Canada's Economic Future: Recession Concerns Despite Tariff Cuts

Table of Contents

The Impact of Tariff Cuts on Canadian Businesses

The Canadian government's recent implementation of tariff cuts aims to boost the country's economic competitiveness. However, the true impact of these measures on Canada's economic future remains multifaceted and requires careful consideration.

Short-Term Benefits:

Tariff reductions can provide immediate benefits for various sectors of the Canadian economy. These include:

- Increased competitiveness for Canadian exporters: Lower tariffs make Canadian goods more attractive in international markets, potentially leading to increased sales and revenue for export-oriented businesses. This is particularly relevant for sectors like agriculture and manufacturing, boosting Canada's global trade position.

- Lower input costs for businesses reliant on imported goods: Reduced tariffs translate to lower costs for raw materials and intermediate goods, increasing profit margins and fostering business growth. This positive ripple effect can stimulate economic activity across various sectors.

- Potential for increased consumer spending: Lower prices on imported goods due to tariff cuts can lead to increased consumer spending, stimulating domestic demand and further boosting economic growth. This is especially beneficial for households facing inflationary pressures.

- Examples of specific sectors benefiting from tariff reductions: The agricultural sector, for instance, could see a significant boost in exports of products like wheat and canola. The manufacturing sector might experience a reduction in the cost of imported components, leading to increased production and job creation. These sectors are key drivers of Canada's economic future.

Long-Term Uncertainty:

While short-term benefits are evident, the long-term effects of tariff cuts on Canada's economic future are less certain. Key uncertainties include:

- Dependence on global economic stability: The success of tariff cuts hinges on the stability of global economic conditions. A global recession or significant trade disruptions could negate the positive effects.

- Potential for retaliatory tariffs from trading partners: Other countries might respond to Canada's tariff cuts with retaliatory measures, potentially offsetting any gains achieved. Careful diplomatic engagement is crucial to manage these risks.

- Need for diversification of export markets: Over-reliance on specific trading partners exposes the Canadian economy to significant risks. Diversification of export markets is crucial to ensure long-term stability and resilience.

- Challenges for businesses adapting to new market conditions: Businesses need time and resources to adapt to the changing market conditions created by tariff adjustments. Government support and assistance programs can help mitigate these challenges.

Recessionary Pressures Facing the Canadian Economy

Despite the potential benefits of tariff cuts, several recessionary pressures threaten Canada's economic future.

Inflationary Pressures:

High inflation rates pose a significant challenge to Canada's economic growth.

- High interest rates impacting consumer spending and investment: The Bank of Canada's efforts to curb inflation through interest rate hikes have dampened consumer spending and investment. This decrease in economic activity is a major concern.

- Rising cost of living squeezing household budgets: Rising prices for essential goods and services are reducing household purchasing power, impacting consumer confidence and economic growth.

- Impact of global inflation on Canadian prices: Global inflationary pressures are further exacerbating the situation in Canada, making it difficult to control domestic inflation.

- Government measures to combat inflation and their effectiveness: Government policies aiming to combat inflation, such as targeted subsidies or tax breaks, require careful assessment of their effectiveness and potential unintended consequences.

Global Economic Slowdown:

The global economic slowdown significantly impacts Canada's economic future.

- Impact of global recessionary trends on Canadian exports and investment: A global recession would dramatically reduce demand for Canadian exports and foreign investment, harming economic growth.

- Vulnerability of Canadian economy to global economic shocks: Canada's reliance on global trade makes it vulnerable to external economic shocks, necessitating diversification and resilience-building strategies.

- Importance of diversification in global trade partnerships: Diversifying trade partners mitigates the impact of shocks originating from a single country or region.

- Strategies for mitigating the impact of global economic downturns: Proactive measures like strengthening social safety nets and investing in infrastructure can help mitigate the impact of economic downturns.

Housing Market Correction:

The ongoing correction in the Canadian housing market adds another layer of complexity to the economic outlook.

- Impact of high interest rates on the housing market: High interest rates have cooled the housing market, resulting in price declines and reduced construction activity.

- Potential for further price declines and their economic consequences: Further price declines could have significant consequences for household wealth and overall economic confidence.

- Government policies aimed at stabilizing the housing market: Government interventions to stabilize the housing market need to be carefully calibrated to avoid unintended consequences.

- Long-term implications for the Canadian economy: The long-term impact of the housing market correction on Canada's economic future requires careful monitoring and analysis.

Government Policies and Economic Outlook

Government policies play a crucial role in shaping Canada's economic future.

Fiscal Policy:

The government's fiscal policy has a direct impact on economic activity.

- Government spending and its impact on economic growth: Government spending on infrastructure, social programs, and other initiatives can stimulate economic growth but needs to be fiscally responsible.

- Effectiveness of government stimulus measures: The effectiveness of government stimulus measures needs careful evaluation to ensure optimal impact and avoid wasteful spending.

- Balancing fiscal responsibility with economic stimulus: Finding the right balance between fiscal responsibility and economic stimulus is a key challenge for policymakers.

- Analysis of recent budget announcements and their implications for the economy: Careful analysis of recent budget announcements is crucial to understanding their potential impact on the economy.

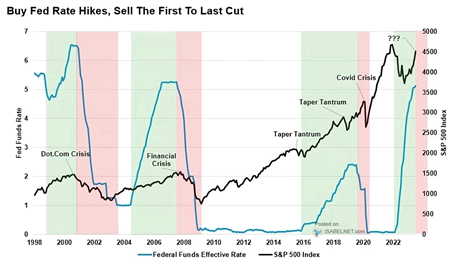

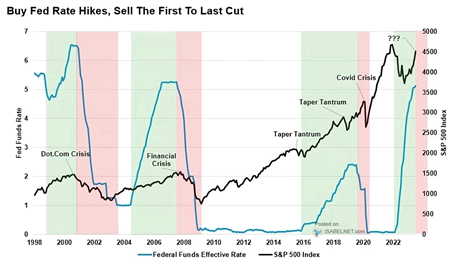

Monetary Policy:

The Bank of Canada's monetary policy significantly influences inflation and economic growth.

- The Bank of Canada's role in managing inflation: The Bank of Canada's primary role is to manage inflation, using interest rate adjustments as its primary tool.

- Impact of interest rate hikes on economic activity: Interest rate hikes, while effective in curbing inflation, can also slow down economic activity.

- Balancing inflation control with economic growth: Finding the right balance between inflation control and economic growth is a delicate balancing act for the Bank of Canada.

- Forecasting future interest rate adjustments and their potential impact: Predicting future interest rate adjustments and their potential impact on the economy is crucial for businesses and individuals.

Conclusion:

Canada's economic future remains a complex picture, with the benefits of recent tariff cuts potentially overshadowed by looming recessionary pressures. While strategic tariff reductions offer short-term advantages, long-term economic health requires a proactive approach addressing inflation, global economic uncertainty, and the housing market correction. Careful government policy, including both fiscal and monetary strategies, will be crucial in navigating these challenges and securing a positive trajectory for Canada's economic future. Understanding the nuances of Canada's economic future and the interplay of these factors is critical for individuals, businesses, and policymakers alike. Stay informed on the latest developments to make well-informed decisions about your financial future in the context of Canada’s evolving economic landscape. Continuously monitoring Canada's economic future is essential for navigating the complexities of the current environment.

Featured Posts

-

Us Stock Market Today Gold Soars Dow Futures Track Tariff And Fed Developments

Apr 23, 2025

Us Stock Market Today Gold Soars Dow Futures Track Tariff And Fed Developments

Apr 23, 2025 -

Yelich Homers First Time Since Back Surgery Recovery

Apr 23, 2025

Yelich Homers First Time Since Back Surgery Recovery

Apr 23, 2025 -

Record Nine Stolen Bases Brewers Rout A In Dominant Performance

Apr 23, 2025

Record Nine Stolen Bases Brewers Rout A In Dominant Performance

Apr 23, 2025 -

Jangan Lewatkan Program Tv Spesial Ramadan 2025 Untuk Menemani Buka Dan Sahur

Apr 23, 2025

Jangan Lewatkan Program Tv Spesial Ramadan 2025 Untuk Menemani Buka Dan Sahur

Apr 23, 2025 -

Profitable Mlb Player Prop Bets Analyzing Todays Games Including The Jazz Matchup

Apr 23, 2025

Profitable Mlb Player Prop Bets Analyzing Todays Games Including The Jazz Matchup

Apr 23, 2025