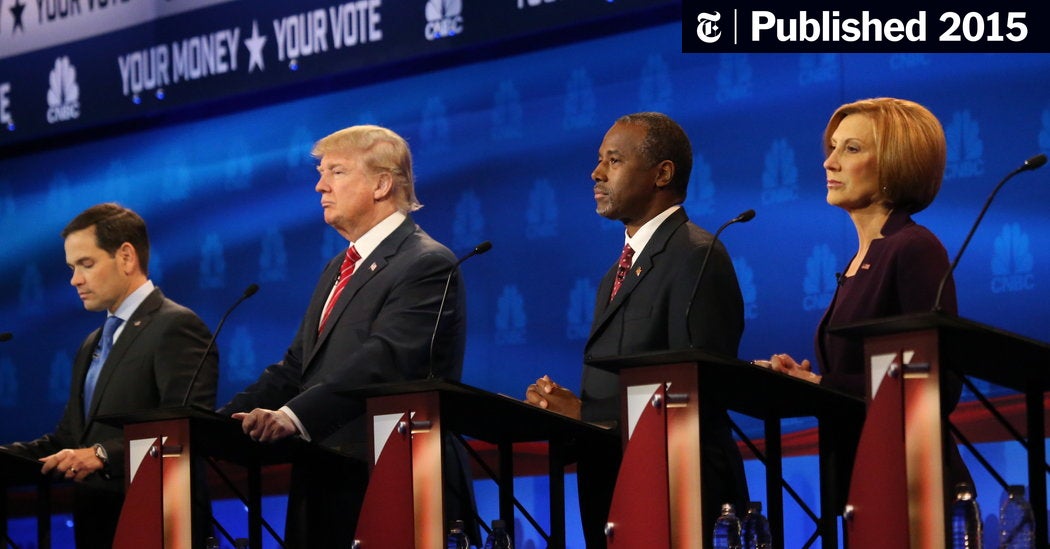

Challenges To Trump’s Tax Plan From Within The Republican Party

Table of Contents

Fiscal Conservatism vs. Tax Cuts

A central conflict stemmed from the inherent tension between fiscal conservatism and the proposed substantial tax cuts. Many Republicans, traditionally champions of fiscal responsibility, expressed deep concerns about the plan's potential to balloon the national debt and deficit. This wasn't a fringe viewpoint; it represented a significant faction within the party.

-

Concerns about increased national debt and deficit spending: The sheer scale of the proposed tax cuts raised alarms about unsustainable levels of government borrowing. Critics argued that such a dramatic reduction in revenue without corresponding spending cuts would inevitably lead to a ballooning national debt, jeopardizing the nation's long-term economic stability.

-

Arguments against prioritizing tax cuts over government spending on crucial areas: Some Republicans argued that prioritizing tax cuts over investments in essential areas like infrastructure, education, and social programs was fiscally irresponsible. They believed that investing in these areas would yield greater long-term economic benefits than short-term tax reductions.

-

Specific Republican figures who voiced these concerns included [insert names and links to relevant sources, e.g., Senator Bob Corker's statements against the plan]. Their arguments emphasized the potential for long-term economic harm caused by irresponsible deficit spending.

The differing interpretations of fiscal responsibility within the Republican party exposed a deep ideological divide, highlighting the complexities of balancing tax cuts with responsible fiscal policy.

Impact on Specific Sectors and Demographics

The plan's projected impact on different segments of the population further fueled internal disagreements. Critics pointed to an uneven distribution of benefits, arguing that the tax cuts disproportionately favored high-income earners and corporations while offering minimal relief to the middle class and low-income families.

-

Unequal distribution of benefits, favoring high-income earners: Analyses of the proposed tax cuts consistently showed that the wealthiest Americans would receive the greatest tax reductions, exacerbating income inequality. This raised concerns about fairness and social justice within the Republican party.

-

Concerns about the impact on the middle class and low-income families: Opponents argued that the tax cuts offered little or no benefit to many middle- and low-income families, further widening the gap between the rich and the poor. Data showing the minimal impact on lower income brackets fueled this criticism.

-

Arguments regarding the long-term economic consequences for different sectors (e.g., small businesses, corporations): Concerns were raised about the long-term impact on small businesses, particularly those unable to fully utilize the tax breaks offered to larger corporations. Conversely, some argued that the corporate tax cuts would stimulate economic growth, leading to job creation and higher wages for all.

The lack of consensus on the plan's impact on various sectors and demographic groups fueled internal party debate and underscored the challenges of achieving broad support within the Republican party.

Political Expediency vs. Long-Term Economic Strategy

Beyond the purely economic arguments, the tax plan became entangled in political expediency. Some Republicans viewed it as a crucial political victory, necessary for fulfilling campaign promises and maintaining the party's image. This perspective often overshadowed long-term economic considerations.

-

Discussion of the role of political posturing and election strategies: The tax plan was viewed by some as a key element of the Trump administration's political agenda, designed to boost the president's approval ratings and enhance the party's standing heading into elections.

-

Analysis of potential short-term economic boosts versus long-term sustainability: Supporters pointed to the potential for short-term economic growth and job creation as a result of the tax cuts. Critics, however, countered that these short-term gains would come at the expense of long-term fiscal stability and could even lead to economic instability.

-

Arguments for and against the tax plan's overall economic vision: The debate centered on the fundamental economic philosophy underpinning the plan – supply-side economics versus a more balanced approach. Some argued that the plan's focus on tax cuts for corporations would trickle down and benefit the entire economy, while others questioned this theory and its potential effectiveness.

-

Mention any internal party discussions or debates regarding the long-term economic consequences: [Insert details of internal party discussions and debates, citing sources if available].

The Role of Lobbying and Special Interests

The intense lobbying efforts exerted by various interest groups significantly shaped the final form of the tax plan and fueled internal conflicts within the Republican party.

-

Identification of key lobbying groups and their influence: Powerful lobbying groups representing corporations, financial institutions, and other special interests played a significant role in shaping the tax legislation, leading to concerns about undue influence and potential conflicts of interest.

-

Discussion on how these interests may have impacted the plan’s design and the resulting internal conflicts: The specific provisions favoring certain industries and sectors sparked internal disagreements, highlighting the influence of lobbying efforts on the final product.

-

Analysis of the potential for corruption or undue influence: This influence raised concerns about potential corruption and the erosion of public trust in the legislative process.

Conclusion

Understanding the challenges to Trump’s Tax Plan from Within the Republican Party is crucial to grasping the complexities of the US political and economic landscape. The internal disagreements highlighted fundamental divisions regarding fiscal conservatism, the distribution of economic benefits, the balance between short-term political gains and long-term economic stability, and the pervasive influence of lobbying. These internal struggles ultimately shaped the final legislation and continue to impact economic policy debates today. To further understand these complex issues, delve into the specific viewpoints of prominent Republican figures, engage in thoughtful discussions, and stay informed about the ongoing political and economic debates surrounding tax reform. Continue your research by exploring reputable sources such as [suggest relevant articles, think tanks, or government websites].

Featured Posts

-

Get Capital Summertime Ball 2025 Tickets Your Step By Step Plan

Apr 29, 2025

Get Capital Summertime Ball 2025 Tickets Your Step By Step Plan

Apr 29, 2025 -

Pw Cs Strategic Withdrawal Exiting Multiple Countries To Mitigate Risk

Apr 29, 2025

Pw Cs Strategic Withdrawal Exiting Multiple Countries To Mitigate Risk

Apr 29, 2025 -

International Implications Pw Cs Departure From 12 Countries

Apr 29, 2025

International Implications Pw Cs Departure From 12 Countries

Apr 29, 2025 -

The Post Roe Reality Examining The Significance Of Otc Birth Control

Apr 29, 2025

The Post Roe Reality Examining The Significance Of Otc Birth Control

Apr 29, 2025 -

Securing Capital Summertime Ball 2025 Tickets Tips And Strategies

Apr 29, 2025

Securing Capital Summertime Ball 2025 Tickets Tips And Strategies

Apr 29, 2025