Broadcom's VMware Acquisition: AT&T Exposes A Potential 1,050% Price Hike

Table of Contents

Understanding the Broadcom VMware Acquisition

Broadcom's Strategy and Market Dominance

Broadcom's acquisition of VMware represents a significant power play in the tech industry. Their strategy is clear: expand beyond their core semiconductor and networking businesses into the lucrative world of enterprise software. This acquisition positions Broadcom to become a truly dominant force, controlling key aspects of both hardware and software infrastructure.

- Past Acquisitions: Broadcom has a history of successful acquisitions, demonstrating a clear pattern of strategic growth. Past acquisitions have significantly boosted their market share in various sectors.

- Market Share: Broadcom already holds a substantial market share in semiconductors and networking. This acquisition further solidifies their position, potentially leading to reduced competition.

- Strategic Fit: The synergy between Broadcom's hardware expertise and VMware's leading virtualization and cloud software is undeniable. This combination offers significant potential for cost savings and increased market control.

VMware's Role in the Enterprise IT Landscape

VMware is a titan in the enterprise IT world, providing critical virtualization and cloud infrastructure solutions to countless businesses globally. Their products are indispensable for many organizations.

- Market Share and Key Products: VMware holds a dominant market share, with flagship products like vSphere, vSAN, and NSX powering data centers worldwide.

- Customer Base: Their extensive customer base spans virtually every industry, making them a crucial component of global IT infrastructure.

- Impact on Data Centers and Cloud Adoption: VMware has played a pivotal role in enabling data center virtualization and facilitating the transition to cloud computing.

AT&T's Price Hike: A Case Study of Potential Impacts

The 1,050% Increase: Details and Analysis

Reports indicate that AT&T is facing a potential 1,050% increase in VMware licensing costs following the acquisition. While the exact details remain somewhat opaque, this exorbitant price jump raises significant concerns. The services affected reportedly include key virtualization components crucial to AT&T's operations. This information was initially reported by [insert source, e.g., Bloomberg, Reuters]. The justification, if any, from Broadcom or VMware, remains unconvincing to many.

- Reasons for the Increase: The potential reasons are multifaceted, ranging from leveraging newly acquired monopoly power to simply capitalizing on a captive market. Reduced competition is a serious concern.

- Quotes from Relevant Parties: [Insert quotes from AT&T representatives, industry analysts, or Broadcom/VMware statements, if available].

Implications for AT&T and its Customers

This price hike has profound implications for AT&T.

- Impact on Profitability and Competitiveness: Such a substantial cost increase could significantly impact AT&T's profitability and competitiveness, potentially forcing them to raise prices for their customers or cut services.

- Customer Churn and Consumer Advocacy: Customers might switch to alternative providers, leading to significant customer churn. Consumer advocacy groups are likely to raise concerns about this drastic price increase.

- Potential Legal Challenges: This situation may lead to legal challenges and regulatory scrutiny, as the price hike could be seen as an anti-competitive practice.

Broader Implications for the Industry

The implications extend far beyond AT&T.

- Other Industries Affected: Other companies relying on VMware products and services, particularly in the telecommunications, finance, and healthcare sectors, face the potential for similar steep price increases.

- Potential for Similar Increases: This case sets a worrying precedent, suggesting the possibility of widespread price hikes across various sectors reliant on VMware technology.

- Anti-Competitive Practices: Concerns about anti-competitive practices and the abuse of market dominance are paramount.

Regulatory Scrutiny and Future Outlook

The Broadcom VMware acquisition is now under increased regulatory scrutiny. Antitrust authorities are likely to investigate potential anti-competitive behavior, particularly regarding pricing practices. Potential government actions might include antitrust lawsuits or regulatory interventions to ensure fair competition and prevent price gouging. The long-term impact on the tech industry’s competitive landscape remains to be seen, but the immediate future looks uncertain for many businesses.

Conclusion: Navigating the Post-Acquisition Landscape of the Broadcom VMware Deal

The Broadcom VMware acquisition presents a complex and concerning scenario. The potential for substantial Broadcom VMware price increases, as evidenced by AT&T's experience, highlights the risks associated with unchecked market consolidation. The VMware acquisition price impact is far-reaching, threatening competition and potentially leading to higher prices for consumers and businesses. The situation warrants ongoing monitoring and advocacy for fair pricing and a competitive market. Stay informed about the evolving situation surrounding the Broadcom’s VMware deal and pricing to protect your business interests. Understanding the potential implications of this mega-merger is crucial for businesses relying on VMware technologies.

Featured Posts

-

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025 -

Googles Dominance Under Fire The Case For A Breakup

Apr 22, 2025

Googles Dominance Under Fire The Case For A Breakup

Apr 22, 2025 -

Razer Blade 16 2025 Ultra Thin Laptop Performance And Price Analysis

Apr 22, 2025

Razer Blade 16 2025 Ultra Thin Laptop Performance And Price Analysis

Apr 22, 2025 -

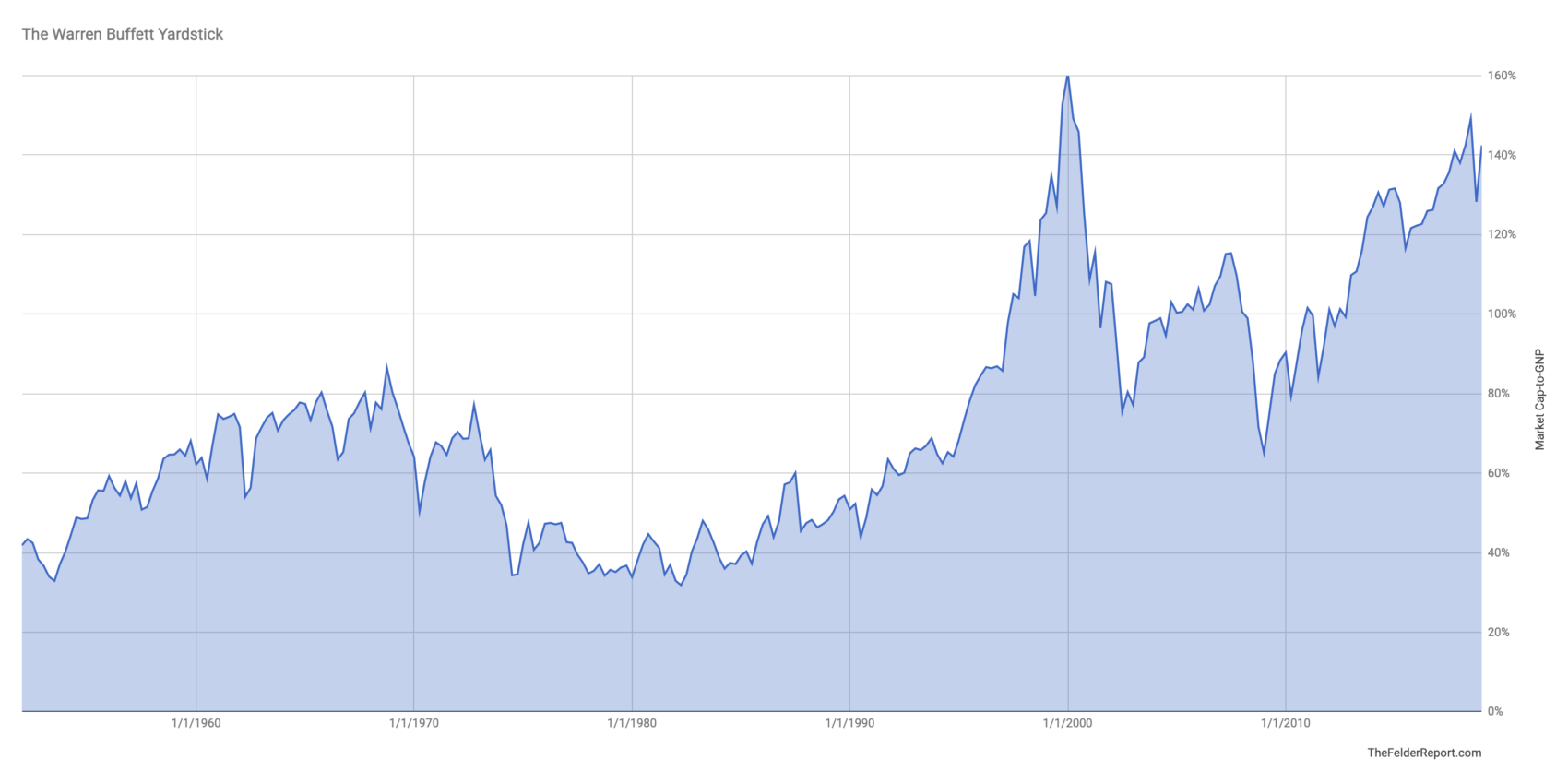

Investor Concerns About Stock Market Valuations Bof As Response

Apr 22, 2025

Investor Concerns About Stock Market Valuations Bof As Response

Apr 22, 2025 -

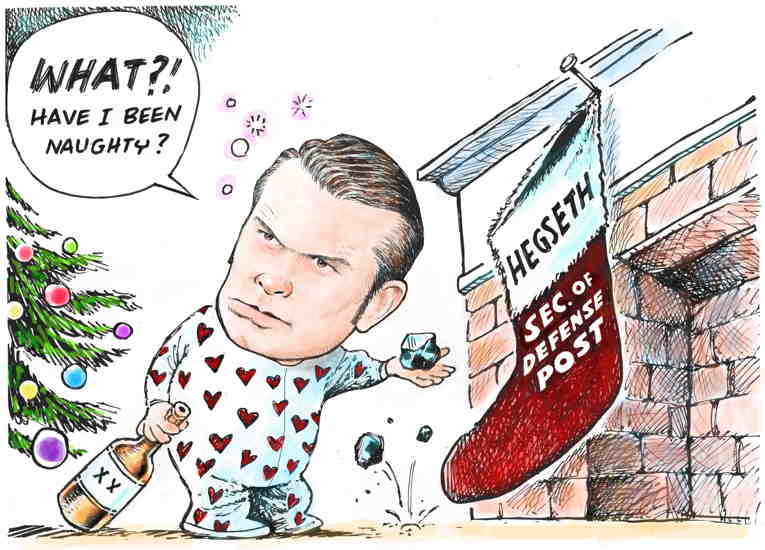

Hegseth Under Fire New Signal Chat And Pentagon Chaos Claims

Apr 22, 2025

Hegseth Under Fire New Signal Chat And Pentagon Chaos Claims

Apr 22, 2025