BP Chief Aims To Double Company Valuation: No US Listing Planned, Reports FT

Table of Contents

BP's Target: Doubling Company Valuation

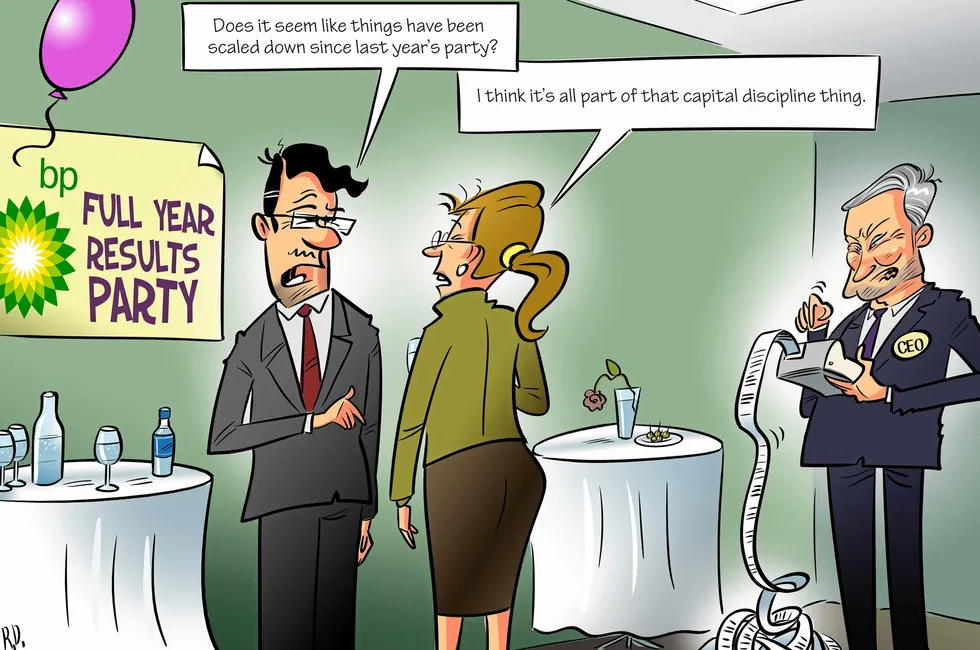

BP's current market capitalization (let's assume, for example, it's currently around £100 billion) represents a significant base from which to aim for a doubling of its valuation to £200 billion. This ambitious target hinges on several key factors. The company’s growth strategy relies on several interconnected elements: projected growth in global energy demand, particularly in developing economies; significant investment in renewable energy sources to align with the global energy transition; and a strong focus on operational efficiency improvements across its existing oil and gas operations.

The expected timeline for achieving this ambitious goal isn't explicitly stated in the FT report, but it likely involves a multi-year strategy, requiring consistent and significant progress across all aspects of the business. However, reaching this target faces considerable challenges. These challenges include potential volatility in oil and gas prices, increasing competition from other energy companies, and the inherent risks associated with large-scale investments in renewable energy technologies.

- Increased investment in renewable energy sources: This includes solar, wind, and potentially other emerging technologies. BP is betting on a future where renewable energy plays a significant role, and this investment is crucial to achieving its valuation target.

- Optimization of existing oil and gas operations: Improving efficiency and profitability in its traditional energy operations is critical. This includes technological advancements and streamlined processes.

- Strategic acquisitions: Acquiring smaller companies with complementary technologies or market presence can accelerate growth and diversification.

- Focus on technological innovation: Investing in research and development to improve operational efficiency, reduce emissions, and develop new technologies is paramount.

Reasons Behind No US Listing

The decision to forgo a US listing, despite the size and potential of the US stock market, is a strategic one. Several factors likely contribute to this decision. Regulatory hurdles and the associated costs of complying with US listing requirements are significant. The existing investor base in Europe and the UK represents a considerable advantage; establishing a new investor base in the US would require significant additional effort and expense.

Remaining listed on the London Stock Exchange offers several advantages. The regulatory environment is arguably less complex and costly than in the US. A strong existing investor base provides stability and reduces the need to cultivate a completely new investor audience. This strategy allows BP to focus resources on its core business rather than navigating a potentially more challenging and costly US listing process.

- Lower listing costs and regulatory burden in the UK: Compliance costs and listing fees are considerably less burdensome in the UK compared to the US.

- Strong existing investor base in Europe and the UK: A readily available investor base reduces the need to seek new investors.

- Potential to attract different types of investors by remaining on the LSE: This could offer benefits in terms of investor diversity and potentially different investment strategies.

Implications and Analysis of BP's Strategy

BP's ambitious plan to double its valuation has significant implications for its share price. Successful execution could lead to substantial increases, attracting further investment and boosting investor confidence. However, the strategy carries inherent risks. Market volatility, geopolitical instability affecting energy prices, and competition from other energy companies represent significant challenges.

This strategy aligns with growing concerns about environmental, social, and governance (ESG) factors in investing. BP’s significant investment in renewable energy demonstrates a commitment to a more sustainable future, which is increasingly important to many investors. However, the transition to a lower-carbon future is a significant undertaking with considerable uncertainty.

The feasibility of BP’s plan depends on several crucial factors. A thorough market analysis considering the competitive landscape is essential. The potential impact of fluctuating oil and gas prices must be considered, and an accurate assessment of the success rate of similar strategies implemented by other energy companies provides valuable context.

- Market analysis considering the competitive landscape within the energy sector: Analyzing the actions and strategies of competitors is crucial for developing a robust plan.

- Assessment of the potential impact of fluctuating oil and gas prices: Price volatility significantly impacts the profitability of traditional energy operations.

- Analysis of the success rate of similar strategies implemented by other energy companies: Learning from others' successes and failures can inform decision-making and strategy development.

Conclusion

BP's CEO has set an ambitious goal: doubling the company's valuation, a strategy that conspicuously avoids a US listing. The plan hinges on significant investments in renewable energy, operational efficiencies, and a focus on navigating the evolving energy landscape. The success of this bold move will depend on factors ranging from market conditions to geopolitical stability and successful execution of the strategic plan.

Call to Action: Stay informed about BP's progress toward its ambitious goal of doubling its company valuation. Follow future developments and analysis related to BP's strategic initiatives and investment plans. Learn more about the company’s approach to doubling its valuation and the ongoing developments in the energy sector.

Featured Posts

-

The David Walliams Simon Cowell Britains Got Talent Feud Explained

May 21, 2025

The David Walliams Simon Cowell Britains Got Talent Feud Explained

May 21, 2025 -

Reddits Top 12 Ai Stocks For 2024 A Deep Dive

May 21, 2025

Reddits Top 12 Ai Stocks For 2024 A Deep Dive

May 21, 2025 -

Bps Chief Executive Sees 31 Pay Reduction

May 21, 2025

Bps Chief Executive Sees 31 Pay Reduction

May 21, 2025 -

Patra Efimereyontes Iatroi 10 Kai 11 Maioy 2024

May 21, 2025

Patra Efimereyontes Iatroi 10 Kai 11 Maioy 2024

May 21, 2025 -

The 2025 Plunge Of Big Bear Ai Bbai Causes And Implications

May 21, 2025

The 2025 Plunge Of Big Bear Ai Bbai Causes And Implications

May 21, 2025