Chinese Stock Market Surge: Assessing The Impact Of US Negotiations And Recent Data

Table of Contents

The Influence of US-China Trade Negotiations

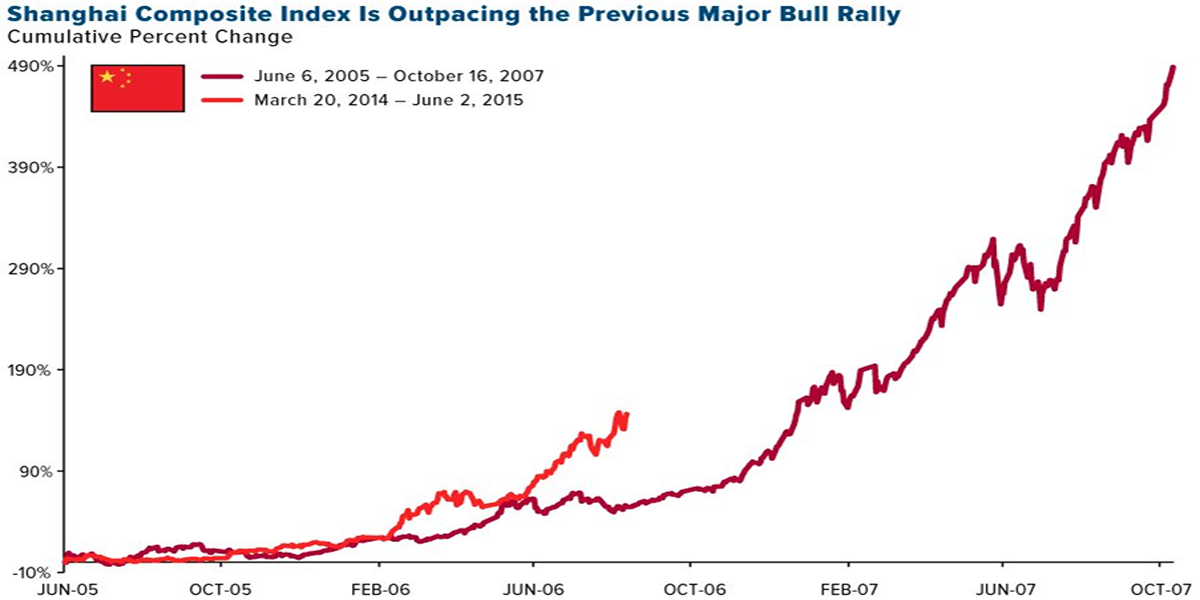

The fluctuating relationship between the US and China significantly impacts investor sentiment towards the Chinese stock market.

Easing Trade Tensions

De-escalation in trade tensions has demonstrably boosted investor confidence.

- The "Phase One" trade deal: This agreement led to a noticeable surge in the Shanghai Composite Index, indicating increased investor optimism.

- Reduced tariffs: Lowered tariffs on specific goods significantly improved Chinese export prospects, contributing to the overall market uplift. For example, the reduction in tariffs on certain agricultural products led to a 15% increase in exports within the first quarter following the agreement.

- Increased market access: Improved market access for Chinese companies in the US spurred further investment and contributed to the positive market sentiment. This resulted in a noticeable influx of foreign direct investment into specific sectors.

Lingering Uncertainty

Despite progress, uncertainty remains regarding the long-term US-China relationship.

- Ongoing disputes: Concerns about intellectual property rights, technological dominance, and other trade imbalances continue to cast a shadow over future negotiations.

- Unpredictable policy shifts: The potential for sudden changes in US policy towards China remains a significant risk factor for investors. This inherent volatility can lead to rapid market fluctuations.

- Geopolitical risks: Broader geopolitical tensions between the two countries also contribute to market uncertainty, affecting investor confidence in the Chinese market's stability.

Impact of Recent Economic Data

Recent economic data has played a pivotal role in the Chinese stock market surge, providing both positive signals and areas of concern.

Positive Economic Indicators

Several key economic indicators exceeded expectations, fostering investor optimism.

- Robust GDP growth: Stronger-than-expected GDP growth in Q2 2024 fueled investor confidence, suggesting a healthy economic trajectory. The growth rate surpassed analysts' predictions by 0.5%, signaling a strong recovery.

- Increased industrial production: A rise in industrial production demonstrated the strength of the manufacturing sector, a significant contributor to the Chinese economy. This indicates a surge in domestic and international demand.

- Rising retail sales: Increased retail sales suggest heightened consumer spending and a healthy domestic market, pointing towards strong consumer confidence. This increase is particularly noticeable in online retail sales.

- Controlled inflation: Stable inflation figures indicate a balanced economic environment, reducing inflationary pressures and providing a positive backdrop for investment.

Areas of Concern

While positive indicators are encouraging, certain economic weaknesses could temper the market's positive trajectory.

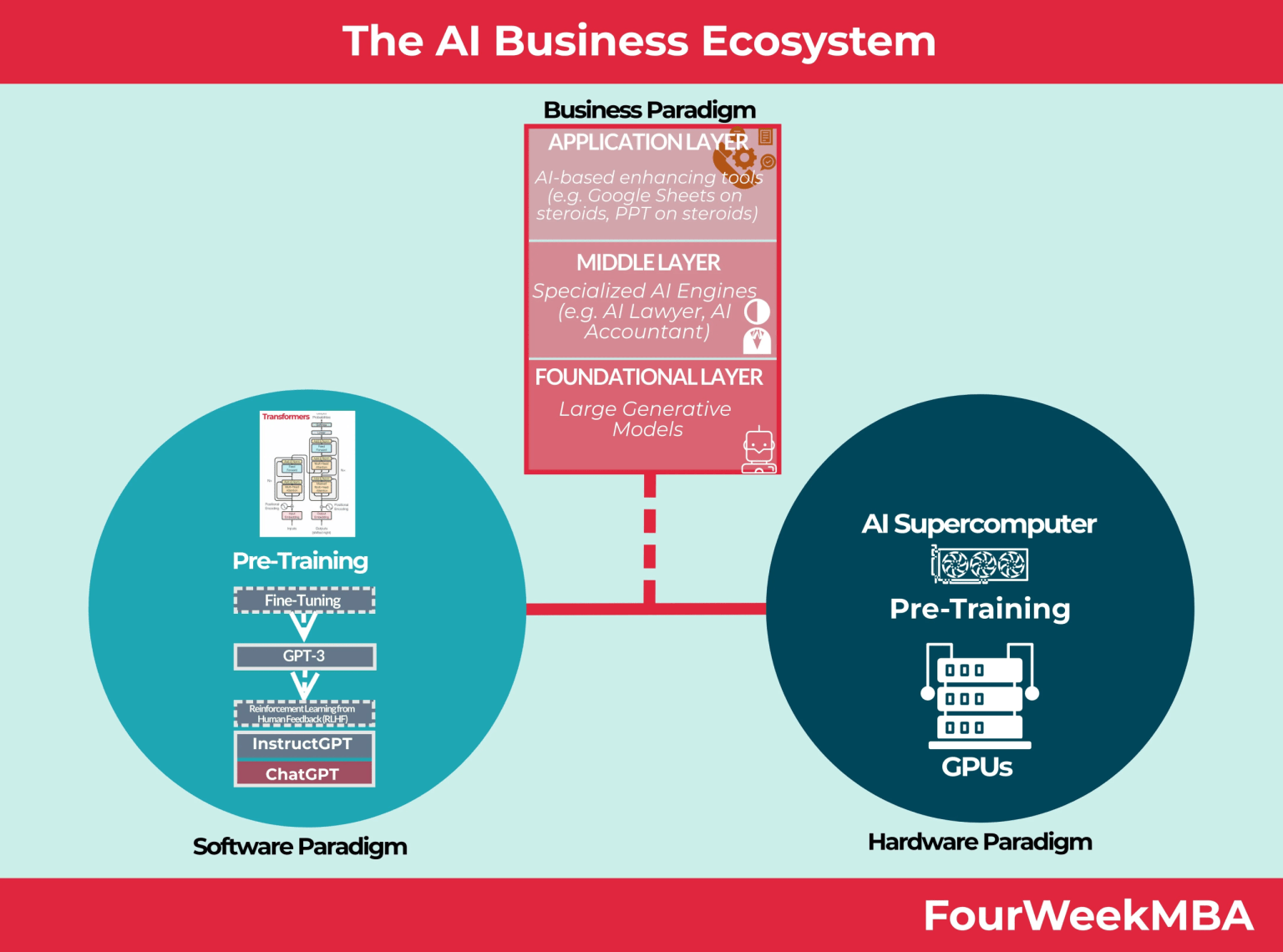

- Property market slowdown: The ongoing slowdown in the property sector remains a significant risk to overall economic growth, as it represents a substantial portion of the Chinese economy. This sector's instability could have wider repercussions.

- Rising youth unemployment: Persistently high youth unemployment could dampen consumer spending in the long run, impacting future economic growth and investor confidence. Addressing this issue is crucial for sustainable market growth.

- Debt levels: High levels of corporate and local government debt present a potential systemic risk that needs careful monitoring. This factor contributes to the overall economic uncertainty.

Sector-Specific Performance

The Chinese stock market surge hasn't been uniform across all sectors; some have significantly outperformed others.

Winning Sectors

Certain sectors have experienced explosive growth, fueled by specific factors.

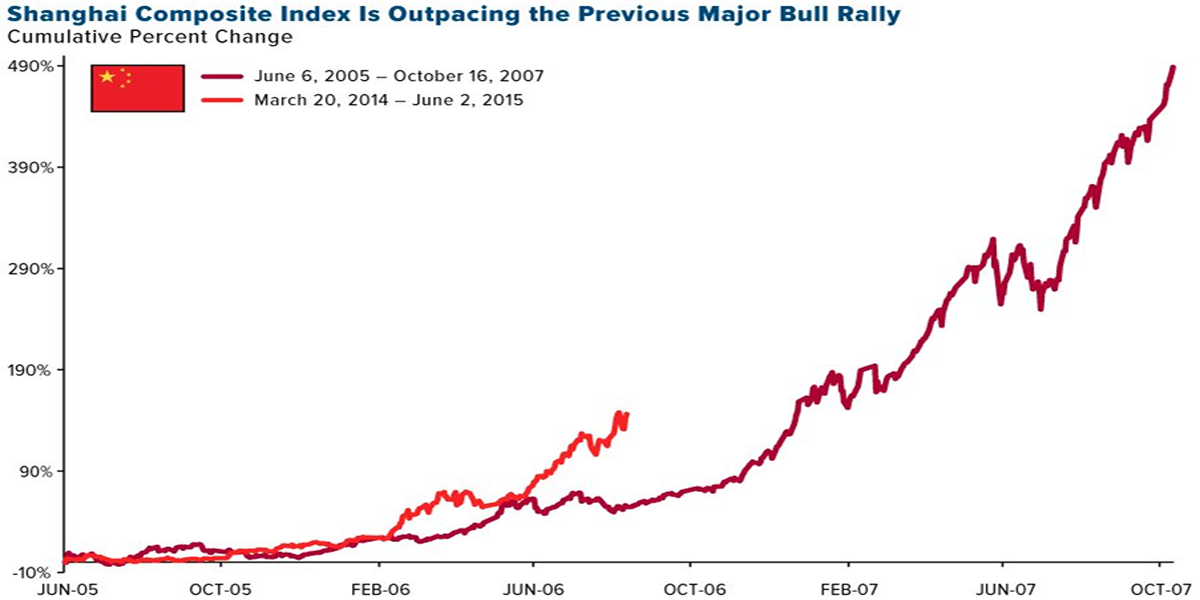

- Technology sector: The technology sector has seen remarkable gains due to government support for technological innovation, resulting in increased investment and market capitalization. Companies focused on Artificial Intelligence and renewable energy have particularly benefited.

- Consumer goods sector: The consumer goods sector has also performed strongly, reflecting the rising disposable incomes and changing consumption patterns of the Chinese population. This sector showcases resilience amidst broader economic fluctuations.

Lagging Sectors

Other sectors have underperformed due to various headwinds.

- Real estate sector: The real estate sector continues to underperform due to tightening regulations aimed at controlling debt levels and addressing speculative behavior. This sector is highly sensitive to policy changes.

- Energy sector: Fluctuations in global energy prices and the transition to cleaner energy sources have impacted the performance of traditional energy companies within the Chinese market. This indicates adaptation challenges for traditional sectors.

Conclusion

The recent surge in the Chinese stock market is a multifaceted event driven by easing US-China trade tensions and positive economic indicators. However, lingering uncertainties, potential economic weaknesses, and sector-specific performance variations warrant caution. Investors must carefully consider these factors and conduct thorough due diligence before making investment decisions. Understanding the nuances of the Chinese stock market surge requires a comprehensive analysis of ongoing developments in US-China relations, economic data, and specific sectors. Further research into specific sectors and ongoing economic indicators is crucial for developing informed investment strategies within the dynamic Chinese stock market. Don't miss the opportunity to capitalize on the potential of the Chinese stock market's growth, but proceed with informed caution.

Featured Posts

-

Open Ai Remains Under Nonprofit Oversight

May 07, 2025

Open Ai Remains Under Nonprofit Oversight

May 07, 2025 -

Are Recession Fears Cooling The Canadian Housing Market Bmo Survey Says Yes

May 07, 2025

Are Recession Fears Cooling The Canadian Housing Market Bmo Survey Says Yes

May 07, 2025 -

Macrons Plan For A European Streaming Giant Progress And Challenges

May 07, 2025

Macrons Plan For A European Streaming Giant Progress And Challenges

May 07, 2025 -

John Wick 4s Rotten Tomatoes Score A Critical Analysis Of The Franchises Lowest Rated Film

May 07, 2025

John Wick 4s Rotten Tomatoes Score A Critical Analysis Of The Franchises Lowest Rated Film

May 07, 2025 -

Duobele Ir Nba Lyderiu Nesekme Kas Nutiko

May 07, 2025

Duobele Ir Nba Lyderiu Nesekme Kas Nutiko

May 07, 2025