BofA's Assessment: Why Current Stock Market Valuations Shouldn't Deter Investors

Table of Contents

BofA's Positive Economic Forecast Fuels Market Confidence

BofA's positive economic forecast is a cornerstone of their bullish outlook. Their analysis incorporates various factors influencing the stock market, providing a more nuanced perspective than simply looking at headline valuations.

-

Continued Economic Growth: BofA predicts continued, albeit moderated, economic growth in the coming quarters. This projection mitigates concerns of an imminent recession, a key factor influencing investor sentiment and stock market valuations. They anticipate a gradual slowdown rather than a sharp contraction.

-

Inflation Expectations and Interest Rates: BofA's forecast incorporates insights into inflation trends and the Federal Reserve's response through interest rate adjustments. While inflation remains a concern, their projections suggest a gradual return to the central bank's target range, reducing the uncertainty surrounding interest rate hikes and their impact on the economy and stock market valuations. They have specific data points within their report, indicating a slowing inflation rate alongside gradual interest rate increases. For instance, they might project inflation to fall from 4% to 2.5% by the end of the year, while the federal funds rate stabilizes around 5.5%.

-

Sustained Corporate Earnings Growth: The positive economic outlook underpins BofA's belief in sustained corporate earnings growth. Even with a moderation in economic expansion, many companies are expected to maintain profitability and even increase their earnings per share (EPS) – a key driver of stock prices and a factor often overlooked when focusing solely on stock market valuations. BofA likely points to specific sectors or companies poised to benefit from this continued growth.

-

GDP Growth Projections: BofA’s report likely includes concrete GDP growth projections, providing quantifiable data to support their overall optimistic view. These projections are crucial for justifying their assessment of stock market valuations as reasonable given the predicted economic performance.

Analyzing Current Stock Market Valuations: A Deeper Dive

While some stock market valuations may seem high compared to historical averages, BofA's analysis suggests a more nuanced perspective. Simply looking at headline P/E ratios, for example, doesn't tell the whole story.

-

Beyond Simple Metrics: BofA uses a range of valuation metrics beyond simple Price-to-Earnings ratios (P/E). They likely incorporate Price-to-Sales ratios (P/S), Discounted Cash Flow (DCF) analysis, and other more sophisticated methods that consider future earnings growth. This holistic approach helps to avoid the pitfalls of relying on a single, potentially misleading metric.

-

Growth vs. Value: BofA's assessment probably differentiates between growth stocks and value stocks. While growth stocks might command higher P/E multiples reflecting expected future growth, BofA's analysis likely identifies instances where these multiples are justified by robust growth prospects. Similarly, they may highlight undervalued value stocks that offer attractive returns based on their current earnings and market capitalization.

-

Sector-Specific Valuations: A detailed sector analysis is crucial. BofA’s report will likely identify sectors where valuations are more attractive than others, offering investors targeted investment opportunities. For example, some sectors may be undervalued due to short-term market sentiment, creating attractive entry points for long-term investors.

Sector-Specific Opportunities Identified by BofA

BofA's sector analysis likely highlights specific areas with attractive investment potential. While specific stock picks should be discussed with a financial advisor, the report likely points to:

-

High-Growth Sectors: These are sectors expected to experience significant expansion, potentially offering high returns but also carrying higher risk. Examples might include technology, renewable energy, or certain healthcare sub-sectors.

-

Resilient Sectors: These sectors are less sensitive to economic downturns. Examples include consumer staples, utilities, and certain healthcare segments. These are often characterized by steady earnings and dividend payouts, providing a more stable investment approach.

-

Undervalued Sectors: BofA might identify sectors currently trading below their intrinsic value based on their fundamental analysis. This represents an opportunity to buy low and potentially benefit from future price appreciation. It's crucial to understand the reasons behind the undervaluation before investing.

Mitigating Market Risks and Volatility

Even with a positive outlook, understanding and mitigating market risks is crucial. BofA's assessment likely addresses these concerns.

-

Diversification: A well-diversified portfolio across different asset classes and sectors is key to reducing the impact of market volatility on your investments. BofA likely emphasizes this as a core principle of sound investment strategy, especially given the current market conditions and stock market valuations.

-

Hedging Strategies: To mitigate risks further, BofA might discuss hedging strategies such as using options or other derivatives to protect against potential losses. However, these strategies also involve complexities and should be considered in consultation with a financial advisor.

-

Risk Tolerance: Aligning your investment strategy with your personal risk tolerance is paramount. BofA's recommendations likely emphasize the importance of understanding your own risk profile and choosing investments accordingly. This is particularly important when considering the variability inherent in stock market valuations.

Conclusion

BofA's analysis suggests that despite seemingly high stock market valuations, the current market presents a compelling opportunity for investors. Their positive economic outlook, coupled with a nuanced understanding of valuation metrics and the identification of sector-specific opportunities, provides a strong foundation for strategic investment decisions. The key is adopting a well-diversified approach and carefully managing risk through proper portfolio diversification and a risk management strategy.

Call to Action: Don't let current stock market valuations deter you. Consult with a financial advisor to assess your risk tolerance and develop an investment strategy based on BofA's insights and your individual financial goals. Learn more about BofA's market assessment and explore potential investment opportunities today. Remember, this information is for general knowledge and does not constitute financial advice. Always conduct your own research and seek professional guidance before making any investment decisions.

Featured Posts

-

Realni Geroi 10 Aktori Spasili Khora

May 13, 2025

Realni Geroi 10 Aktori Spasili Khora

May 13, 2025 -

Einsatz An Braunschweiger Grundschule Die Lage Ist Entspannt

May 13, 2025

Einsatz An Braunschweiger Grundschule Die Lage Ist Entspannt

May 13, 2025 -

Qanwn Lywnardw Dy Kabryw Llelaqat Astthnae Jdyd

May 13, 2025

Qanwn Lywnardw Dy Kabryw Llelaqat Astthnae Jdyd

May 13, 2025 -

Hamas Releases American Israeli Hostage Edan Alexander In Gaza

May 13, 2025

Hamas Releases American Israeli Hostage Edan Alexander In Gaza

May 13, 2025 -

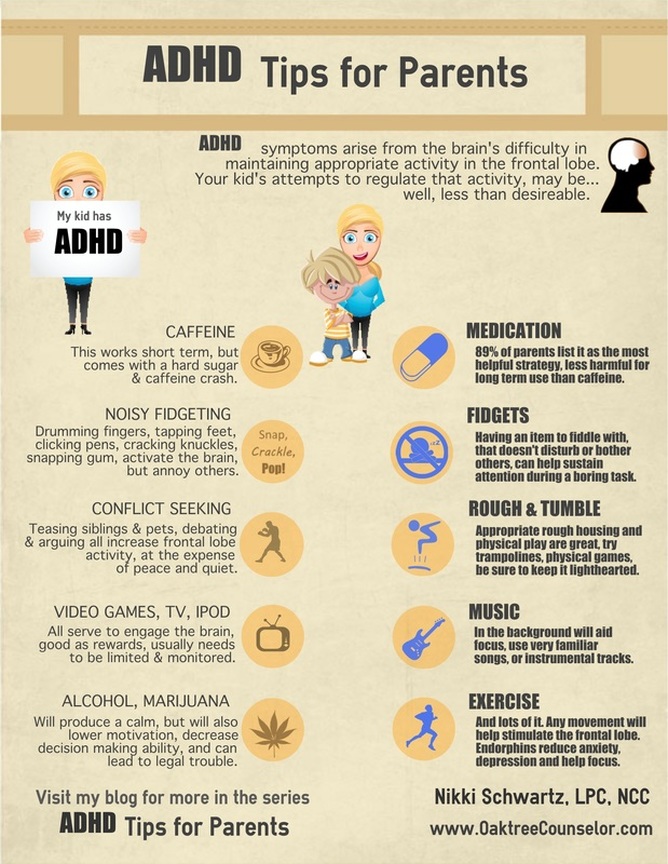

Inside Our Adhd Minds A Guide To Self Understanding

May 13, 2025

Inside Our Adhd Minds A Guide To Self Understanding

May 13, 2025