Dragon Den: Unexpected Twist As Entrepreneur Snubs Offers, Chooses Controversial Deal

Table of Contents

The popular business show Dragon's Den witnessed a dramatic twist recently when Sarah Jones, pitching her innovative sustainable clothing line, "EcoThreads," surprised the investors with a bold decision. Instead of accepting substantial offers from several Dragons, she chose a seemingly less lucrative, yet far more controversial deal. This unprecedented move sparked debate and highlights the complexities of securing funding and building a successful business in the fiercely competitive fashion industry.

The Initial Pitches and Offers

Sarah Jones's pitch centered around EcoThreads, a line of clothing made from recycled ocean plastic. She highlighted the unique selling points: the eco-friendly materials, the stylish designs, and the potential for significant market disruption in the fast fashion industry. Her presentation was polished, her projections ambitious, and her passion undeniable. The Dragons were impressed.

The offers poured in:

- Bullet points:

- Dragon A, Deborah Meaden, offered £250,000 for a 25% equity stake, emphasizing the potential for rapid growth and strong returns on investment.

- Dragon B, Peter Jones, countered with £300,000 for a 30% equity stake, citing his extensive experience in the retail sector and his ability to accelerate market penetration.

- Dragon C, Touker Suleyman, presented a different investment structure: £200,000 for a 20% stake plus a significant marketing and distribution partnership within his existing retail network. This offer held the promise of immediate access to a vast customer base.

The Controversial Deal Revealed

Despite the impressive offers, Sarah rejected them all. Her chosen partner? "FastFashionFix," a large, established, but ethically controversial fast-fashion retailer known for its low prices and questionable labor practices. This unconventional partnership was deemed a risky investment by many, including the Dragons themselves. The deal involved a significantly smaller investment of £100,000 for a 10% stake, but included a guaranteed national distribution deal through FastFashionFix’s extensive network of stores.

- Bullet points:

- Potential benefits: Immediate access to a massive market share, guaranteed distribution channels, rapid brand awareness, and significant sales volume.

- Risks involved: Potential reputational damage associated with aligning with a company criticized for unethical practices, potential conflicts of interest concerning sustainability principles, and the pressure to compromise on ethical production methods.

- Long-term strategy: Sarah's vision extended beyond solely focusing on sustainable materials. She planned to leverage FastFashionFix's reach to make eco-friendly clothing accessible to a larger consumer base, eventually influencing the overall industry's ethical standards from within.

Reactions from the Dragons and the Audience

The Dragons were visibly stunned. Deborah Meaden expressed her disbelief, questioning the long-term viability of such an alliance. Peter Jones predicted potential reputational fallout. Touker Suleyman, while initially surprised, acknowledged the strategic genius of the move if successfully executed.

- Bullet points:

- Dragon A: "I'm genuinely surprised. This deal compromises your brand's ethical image."

- Dragon B: "I think this is a huge gamble that could backfire spectacularly."

- Audience response on social media: Divided opinions flooded social media, with some praising Sarah's bold strategy and others condemning her association with FastFashionFix.

Analyzing the Entrepreneur's Strategic Move

Sarah's decision was a calculated, albeit high-risk, strategy. It wasn't simply about securing funding; it was about market penetration. She recognized that while ethical consumerism is growing, it's still a niche market. Partnering with FastFashionFix, despite the ethical concerns, provided an immediate shortcut to mass distribution.

- Bullet points:

- Advantages: Unprecedented access to a huge market; rapid sales growth; potential to influence the broader industry from within.

- Potential downsides: Reputational damage, potential conflicts of interest, the difficulty of maintaining ethical standards under pressure from a fast-fashion giant.

- Lessons for aspiring entrepreneurs: Don't always aim for the highest offer; consider unconventional partnerships that could provide unique strategic advantages, even if risky.

Conclusion

The unexpected twist in this Dragon's Den episode serves as a reminder that securing funding isn't just about the highest offer but also aligning with the right partners and vision. Sarah Jones's decision, while controversial, showcases the boldness and strategic thinking required in the world of entrepreneurship. Her move highlights the complexities of balancing ethical principles with the realities of market penetration.

Call to Action: Want to learn more about navigating the complexities of securing investment and making bold decisions in the business world? Follow our blog for more insightful analyses of Dragon's Den and other entrepreneurial journeys. #DragonsDen #InvestmentDeals #BusinessDecisions #EntrepreneurshipTips

Featured Posts

-

Brtanwy Parlymnt Ka Kshmyr Ke Msyle Ke Hl Ky Hmayt Myn Wadh Mwqf

May 01, 2025

Brtanwy Parlymnt Ka Kshmyr Ke Msyle Ke Hl Ky Hmayt Myn Wadh Mwqf

May 01, 2025 -

Xrp Price Prediction Will Xrp Hit 10 Ripples Dubai License And Resistance Breakout

May 01, 2025

Xrp Price Prediction Will Xrp Hit 10 Ripples Dubai License And Resistance Breakout

May 01, 2025 -

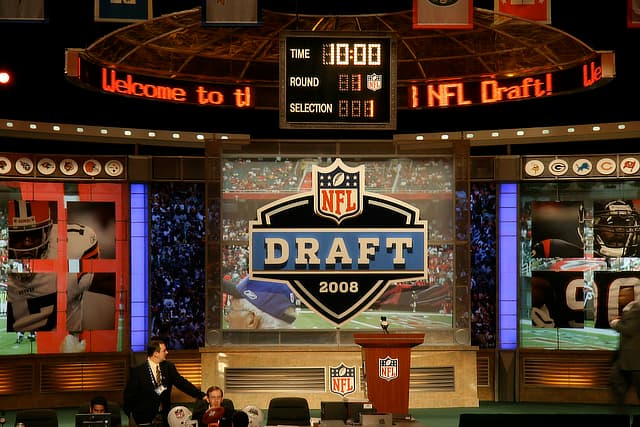

Nfl Draft 2024 Panthers Path To Success With Their 8th Overall Pick

May 01, 2025

Nfl Draft 2024 Panthers Path To Success With Their 8th Overall Pick

May 01, 2025 -

Xrp Ripple Price Below 3 Should You Invest Right Now

May 01, 2025

Xrp Ripple Price Below 3 Should You Invest Right Now

May 01, 2025 -

Open Ai Challenges Google With Chat Gpt Shopping Integration

May 01, 2025

Open Ai Challenges Google With Chat Gpt Shopping Integration

May 01, 2025