How Did Donald Trump's First 100 Days Impact Elon Musk's Net Worth?

Table of Contents

The first 100 days of any presidency are a period of intense scrutiny and significant change. For entrepreneurs like Elon Musk, whose fortunes are deeply intertwined with the global economy, these initial days can have a profound impact. This article analyzes how Donald Trump's first 100 days in office affected Elon Musk's net worth, examining key policy decisions and market reactions. We'll delve into the interplay of economic policies, geopolitical events, and media narratives to understand this complex relationship.

Trump's Economic Policies and Their Initial Market Impact

Donald Trump's economic platform, focused on deregulation and tax cuts, had significant potential implications for both Tesla and SpaceX, key components of Elon Musk's vast wealth.

Deregulation and its Effect on Tesla

Trump's emphasis on deregulation promised potential benefits for Tesla across its automotive and energy sectors.

- Reduced environmental regulations: Easing environmental restrictions could lower Tesla's production costs and potentially accelerate its expansion. However, it could also lead to criticism for potentially harming environmental protection efforts.

- Potential impact on electric vehicle subsidies: Changes in government incentives for electric vehicles (EVs) could directly affect Tesla's sales and profitability. A reduction in subsidies could hurt sales, while an increase would boost them.

- Changes in fuel efficiency standards: Relaxing fuel efficiency standards might initially boost sales of Tesla's electric vehicles but could also negatively impact the long-term push toward sustainable transportation.

These potential changes, both positive and negative, significantly impacted Tesla's stock price and, consequently, Musk's net worth, making it a volatile period for investors.

Tax Cuts and their Influence on SpaceX

The proposed corporate tax cuts were a significant element of Trump's economic agenda. For SpaceX, a rapidly growing private space exploration company, these cuts could have influenced its growth trajectory.

- Impact on SpaceX's ability to secure funding: Lower corporate tax rates could increase SpaceX's profitability, making it a more attractive investment for venture capitalists and potentially allowing it to secure funding more easily.

- Potential increase in profitability: Reduced tax burdens would directly increase SpaceX's bottom line, potentially contributing to faster expansion and increased valuation.

- Effect on the space exploration industry: The overall impact on the space exploration industry, potentially driven by the tax cuts, could influence investor sentiment towards SpaceX, indirectly impacting Musk's net worth.

The success and funding secured by SpaceX directly correlate with Musk’s overall net worth, making the tax cut proposals a critical factor during this period.

Geopolitical Events and Market Volatility

Trump's first 100 days were marked by significant geopolitical shifts, impacting global markets and creating volatility that affected Musk's companies.

International Trade Relations and Tesla's Global Operations

Trump's early trade policies, including threats of tariffs, significantly influenced Tesla's global operations.

- Impact of tariffs on imported materials: Tariffs on imported materials used in Tesla's vehicles could increase manufacturing costs, impacting profitability and competitiveness.

- Effects on Tesla's manufacturing costs: Increased costs due to tariffs could force Tesla to raise prices or absorb the losses, affecting its market share and stock price.

- Consequences for Tesla's global market share: Increased manufacturing costs due to trade tensions could hurt Tesla's competitiveness in international markets, potentially reducing its global market share.

These factors had a direct impact on Tesla's stock price, and therefore, Musk's net worth, creating significant uncertainty for investors.

Shifting Global Investment Sentiment

Trump's presidency created uncertainty in the global markets, significantly affecting investor confidence, especially in sectors like technology and renewable energy where Musk's companies operate.

- Increased or decreased market volatility: The uncertainty surrounding Trump's policies led to increased market volatility, causing significant fluctuations in Tesla and SpaceX valuations.

- Shifts in investor sentiment towards renewable energy and space exploration: Investor confidence in the renewable energy and space exploration sectors could have been influenced by the Trump administration's policies, potentially influencing investment in Tesla and SpaceX.

These shifts in investor sentiment directly impacted the valuations of Tesla and SpaceX, creating significant fluctuations in Musk's net worth.

The Role of Media and Public Perception

Trump's presidency, coupled with his active use of social media, created a highly dynamic media environment that directly affected market perception of Tesla and SpaceX.

Trump's Public Statements and their Impact on Tesla and SpaceX Stock

Trump's public statements and tweets about Musk or his companies directly influenced market sentiment.

- Specific examples of tweets or statements: Analyzing specific instances where Trump mentioned Musk or his companies reveals the immediate market reaction to these pronouncements.

- Their immediate market reaction: A positive or negative statement from Trump could lead to short-term fluctuations in Tesla and SpaceX stock prices.

- Long-term effects on investor confidence: Repeated positive or negative statements could influence long-term investor confidence, affecting the overall valuation of the companies.

This direct link between Trump's public image and market response had a clear impact on Musk’s net worth.

Overall Media Coverage and its Effect on Investor Behavior

The overall media narrative surrounding Trump's presidency influenced investor behavior, creating a ripple effect on Musk's net worth.

- Analysis of media sentiment: The prevailing media sentiment towards Trump's presidency influenced the overall risk appetite of investors, affecting investment decisions in the technology sector.

- Impact on investor risk appetite: Negative media coverage might have increased investor risk aversion, potentially leading to decreased investment in Tesla and SpaceX.

- Correlation between news cycles and Musk's net worth fluctuations: By analyzing news cycles and their correlation with Musk’s net worth fluctuations, we can determine the extent of media influence.

Conclusion

This analysis shows that the first 100 days of the Trump presidency had a multifaceted impact on Elon Musk's net worth. While some policies potentially benefited Tesla and SpaceX, market volatility and shifting investor sentiment played a significant role. Understanding these complex interactions is crucial for assessing the relationship between political leadership and the fortunes of major entrepreneurs.

Call to Action: To delve deeper into the complex relationship between political events and the financial markets, continue exploring the impact of Donald Trump's presidency on Elon Musk's net worth and other key economic indicators. Further research can provide a more nuanced understanding of these interconnected forces.

Featured Posts

-

Le Ministre Europeen Francais Vante Le Partage Du Bouclier Nucleaire

May 10, 2025

Le Ministre Europeen Francais Vante Le Partage Du Bouclier Nucleaire

May 10, 2025 -

Solve Nyt Strands March 14 Game 376 Hints And Answers

May 10, 2025

Solve Nyt Strands March 14 Game 376 Hints And Answers

May 10, 2025 -

Trumps Reluctance To Drop Tariffs Warners Assessment

May 10, 2025

Trumps Reluctance To Drop Tariffs Warners Assessment

May 10, 2025 -

Credit Suisse Whistleblower Case 150 Million Settlement

May 10, 2025

Credit Suisse Whistleblower Case 150 Million Settlement

May 10, 2025 -

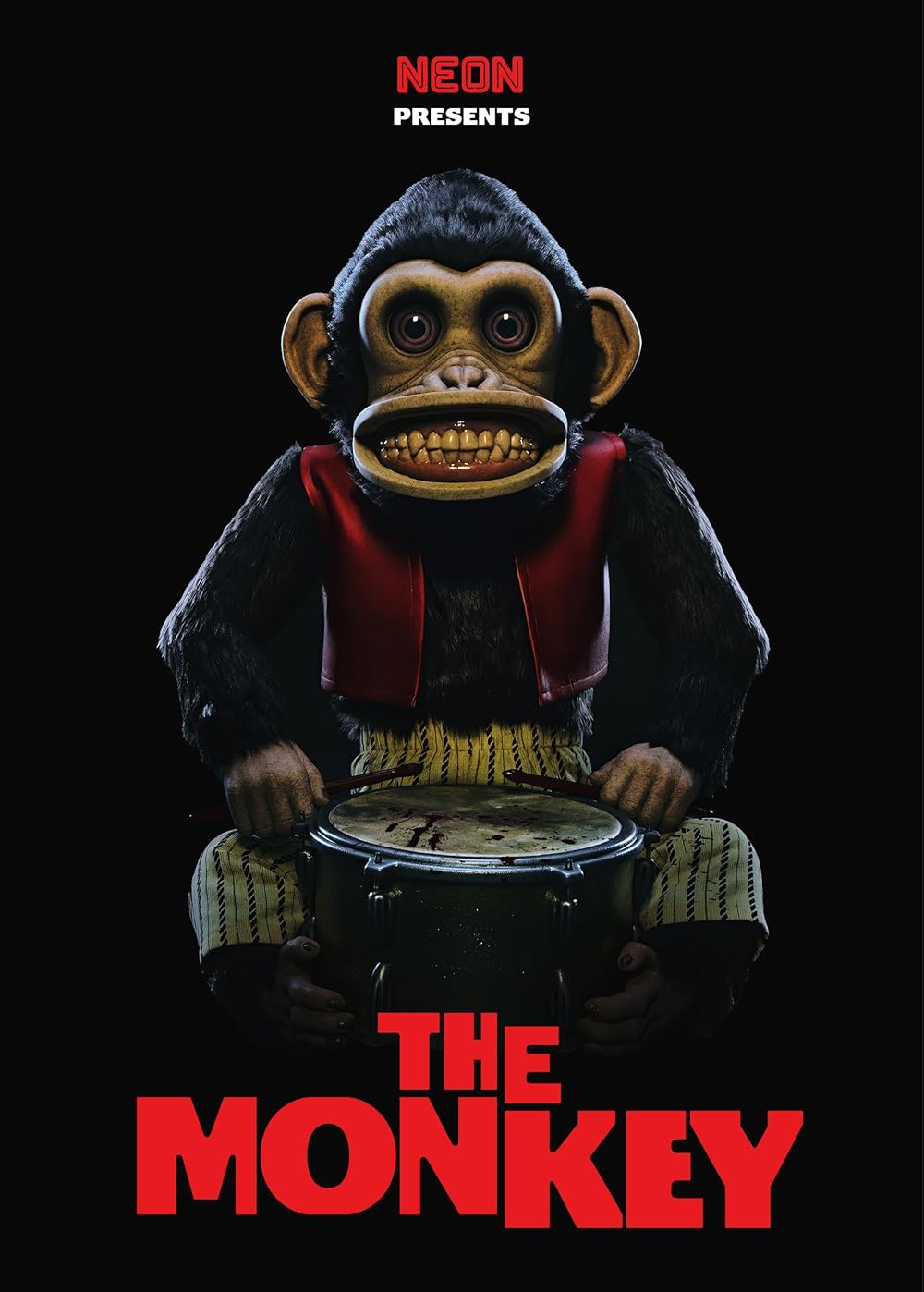

A Potential Monkey Disaster Assessing Stephen Kings 2025 Film Slate

May 10, 2025

A Potential Monkey Disaster Assessing Stephen Kings 2025 Film Slate

May 10, 2025