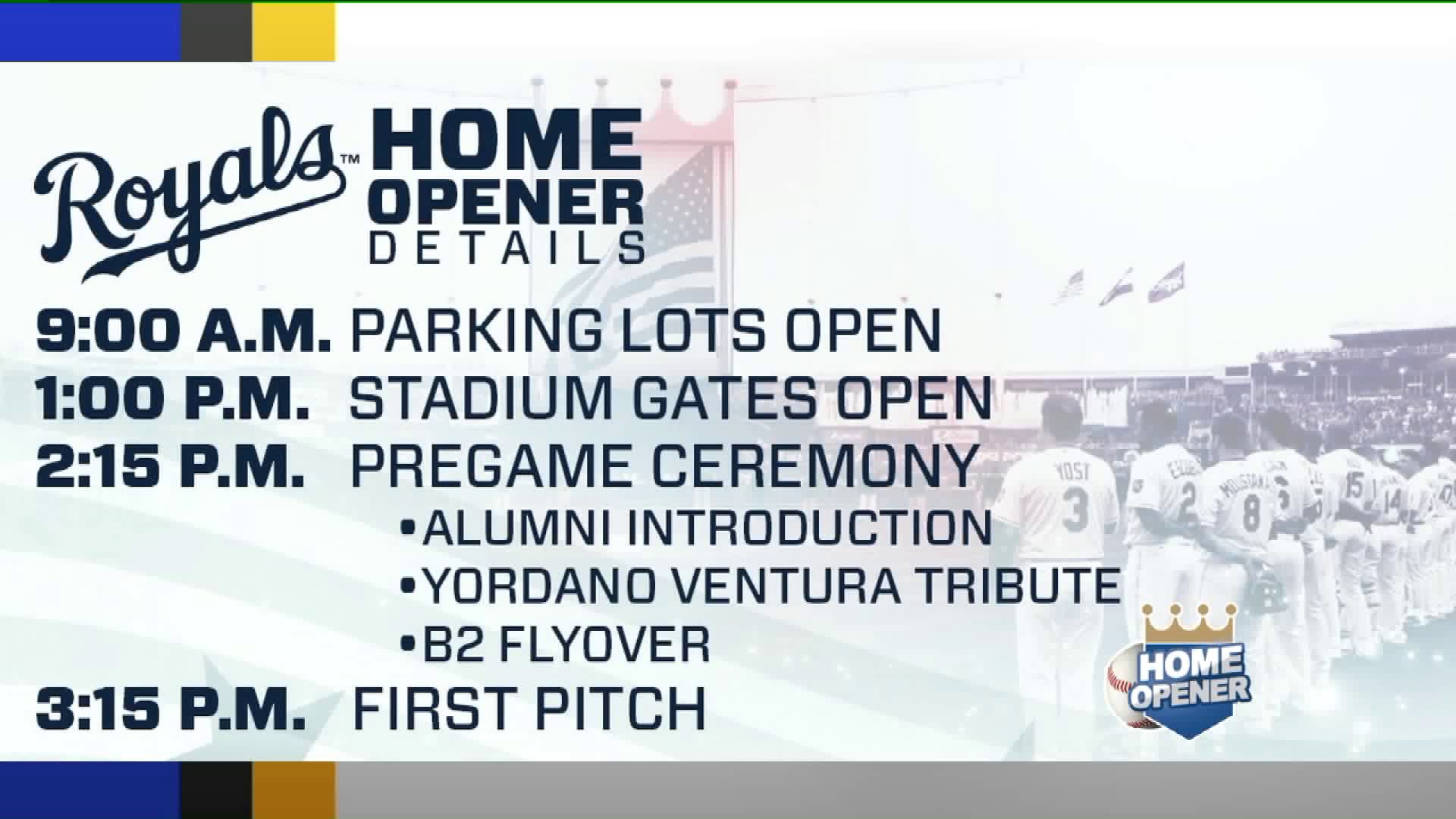

Royals Crush Brewers 11 1 In Home Opener

Apr 23, 2025

Royals Crush Brewers 11 1 In Home Opener

Apr 23, 2025 -

The Trump Powell Feud Intensifies President Calls For Chairmans Termination

Apr 23, 2025

The Trump Powell Feud Intensifies President Calls For Chairmans Termination

Apr 23, 2025 -

Pierre Poilievres Failed Campaign Analyzing A 20 Point Poll Decline

Apr 23, 2025

Pierre Poilievres Failed Campaign Analyzing A 20 Point Poll Decline

Apr 23, 2025 -

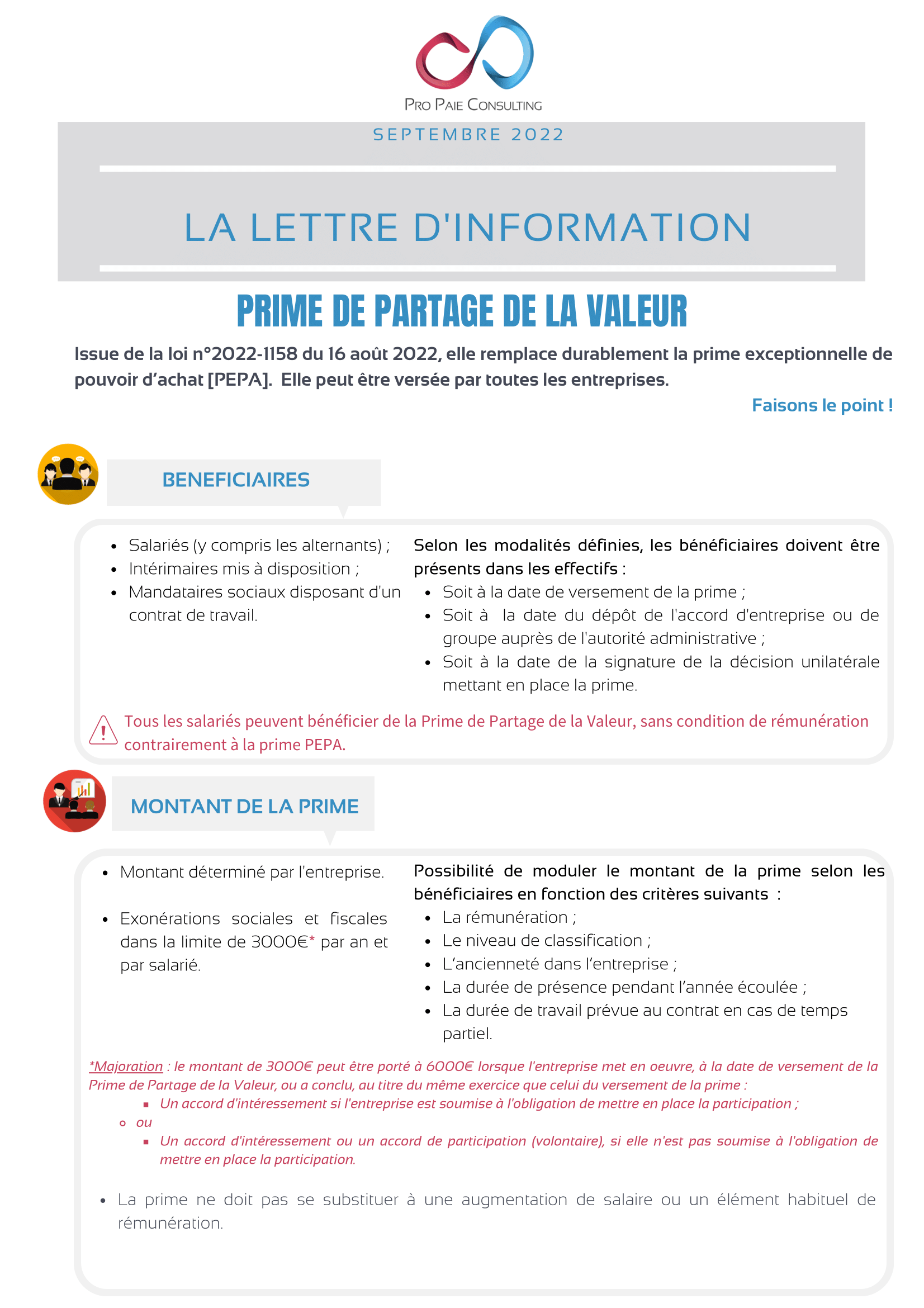

Infotel Delivrer De La Valeur Ajoutee Le 17 Fevrier Et Au Dela

Apr 23, 2025

Infotel Delivrer De La Valeur Ajoutee Le 17 Fevrier Et Au Dela

Apr 23, 2025