Thailand's Deflation: Implications For Future Interest Rate Cuts

Table of Contents

Understanding Thailand's Deflationary Pressures

Thailand's deflationary environment is characterized by a sustained fall in the consumer price index (CPI). For example, [insert recent CPI data and percentage decrease here – cite source]. This deflation isn't a one-off event; it's a persistent trend driven by a confluence of factors affecting the Thai economy.

Several underlying causes contribute to this deflationary pressure in Thailand:

- Weak Domestic Demand: Sluggish consumer spending, fueled by factors such as [explain specific reasons, e.g., high household debt, uncertainty about future economic prospects], has significantly reduced overall demand.

- Falling Commodity Prices: The global decline in commodity prices, particularly those impacting key Thai exports like [mention specific commodities], has suppressed inflationary pressures.

- Stronger Thai Baht: The appreciation of the Thai baht against major currencies makes imports cheaper, further contributing to deflationary pressures. This is especially significant given Thailand's reliance on imports for certain goods and services. [cite data on Baht exchange rate].

- Impact of Global Economic Slowdown: The global economic slowdown, and particularly the weakening of key trading partners’ economies, reduces demand for Thai exports, impacting growth and contributing to the deflationary spiral.

Understanding these interconnected factors – "deflation Thailand," "Thai economy," "consumer price index Thailand," and "Baht exchange rate" – is crucial to formulating effective policy responses.

The Impact of Deflation on the Thai Economy

The consequences of sustained deflation on the Thai economy are far-reaching and predominantly negative. A prolonged period of deflation can create a vicious cycle that undermines economic stability and growth.

- Reduced Consumer Spending: Consumers delay purchases anticipating further price drops, leading to a decrease in overall demand. This "wait-and-see" attitude exacerbates deflationary pressures.

- Decreased Business Investment: Businesses postpone investments due to weak demand and uncertainty about future returns, further dampening economic activity.

- Potential for a Debt Trap: Deflation increases the real value of debt, making it harder for businesses and individuals to repay loans, potentially leading to financial distress and defaults. This significantly impacts "consumer spending Thailand" and "investment Thailand."

- Impact on Economic Growth and GDP: The combined effect of reduced consumer spending, decreased business investment, and potential debt problems leads to lower economic growth and a contraction in GDP. [cite relevant GDP data if available]. The "economic impact deflation" on Thailand is clearly visible in these figures.

Addressing these detrimental effects is paramount for Thailand's economic well-being.

The Bank of Thailand's Response and Potential Interest Rate Cuts

The Bank of Thailand's current monetary policy stance [describe the current policy – e.g., current interest rate, recent policy announcements]. Given the deflationary pressures, there's increasing speculation about potential interest rate cuts to stimulate economic activity. However, this decision isn't straightforward.

The likelihood of future interest rate cuts hinges on several factors:

- Inflationary Pressures: While deflation is the immediate concern, the Bank of Thailand must also consider the potential for future inflationary pressures. [Discuss any inflationary risks, e.g., rising oil prices, supply chain disruptions].

- Exchange Rate Volatility: Interest rate cuts can weaken the Thai baht, potentially exacerbating import costs and inflation. Managing "Thai baht volatility" is a key consideration.

- Global Economic Uncertainty: The global economic outlook adds another layer of complexity, making it crucial to consider the international ramifications of monetary policy decisions. The Bank of Thailand needs to consider the global context when formulating its "interest rate policy."

These factors highlight the delicate balancing act faced by the Bank of Thailand in its pursuit of economic stability.

Alternative Policy Measures to Combat Deflation

Besides interest rate cuts, the Bank of Thailand might consider alternative policy measures to combat deflation:

- Fiscal Policy Measures (Government Spending): Increased government spending on infrastructure projects or social programs can boost demand and stimulate economic activity. This requires careful planning and execution of "fiscal policy Thailand."

- Structural Reforms to Boost Productivity: Implementing structural reforms to improve efficiency and productivity in various sectors can enhance competitiveness and long-term growth. "Structural reforms Thailand" are essential for sustainable economic development.

- Measures to Support Specific Sectors of the Economy: Targeted support for specific sectors heavily impacted by deflation could help revitalize economic activity. This might include subsidies, tax breaks, or other forms of "economic stimulus Thailand."

A multifaceted approach, combining monetary and fiscal policies with structural reforms, is likely to be the most effective strategy.

Conclusion: Thailand's Deflation and the Path Forward

Thailand's deflationary pressures present a significant challenge requiring a carefully calibrated response. While interest rate cuts are a potential tool, the Bank of Thailand must consider the potential risks and explore alternative policy measures. The impact of deflation on various sectors of the Thai economy, from reduced consumer spending to the threat of a debt trap, underscores the urgency of addressing this issue. Analyzing Thailand's economic outlook requires close monitoring of the situation and careful consideration of all available policy options.

To stay informed about "Thailand's deflationary pressures" and the potential for "future interest rate cuts in Thailand," follow reputable economic news sources and official announcements from the Bank of Thailand. Understanding the complexities of "analyzing Thailand's economic outlook" is crucial for navigating these challenging times. Actively engage with information from credible sources to make informed decisions regarding your investments and financial planning in light of these economic developments.

Featured Posts

-

The Karate Kid Exploring The Films Enduring Themes

May 07, 2025

The Karate Kid Exploring The Films Enduring Themes

May 07, 2025 -

John Wick Experience Las Vegas Everything You Need To Know

May 07, 2025

John Wick Experience Las Vegas Everything You Need To Know

May 07, 2025 -

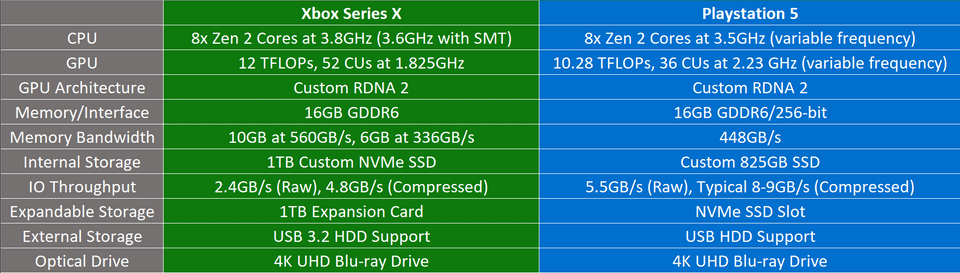

Ps 5 Vs Xbox Series S A Detailed Comparison Of Key Differences

May 07, 2025

Ps 5 Vs Xbox Series S A Detailed Comparison Of Key Differences

May 07, 2025 -

Play Station 5 Pro Hardware Teardown And Performance Implications

May 07, 2025

Play Station 5 Pro Hardware Teardown And Performance Implications

May 07, 2025 -

Avoid Unforced Errors Warren Buffetts Leadership Strategies For Success

May 07, 2025

Avoid Unforced Errors Warren Buffetts Leadership Strategies For Success

May 07, 2025