Canadian Housing Market Slowdown: BMO Survey Highlights Recession Anxiety

Table of Contents

BMO Survey Findings: A Deeper Dive

The BMO survey offers a stark picture of the shifting landscape of the Canadian housing market. Two key findings stand out: declining consumer confidence and the overwhelming impact of rising interest rates.

Declining Consumer Confidence

The survey reveals a sharp decline in consumer confidence regarding the housing market. This downturn is directly linked to rising interest rates, fears of a looming recession, and the increasing difficulty of affording a home.

- Bullet Point 1: Consumer confidence in the housing market plummeted by 15% compared to the previous quarter's survey, representing the most significant drop in five years.

- Bullet Point 2: Survey respondents cited job security concerns (40%), affordability challenges (35%), and uncertainty about future interest rate hikes (25%) as their primary anxieties.

- Bullet Point 3: Geographical variations exist, with consumer sentiment significantly lower in major urban centers like Toronto and Vancouver compared to smaller cities in more rural provinces.

Impact of Rising Interest Rates

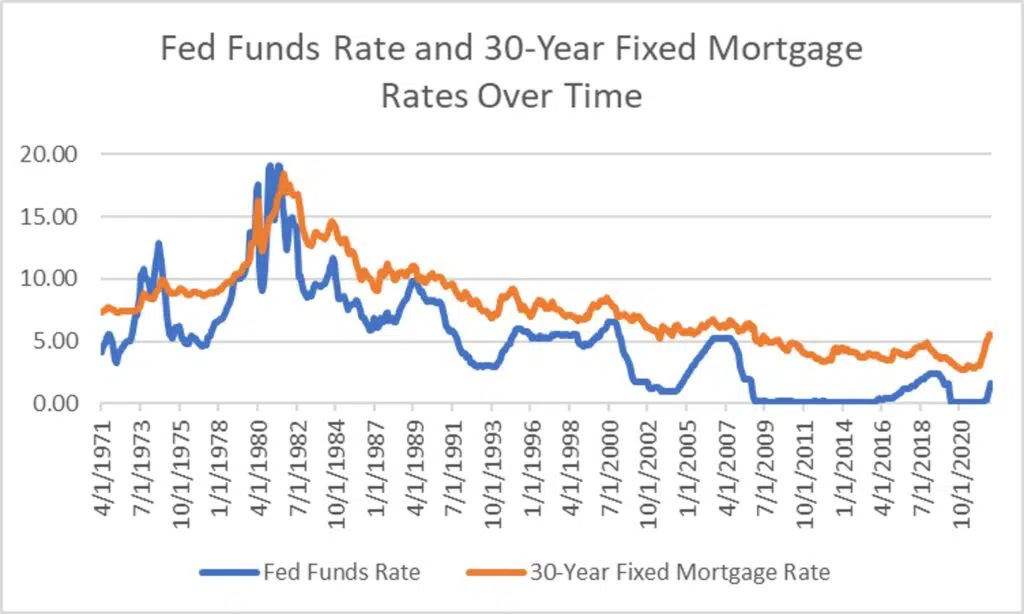

The Bank of Canada's aggressive interest rate hikes are severely impacting housing affordability. Higher borrowing costs make mortgages significantly more expensive, effectively pricing many potential buyers out of the market.

- Bullet Point 1: The average five-year fixed mortgage rate has increased by approximately 2% in the last six months, leading to a substantial increase in monthly payments for homeowners.

- Bullet Point 2: First-time homebuyers are the most vulnerable segment, with many now unable to meet the stricter mortgage qualification criteria. The impact on this group is particularly significant for the future health of the Canadian housing market.

- Bullet Point 3: Economists predict further interest rate hikes are possible, depending on inflation trends, potentially exacerbating the existing slowdown in the Canadian housing market.

Factors Contributing to the Slowdown

Several interconnected factors are contributing to the current slowdown in the Canadian housing market. High inflation, the escalating cost of living, and government policies all play significant roles.

High Inflation and Cost of Living

Soaring inflation and the rapidly increasing cost of living are significantly eroding consumer purchasing power, directly impacting demand for housing.

- Bullet Point 1: Canada's inflation rate recently reached its highest level in decades, significantly impacting household budgets and reducing disposable income available for housing purchases.

- Bullet Point 2: The combination of higher inflation and increased interest rates creates a double whammy, making housing significantly less affordable. This is leading to a decrease in demand and putting downward pressure on prices.

- Bullet Point 3: A comparison to historical inflation rates reveals that the current situation is unique, with the combined impact of inflation and interest rate increases creating unprecedented challenges for the housing market.

Government Policies and Regulations

Government policies intended to cool the overheated housing market, such as stricter stress tests for mortgage approvals, are also contributing to the slowdown.

- Bullet Point 1: The stricter stress tests introduced in recent years require mortgage applicants to demonstrate the ability to handle higher interest rates, thus limiting borrowing power.

- Bullet Point 2: These policies have disproportionately affected first-time homebuyers and those with lower incomes, further dampening demand in certain market segments.

- Bullet Point 3: While intended to stabilize the market, these policies have unintentionally contributed to the current slowdown, and any future policy changes will be closely watched for their impact on the Canadian housing market.

Potential Outcomes and Future Predictions

Experts predict a period of adjustment in the Canadian housing market, with varying degrees of price correction expected across different regions.

Predicting Housing Price Adjustments

Market analysts predict moderate to significant price corrections in various Canadian markets, depending on local economic conditions and supply and demand dynamics.

- Bullet Point 1: Predictions range from a 5% to 15% decrease in average housing prices across major Canadian cities within the next year.

- Bullet Point 2: The extent of price adjustments will be influenced by factors such as local inventory levels, the pace of interest rate hikes, and the overall economic climate.

- Bullet Point 3: Regional variations are expected, with markets in Toronto and Vancouver, which experienced the most significant price increases in recent years, potentially facing the largest corrections.

Implications for the Canadian Economy

The slowdown in the housing market has significant implications for the broader Canadian economy, potentially contributing to a more widespread economic slowdown.

- Bullet Point 1: The housing sector is a significant driver of economic activity, with knock-on effects on related industries such as construction, finance, and retail.

- Bullet Point 2: A decline in housing activity could lead to job losses in these sectors, potentially impacting overall employment numbers and consumer confidence.

- Bullet Point 3: There's a risk of a cascading economic downturn if the slowdown in the housing market is not managed effectively and the government doesn't implement appropriate countermeasures.

Conclusion

The BMO survey's findings clearly indicate a concerning slowdown in the Canadian housing market, driven by recession anxieties, rising interest rates, reduced consumer confidence, and government policies. Understanding these intertwined factors is crucial for navigating the current market. Staying informed about the evolving Canadian housing market and its potential for further adjustments is vital for both buyers and sellers. Monitor economic indicators and expert analyses to make informed decisions. Learn more about the latest developments in the Canadian housing market slowdown and its potential impact by [link to relevant resource/further reading].

Featured Posts

-

Apple Watches And Nhl Officials A New Era In Officiating

May 07, 2025

Apple Watches And Nhl Officials A New Era In Officiating

May 07, 2025 -

Thailands Deflation Implications For Future Interest Rate Cuts

May 07, 2025

Thailands Deflation Implications For Future Interest Rate Cuts

May 07, 2025 -

Xrp Up 400 In Three Months Time To Invest Or Wait

May 07, 2025

Xrp Up 400 In Three Months Time To Invest Or Wait

May 07, 2025 -

V Kocanih In Drugod Pokop Zrtev Pozara V Nocnem Klubu

May 07, 2025

V Kocanih In Drugod Pokop Zrtev Pozara V Nocnem Klubu

May 07, 2025 -

John Wick The Case For A Beloved Characters Comeback After 10 Years

May 07, 2025

John Wick The Case For A Beloved Characters Comeback After 10 Years

May 07, 2025