BofA's View: Addressing Concerns About Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA, a leading financial institution, constantly analyzes market trends and provides valuable insights into investment strategies. Their assessment of current stock market valuations involves a multi-faceted approach utilizing several key valuation metrics.

Valuation Metrics Used by BofA:

BofA likely employs a range of valuation metrics to gauge market health and identify potential risks or opportunities. These metrics provide different perspectives on whether current prices accurately reflect the underlying value of companies.

- Price-to-Earnings ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio might suggest the market expects high future earnings growth, but it could also signal overvaluation. Limitations include its sensitivity to accounting practices and its inapplicability to companies with negative earnings.

- Price-to-Sales ratio (P/S): This compares a company's stock price to its revenue per share. It's useful for valuing companies with no earnings or inconsistent earnings, but it doesn't consider profitability directly.

- Price-to-Book ratio (P/B): This compares a company's market capitalization to its book value (assets minus liabilities). A high P/B ratio might suggest the market expects significant future growth, but it can also reflect inflated asset values.

- Dividend Yield: This represents the annual dividend payment relative to the stock price. A high dividend yield can be attractive to income-seeking investors, but it doesn't necessarily reflect the underlying value of the company.

While precise data from BofA's internal research is proprietary, publicly available commentary suggests that certain sectors show elevated P/E ratios compared to historical averages. Analyzing these ratios in conjunction with other economic indicators is critical for a comprehensive view.

Comparison to Historical Valuations:

Comparing current valuations to historical averages provides valuable context. We can examine how current P/E ratios, for instance, compare to those seen during periods like the dot-com bubble of the late 1990s or the 2008 financial crisis.

- Dot-com Bubble (late 1990s): Tech stocks reached extremely high valuations before a significant market correction.

- 2008 Financial Crisis: The market experienced a sharp decline, leading to lower valuations across most sectors.

Current valuation multiples, depending on the sector, may be higher or lower than those seen in previous cycles. However, crucially, these historical comparisons must consider differences in interest rate environments, economic growth rates, and technological advancements. Direct comparisons without considering these factors can be misleading.

Factors Contributing to Elevated Stock Market Valuations

Several factors contribute to the current perception of elevated stock market valuations.

Low Interest Rates and Monetary Policy:

Historically low interest rates significantly influence stock valuations. Low rates decrease the attractiveness of bonds, pushing investors toward higher-yielding assets like equities.

- Present Value of Future Earnings: Low interest rates increase the present value of a company's future earnings, making its stock appear more valuable.

- Quantitative Easing (QE): Central bank policies, such as QE, have injected significant liquidity into the market, further boosting asset prices. However, rising interest rates are starting to shift this dynamic.

Corporate Earnings Growth and Expectations:

Strong corporate earnings growth, or expectations of such growth, can justify higher stock prices. However, the sustainability of this growth needs careful assessment.

- BofA's Earnings Projections: BofA's sector-specific earnings projections play a significant role in their overall market valuation assessment. While precise figures are often kept internal, their public statements offer insights into their expectations.

- Inflation and Supply Chain Issues: Inflation and supply chain disruptions pose considerable challenges to corporate earnings, potentially dampening growth projections.

Market Sentiment and Investor Behavior:

Psychological factors significantly impact market valuations. Investor sentiment, influenced by news, economic data, and speculation, can lead to market bubbles or crashes.

- Herd Behavior: Investors often follow trends, amplifying price movements.

- Fear of Missing Out (FOMO): This psychological phenomenon can lead to irrational exuberance and inflated valuations.

- Market Optimism/Pessimism: Shifts in overall market sentiment greatly affect stock prices.

BofA's Recommendations and Mitigation Strategies

Given the potential risks associated with elevated valuations, BofA likely recommends a cautious approach.

Investment Strategies for Managing Elevated Valuations:

BofA’s recommendations probably emphasize prudent strategies to mitigate potential risks.

- Diversification: Spreading investments across different asset classes and sectors reduces overall portfolio risk.

- Sector Rotation: Shifting investments from overvalued sectors to undervalued ones can improve risk-adjusted returns.

- Value Investing: Focusing on undervalued companies with strong fundamentals.

- Alternative Investments: Exploring asset classes like real estate or commodities to diversify beyond traditional equities.

BofA might also suggest considering bonds or other fixed-income instruments, depending on investor risk tolerance and overall portfolio goals.

Risk Assessment and Portfolio Management:

Thorough risk assessment is crucial.

- Stress Testing: Analyzing portfolio performance under various adverse scenarios.

- Downside Protection: Employing strategies to limit potential losses.

- Stop-Loss Orders: Setting pre-determined sell points to minimize losses.

- Financial Planning Tools: Utilizing software or consulting professionals to optimize investment strategies.

Seeking professional financial advice is paramount before implementing any significant investment changes.

Conclusion

BofA's view on elevated stock market valuations acknowledges the risks and opportunities present in the current market environment. Factors like low interest rates, corporate earnings growth, and investor sentiment all play a role. Their recommended strategies focus on diversification, risk management, and a careful assessment of individual company valuations. Stay informed about BofA's ongoing analysis of stock market valuations and remember to consult with a financial professional to create a personalized investment strategy. Learn more about managing risk in a market with elevated valuations by seeking professional advice tailored to your specific financial goals and risk tolerance.

Featured Posts

-

Pam Bondi Accused Of Concealing Epstein Records By Senate Democrats

May 10, 2025

Pam Bondi Accused Of Concealing Epstein Records By Senate Democrats

May 10, 2025 -

How Did Donald Trumps First 100 Days Impact Elon Musks Net Worth

May 10, 2025

How Did Donald Trumps First 100 Days Impact Elon Musks Net Worth

May 10, 2025 -

Strictly Come Dancing Wynne Evans Responds To Return Speculation

May 10, 2025

Strictly Come Dancing Wynne Evans Responds To Return Speculation

May 10, 2025 -

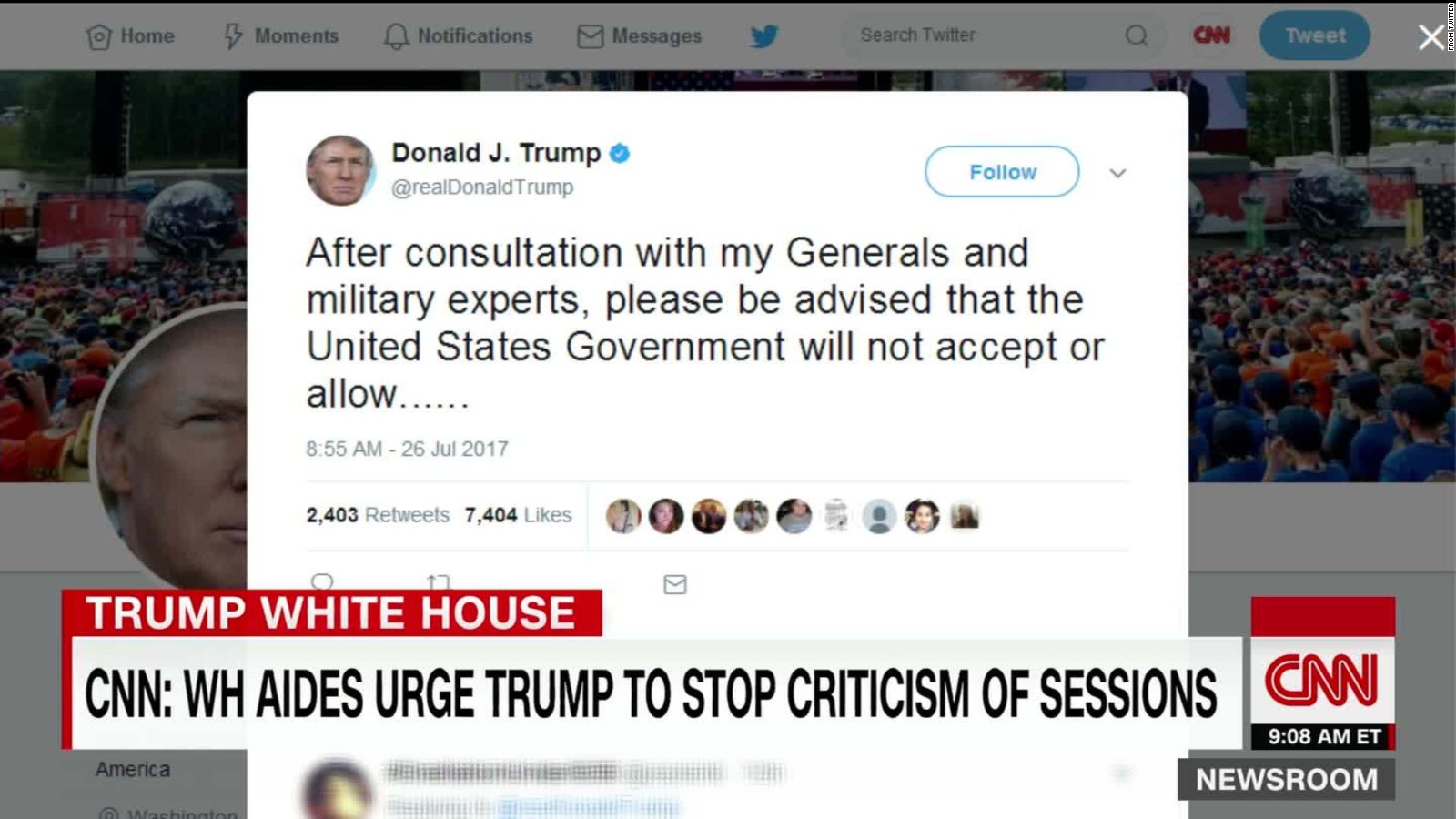

Trumps Transgender Military Ban Fact Vs Fiction

May 10, 2025

Trumps Transgender Military Ban Fact Vs Fiction

May 10, 2025 -

Maldives Vacation Elizabeth Hurleys Bikini Style

May 10, 2025

Maldives Vacation Elizabeth Hurleys Bikini Style

May 10, 2025