China's Steel Production Cuts: The Effect On Iron Ore Prices

Table of Contents

The Direct Impact of Reduced Steel Production on Iron Ore Demand

Reduced steel production directly translates to lower demand for iron ore, the primary raw material in steelmaking. This fundamental relationship is a cornerstone of understanding iron ore price volatility. The impact is straightforward:

- Reduced steel production capacity: When Chinese steel mills reduce their output, they inherently require less iron ore.

- Decreased iron ore procurement: Steel mills, facing decreased production targets, immediately scale back their iron ore orders from suppliers. This is reflected in reduced shipping volumes and lower prices offered.

- Downward pressure on iron ore prices: The decreased demand, exceeding any potential supply-side adjustments in the short term, creates a surplus, putting downward pressure on iron ore prices.

- Magnitude of price impact: The extent of the price drop is directly proportional to the magnitude of the steel production cuts. Larger cuts, especially unexpected ones, usually lead to more significant price declines. For example, the sharp production cuts in 2018-2019 led to a considerable drop in iron ore prices, impacting mining companies globally. Conversely, periods of increased Chinese steel production are often correlated with higher iron ore prices.

The Role of Government Policies in Shaping Steel Production and Iron Ore Prices

Chinese government policies play a pivotal role in shaping steel production levels and consequently influencing iron ore prices. These policies are multifaceted, including:

- Environmental regulations and carbon emission targets: China's commitment to reducing carbon emissions has led to stricter environmental regulations on steel production, limiting the output of high-emission steel mills.

- Capacity reduction initiatives: Government programs aimed at consolidating the steel industry and reducing overcapacity have directly resulted in the closure or downsizing of many steel plants. These measures, while beneficial for environmental sustainability and industry efficiency, directly decrease demand for iron ore.

- Technological upgrades and industry consolidation: Policies promoting technological upgrades within the steel industry can indirectly impact iron ore demand. More efficient steelmaking processes often require less iron ore per ton of steel produced. The consolidation of the steel industry into larger, more efficient players may also lead to optimized iron ore procurement strategies, potentially impacting prices.

- Future policy implications: The ongoing focus on sustainability and efficiency suggests that China's government is likely to continue implementing policies affecting steel production, making it crucial for market participants to anticipate and respond to future policy changes. The ongoing shift towards green steel and reduced reliance on traditional blast furnaces could significantly alter the future iron ore market.

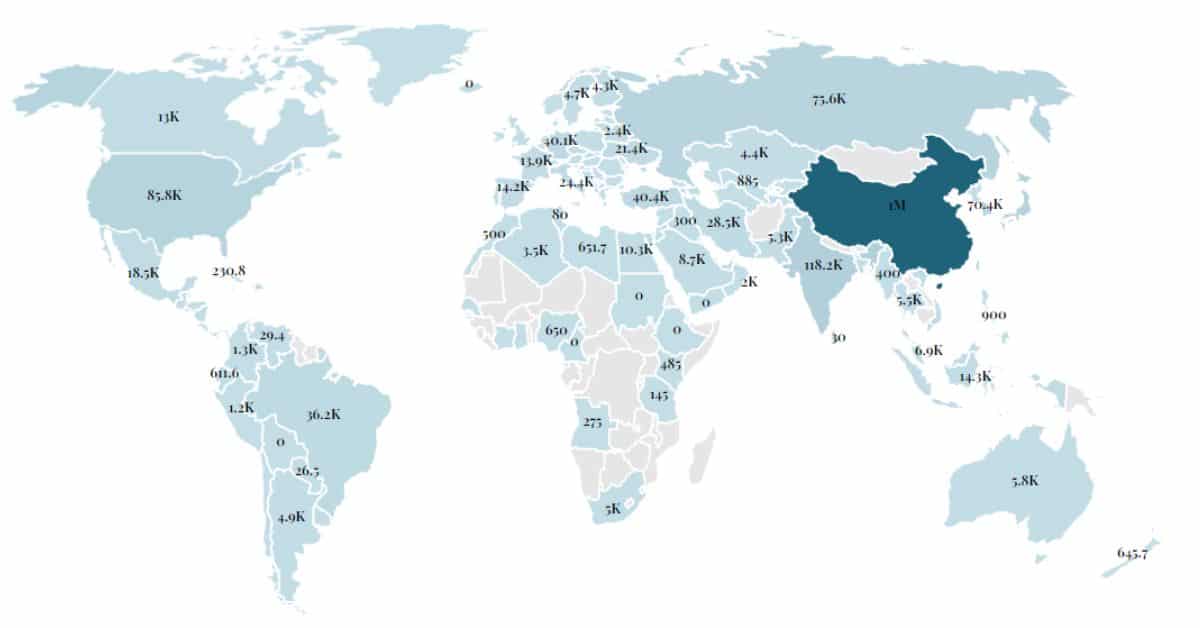

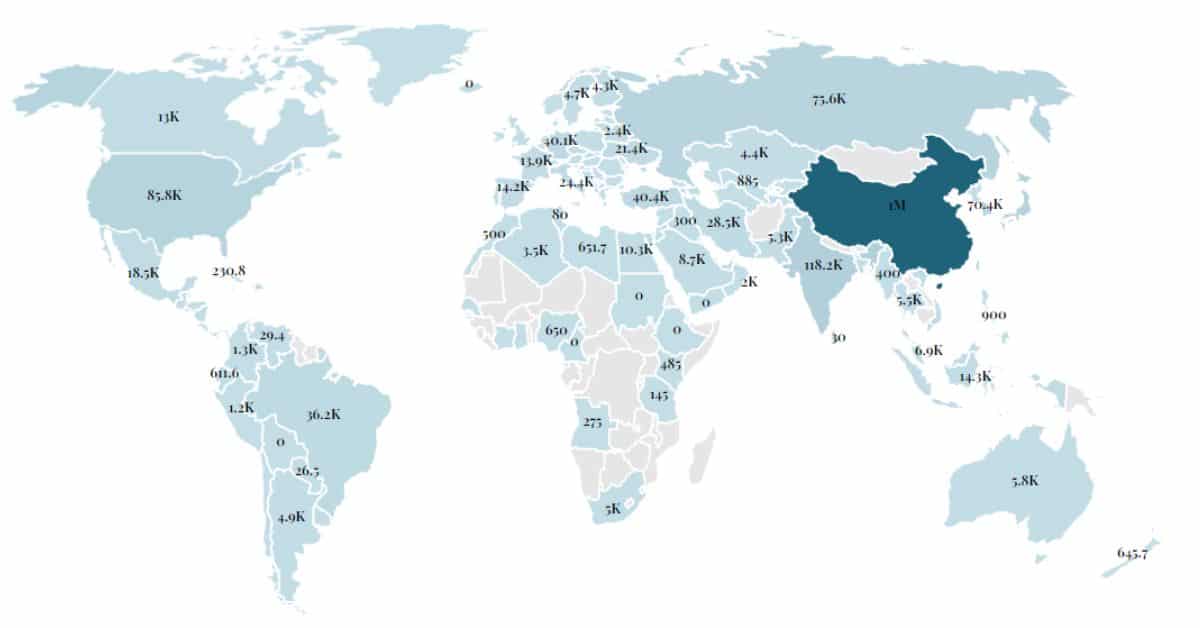

Global Market Dynamics and Their Influence on Iron Ore Prices Despite Chinese Cuts

While China's steel production is dominant, global market dynamics also exert a significant influence on iron ore prices, creating a complex interplay of factors:

- Global steel demand: Increased steel demand from other countries, particularly in developing economies, can offset the price pressure from reduced Chinese steel production. A robust global market can mitigate the downward pressure exerted by China's reduced demand.

- International iron ore trade: The global nature of the iron ore market means that supply chain disruptions, such as logistical bottlenecks or geopolitical instability, can heavily influence prices regardless of Chinese production levels.

- Alternative steelmaking materials: The emergence of alternative materials and steelmaking processes that require less iron ore can also have a significant long-term impact on iron ore demand and pricing. This is an important factor for future market projections.

- Price volatility: The interaction of all these factors leads to considerable price volatility in the iron ore market, demanding careful analysis and strategic planning from stakeholders.

The Impact of Speculation and Investor Sentiment on Iron Ore Prices

The iron ore market is not immune to the effects of speculation and investor sentiment. News and forecasts regarding China's steel production frequently trigger market reactions:

- Commodity trading and market speculation: Traders and investors often react to news concerning steel production cuts, leading to price fluctuations that might not entirely reflect underlying supply and demand.

- Investor confidence and market behavior: Positive or negative investor sentiment regarding the future of the Chinese steel industry and global economic growth can significantly influence iron ore prices.

- Futures markets and price forecasting: The iron ore futures market plays a critical role in shaping price expectations and influencing actual trading activity, amplifying price swings based on speculation.

Conclusion

China's steel production cuts have a profound and multifaceted impact on iron ore prices. The direct impact on demand, coupled with government policies, global market forces, and speculative trading, creates a volatile and interconnected market. Understanding these complex dynamics is crucial for businesses involved in the steel and iron ore industries. Staying informed about changes in China's steel production and their ripple effects on global iron ore prices is essential for managing risk and capitalizing on opportunities within this volatile but important commodity market. Learn more about China steel production and iron ore price forecasting to navigate this dynamic environment effectively.

Featured Posts

-

Ray Epps V Fox News A Deep Dive Into The Jan 6th Defamation Lawsuit

May 10, 2025

Ray Epps V Fox News A Deep Dive Into The Jan 6th Defamation Lawsuit

May 10, 2025 -

Frantsiya I Polsha Novoe Oboronnoe Soglashenie Signal Dlya S Sh A I Rossii

May 10, 2025

Frantsiya I Polsha Novoe Oboronnoe Soglashenie Signal Dlya S Sh A I Rossii

May 10, 2025 -

Nikto Ne Priekhal K Vladimiru Zelenskomu 9 Maya Odinochestvo Prezidenta

May 10, 2025

Nikto Ne Priekhal K Vladimiru Zelenskomu 9 Maya Odinochestvo Prezidenta

May 10, 2025 -

Is Jesse Watters A Hypocrite Recent Comments Under Scrutiny

May 10, 2025

Is Jesse Watters A Hypocrite Recent Comments Under Scrutiny

May 10, 2025 -

Toxic Chemical Residue From Ohio Derailment Months Long Impact On Buildings

May 10, 2025

Toxic Chemical Residue From Ohio Derailment Months Long Impact On Buildings

May 10, 2025