Buy-and-Hold: Facing The Emotional Challenges Of Long-Term Investing

Table of Contents

Fear and Greed: The Twin Demons of Buy-and-Hold

Fear and greed are powerful emotions that can significantly impact investment decisions, particularly within a buy-and-hold strategy. These twin demons often lead to impulsive actions that can derail even the most well-planned investment approach.

- Fear driving impulsive selling during market downturns: When the market dips, fear can trigger panic selling, leading investors to lock in losses at precisely the wrong time. This emotional response often contradicts the core principle of buy-and-hold, which relies on weathering short-term market fluctuations.

- Greed leading to chasing overvalued assets and missing diversification opportunities: During market booms, greed can lead investors to chase high-performing assets, often at inflated prices. This can create an unbalanced portfolio and increase overall risk, negating the benefits of diversification.

- The importance of a well-defined investment plan to mitigate these emotions: A detailed investment plan, outlining your risk tolerance, financial goals, and asset allocation, acts as a crucial anchor during times of market turbulence. This plan should be reviewed regularly but not altered impulsively based on short-term market movements.

- Using stop-loss orders and diversification to manage risk: Stop-loss orders can help limit potential losses, while diversification across various asset classes reduces the impact of any single investment's underperformance. These are crucial tools in managing the emotional rollercoaster of investing.

Dealing with Market Volatility and Uncertainty

Market fluctuations are inevitable, and their psychological impact on buy-and-hold investors can be substantial. The constant ups and downs can trigger anxiety and doubt, potentially leading to premature selling.

- The importance of understanding market cycles and their temporary nature: Recognizing that market corrections are a normal part of the investment cycle is crucial. Remembering that these downturns are temporary and historically followed by periods of growth helps maintain perspective.

- Strategies for managing anxiety during market corrections: Focusing on long-term goals, rather than short-term market noise, is essential. Regular portfolio reviews can provide reassurance and confirm that your investments are still aligned with your overall strategy.

- Avoiding frequent portfolio checks and reacting to daily news: Constantly monitoring your portfolio and reacting to daily market news can amplify anxiety and lead to poor decision-making. Sticking to your predetermined investment schedule and avoiding excessive news consumption helps maintain a calm and rational approach.

- The benefits of dollar-cost averaging to reduce the impact of volatility: Dollar-cost averaging involves investing a fixed amount at regular intervals, regardless of market fluctuations. This strategy mitigates the risk of investing a lump sum at a market peak and helps to average out the cost over time.

The Temptation to Time the Market

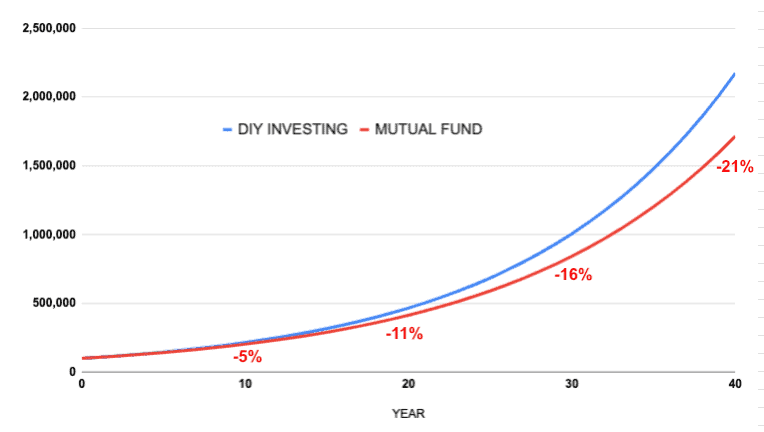

Trying to time the market—buying low and selling high—is a tempting but often disastrous strategy incompatible with buy-and-hold investing.

- The near impossibility of consistently predicting market peaks and troughs: Accurately predicting market movements is exceptionally difficult, even for seasoned professionals. Attempting to time the market often results in missed opportunities and lower overall returns.

- The potential for missing out on significant gains by attempting market timing: By trying to perfectly time the market, investors risk missing out on periods of substantial growth. This lost potential can significantly impact long-term returns.

- Highlighting the historical success of buy-and-hold strategies over market timing: Numerous studies demonstrate the superior performance of buy-and-hold strategies over attempts at market timing. The simplicity and long-term consistency of buy-and-hold contribute to its effectiveness.

- Focusing on consistent investing rather than trying to beat the market: Buy-and-hold investing emphasizes consistent contributions and long-term growth. Rather than trying to outsmart the market, it focuses on participating in its overall upward trajectory.

Overcoming FOMO (Fear of Missing Out)

Fear of missing out (FOMO) can significantly impact investment decisions, leading investors to chase hot trends and make impulsive choices.

- The dangers of investing based on hype or social media trends: Investing based solely on hype or social media trends is incredibly risky. These trends are often short-lived, leading to quick gains followed by significant losses.

- The importance of sticking to your investment plan despite social pressure: Maintaining discipline and sticking to your well-defined investment plan is crucial, regardless of what others are doing.

- Focusing on your own financial goals rather than comparing yourself to others: Comparing your investment performance to others can fuel FOMO and lead to poor decisions. Focusing on your own personal financial goals helps to maintain perspective and discipline.

Maintaining Patience and Discipline in Buy-and-Hold Investing

Patience and discipline are essential components of a successful buy-and-hold strategy. Long-term investing requires weathering market storms and resisting the urge to react to short-term fluctuations.

- Understanding that long-term investing requires patience and time: Buy-and-hold is a long-term game. Short-term market noise should be ignored in favor of a long-term perspective.

- Developing a robust investment plan and sticking to it consistently: A detailed and well-researched investment plan provides a roadmap for achieving your financial goals. Sticking to this plan consistently is vital.

- The benefits of periodic portfolio reviews to ensure alignment with goals: Regular portfolio reviews help ensure your investments remain aligned with your changing financial goals and risk tolerance.

- Seeking professional advice when needed: Don't hesitate to seek advice from a qualified financial advisor, particularly if you are struggling to manage the emotional aspects of investing.

Conclusion

Buy-and-hold investing, while a powerful strategy for long-term wealth creation, presents significant emotional hurdles. Successfully navigating these challenges—managing fear and greed, dealing with market volatility, resisting the urge to time the market, and overcoming FOMO—requires discipline, patience, and a well-defined investment plan. Remember, the key to successful buy-and-hold investing is to focus on your long-term financial goals, avoid emotional decision-making, and maintain a consistent approach. By understanding and addressing these emotional aspects, you significantly improve your chances of achieving your financial objectives through buy-and-hold investing. Start building your long-term wealth today with a well-planned buy-and-hold strategy!

Featured Posts

-

Ccmf 2025 Tickets Gone Looking Ahead To Future Events

May 25, 2025

Ccmf 2025 Tickets Gone Looking Ahead To Future Events

May 25, 2025 -

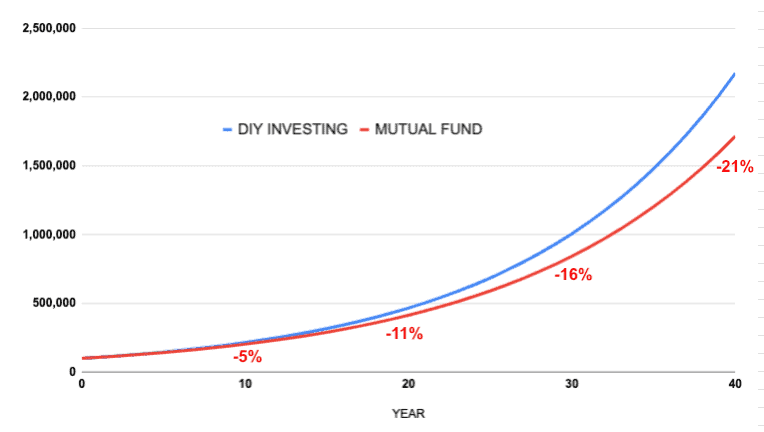

Le Clash Ardisson Baffie Retour Sur La Phrase Essaie De Parler Pour Toi

May 25, 2025

Le Clash Ardisson Baffie Retour Sur La Phrase Essaie De Parler Pour Toi

May 25, 2025 -

Leeds Make Contact For Kyle Walker Peters Transfer

May 25, 2025

Leeds Make Contact For Kyle Walker Peters Transfer

May 25, 2025 -

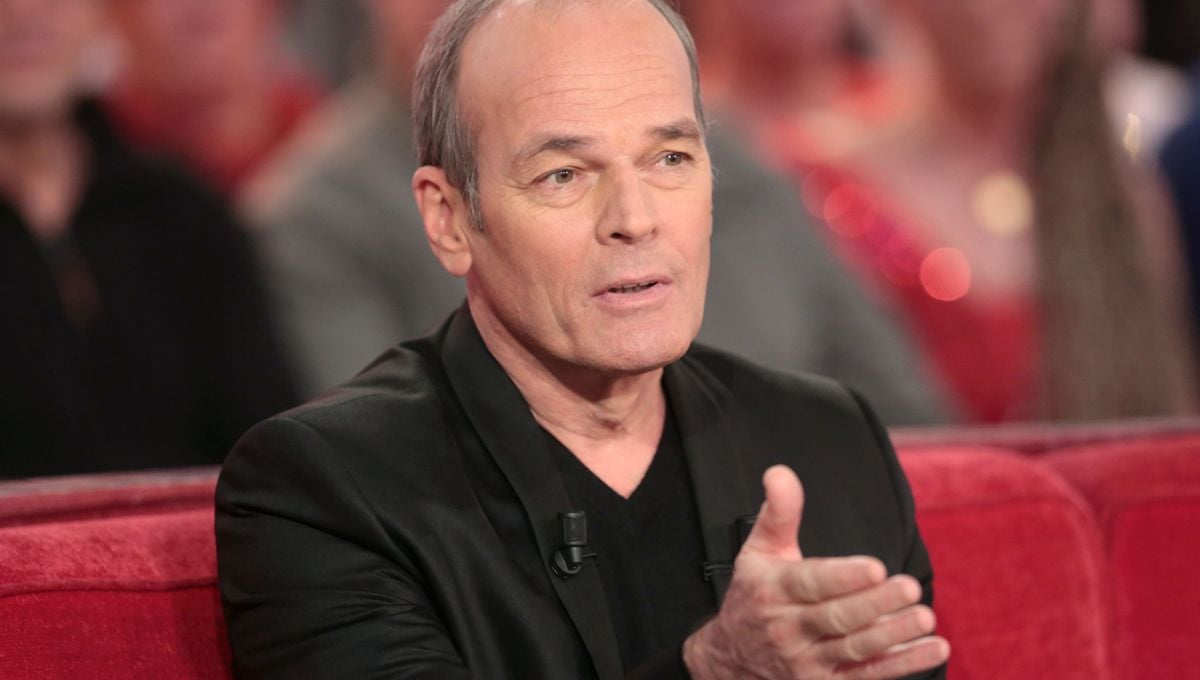

Market Reaction To Uk Inflation Reduced Boe Rate Cut Expectations And Pound Appreciation

May 25, 2025

Market Reaction To Uk Inflation Reduced Boe Rate Cut Expectations And Pound Appreciation

May 25, 2025 -

Thierry Ardisson Et Laurent Baffie Une Dispute Explosive

May 25, 2025

Thierry Ardisson Et Laurent Baffie Une Dispute Explosive

May 25, 2025