Capitalizing On Connections: Access To Investments In Elon Musk's Private Companies

Table of Contents

Gaining access to investment opportunities in Elon Musk's private companies is a highly sought-after goal for many high-net-worth individuals and sophisticated investors. These ventures, often at the forefront of technological innovation, promise potentially enormous returns, but accessing them requires a strategic approach. This article explores the strategies and pathways available to capitalize on these unique connections and access these exclusive investment opportunities.

Understanding the Landscape of Elon Musk's Private Investments

Identifying Key Companies

Elon Musk's entrepreneurial endeavors extend beyond publicly traded companies like Tesla. Several private ventures offer intriguing investment possibilities, each with its unique characteristics and potential for growth. Let's examine some key players:

-

SpaceX: Revolutionizing space exploration with reusable rockets and ambitious Mars colonization plans, SpaceX represents a significant investment opportunity in the burgeoning commercial space industry. SpaceX investment opportunities are highly competitive.

-

The Boring Company: Focusing on innovative infrastructure solutions, such as high-speed underground transportation tunnels, The Boring Company tackles urban challenges with potentially disruptive technology. Securing Boring Company funding requires navigating a complex landscape.

-

Neuralink: Developing advanced brain-computer interfaces, Neuralink pushes the boundaries of neuroscience and could revolutionize healthcare and human augmentation. Investment in Neuralink is considered highly speculative but potentially lucrative.

-

X Corp (formerly Twitter): While now publicly traded, the company's future trajectory under Musk's leadership continues to attract significant interest and presents opportunities for investors. Understanding the complexities of Twitter private equity is crucial.

The Challenges of Access

Accessing investment opportunities in these companies is exceptionally challenging. Several factors contribute to this exclusivity:

-

Limited Availability: Funding rounds are infrequent and often oversubscribed, meaning many investors are left out.

-

High Investment Thresholds: Minimum investment requirements are typically substantial, often exceeding millions of dollars.

-

Stringent Due Diligence: Potential investors undergo rigorous vetting processes to ensure they meet the companies' criteria.

-

Networking Requirements: Strong connections within the venture capital and high-net-worth investor communities are often essential for gaining access. Private investment challenges are significant, necessitating expertise and connections.

Strategies for Gaining Access to Elon Musk's Private Investments

Networking and Relationship Building

Building a robust network within relevant circles is paramount. This involves:

-

Attending Industry Events: Networking at conferences, summits, and industry gatherings focused on space exploration, infrastructure, biotechnology, and technology is crucial.

-

Connecting with Venture Capitalists: Developing relationships with venture capitalists who specialize in early-stage investments in high-growth companies is essential.

-

Leveraging Existing Networks: Utilize existing professional and personal connections to identify potential avenues for accessing these exclusive investment opportunities.

-

Developing Expertise: Deep knowledge of the industries involved will enhance credibility and attract attention from relevant players. High-net-worth networking opportunities are not always readily apparent and require strategic effort.

Exploring Private Equity and Venture Capital Firms

Private equity and venture capital firms often play a pivotal role in facilitating access to such investments:

-

Identifying Relevant Firms: Research firms with a proven track record of investing in similar ventures, aligning their investment criteria with your goals.

-

Understanding Investment Criteria: Thoroughly understand the investment strategies and criteria of these firms to increase your chances of being considered.

-

Building Relationships: Develop professional relationships with fund managers and other key personnel within these firms. Private equity investment strategies often involve long-term relationships.

Direct Investment Opportunities

While rare, opportunities for direct investment may arise through participation in funding rounds.

-

Understanding the Process: Familiarize yourself with the process of participating in private funding rounds, which typically involves significant legal and regulatory considerations.

-

Navigating Legal and Regulatory Requirements: Engage legal and financial professionals with expertise in private investments to ensure compliance.

-

Assessing Risks: Private investments are inherently risky; conduct thorough due diligence and understand the potential downsides before committing capital. Direct private investment carries significant risks and requires careful assessment.

Conclusion

Accessing investment opportunities in Elon Musk's private companies requires a strategic approach, combining diligent research, strong networking, and a thorough understanding of the private investment landscape. While challenging, the potential returns can be substantial for those who successfully navigate this exclusive world. Private investment challenges are numerous, but the rewards can be substantial for those willing to invest the time and effort to access them.

Call to Action: Ready to explore the potential of capitalizing on connections and gaining access to exclusive investment opportunities in Elon Musk's private companies? Begin building your network and researching relevant private equity firms today. Start your journey towards accessing high-growth investments and potentially significant returns. Remember to carefully consider the inherent risks associated with private investments before committing any capital.

Featured Posts

-

Benson Boones I Heart Radio Music Awards 2025 Outfit Photo 5137819

Apr 26, 2025

Benson Boones I Heart Radio Music Awards 2025 Outfit Photo 5137819

Apr 26, 2025 -

George Santos Prison Fears And Outburst Against Prosecutors Before Sentencing

Apr 26, 2025

George Santos Prison Fears And Outburst Against Prosecutors Before Sentencing

Apr 26, 2025 -

Benson Boone I Heart Radio Music Awards 2025 Sheer Lace Top Look

Apr 26, 2025

Benson Boone I Heart Radio Music Awards 2025 Sheer Lace Top Look

Apr 26, 2025 -

Jennifer Anistons Friendship With Chelsea Handler A Toxic Betrayal

Apr 26, 2025

Jennifer Anistons Friendship With Chelsea Handler A Toxic Betrayal

Apr 26, 2025 -

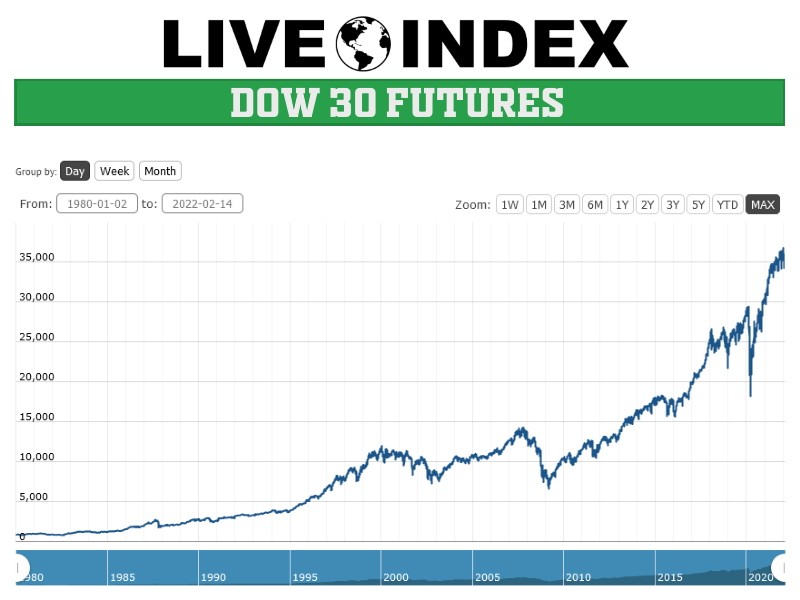

Stock Market Update Dow Futures Point To Strong Week End

Apr 26, 2025

Stock Market Update Dow Futures Point To Strong Week End

Apr 26, 2025