Trump's Trade Policy And The Federal Reserve: How They Are Fueling Bitcoin's (BTC) Growth

Table of Contents

Trump's Trade Wars and the Flight to Safety

Uncertainty and Safe-Haven Assets

Trump's aggressive trade policies, marked by tariffs and trade disputes, injected significant uncertainty into the global economy. This uncertainty triggered a flight to safety, pushing investors towards assets perceived as less vulnerable to market fluctuations.

- Increased market volatility: Tariffs and trade disputes created considerable market volatility, making traditional investments riskier.

- Search for uncorrelated assets: Investors actively sought assets with low correlation to traditional markets, aiming to diversify and mitigate risk.

- Bitcoin's decentralized nature: Bitcoin's decentralized nature and independence from government control made it an attractive safe-haven asset, offering protection against geopolitical risks. Its inherent resistance to censorship and control made it a compelling alternative.

Weakening of the Dollar and Bitcoin's Rise

Trump's trade policies, including trade deficits and potential weakening of the US dollar, indirectly contributed to Bitcoin's price increase. Since Bitcoin is priced in USD, a weaker dollar can lead to higher BTC prices in other currencies.

- Inverse relationship: A weakening dollar often correlates inversely with Bitcoin's price. When the dollar falls, Bitcoin, as an alternative asset, can appreciate.

- Dollar weakness and BTC increases: Several periods show a clear correlation between US dollar weakness and subsequent Bitcoin price rallies. This relationship isn't always direct, but it's a noticeable trend in historical data.

- Capital flight: The uncertainty surrounding the dollar potentially drove some capital flight into Bitcoin, further boosting its value as investors sought alternative stores of value.

The Federal Reserve's Monetary Policy and Bitcoin's Appeal

Quantitative Easing and Inflationary Concerns

The Federal Reserve's monetary policies, particularly quantitative easing (QE), fueled concerns about inflation. QE, through low interest rates and money printing, expanded the money supply, raising fears of a decline in the dollar's purchasing power.

- Inflationary pressures: Low interest rates and the expansion of the money supply can create inflationary pressures, eroding the value of fiat currencies.

- Bitcoin as an inflation hedge: Investors viewed Bitcoin as a potential hedge against inflation due to its limited supply of 21 million coins. This scarcity is seen as a key differentiator from fiat currencies.

- Limited supply: Bitcoin's fixed supply acts as a natural constraint against inflation, making it an attractive investment during periods of monetary expansion.

Interest Rate Hikes and Bitcoin Volatility

Federal Reserve interest rate adjustments also played a role in Bitcoin's volatility. Changes in interest rates influence investor risk appetite and capital allocation.

- Risk appetite and interest rates: Higher interest rates can dampen investor risk appetite, potentially leading to capital flowing out of riskier assets like Bitcoin.

- Capital shifts: Changes in interest rates can cause significant capital shifts between traditional assets (like bonds) and riskier alternatives, including Bitcoin. High rates make bonds more attractive, potentially reducing investment in cryptocurrencies.

- Volatility: These shifts in capital flow contribute to the inherent volatility observed in Bitcoin's price.

The Interplay of Trump's Policies, the Fed's Actions, and Bitcoin's Growth

Synergistic Effects on Bitcoin's Price

The combined effects of Trump's trade policies and the Federal Reserve's actions created a climate conducive to Bitcoin's growth. While seemingly disparate, these factors synergistically fueled Bitcoin's price appreciation.

- Convergence of factors: The uncertainty from trade wars and inflationary concerns from QE created a perfect storm for increased demand for alternative assets, boosting Bitcoin's value.

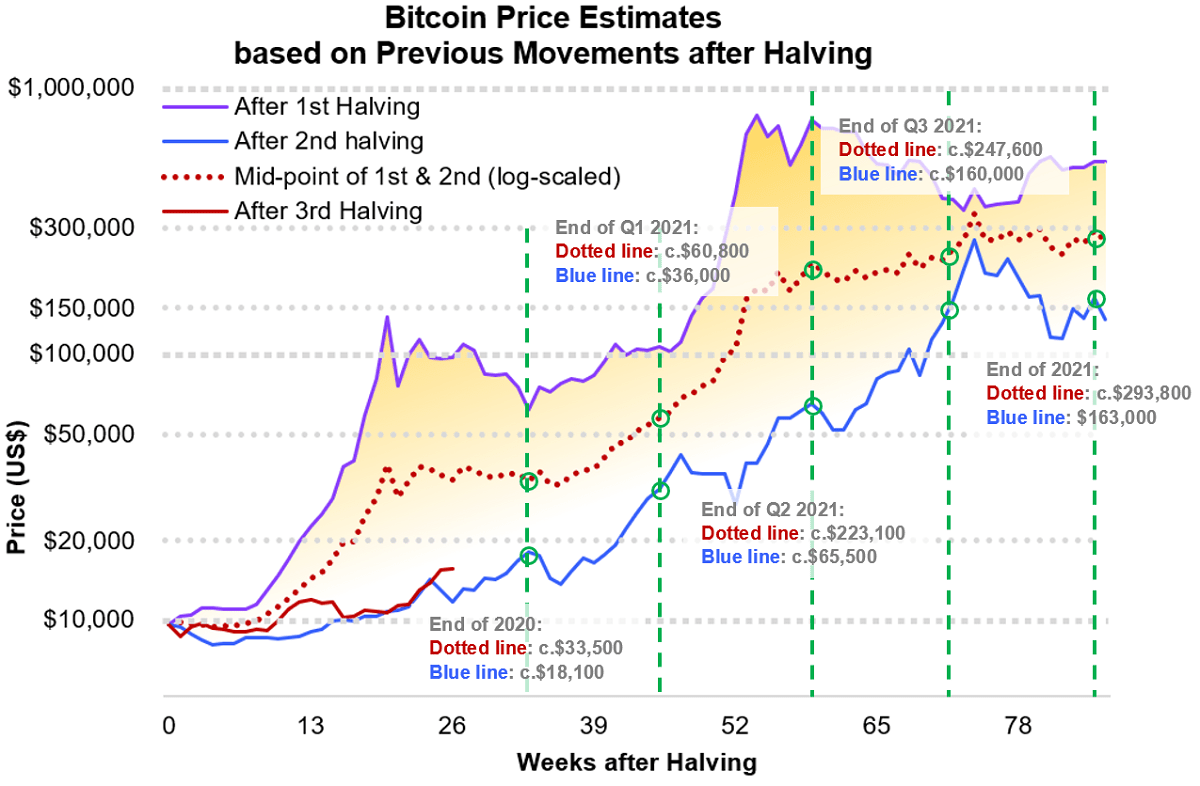

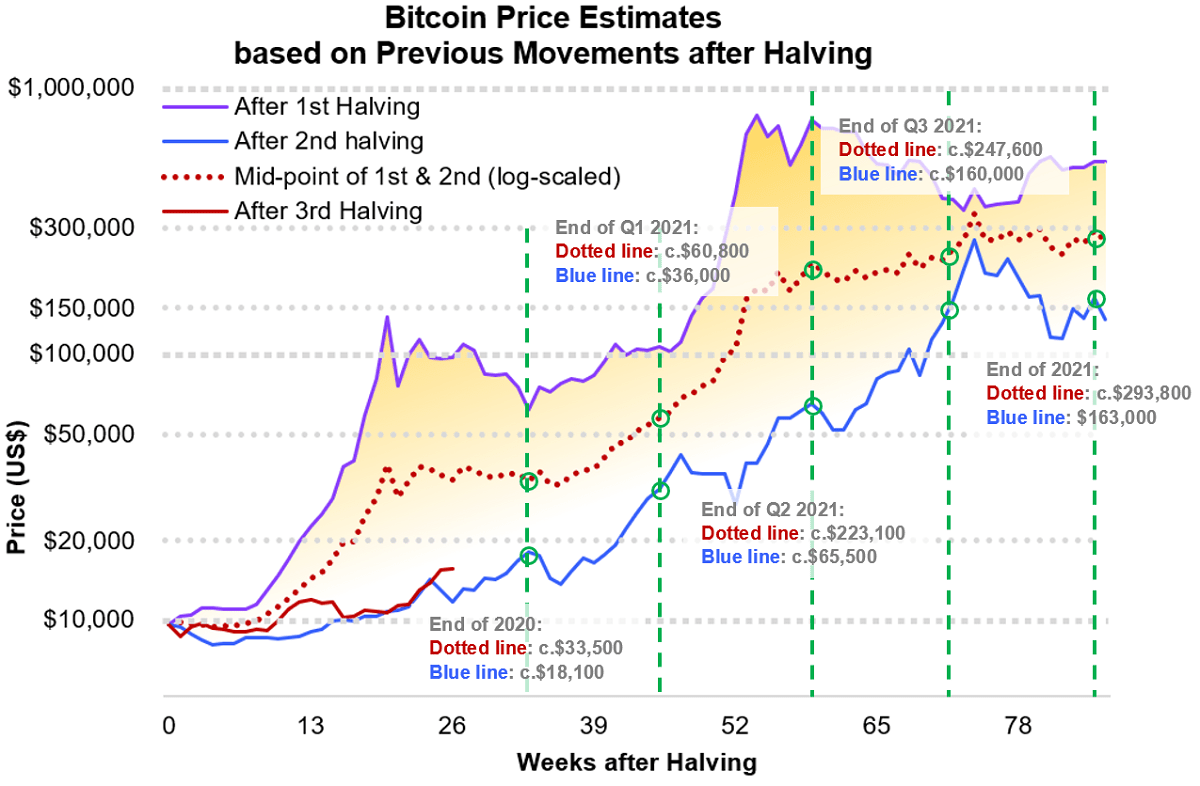

- Timeline correlation: Analyzing the timeline reveals a notable correlation between key events—like tariff announcements or significant QE measures—and subsequent changes in Bitcoin's price.

- Amplifying effects: Media coverage and investor sentiment played a vital role in amplifying the effects of these macroeconomic factors on Bitcoin's price.

Conclusion: Navigating the Complex Relationship Between Geopolitics, Monetary Policy, and Bitcoin (BTC)

Trump's trade policies and the Federal Reserve's actions indirectly, yet significantly, fueled Bitcoin's growth. Understanding the interplay between macroeconomic factors and cryptocurrency markets is crucial for investors. The relationship between these geopolitical and monetary forces and Bitcoin's price is complex and dynamic. This analysis highlights the need to carefully consider these broader economic forces when assessing Bitcoin's future trajectory. To further your understanding of this fascinating relationship, explore resources on macroeconomic factors influencing cryptocurrency markets and consider how Bitcoin might fit into your diversified investment strategy. The legacy of Trump's policies and the ongoing actions of the Federal Reserve will continue to shape the landscape for Bitcoin (BTC) and other cryptocurrencies in the years to come.

Featured Posts

-

Is Betting On Natural Disasters Like The Los Angeles Wildfires The New Normal

Apr 24, 2025

Is Betting On Natural Disasters Like The Los Angeles Wildfires The New Normal

Apr 24, 2025 -

How Effective Middle Management Drives Business Results And Improves Employee Experience

Apr 24, 2025

How Effective Middle Management Drives Business Results And Improves Employee Experience

Apr 24, 2025 -

Indias Stock Market Surge A Deep Dive Into The Niftys Rally

Apr 24, 2025

Indias Stock Market Surge A Deep Dive Into The Niftys Rally

Apr 24, 2025 -

Eu Targets Russian Gas Spot Market Phaseout Discussion

Apr 24, 2025

Eu Targets Russian Gas Spot Market Phaseout Discussion

Apr 24, 2025 -

Trump Administrations Response To Harvards Lawsuit Open To Negotiation

Apr 24, 2025

Trump Administrations Response To Harvards Lawsuit Open To Negotiation

Apr 24, 2025