China's Rate Cuts And Eased Bank Lending: A Response To Tariffs

Table of Contents

The Impact of Tariffs on the Chinese Economy

The US-China trade war, characterized by tit-for-tat tariff increases, has dealt a significant blow to the Chinese economy. These tariffs have directly impacted Chinese exports, leading to a slowdown in GDP growth and increased economic uncertainty. The impact isn't uniform across all sectors; some industries, particularly technology and agriculture, have been disproportionately affected.

-

Decreased export volume in specific sectors: The technology sector, a key driver of Chinese economic growth, has experienced a notable decline in exports to the US due to increased tariffs. Similarly, the agricultural sector has faced significant challenges, with reduced demand for Chinese agricultural products in the US market.

-

Reduced foreign investment in China: The trade war has created uncertainty among foreign investors, leading to a decrease in foreign direct investment (FDI) in China. This hesitation stems from concerns about future market access and potential disruptions to supply chains.

-

Slowdown in GDP growth rate: The impact of tariffs on exports and investment has undeniably slowed China's GDP growth rate. While the exact figures vary depending on the source and methodology, the overall trend shows a noticeable deceleration.

-

Increased unemployment in export-oriented industries: The reduced export demand has led to job losses in export-oriented industries, particularly in manufacturing. This has heightened social and economic concerns within China.

China's Monetary Policy Response: Rate Cuts and Eased Lending

In response to the economic slowdown caused by the trade war, the People's Bank of China (PBOC) has implemented a series of monetary policy measures aimed at stimulating economic activity. These measures primarily involve rate cuts and easing bank lending regulations.

-

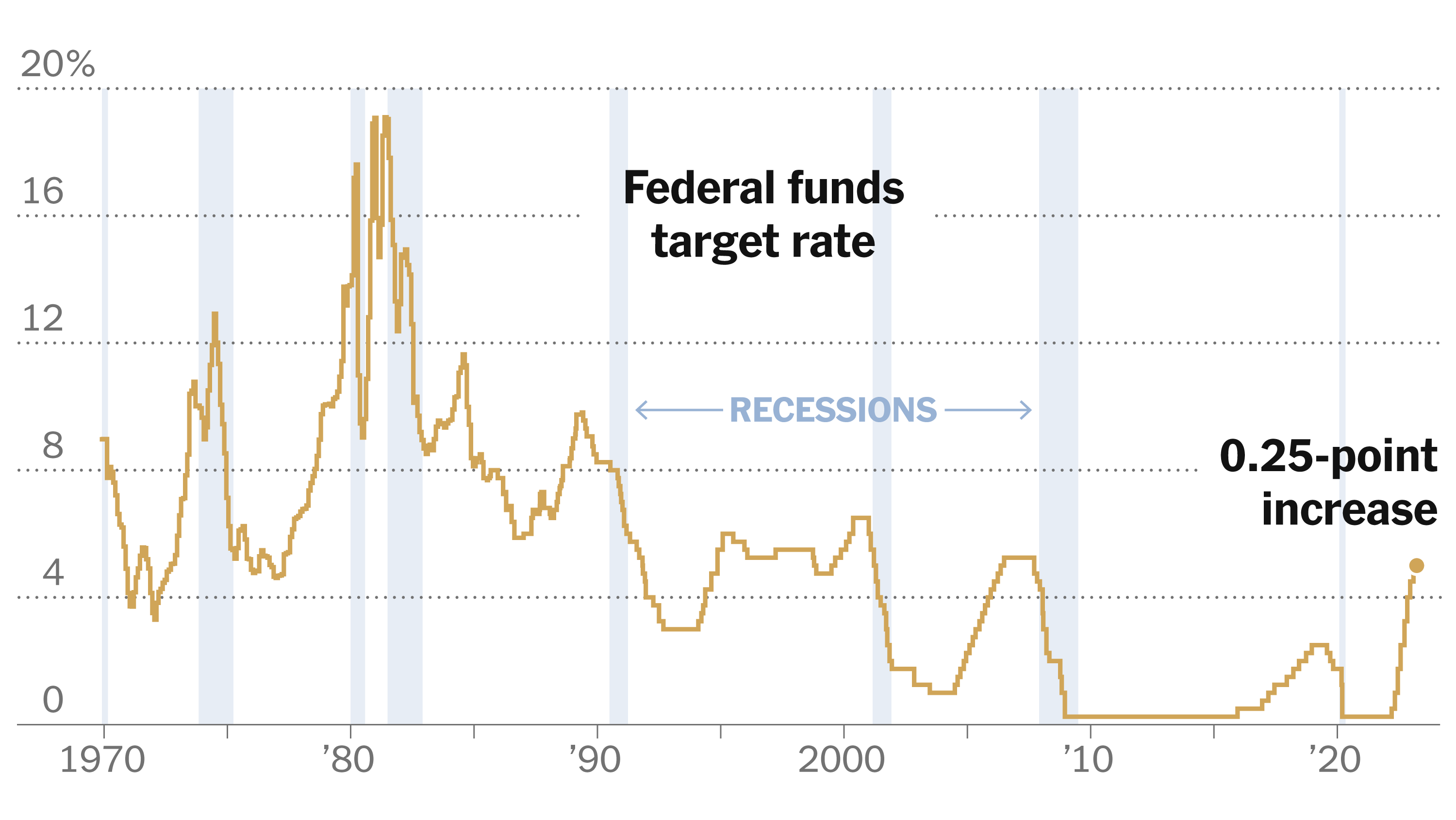

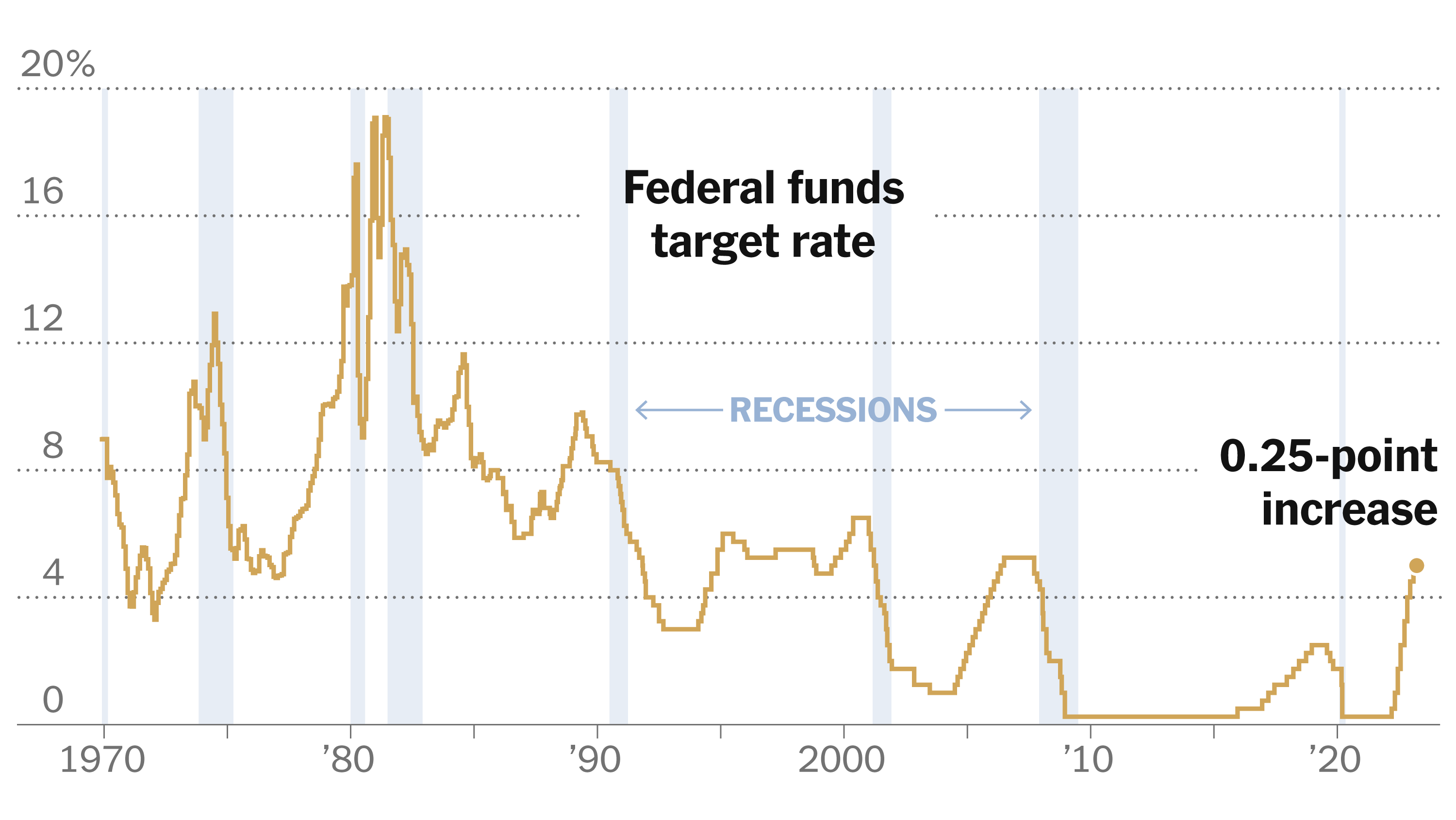

Specific interest rate cuts: The PBOC has lowered several key interest rates, including the benchmark lending rate (LPR) and the reserve requirement ratio (RRR), on multiple occasions in the past year. These cuts aim to make borrowing cheaper for businesses and consumers, encouraging investment and spending.

-

Details on changes to reserve requirement ratios (RRR): Lowering the RRR injects more liquidity into the banking system, allowing banks to lend more money. This increased lending capacity is intended to boost investment and consumption.

-

Measures taken to encourage bank lending to specific sectors: The government has actively encouraged banks to increase lending to small and medium-sized enterprises (SMEs), a vital component of the Chinese economy. These measures often include preferential lending rates and relaxed collateral requirements.

-

The potential impact on the RMB exchange rate: The rate cuts and increased liquidity could potentially lead to a devaluation of the RMB exchange rate. While this could boost exports in the short term, it also carries risks of capital flight and inflation.

Intended Effects of the Stimulus Measures

The intended effect of China's rate cuts and eased lending is a multifaceted economic stimulus package designed to counteract the negative impacts of the tariffs and boost growth.

-

Increased investment in infrastructure projects: Lower interest rates are intended to encourage increased investment in infrastructure projects, creating jobs and stimulating economic activity.

-

Stimulated consumer spending and domestic demand: Lower borrowing costs should, in theory, increase consumer spending and bolster domestic demand, partially offsetting the decline in exports.

-

Improved access to credit for businesses: Easing bank lending regulations and encouraging loans to SMEs aim to improve access to credit for businesses, enabling them to expand operations, hire more employees, and invest in future growth.

-

Support for struggling export-oriented industries: The measures are intended to provide a lifeline for struggling export-oriented industries, helping them to weather the storm of reduced international demand.

Potential Risks and Challenges

While the stimulus measures aim to mitigate the negative impacts of the tariffs, there are also potential risks and challenges associated with this approach.

-

Increased risk of non-performing loans (NPLs): Increased lending, especially to struggling businesses, could lead to a rise in non-performing loans, posing a threat to the stability of the banking sector.

-

Potential for inflationary pressure: Increased liquidity injected into the system could fuel inflationary pressure, eroding purchasing power and potentially undermining the effectiveness of the stimulus.

-

Risk of capital flight: A potential devaluation of the RMB could trigger capital flight, as investors seek safer investments in other currencies.

-

Challenges in effectively targeting stimulus measures: Ensuring that the stimulus measures effectively reach the intended beneficiaries and avoid misallocation of resources remains a significant challenge.

Conclusion

China's rate cuts and eased bank lending are a direct response to the economic challenges posed by the ongoing trade tensions with the US. While these measures aim to stimulate economic growth, counteract the impact of tariffs, and support struggling businesses, they also present potential risks, including increased debt levels and inflation. The effectiveness of this monetary policy response in mitigating the negative impacts of the trade war remains to be seen and requires ongoing monitoring. Staying informed about developments in China's monetary policy, including further analysis of interest rates China, is crucial for understanding the country's economic trajectory and its implications for global markets. Further research into the long-term effects of these China rate cuts and their impact on GDP growth China is strongly recommended.

Featured Posts

-

Cash Only Ubers Updated Auto Service Policy

May 08, 2025

Cash Only Ubers Updated Auto Service Policy

May 08, 2025 -

Lahore Weather Forecast Eid Ul Fitr Update Next 2 Days

May 08, 2025

Lahore Weather Forecast Eid Ul Fitr Update Next 2 Days

May 08, 2025 -

Colin Cowherd Criticizes Jayson Tatum Following Celtics Game 1 Defeat

May 08, 2025

Colin Cowherd Criticizes Jayson Tatum Following Celtics Game 1 Defeat

May 08, 2025 -

Lotto Draw Results Wednesday April 16 2025

May 08, 2025

Lotto Draw Results Wednesday April 16 2025

May 08, 2025 -

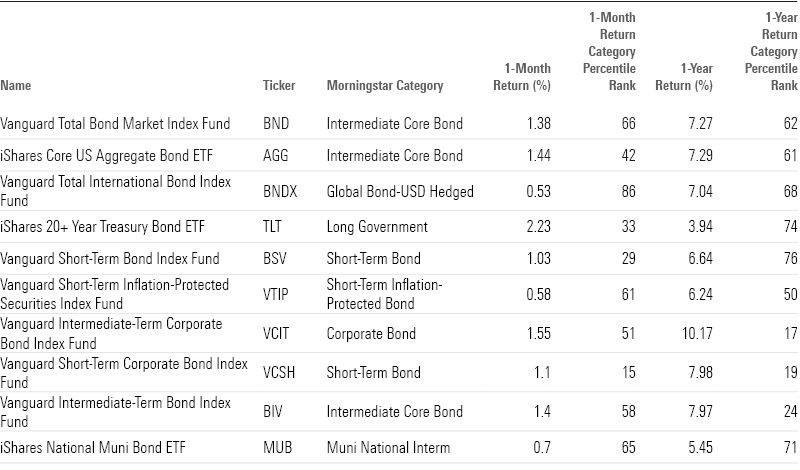

Analysis The Recent Retreat Of Taiwanese Investors From Us Bond Etfs

May 08, 2025

Analysis The Recent Retreat Of Taiwanese Investors From Us Bond Etfs

May 08, 2025