Canada's Conservatives: Tax Cuts And Deficit Reduction Plan

Table of Contents

The Canadian Conservative Party's platform consistently emphasizes tax cuts and deficit reduction as cornerstones of their economic policy. This article provides a thorough examination of their plan, analyzing its proposed tax cuts, deficit reduction strategies, and potential impact on the Canadian economy. We will assess the feasibility and potential consequences of their proposed changes, considering various perspectives and independent analyses.

Proposed Tax Cuts

The Conservative Party's proposed tax cuts aim to stimulate the Canadian economy by increasing disposable income and encouraging investment. Their plan typically involves a multi-pronged approach:

Individual Income Tax Reductions

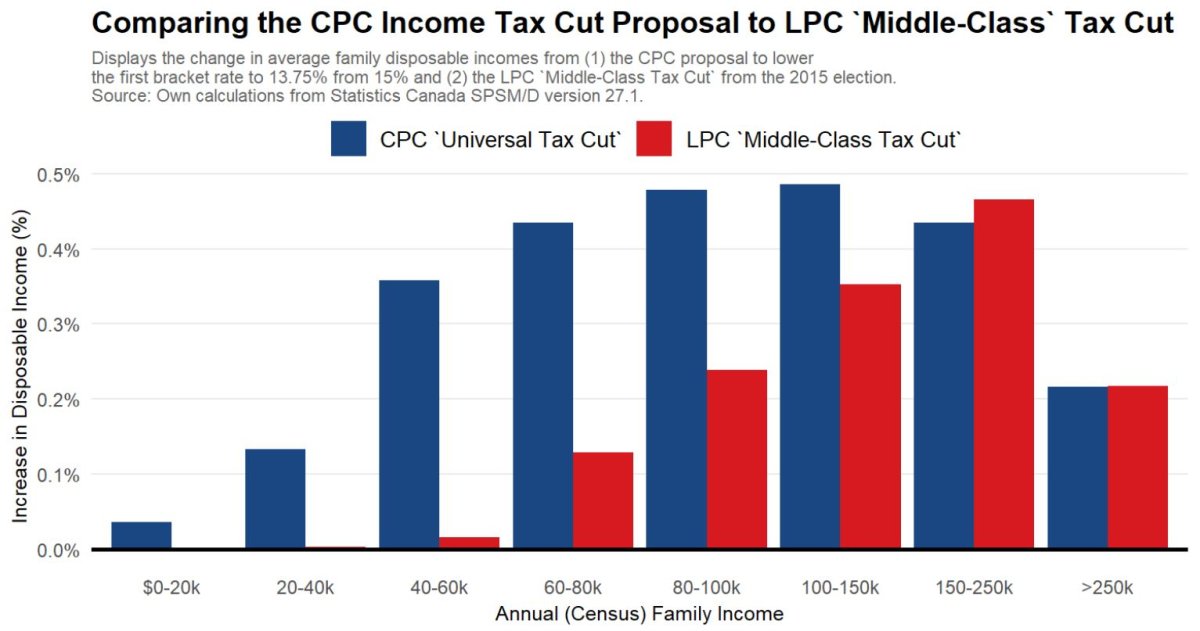

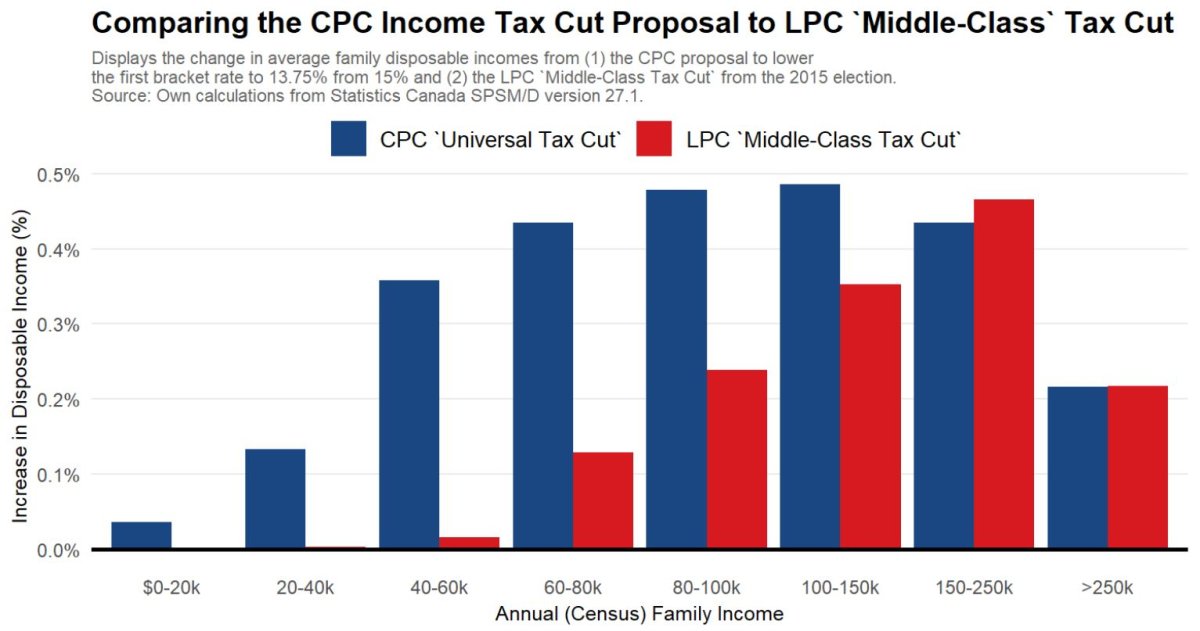

The Conservatives generally propose reducing individual income tax rates across various brackets. While specific percentages and thresholds vary depending on the election cycle, the goal remains consistent: to leave more money in the hands of Canadian taxpayers.

- Example: A past proposal might have included a reduction from 20.5% to 19.5% in a specific tax bracket, resulting in an annual savings of, for example, $500 for individuals earning between $50,000 and $75,000.

- Potential Benefits: Increased disposable income could stimulate consumer spending, boosting economic activity and creating jobs.

- Potential Criticisms: Critics argue that such reductions could significantly impact government revenue, potentially hindering funding for essential public services and social programs. Concerns about the disproportionate benefit to higher-income earners are also frequently raised.

Corporate Tax Rate Changes

Lowering the corporate tax rate is another key element of the Conservative Party's tax platform. The argument is that a more competitive corporate tax rate will attract foreign investment, incentivize business expansion, and ultimately lead to job creation.

- Example: A proposed reduction from 15% to 12% could make Canada more attractive to multinational corporations compared to other G7 nations.

- Potential Benefits: Attracting foreign investment could lead to significant economic growth and the creation of higher-paying jobs.

- Potential Criticisms: Concerns exist about the potential loss of government revenue and the fairness of providing tax breaks to corporations, particularly large, profitable ones. Some argue that the benefits may not trickle down to the average worker.

Other Tax Measures

Beyond individual and corporate income taxes, the Conservatives may propose other tax measures. These could include:

- GST/HST adjustments: Potential changes to the Goods and Services Tax or Harmonized Sales Tax, which could impact consumer spending.

- Capital gains tax modifications: Adjustments to the tax rate on capital gains, potentially influencing investment decisions.

- Targeted tax credits: Introduction or expansion of tax credits for specific groups (e.g., families with children, individuals with disabilities), aiming to provide targeted support.

Each of these measures would have its own set of potential benefits and criticisms, requiring careful consideration of their broader economic impacts.

Deficit Reduction Strategies

The Conservative Party's approach to deficit reduction usually involves a combination of spending cuts, efficiency improvements, and economic growth initiatives.

Spending Cuts

To reduce government spending, the Conservatives typically identify areas for cuts. These areas often include:

- Specific program reductions: Potential cuts could target specific federal programs deemed less essential or inefficient. Precise examples and the amounts saved would depend on the specific plan proposed.

- Departmental budget reductions: Reductions in the budgets of various government departments may be proposed.

- Potential consequences: Such cuts can lead to reductions in public services, affecting areas like healthcare, education, and social welfare programs. This could lead to considerable public backlash and political opposition.

Increased Efficiency and Productivity

The Conservatives often emphasize streamlining government operations and reducing administrative waste to improve efficiency.

- Examples: Implementing modern technology, reducing bureaucratic red tape, and improving inter-departmental coordination are potential measures.

- Challenges: Achieving substantial efficiency gains can be difficult and often requires significant organizational change and overcoming bureaucratic inertia.

Economic Growth Initiatives

Stimulating economic growth is central to the Conservative deficit reduction strategy. Increased economic activity leads to higher tax revenues, allowing the government to reduce the deficit without drastic spending cuts. Proposed initiatives may include:

- Tax incentives for businesses: Tax breaks or incentives to encourage business investment and job creation.

- Regulatory reforms: Easing regulations to make it easier for businesses to operate and create jobs.

- Infrastructure investments: Investing in infrastructure projects to stimulate economic activity and create jobs.

- Trade agreements: Negotiating trade agreements to increase export opportunities for Canadian businesses.

- Potential for deficit reduction: The effectiveness of these initiatives in reducing the deficit depends on their success in stimulating economic growth and generating sufficient additional tax revenue.

Economic Impact and Analysis

Understanding the potential economic impact of the Conservative Party's plan requires careful analysis:

Independent Economic Analyses

Independent economic analyses of past Conservative plans have offered varying perspectives. Some analyses have been optimistic, highlighting the potential for economic growth and job creation, while others have expressed concerns about the potential negative consequences of spending cuts and tax reductions. It's crucial to review multiple independent analyses to get a balanced view.

Potential Risks and Challenges

Potential risks and challenges associated with the Conservative plan include:

- Economic slowdown: The proposed spending cuts could negatively impact economic growth, potentially offsetting the benefits of tax cuts.

- Social inequality: Tax cuts might disproportionately benefit higher-income earners, exacerbating social inequality.

- Unforeseen economic shocks: Global economic events could undermine the plan's effectiveness.

Comparison to Other Parties' Plans

Comparing the Conservative plan with those of other political parties is crucial for informed decision-making. Each party offers a different approach to tax cuts, deficit reduction, and economic policy, making direct comparisons essential for voters to understand the implications of each platform.

Conclusion

Canada's Conservative Party's plan for tax cuts and deficit reduction involves a multifaceted approach encompassing individual and corporate tax reductions, spending cuts, and economic growth initiatives. While proponents argue that this strategy will stimulate the economy and improve the fiscal situation, critics express concerns about potential negative impacts on public services, social programs, and income inequality. Understanding the potential benefits and drawbacks of this plan requires careful consideration of independent economic analyses and a comparison with the proposals of other political parties. To further understand the details of Canada's Conservative Party's approach to tax cuts and deficit reduction, explore their official website and conduct your own research. Understanding these economic policies is crucial for informed voting in the next Canadian election.

Featured Posts

-

Strategic Partnership Saudi Arabia India To Establish Major Oil Refining Capacity

Apr 24, 2025

Strategic Partnership Saudi Arabia India To Establish Major Oil Refining Capacity

Apr 24, 2025 -

Selling Sunset Star Calls Out La Landlord Price Gouging After Fires

Apr 24, 2025

Selling Sunset Star Calls Out La Landlord Price Gouging After Fires

Apr 24, 2025 -

La Fires Price Gouging Accusations Against Landlords Surface

Apr 24, 2025

La Fires Price Gouging Accusations Against Landlords Surface

Apr 24, 2025 -

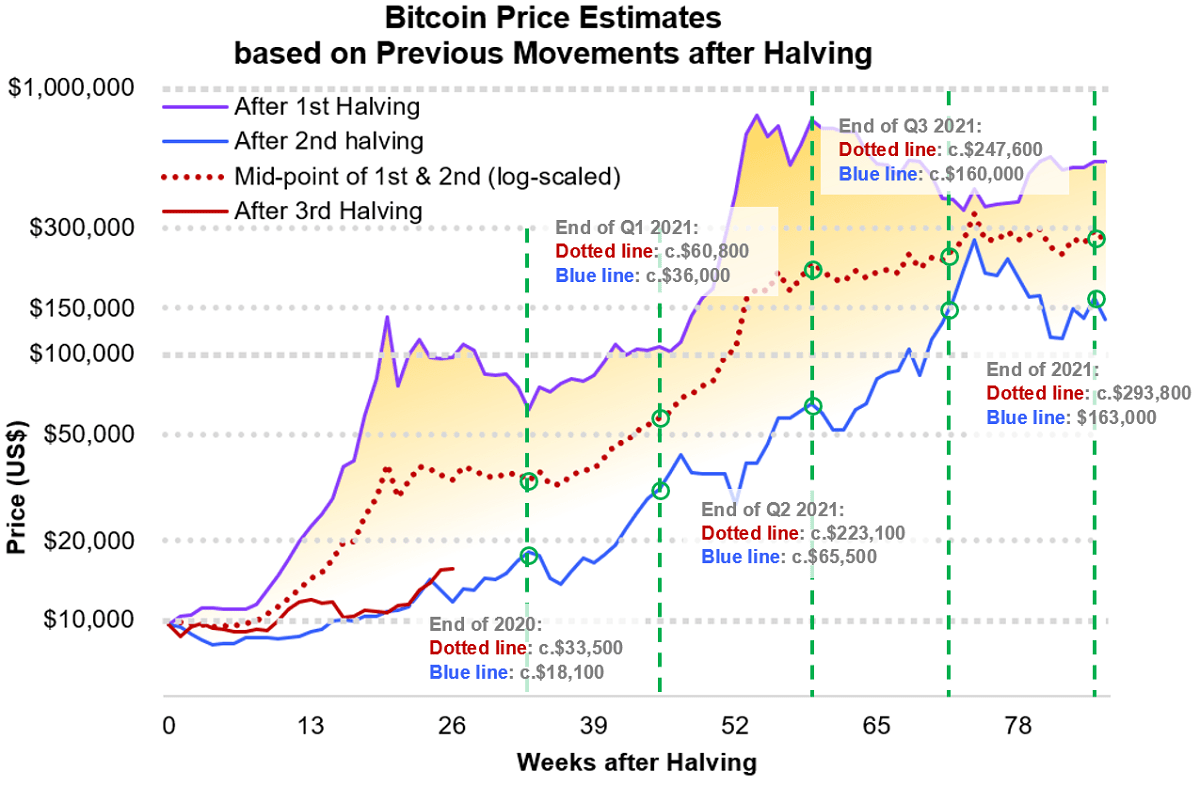

Trumps Trade Policy And The Federal Reserve How They Are Fueling Bitcoins Btc Growth

Apr 24, 2025

Trumps Trade Policy And The Federal Reserve How They Are Fueling Bitcoins Btc Growth

Apr 24, 2025 -

Experts Link Trumps Budget Cuts To Increased Tornado Season Risks

Apr 24, 2025

Experts Link Trumps Budget Cuts To Increased Tornado Season Risks

Apr 24, 2025