Comparing MicroStrategy And Bitcoin As Investments: A 2025 Perspective

Table of Contents

In 2025, the landscape of digital assets and traditional tech investments is dramatically different than it was a few years ago. This article compares two significant players in this evolving space: MicroStrategy, a publicly traded business intelligence company with a substantial Bitcoin holding, and Bitcoin itself. We'll analyze the potential risks and rewards of investing in each, helping you make informed decisions regarding MicroStrategy vs Bitcoin Investment in the current market. Understanding the nuances of each investment is crucial for navigating this complex and potentially lucrative sector.

H2: MicroStrategy's Bitcoin Strategy: A Deep Dive

H3: MicroStrategy's Business Model and Bitcoin Holdings:

MicroStrategy's core business lies in providing enterprise analytics and business intelligence software. However, since 2020, the company has dramatically shifted its strategy, accumulating a significant amount of Bitcoin as a primary treasury asset. This bold move positions MicroStrategy as a major corporate adopter of Bitcoin, influencing other companies to consider similar strategies. As of late 2024 (data would need updating for a 2025 perspective), MicroStrategy held a substantial amount of Bitcoin, representing a significant portion of its total assets. The value of this holding fluctuates dramatically with the price of Bitcoin, significantly impacting MicroStrategy's reported financial performance and market capitalization.

- Market capitalization impact: Bitcoin's price volatility directly affects MicroStrategy's market cap, leading to periods of substantial gains and losses.

- Long-term strategic goals: MicroStrategy's Bitcoin strategy reflects a long-term bet on the future of Bitcoin as a store of value and a hedge against inflation.

- Regulatory risks associated with Bitcoin holdings: Changes in regulations surrounding Bitcoin ownership and taxation pose ongoing risks to MicroStrategy's investment.

H3: Analyzing MicroStrategy as a Stock Investment:

MicroStrategy's stock performance is intrinsically linked to Bitcoin's price. When Bitcoin's price rises, MicroStrategy's stock tends to follow suit, and vice versa. Therefore, investing in MicroStrategy stock is essentially an indirect investment in Bitcoin, albeit with the added layer of MicroStrategy's business performance. Analyzing MicroStrategy independently of its Bitcoin holdings requires evaluating its core business, its competitive landscape within the business intelligence sector, and its overall financial health.

- Earnings reports and projections: Analyzing MicroStrategy's earnings reports and future projections is vital to assess its long-term sustainability beyond its Bitcoin holdings.

- Analyst ratings and recommendations: Keeping track of analyst ratings and recommendations provides valuable insights into the market's overall sentiment towards MicroStrategy.

- Competitive landscape in business intelligence: Understanding MicroStrategy's position in the competitive business intelligence market helps evaluate its growth potential and long-term viability.

H3: Risks and Rewards of Investing in MicroStrategy:

Investing in MicroStrategy presents a unique blend of risks and rewards. The high correlation between MicroStrategy's stock price and Bitcoin's price means significant potential gains, but equally significant potential losses. This volatility is a crucial factor to consider.

- Diversification benefits/lack thereof: Investing solely in MicroStrategy for Bitcoin exposure offers limited diversification benefits compared to a diversified portfolio.

- Potential for future acquisitions/divestitures: MicroStrategy's future acquisitions or divestitures could significantly impact its stock price, independent of Bitcoin's performance.

- Management expertise and track record: The expertise and track record of MicroStrategy's management team play a crucial role in the company's success and should be carefully evaluated.

H2: Bitcoin's Future and Investment Potential in 2025

H3: Bitcoin's Technological Underpinnings and Adoption:

Bitcoin's underlying technology, the blockchain, continues to evolve. Layer-2 solutions aim to improve scalability and transaction speed, addressing some of Bitcoin's limitations. Wider adoption hinges on several factors, including regulatory clarity, improved infrastructure, and increased user-friendliness.

- Layer-2 solutions: The development and adoption of Layer-2 solutions are critical for Bitcoin's long-term scalability and usability.

- Institutional adoption rates: The increasing involvement of institutional investors is a significant driver of Bitcoin's price and overall market stability.

- Global regulatory landscape: The evolving regulatory landscape across different jurisdictions significantly impacts Bitcoin's accessibility and usability.

H3: Bitcoin's Price Volatility and Risk Assessment:

Bitcoin's price has historically been extremely volatile, experiencing periods of dramatic price swings. Predicting future price movements is inherently challenging, although macroeconomic conditions, technological advancements, and regulatory developments can significantly influence Bitcoin's price. Risk management strategies are crucial for navigating this volatility.

- Dollar cost averaging: This strategy involves investing a fixed amount of money at regular intervals, mitigating the impact of price volatility.

- Risk tolerance assessment: Investors should carefully assess their risk tolerance before investing in Bitcoin due to its inherent volatility.

- Portfolio diversification strategies: Diversifying investments across different asset classes can reduce overall portfolio risk.

H3: Risks and Rewards of Direct Bitcoin Investment:

Direct Bitcoin investment offers maximum exposure to its price fluctuations, leading to potentially high returns but also significant losses. Security and management of Bitcoin investments require careful attention.

- Security risks of private keys: Losing access to private keys can result in the permanent loss of Bitcoin holdings.

- Tax implications of Bitcoin gains: Understanding the tax implications of Bitcoin gains is crucial for investors in all jurisdictions.

- Potential for future technological disruption: While unlikely, technological advancements could potentially disrupt Bitcoin's dominance in the cryptocurrency market.

H2: MicroStrategy vs. Bitcoin: A Comparative Analysis

| Feature | MicroStrategy Investment | Direct Bitcoin Investment |

|---|---|---|

| Risk Profile | Moderate to High (correlated with Bitcoin) | Very High |

| Potential Return | Moderate to High (correlated with Bitcoin) | Very High (but also very high loss potential) |

| Liquidity | High (publicly traded stock) | Moderate (exchange dependent) |

| Suitability | Moderately risk-tolerant investors | High-risk tolerance, long-term perspective |

| Diversification | Limited (correlated with Bitcoin) | Requires significant portfolio diversification |

Investing in MicroStrategy offers a less volatile, albeit indirect, exposure to Bitcoin, while direct investment provides maximum exposure but with significantly higher risk. The choice depends on your risk tolerance and investment horizon.

Conclusion:

This comparative analysis of MicroStrategy vs Bitcoin Investment in 2025 highlights the distinct risk-reward profiles of each option. While MicroStrategy offers a more indirect exposure to Bitcoin with the added layer of its business operations, direct Bitcoin investment provides maximum exposure but carries greater volatility. The optimal choice depends significantly on your individual risk tolerance, investment goals, and understanding of the cryptocurrency market. Before making any investment decisions, conduct thorough research and consider consulting a financial advisor experienced in digital assets. Remember to carefully weigh the benefits of MicroStrategy vs Bitcoin Investment based on your personal circumstances. Consider your personal risk tolerance and investment goals when deciding between a MicroStrategy vs Bitcoin investment strategy.

Featured Posts

-

Pnjab Myn Pwlys Afsran Ky Tbdylyan 8 Ays Pyz Awr 21 Dy Ays Pyz Mtathr

May 08, 2025

Pnjab Myn Pwlys Afsran Ky Tbdylyan 8 Ays Pyz Awr 21 Dy Ays Pyz Mtathr

May 08, 2025 -

Re Examining The Thunder Bulls Offseason Trade A Look At The Actual Events

May 08, 2025

Re Examining The Thunder Bulls Offseason Trade A Look At The Actual Events

May 08, 2025 -

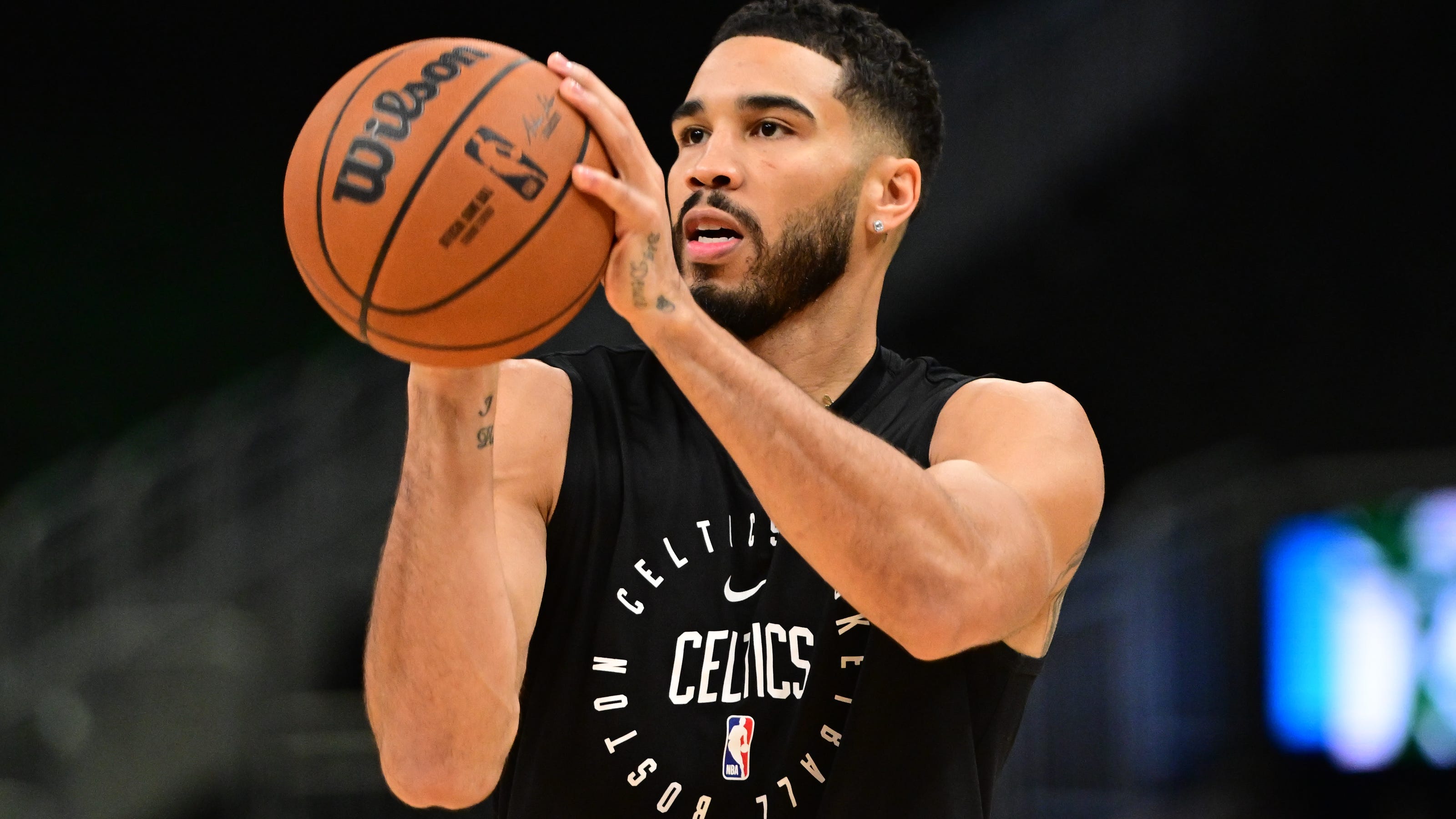

Jayson Tatum On Steph Curry A Candid All Star Game Reflection

May 08, 2025

Jayson Tatum On Steph Curry A Candid All Star Game Reflection

May 08, 2025 -

Tfasyl Isabt Barbwza Fy Merkt Marakana

May 08, 2025

Tfasyl Isabt Barbwza Fy Merkt Marakana

May 08, 2025 -

Visible Pain Assessing Jayson Tatums Ankle Injury Severity

May 08, 2025

Visible Pain Assessing Jayson Tatums Ankle Injury Severity

May 08, 2025