CoreWeave, Inc. (CRWV): Explaining The Recent Stock Price Increase

Table of Contents

Strong Growth in the AI Computing Market

The explosive growth of artificial intelligence (AI) is fueling an unprecedented demand for high-performance computing resources. This surge in AI adoption across various sectors is directly impacting the demand for cloud computing services. CoreWeave's specialized infrastructure is perfectly positioned to capitalize on this trend.

Increased Demand for AI Infrastructure

- CoreWeave's cloud-based infrastructure offers scalable GPU computing power, a critical component for training large language models (LLMs) and other demanding AI applications. This scalability is a key differentiator in the competitive cloud computing market.

- The company's focus on sustainability and energy efficiency is also attracting environmentally conscious clients. This commitment to ESG (Environmental, Social, and Governance) factors is increasingly important for many businesses and investors.

- Increased adoption of AI across various sectors (healthcare, finance, autonomous vehicles, etc.) is directly contributing to higher demand for CoreWeave's services. The expansion of AI into new industries ensures a consistently growing market for CoreWeave's offerings.

Strategic Partnerships and Collaborations

CoreWeave's strategic alliances with major technology players enhance its market reach and credibility, further boosting the CoreWeave stock.

- Partnerships provide access to new customer segments and technological advancements. These collaborations allow CoreWeave to leverage existing networks and expertise.

- Collaborations can lead to innovative solutions and enhanced product offerings. This constant innovation keeps CoreWeave ahead of the competition.

- Strong partnerships boost investor confidence and contribute to a positive market perception. These strategic relationships signal stability and growth potential.

CoreWeave's Competitive Advantages

CoreWeave's success isn't just about market timing; it's about possessing significant competitive advantages that differentiate them within the cloud computing sector.

Superior Technology and Infrastructure

CoreWeave boasts a cutting-edge infrastructure designed specifically for high-performance computing.

- Its use of advanced GPUs and optimized software provides superior performance compared to competitors. This translates to faster processing times and improved efficiency for clients.

- The company’s commitment to innovation and technological advancement sets it apart. CoreWeave consistently invests in R&D to maintain its technological leadership.

- This technological edge attracts high-profile clients seeking unparalleled computing power. Demand for leading-edge technology drives revenue growth and strengthens the CoreWeave stock.

Efficient and Scalable Operations

CoreWeave's cloud-based model enables efficient scaling to meet fluctuating demand. This operational efficiency is a critical factor influencing the CoreWeave stock price.

- This scalability allows the company to quickly adapt to market changes and emerging opportunities. CoreWeave can readily expand its resources to meet growing demand.

- Efficient operations contribute to higher profitability and stronger financial performance. Cost-effectiveness is a key driver of long-term success.

- Scalability is a major draw for large-scale AI projects demanding immense computing resources. This capacity to handle massive workloads is a key selling point.

Positive Market Sentiment and Investor Confidence

Positive market sentiment and growing investor confidence are key indicators impacting the CoreWeave stock.

Strong Financial Performance

CoreWeave's impressive financial results, including revenue growth and profitability, have bolstered investor confidence. (Note: Include specific data points from financial reports if available, such as revenue growth percentages and profitability margins.)

- Positive earnings reports and financial forecasts reinforce a positive outlook for the stock. Consistent financial success reassures investors.

- Demonstrated profitability contributes to higher valuations and increased investor interest. Profitability is a major driver of stock price appreciation.

- Strong financial performance attracts institutional investors seeking high-growth opportunities. Large investors are drawn to companies demonstrating sustained growth.

Growing Market Share

CoreWeave's increasing market share in the AI infrastructure sector is a clear indicator of its success and a major factor influencing CoreWeave stock.

- Market share growth demonstrates the company's ability to compete effectively and attract customers. Market share growth indicates strong market positioning.

- Expansion of market share translates to higher revenue and increased profitability. Larger market share leads to increased revenue and stronger profits.

- Growing market share signals a strong future outlook for the company. A positive trajectory in market share reflects future growth potential.

Conclusion

The recent increase in CoreWeave stock price can be attributed to a confluence of factors, including the booming AI computing market, CoreWeave's competitive advantages, and positive investor sentiment. The company's innovative technology, strategic partnerships, strong financial performance, and growing market share all contribute to a bullish outlook for CoreWeave stock. Staying informed about CoreWeave's progress and developments is crucial for investors interested in this dynamic segment of the technology sector. For those seeking exposure to the growth of AI and high-performance computing, understanding the factors driving the CoreWeave stock price is essential. Continue your research on CoreWeave stock and consider its potential in your investment portfolio. Remember to conduct thorough due diligence before making any investment decisions related to CoreWeave stock or any other security.

Featured Posts

-

Two Israeli Embassy Staff Members Killed In Washington Dc Shooting Ap Images

May 22, 2025

Two Israeli Embassy Staff Members Killed In Washington Dc Shooting Ap Images

May 22, 2025 -

Conquering Financial Challenges Strategies To Manage Limited Funds

May 22, 2025

Conquering Financial Challenges Strategies To Manage Limited Funds

May 22, 2025 -

Grocery Price Increases Outpace Inflation For Third Consecutive Month

May 22, 2025

Grocery Price Increases Outpace Inflation For Third Consecutive Month

May 22, 2025 -

University Of Wyoming Releases Documentary On Pronghorn Winter Survival

May 22, 2025

University Of Wyoming Releases Documentary On Pronghorn Winter Survival

May 22, 2025 -

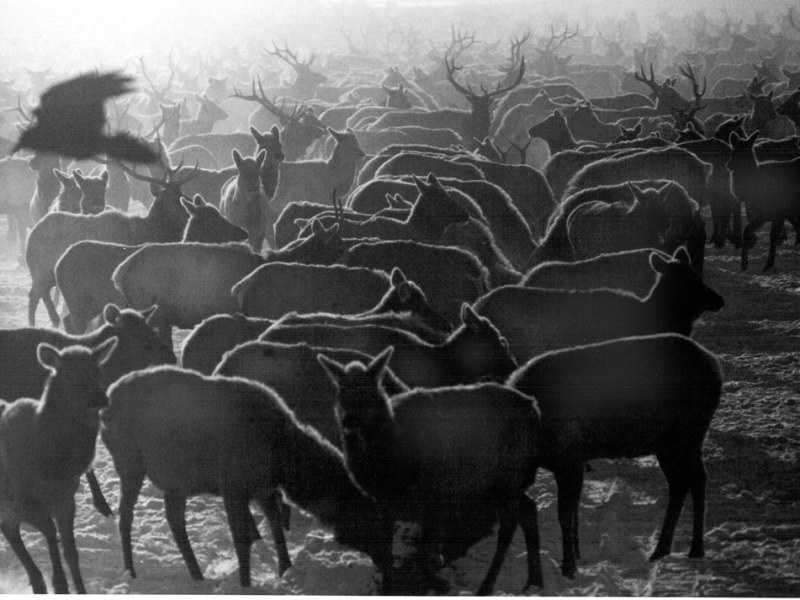

Jackson Hole Elk Feedground Cwd Confirmation And Implications

May 22, 2025

Jackson Hole Elk Feedground Cwd Confirmation And Implications

May 22, 2025