Buy XRP (Ripple) Now? A Look At The Current Sub-$3 Price

Table of Contents

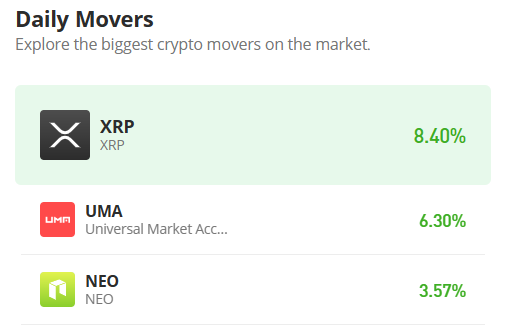

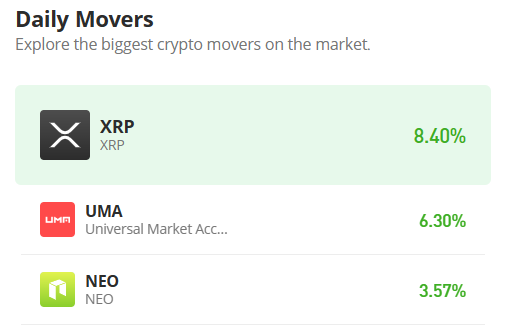

XRP's Current Market Position and Recent Price Action

Understanding XRP's current market position is crucial before considering any investment. Analyzing its market capitalization and trading volume provides insights into its overall strength and momentum. Currently, XRP holds a significant market cap (check and insert current market cap here), indicating its position within the broader cryptocurrency landscape. However, its trading volume (check and insert current trading volume here) reveals [insert analysis based on current trading volume, e.g., "moderate trading activity," "high volatility," etc.].

- Recent Price Trends: [Insert analysis of recent XRP price trends, referencing specific time periods and percentage changes, e.g., "Over the past month, XRP has experienced a [percentage]% decrease, largely influenced by…"]

- Key Technical Indicators: [If applicable, discuss relevant technical indicators like moving averages, RSI, or MACD, and their implications for XRP's price. Be sure to cite your sources for technical analysis].

- Influential News: [Discuss recent news impacting XRP's price. This might include partnerships, regulatory updates, or developments in the Ripple vs. SEC lawsuit. Always cite your sources for news.]

The Ripple vs. SEC Lawsuit: Its Impact on XRP's Price and Future

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly impacts XRP's price and future prospects. The SEC alleges that XRP is an unregistered security, a claim Ripple vehemently denies. The outcome of this lawsuit remains uncertain, creating significant regulatory uncertainty for XRP investors.

- Lawsuit Summary and Current Status: [Provide a concise summary of the lawsuit's core arguments and its current stage. Include information on any recent court filings or developments. Cite your sources.]

- Potential Positive Outcomes: [Describe scenarios where Ripple wins the case, leading to potential price increases. This might include the SEC dropping the charges or a court ruling declaring XRP not a security.]

- Potential Negative Outcomes: [Outline the consequences of an SEC victory, including the potential for XRP to be classified as a security, leading to significant price drops and delisting from exchanges.]

- Market Reaction: [Analyze how the market is currently reacting to the ongoing lawsuit. Are investors largely pessimistic or optimistic? Use relevant data to support your analysis.]

Fundamental Analysis of XRP and Ripple's Technology

Beyond the legal battles, it's essential to assess XRP's underlying technology and its potential use cases. RippleNet, Ripple's payment network, aims to facilitate faster and cheaper cross-border transactions for financial institutions. XRP acts as a bridge currency within this network, enabling near-instant settlements.

- XRP's Role in RippleNet: [Explain how XRP facilitates transactions on RippleNet and its advantages over traditional methods.]

- Potential for Widespread Adoption: [Discuss the potential for RippleNet and XRP to gain widespread adoption among banks and financial institutions. Analyze factors influencing adoption, such as cost savings, speed, and regulatory compliance.]

- Comparison to Competitors: [Compare XRP to other cryptocurrencies in the payment space, highlighting its strengths and weaknesses. Consider factors such as transaction speed, fees, and scalability.]

- Technology Strengths and Weaknesses: [Analyze the strengths and weaknesses of Ripple's underlying technology, addressing aspects such as scalability, security, and energy efficiency.]

Risk Assessment and Investment Strategies for XRP

Investing in cryptocurrencies, including XRP, involves significant risk. The market is highly volatile, and prices can fluctuate dramatically in short periods. Understanding and managing these risks is crucial for responsible investing.

- Volatility of the Cryptocurrency Market: [Emphasize the inherent volatility of the cryptocurrency market and its impact on XRP's price.]

- Potential for Significant Losses: [Clearly state the possibility of losing a substantial portion or even all of your investment.]

- Risk Management Strategies: [Recommend practical strategies for managing risk, such as dollar-cost averaging (investing a fixed amount regularly regardless of price) and diversification (spreading investments across various assets).]

- Determining Investment Amounts: [Advise readers to invest only what they can afford to lose and to avoid investing based on emotions or hype.]

Conclusion

The sub-$3 price of XRP presents a complex investment scenario. While its underlying technology holds promise and the potential positive outcomes of the Ripple lawsuit could significantly boost its price, the regulatory uncertainty and inherent volatility of the cryptocurrency market pose considerable risks. Before considering buying XRP, carefully analyze its current market position, the ongoing lawsuit's potential impact, and the risks involved. Remember to conduct your own thorough research and only invest what you can afford to lose. Considering all factors, is now the right time to buy XRP? The decision is ultimately yours. Weigh the pros and cons of buying XRP carefully before making any investment decisions. Learn more about investing in XRP responsibly.

Featured Posts

-

Bkpm Incar Investasi Rp 3 6 Triliun Di Pekanbaru Tahun Ini

May 01, 2025

Bkpm Incar Investasi Rp 3 6 Triliun Di Pekanbaru Tahun Ini

May 01, 2025 -

Daisy Midgeley Pre Coronation Street Acting Roles Revealed

May 01, 2025

Daisy Midgeley Pre Coronation Street Acting Roles Revealed

May 01, 2025 -

Duurzaam Schoolgebouw Kampen Juridische Strijd Om Stroomvoorziening

May 01, 2025

Duurzaam Schoolgebouw Kampen Juridische Strijd Om Stroomvoorziening

May 01, 2025 -

Cavs Week 16 A Big Trade A Much Needed Break And Whats Next

May 01, 2025

Cavs Week 16 A Big Trade A Much Needed Break And Whats Next

May 01, 2025 -

Dragon Den Unexpected Twist As Entrepreneur Snubs Offers Chooses Controversial Deal

May 01, 2025

Dragon Den Unexpected Twist As Entrepreneur Snubs Offers Chooses Controversial Deal

May 01, 2025