Boosting Capital Market Cooperation: A Tripartite Agreement Between Pakistan, Sri Lanka, And Bangladesh

Table of Contents

Potential Economic Benefits of Increased Capital Market Integration

A tripartite agreement focused on capital market cooperation between Pakistan, Sri Lanka, and Bangladesh promises substantial economic benefits for all participating nations. This integration would create a larger, more dynamic market, attracting significant investment and fostering economic growth.

Enhanced Investment Opportunities

- Increased Foreign Direct Investment (FDI): A unified capital market would significantly enhance the region's attractiveness to foreign investors. The combined size and potential of these three economies would present a compelling investment proposition, attracting substantial FDI flows. This influx of capital would be crucial for infrastructure development and economic diversification.

- Attracting International Investors: A larger, integrated market reduces the risks associated with investing in individual countries. This is particularly appealing to international investors seeking diversification and stable returns, leading to increased competition and improved investment opportunities.

- SME Financing: Access to capital is a critical constraint for Small and Medium-sized Enterprises (SMEs) in these countries. Market integration would expand access to a wider range of financial instruments and investors, fostering SME growth and job creation. Increased SME financing directly contributes to the overall economic growth and development of the region.

Deeper Financial Markets and Liquidity

Pooling resources through capital market integration leads to deeper and more liquid financial markets.

- Lower Borrowing Costs: Increased market liquidity translates to lower borrowing costs for businesses and governments. This fosters investment, stimulates economic activity, and strengthens the financial stability of the region as a whole.

- Improved Market Efficiency: A larger, more integrated market leads to greater price discovery and increased trading volume. This improves market efficiency and reduces transaction costs for all participants. Increased market depth and breadth also allow for better risk management.

- Enhanced Market Depth and Breadth: Integration allows investors to access a wider range of investment options, fostering greater diversification and reducing reliance on individual markets. This enhanced market depth and breadth increase overall market resilience.

Diversification and Risk Reduction

Diversification is key to managing risk in any investment portfolio.

- Reduced Volatility: Investing across three distinct markets significantly reduces exposure to the volatility of any single economy. This diversification strategy cushions the impact of economic shocks and strengthens the overall resilience of the regional financial system.

- Enhanced Portfolio Diversification: Investors gain access to a broader range of asset classes and investment opportunities, leading to more robust and diversified portfolios. This translates to reduced risk and improved returns in the long run.

- Increased Economic Resilience: The combined economic strength of the three nations creates a more resilient region, better able to withstand global economic downturns and external shocks. This is achieved through portfolio diversification and stronger overall financial stability.

Key Challenges and Considerations for a Tripartite Agreement

While the potential benefits are significant, several challenges need careful consideration.

Regulatory Harmonization

- Aligning Regulations: Harmonizing regulations across Pakistan, Sri Lanka, and Bangladesh requires significant effort. Differences in accounting standards, investor protection laws, and corporate governance frameworks must be addressed to create a unified and transparent market.

- Standardized Accounting Practices: Adoption of internationally recognized accounting standards is crucial to ensure transparency and comparability of financial information across borders. This improves investor confidence and facilitates cross-border investments.

- Investor Protection Measures: Robust investor protection mechanisms are essential to attract investment. Harmonizing regulations in this area will boost investor confidence and promote market development.

Infrastructure Development

- Robust IT Infrastructure: A robust IT infrastructure is crucial for efficient cross-border trading. This includes reliable internet connectivity, secure electronic trading platforms, and advanced clearing and settlement systems.

- Efficient Clearing and Settlement Systems: These systems are vital for ensuring timely and secure processing of transactions, reducing counterparty risk, and maintaining market integrity.

- Improved Communication Networks: Efficient and secure communication networks are crucial for facilitating seamless information exchange between market participants and regulators.

Political and Economic Stability

- Political Stability: Political stability is paramount for attracting foreign investment and ensuring the long-term success of the agreement. This includes stable political leadership, transparent governance, and a predictable regulatory environment.

- Macroeconomic Stability: Stable macroeconomic conditions – including low inflation, manageable public debt, and a stable exchange rate – are essential for attracting investment and fostering economic growth.

- Consistent Economic Policies: Countries must maintain consistent and predictable economic policies to create a stable and attractive investment climate. This includes a transparent tax system and reliable legal frameworks.

Potential Mechanisms for Boosting Capital Market Cooperation

Several mechanisms can facilitate enhanced capital market cooperation.

Establishing a Joint Regulatory Body

- Collaborative Regulatory Framework: A joint regulatory body could harmonize regulations, streamline processes, and ensure a level playing field for all market participants.

- Streamlining Regulations: A unified regulatory framework eliminates inconsistencies and simplifies compliance procedures, reducing costs and improving efficiency for businesses.

- Transparency and Accountability: The joint body must be transparent and accountable, ensuring that regulations are applied fairly and consistently.

Developing Standardized Trading Platforms

- Unified Trading Platform: Creating a standardized trading platform across the three countries improves market liquidity and reduces transaction costs. This is a key step towards seamless integration.

- Regional Stock Exchange: The possibility of a regional stock exchange merits exploration. This could significantly boost market liquidity and attract foreign investment.

- Reduced Transaction Costs: A unified platform would streamline trading processes, reducing transaction costs for investors and businesses.

Promoting Information Sharing and Capacity Building

- Best Practice Sharing: Regular exchange of information and best practices between regulators and market participants is crucial for fostering cooperation and learning from one another.

- Capacity Building Programs: Investment in capacity building programs improves the technical and managerial skills of market participants, enhancing market efficiency and effectiveness.

- International Cooperation: International organizations can play a significant role in supporting the process, providing technical assistance and promoting best practices.

Conclusion: The Future of Capital Market Cooperation in South Asia

A tripartite agreement focused on boosting capital market cooperation between Pakistan, Sri Lanka, and Bangladesh offers significant potential for economic growth and regional integration. While challenges related to regulatory harmonization, infrastructure development, and maintaining political and economic stability must be addressed, the potential rewards are substantial. By prioritizing the establishment of mechanisms that facilitate this partnership – including a joint regulatory body, standardized trading platforms, and robust information sharing – these nations can unlock significant economic opportunities. Further research and discussion are vital to explore the feasibility and implementation of a tripartite agreement to strengthen capital market cooperation, enhancing capital market linkages and improving regional capital markets for the benefit of all. Policymakers must prioritize this vital initiative for sustained economic progress.

Featured Posts

-

Kjoreforhold I Sor Norges Fjell Vintervaer Og Sikkerhet

May 09, 2025

Kjoreforhold I Sor Norges Fjell Vintervaer Og Sikkerhet

May 09, 2025 -

Edmonton Oilers Draisaitl Leaves Game Due To Injury

May 09, 2025

Edmonton Oilers Draisaitl Leaves Game Due To Injury

May 09, 2025 -

The Heartbeat Of Europe A Footballers Journey After Wolves Rejection

May 09, 2025

The Heartbeat Of Europe A Footballers Journey After Wolves Rejection

May 09, 2025 -

Loi Khai Gay Soc Bao Mau O Tien Giang Tat Tre Toi Tap

May 09, 2025

Loi Khai Gay Soc Bao Mau O Tien Giang Tat Tre Toi Tap

May 09, 2025 -

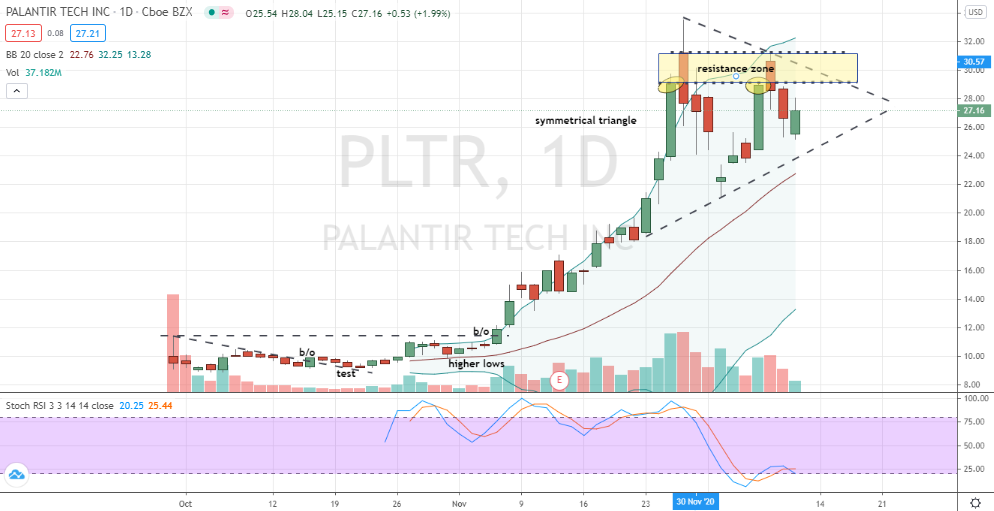

Should You Buy Palantir Stock Before May 5th A Prudent Investors Guide

May 09, 2025

Should You Buy Palantir Stock Before May 5th A Prudent Investors Guide

May 09, 2025