CoreWeave, Inc. (CRWV) Stock Surge Explained: Thursday's Price Jump

Table of Contents

Potential Catalysts Behind the CoreWeave (CRWV) Stock Jump

Several factors could have contributed to the remarkable increase in CoreWeave (CRWV) stock price on Thursday. Let's explore some of the most likely catalysts:

Positive Earnings Report or Pre-Earnings Guidance

A positive earnings report or unexpectedly strong pre-earnings guidance could be a significant driver of the CRWV stock surge. While specifics weren't immediately available at the time of this writing, potential contributing factors could include:

- Revenue Growth: A significant increase in year-over-year revenue, exceeding analyst expectations, would undoubtedly boost investor confidence. Strong growth in cloud computing services, particularly those tailored for AI applications, would be a key indicator.

- Earnings Per Share (EPS) Beat: Exceeding projected EPS targets showcases the company's profitability and efficiency, attracting more investors.

- Upward Revisions to Future Guidance: Positive revisions to future revenue and earnings projections signal optimism about CoreWeave's growth trajectory and future performance. These projections, particularly those concerning AI-related services, would be closely watched by investors.

- Financial Results: Any other positive financial metrics from the earnings report could influence the positive market reaction.

Increased Investor Confidence in the AI Market

CoreWeave's strong position in the rapidly expanding AI market likely plays a significant role in the stock surge. The increasing demand for powerful cloud computing resources to fuel AI applications is a major tailwind for the company.

- Demand for AI Infrastructure: The booming AI sector necessitates robust cloud infrastructure to handle the massive computational demands of machine learning and deep learning algorithms. CoreWeave's specialized infrastructure is well-positioned to capitalize on this demand.

- Strategic Partnerships and Deals: Recent partnerships or significant deals with major AI players could have boosted investor confidence, demonstrating CoreWeave’s market leadership and future growth potential.

- Competitor Performance: Positive performance from competitors in the AI cloud computing space could indicate a generally positive sentiment towards the sector, indirectly benefiting CoreWeave.

Analyst Upgrades and Price Target Increases

Positive changes in analyst ratings and increased price targets can significantly impact a stock's price. Any upgrades from influential analysts could have triggered a buying frenzy.

- Buy Ratings and Outperform Ratings: An influx of "buy" or "outperform" ratings from respected financial analysts would indicate a positive outlook on CoreWeave's future performance, driving increased demand for the stock.

- Increased Price Targets: Higher price targets set by analysts suggest that the stock is undervalued and has further upside potential. This can create a positive feedback loop, attracting more investors and driving the price higher. For example, [Link to reputable financial news source about analyst upgrades, if available].

Market-Wide Factors and Sector Trends

Broader market trends and sector-specific factors can also influence the CRWV stock price.

- Overall Market Sentiment: A generally bullish market sentiment could lift many stocks, including CoreWeave. Positive economic news or overall investor optimism could contribute to this upward movement.

- Cloud Computing Sector Performance: Strong performance within the broader cloud computing sector might reflect a positive view on the technology's future, benefiting CoreWeave as a key player in this sector.

- Macroeconomic Factors: Positive macroeconomic indicators such as low interest rates or strong economic growth can influence investor behavior and lead to increased investment in growth stocks.

Analyzing the Sustainability of the CoreWeave (CRWV) Stock Surge

While the Thursday surge is exciting, understanding its sustainability is crucial for investors.

Short-Term vs. Long-Term Implications

- Temporary Fluctuation or Fundamental Shift?: The price jump might represent a temporary market reaction to short-term news or a more fundamental shift in investor perception of CoreWeave's long-term potential. More data is needed to determine this.

- Potential Risks and Future Challenges: Factors like increased competition, economic downturns, or technological disruptions could pose risks to CoreWeave's continued success and impact the sustainability of the stock's price.

Evaluating CRWV's Valuation and Future Prospects

- Key Metrics: Analyzing metrics such as the Price-to-Earnings ratio (P/E), revenue growth rates, and market capitalization helps assess whether the current stock price accurately reflects CoreWeave's intrinsic value and future growth potential.

- Growth Potential: CoreWeave's innovative business model and strong market position in the rapidly expanding AI cloud computing space offer substantial growth potential, but this needs to be carefully weighed against potential risks.

Risk Factors and Potential Downsides

- Competition: The cloud computing market is highly competitive, and the emergence of new players or increased competition from established giants could pose a significant challenge.

- Economic Downturns: Economic recessions can reduce demand for cloud computing services, impacting CoreWeave's revenue and profitability.

- Technological Disruptions: Rapid technological advancements could render CoreWeave's technology obsolete, impacting its competitive advantage.

Conclusion: Understanding the CoreWeave (CRWV) Stock Surge and its Future

The CoreWeave (CRWV) stock surge on Thursday was likely driven by a combination of factors, including potentially positive earnings news, increased investor confidence in the AI market, analyst upgrades, and broader market trends. However, the sustainability of this increase remains to be seen. While the CoreWeave (CRWV) stock surge offers intriguing possibilities, thorough due diligence on CoreWeave stock is crucial before investing. Carefully consider the company's valuation, future prospects, and potential risks before making any investment decisions. Conduct further research and, if necessary, seek professional financial advice to make informed investment choices regarding CoreWeave (CRWV) stock.

Featured Posts

-

Uw Documentary Pronghorn Survival Following Devastating Winter

May 22, 2025

Uw Documentary Pronghorn Survival Following Devastating Winter

May 22, 2025 -

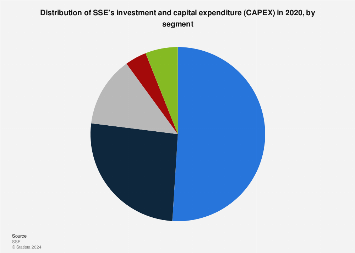

Sse Responds To Slowing Growth With 3 Billion Spending Reduction

May 22, 2025

Sse Responds To Slowing Growth With 3 Billion Spending Reduction

May 22, 2025 -

5 Podcasts De Misterio Suspenso Y Terror Recomendaciones Para Adictos A La Adrenalina

May 22, 2025

5 Podcasts De Misterio Suspenso Y Terror Recomendaciones Para Adictos A La Adrenalina

May 22, 2025 -

The Goldbergs The Evolution Of The Goldberg Family Throughout The Series

May 22, 2025

The Goldbergs The Evolution Of The Goldberg Family Throughout The Series

May 22, 2025 -

Bbc Breakfast Presenters Are You Still There Moment Guest Interruption

May 22, 2025

Bbc Breakfast Presenters Are You Still There Moment Guest Interruption

May 22, 2025