Cantor Explores $3 Billion Crypto SPAC With Tether And SoftBank: A Deep Dive

Table of Contents

Cantor Fitzgerald's Strategic Move into the Crypto Market

Cantor Fitzgerald, a renowned name in global financial markets, boasts a rich history of success in traditional finance. Their expertise spans brokerage, investment banking, and trading across various asset classes. This foray into the crypto market via a SPAC represents a bold strategic decision, driven by several key factors. The rationale behind this move is multifaceted: it signifies Cantor's recognition of the burgeoning crypto market’s potential and a desire to actively participate in its evolution.

By leveraging a SPAC structure, Cantor can efficiently raise substantial capital to acquire or merge with promising crypto companies, gaining immediate access to cutting-edge technologies and established players within the industry. This strategic move offers several significant benefits:

- Diversification of investment portfolio: Expanding beyond traditional financial instruments to include high-growth crypto assets reduces risk and potentially increases overall returns.

- Capitalizing on the growing crypto market: The crypto market's exponential growth presents a massive opportunity for substantial profits. A Cantor Crypto SPAC allows them to directly tap into this potential.

- Establishing leadership in the institutional crypto space: This move positions Cantor as a leader in the institutional adoption of crypto, attracting both investors and innovative crypto projects.

- Potential for high returns on investment: Successful investments in the rapidly expanding crypto sector offer the potential for exceptionally high returns.

The Role of Tether and SoftBank

The potential involvement of Tether and SoftBank adds significant weight to the Cantor Crypto SPAC. Tether, a stablecoin with a massive market capitalization, brings its established presence and credibility within the crypto ecosystem. Its participation would lend substantial legitimacy and potentially attract a wider range of investors. SoftBank, a global powerhouse known for its expertise in technological innovation and substantial financial resources, could provide invaluable strategic guidance and further bolster investor confidence.

The strategic alignment between these three entities is undeniable:

- Tether's credibility and market dominance: Tether's size and influence within the crypto market significantly enhances the SPAC's attractiveness to investors.

- SoftBank's financial clout and technological expertise: SoftBank's investment capabilities and technological insight can help identify and support promising crypto ventures.

- Synergies between the three companies: The combined strengths of Cantor, Tether, and SoftBank create a powerful force within the crypto industry.

- Increased investor confidence: The involvement of these prominent players significantly increases investor trust and participation in the SPAC.

Implications and Potential Impact on the Crypto Market

The potential injection of $3 billion into the crypto market through the Cantor Crypto SPAC has far-reaching implications. This significant capital infusion could:

- Increase liquidity in the crypto market: Greater liquidity leads to more efficient trading and reduced price volatility.

- Enhance credibility and legitimacy of cryptocurrencies: Institutional involvement legitimizes cryptocurrencies in the eyes of mainstream investors.

- Accelerate crypto adoption by mainstream investors: This initiative could encourage broader institutional investment and mainstream adoption of crypto assets.

However, potential risks and challenges exist:

- Regulatory hurdles: The evolving regulatory landscape for cryptocurrencies and SPACs poses a potential obstacle.

- Market volatility: The crypto market is inherently volatile, introducing significant risk to investment.

Regulatory Landscape and Future Outlook

Navigating the regulatory environment will be crucial for the Cantor Crypto SPAC's success. The Securities and Exchange Commission (SEC) regulations, along with international frameworks, will need to be meticulously addressed. Potential regulatory uncertainty could significantly impact the timeline and feasibility of the project.

- SEC regulations and compliance: Adherence to SEC rules governing SPACs and securities offerings is paramount.

- International regulatory frameworks: Navigating varying regulatory landscapes in different jurisdictions will be essential.

- Potential for regulatory uncertainty: Changes in regulations could impact the SPAC's trajectory.

- Long-term prospects for the crypto market: The long-term growth potential of the crypto market remains a key factor influencing the SPAC's success.

Conclusion:

Cantor Fitzgerald's proposed $3 billion crypto SPAC, potentially involving Tether and SoftBank, marks a watershed moment for the cryptocurrency industry. This ambitious venture reflects growing institutional confidence in digital assets and has the potential to profoundly impact the crypto market's growth and development. While challenges related to the Cantor Crypto SPAC and the regulatory landscape exist, the potential rewards are substantial. To stay abreast of the latest developments in this groundbreaking initiative, continue to follow our coverage on the Cantor Crypto SPAC and related news. Understanding the implications of this pivotal move is crucial for anyone invested in or interested in the future of finance and the Cantor Crypto SPAC.

Featured Posts

-

February 20th Bold And The Beautiful Spoilers Steffy Liam And Poppys Impact On Finn

Apr 24, 2025

February 20th Bold And The Beautiful Spoilers Steffy Liam And Poppys Impact On Finn

Apr 24, 2025 -

Whataburger Video Propels Hisd Mariachi To Uil State

Apr 24, 2025

Whataburger Video Propels Hisd Mariachi To Uil State

Apr 24, 2025 -

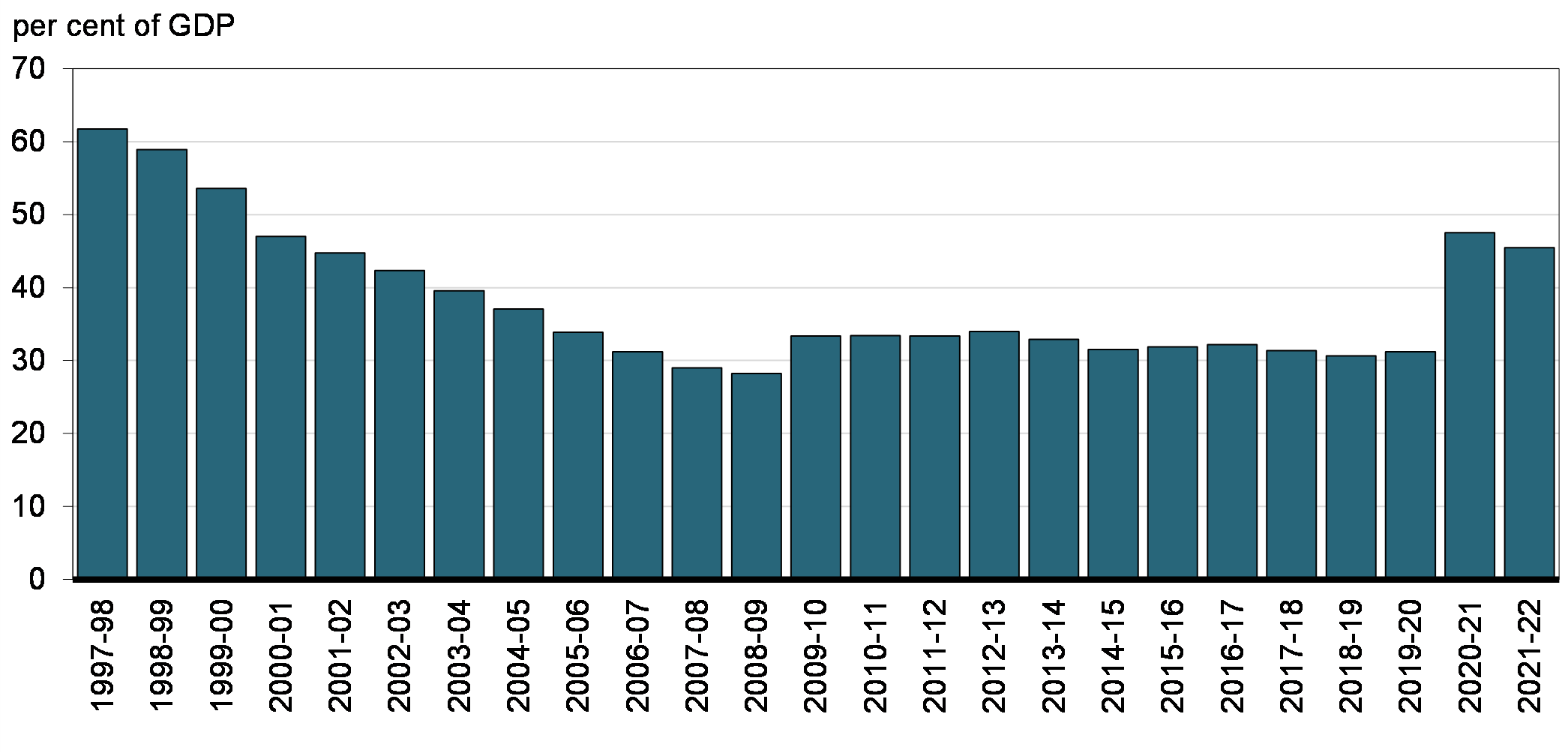

Canadas Fiscal Health The Impact Of Liberal Spending Decisions

Apr 24, 2025

Canadas Fiscal Health The Impact Of Liberal Spending Decisions

Apr 24, 2025 -

Bitcoin Price Climbs Amidst Easing Trade Tensions And Fed Uncertainty

Apr 24, 2025

Bitcoin Price Climbs Amidst Easing Trade Tensions And Fed Uncertainty

Apr 24, 2025 -

Ella Bleu Travolta Put Od Djetinjstva Do Zrele Ljepote

Apr 24, 2025

Ella Bleu Travolta Put Od Djetinjstva Do Zrele Ljepote

Apr 24, 2025