Canada's Fiscal Health: The Impact Of Liberal Spending Decisions

Table of Contents

Increased Social Spending and its Effects

The Liberal government has significantly increased social spending, impacting Canada's fiscal health. This section examines the expansion of existing programs and the introduction of new ones, analyzing their effects on the deficit and debt.

Expansion of Social Programs

The expansion of social programs under the Liberal government has been a prominent feature of its fiscal policy. This includes substantial increases to existing programs like the Canada Child Benefit (CCB) and the introduction of new initiatives aimed at addressing social inequality.

- Increased program costs: The CCB, for example, has seen significant increases in budgetary allocation, leading to higher overall social spending. Data from the Department of Finance Canada can illustrate the magnitude of these increases year over year.

- Projected budget impact: The long-term budgetary implications of expanded social programs are substantial, requiring careful consideration of their sustainability. Independent analyses, like those from the Parliamentary Budget Officer, often provide projections of future spending needs.

- Impact on poverty reduction: While increased social spending aims to reduce poverty and inequality, assessing its effectiveness requires examining poverty rates and income distribution data before and after the implementation of these programs.

- Potential unintended consequences: Increased social assistance might lead to unintended consequences, such as disincentives to work or potential increases in welfare dependency. Economic studies often explore these complex effects.

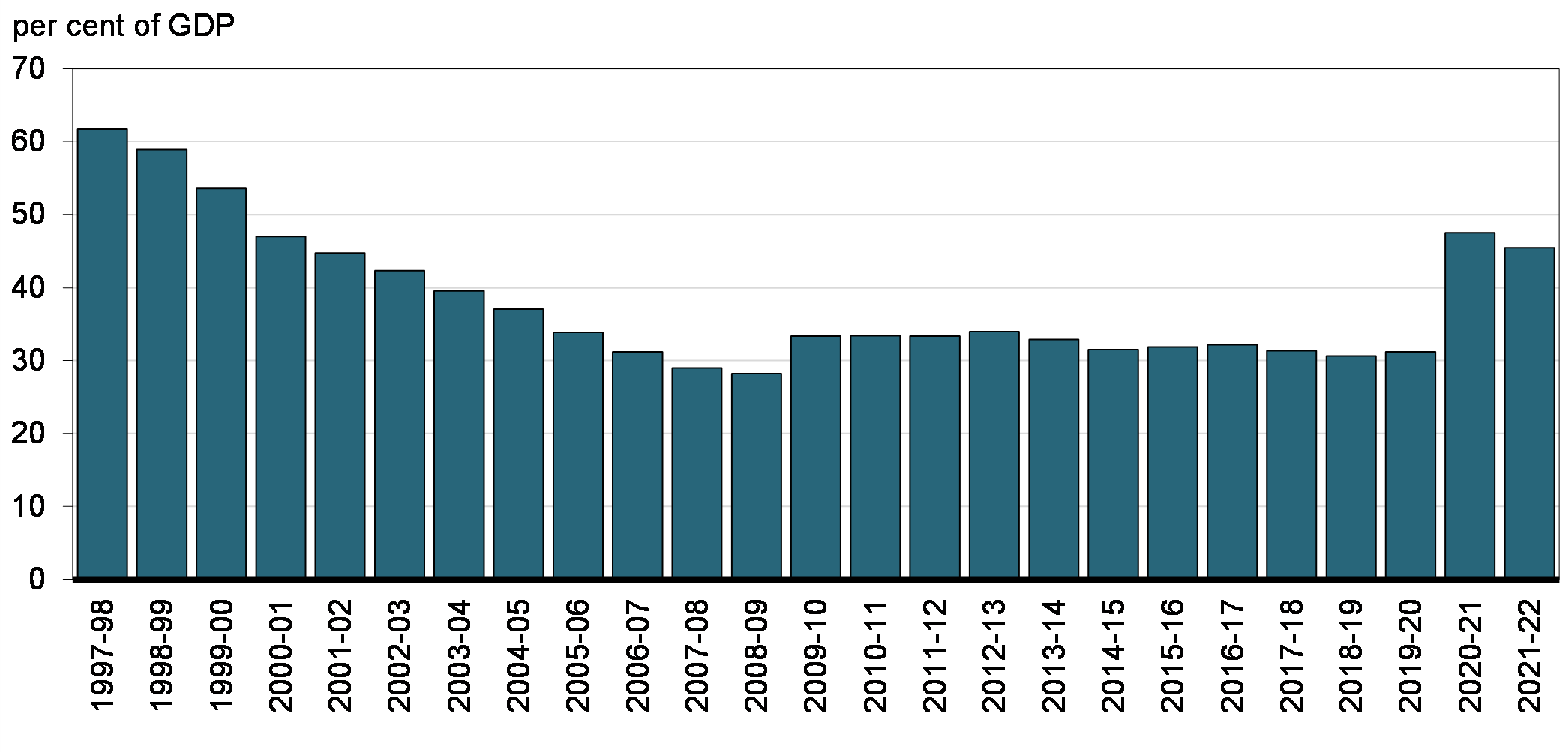

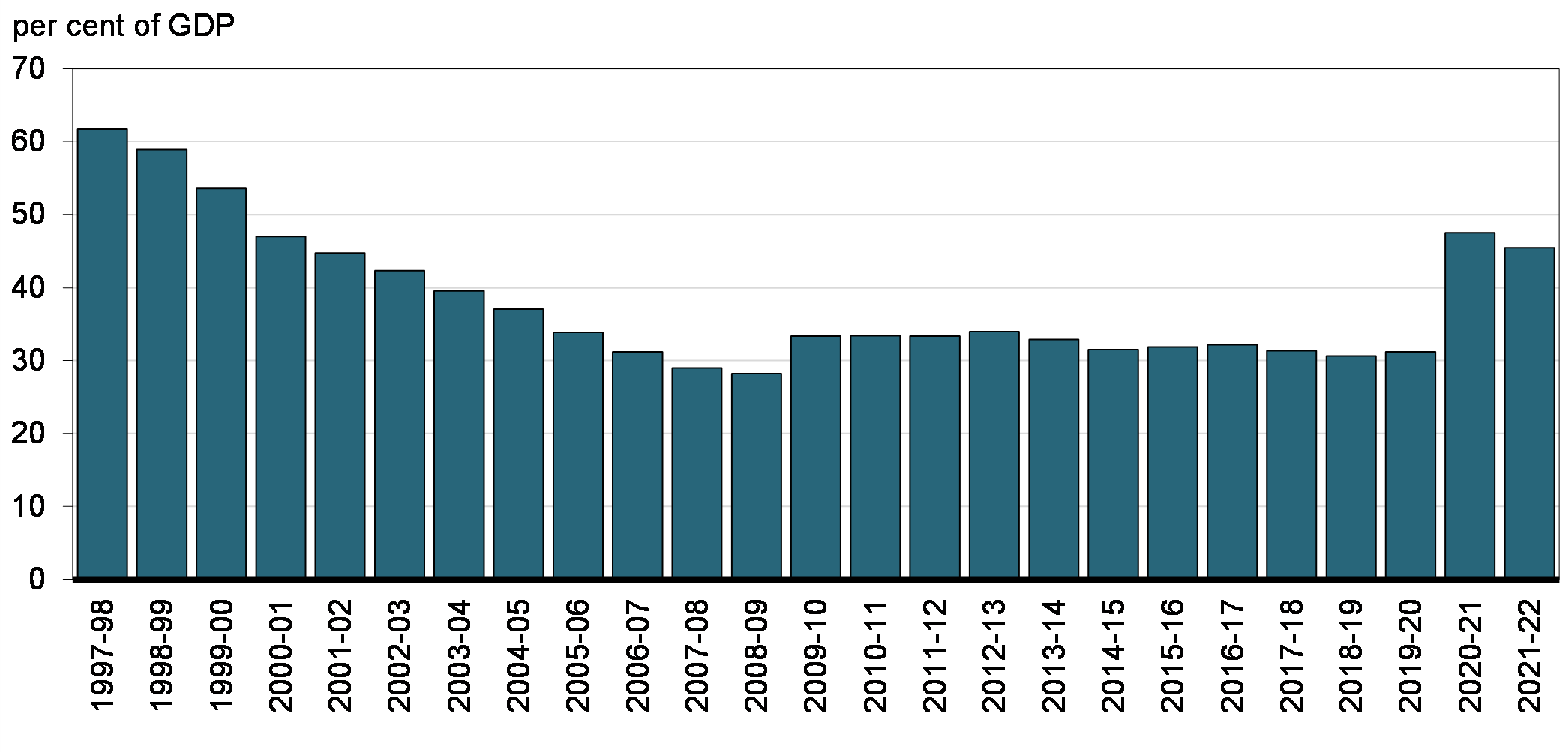

Impact on the Deficit and Debt

The expansion of social programs has undoubtedly contributed to the federal budget deficit and the growth of Canada's national debt.

- Analysis of deficit figures: Examining deficit figures over the past several years reveals the significant impact of increased social spending. Comparing these figures to those under previous governments provides valuable context.

- Comparison to previous governments' spending: Analyzing the spending patterns of previous governments allows for a comparative perspective on the scale and nature of the current social spending increases.

- Projections for future debt: Understanding future debt projections is vital. Reports from the Department of Finance and the Bank of Canada provide insights into the long-term sustainability of the current fiscal trajectory. These reports often incorporate various economic scenarios and assumptions.

Infrastructure Investments and Economic Growth

The Liberal government has also made significant investments in infrastructure projects, aiming to stimulate economic growth and create jobs.

Infrastructure Spending Initiatives

Significant investments have been made in various infrastructure projects across the country, encompassing roads, bridges, public transit, and other essential infrastructure upgrades.

- Types of projects funded: The government's infrastructure plan outlines the types of projects receiving funding, ranging from large-scale transportation projects to smaller community-based initiatives.

- Total investment amounts: Tracking the total investment amounts in infrastructure projects provides a clear picture of the government's commitment to this area.

- Projected economic returns: Economic impact assessments often accompany infrastructure projects, projecting job creation, GDP growth, and other economic benefits.

- Potential delays or cost overruns: Large-scale infrastructure projects frequently encounter delays or cost overruns. Analyzing these issues is crucial to assessing the overall effectiveness of the investment.

Evaluating the Return on Investment

Assessing the return on investment (ROI) of infrastructure spending is crucial to evaluating its long-term economic benefits.

- Analysis of economic models: Economic models are often used to justify infrastructure spending. Examining these models and their underlying assumptions is important.

- Comparison to international infrastructure spending: Comparing Canada's infrastructure spending to that of other developed nations provides a comparative context.

- Consideration of long-term sustainability: Evaluating the long-term sustainability of infrastructure projects, including their maintenance and future upgrades, is crucial for assessing their true ROI.

Taxation Policies and their Influence

Taxation policies play a crucial role in shaping Canada's fiscal health. This section analyzes changes in tax rates and their influence on fiscal sustainability.

Changes in Tax Rates and Brackets

The Liberal government has implemented several changes to personal and corporate income tax rates.

- Specific changes implemented: Detailed information on specific changes, including increases or decreases in tax rates and brackets, can be found in government budget documents.

- Impact on tax revenue: Analyzing the impact of these tax changes on government tax revenue is crucial to understanding their financial implications.

- Effects on income inequality: Tax policy changes can affect income inequality. Examining the distributional effects of these changes is important.

- Potential for tax avoidance: Changes to tax laws can potentially lead to increased tax avoidance strategies. This needs to be factored into assessments of tax policy effectiveness.

Impact on Fiscal Sustainability

The long-term impact of taxation policies on Canada's fiscal health is a significant consideration.

- Sustainability of the tax system: Assessing the long-term sustainability of the current tax system, including its ability to generate sufficient revenue to cover government spending, is crucial.

- Potential for future tax increases: The possibility of future tax increases, either to address deficits or fund new initiatives, must be considered.

- Effects on economic competitiveness: High tax rates can negatively affect a country's economic competitiveness, impacting investment and job creation. Analyzing these potential effects is vital.

Conclusion

This analysis of Canada's fiscal health under Liberal spending reveals a complex picture. Increased social spending addresses critical societal needs, and infrastructure investments aim to boost economic growth. However, the impact on the deficit and debt necessitates careful monitoring. The effectiveness of taxation policies in balancing revenue generation and economic stimulation is also a key consideration. The long-term implications of these decisions will significantly shape Canada's economic future. Understanding the intricacies of Canada's fiscal health is paramount. Continue to research and engage in informed discussions about the ongoing impact of Liberal spending decisions to ensure a sustainable and prosperous future for Canada. Stay informed about Canada's fiscal health and participate in the national conversation.

Featured Posts

-

Cocaine Found At White House Secret Service Completes Investigation

Apr 24, 2025

Cocaine Found At White House Secret Service Completes Investigation

Apr 24, 2025 -

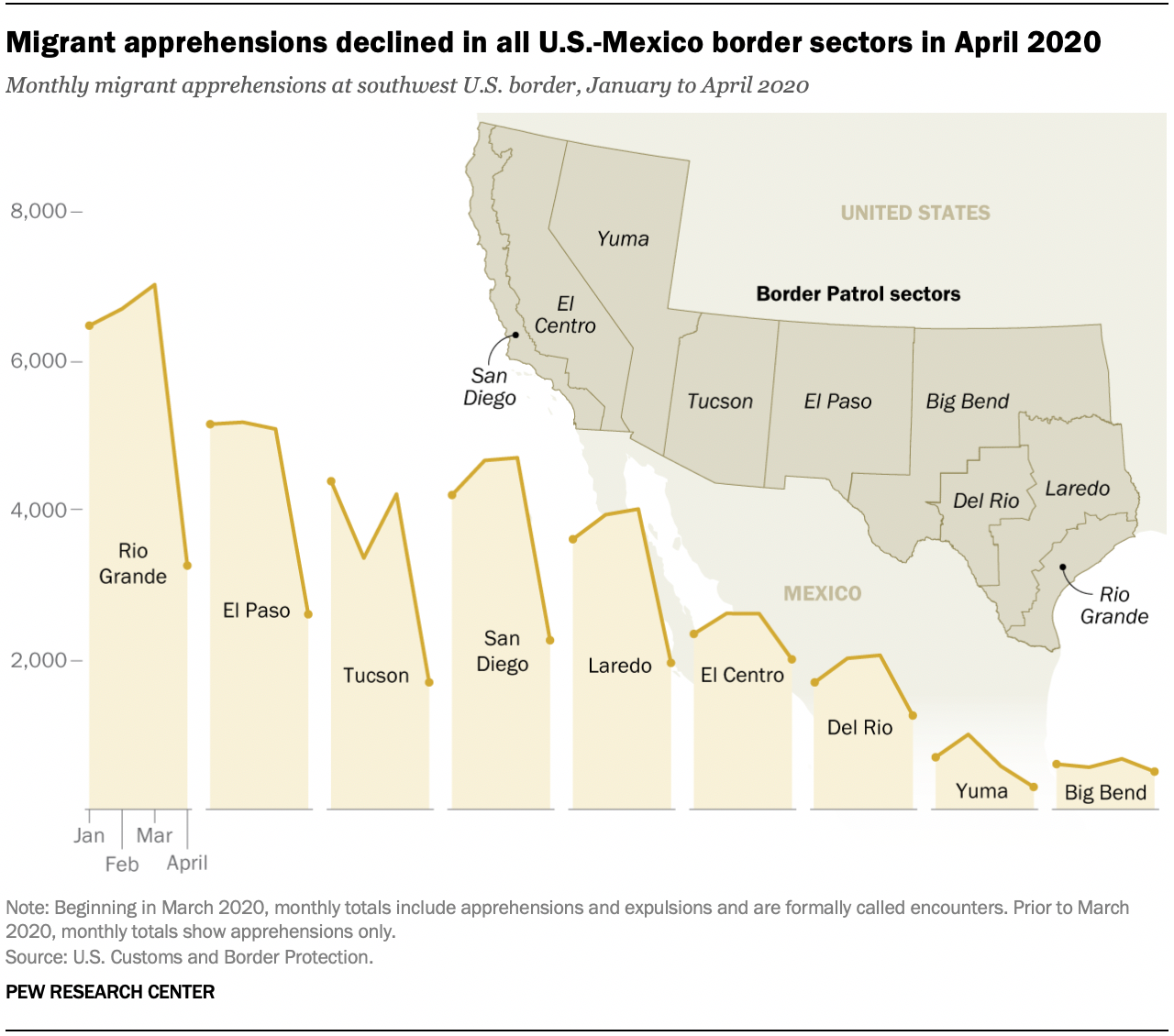

Reduced Apprehensions At The U S Canada Border A White House Statement

Apr 24, 2025

Reduced Apprehensions At The U S Canada Border A White House Statement

Apr 24, 2025 -

The Destruction Of Pope Francis Ring A Papal Tradition Explained

Apr 24, 2025

The Destruction Of Pope Francis Ring A Papal Tradition Explained

Apr 24, 2025 -

Cantor Explores 3 Billion Crypto Spac With Tether And Soft Bank A Deep Dive

Apr 24, 2025

Cantor Explores 3 Billion Crypto Spac With Tether And Soft Bank A Deep Dive

Apr 24, 2025 -

Teslas Optimus Robot Production Faces Setbacks Due To Chinese Rare Earth Policies

Apr 24, 2025

Teslas Optimus Robot Production Faces Setbacks Due To Chinese Rare Earth Policies

Apr 24, 2025