Credit Suisse Whistleblower Settlement: Up To $150 Million Awarded

Table of Contents

Details of the Credit Suisse Whistleblower Case

The Allegations

The Credit Suisse whistleblower settlement stems from serious allegations of financial misconduct. The specifics of the case remain partially confidential due to legal agreements, but reports indicate allegations involving fraudulent activities, potentially including securities fraud, market manipulation, and significant regulatory breaches. These alleged actions violated various financial regulations and ethical guidelines, jeopardizing investor confidence and potentially causing substantial financial harm. The exact nature of the fraudulent activities is still emerging, but the sheer scale of the settlement points to a wide-ranging and serious breach of trust. Keywords related to the allegations include: fraudulent activities, securities fraud, market manipulation, regulatory breaches, insider trading (if applicable).

The Whistleblower's Role

The whistleblower played a pivotal role in bringing this misconduct to light. Their courageous act involved providing substantial inside information, including crucial evidence and confidential information, to the relevant authorities. The timing of their disclosure was also critical, allowing investigators to act swiftly and effectively. Their contribution was instrumental in the SEC investigation and subsequent settlement, demonstrating the power of a single individual to expose widespread wrongdoing. Key terms related to the whistleblower's role include: inside information, evidence, confidential information, courageous act, whistleblower protection.

The SEC's Investigation

The Securities and Exchange Commission (SEC) launched a thorough investigation following the whistleblower's report. The SEC's involvement was crucial in validating the allegations, gathering evidence, and ultimately facilitating the record-breaking settlement. This highlights the SEC's commitment to enforcing securities laws and protecting investors from fraudulent activities. The investigation underscores the importance of regulatory compliance and the consequences of failing to adhere to these regulations. Relevant keywords for this section: SEC investigation, enforcement action, regulatory compliance, investigation timeline.

- Specific examples of alleged misconduct: (While specifics remain largely confidential, examples could be broadly cited, such as potential manipulation of financial statements, improper accounting practices, or participation in illegal schemes.)

- Timeline of events: (A timeline should outline key dates from the initial whistleblowing, the SEC investigation, and the eventual settlement.)

- Key individuals involved: (While names may not be publicly available due to confidentiality, the roles of key players, such as the whistleblower, SEC investigators, and Credit Suisse executives, can be described.)

The Significance of the $150 Million Settlement

Record-Breaking Award

The $150 million settlement is unprecedented in the context of whistleblower awards. It sets a new benchmark, signaling a stronger commitment to rewarding individuals who expose corporate wrongdoing. This substantial award sends a clear message that whistleblowing is not only morally right but can also be financially rewarding. This significantly increases the incentive for others to come forward with information about corporate misconduct.

Impact on Corporate Culture

This settlement has profound implications for corporate culture and compliance programs within Credit Suisse and the broader financial industry. The sheer size of the payout emphasizes the high cost of ignoring ethical lapses and the necessity for robust internal controls. Financial institutions are likely to re-evaluate their compliance measures and ethics training programs in light of this case. The emphasis is shifting towards a culture of proactive compliance and ethical decision-making.

Deterrent Effect

The substantial reward serves as a powerful deterrent against future financial misconduct. The potential financial penalties associated with unethical behavior are now dramatically higher, increasing the risk for companies and individuals considering engaging in such activities. This potentially leads to a more ethical and transparent financial landscape.

- Comparison with previous whistleblower settlements: (Compare the $150 million award to previous high-profile settlements to highlight its exceptional nature.)

- Potential impact on shareholder value: (Discuss the potential impact of the settlement on Credit Suisse's stock price and shareholder confidence.)

- Implications for the future of corporate governance: (Analyze the potential changes in corporate governance practices resulting from this case.)

Implications for Future Whistleblowers

Encouraging Reporting

This settlement sends a powerful message, encouraging potential whistleblowers to come forward and report suspected illegal or unethical activities. The substantial reward demonstrates that there is a strong support system in place for those willing to risk reporting wrongdoing. This creates a greater incentive for individuals to report misconduct, even if it carries significant personal risks.

Importance of Whistleblower Protection

The Credit Suisse case highlights the vital importance of whistleblower protection laws and programs. These safeguards are essential to protect individuals who report wrongdoing from retaliation. Whistleblowing can be risky, and robust legal protections are crucial to ensure that those who come forward are shielded from potential consequences. Strong whistleblower protections are paramount for a just and transparent society.

Seeking Legal Counsel

Individuals who suspect illegal activity within their organizations should seek legal counsel to protect their rights and understand the complexities of filing a whistleblower complaint. Legal professionals can advise on the best course of action, ensuring that the process is conducted safely and effectively. This support is crucial in navigating the potential challenges and legal complexities involved in whistleblowing.

- Key benefits of whistleblowing: (List the benefits, such as contributing to a more ethical workplace, preventing further harm, and potentially receiving a financial reward.)

- Steps to take if you suspect illegal activity: (Provide a concise outline of steps to take, including documenting evidence and considering legal counsel.)

- Resources for whistleblowers: (List resources such as the SEC's whistleblower program website and legal aid organizations.)

Conclusion

The Credit Suisse whistleblower settlement, with its record-breaking $150 million award, marks a significant turning point in corporate accountability. The case underscores the critical role whistleblowers play in exposing financial fraud and highlights the importance of robust whistleblower protection laws. This landmark settlement is a testament to the power of individuals to challenge corporate wrongdoing and create a more transparent and ethical financial system. If you have information regarding potential financial misconduct, consider reporting it. Protect yourself and help expose corporate wrongdoing. Learn more about whistleblower rights and rewards. Understanding the Credit Suisse whistleblower case is crucial for promoting corporate transparency.

Featured Posts

-

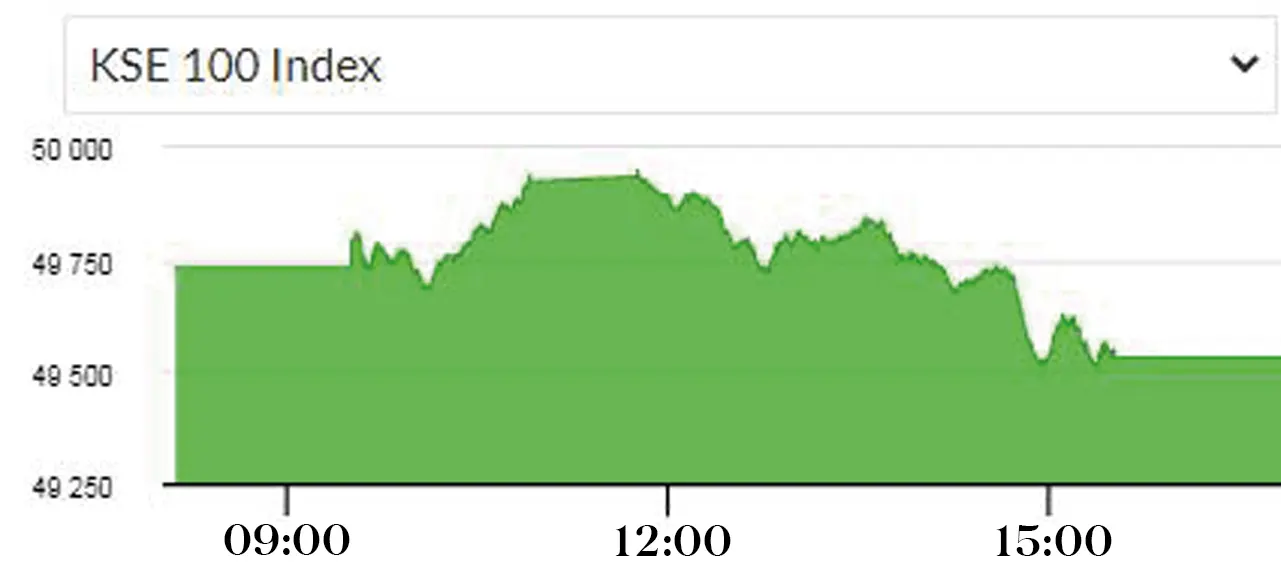

Pakistani Market Instability Causes Stock Exchange Portal Outage

May 09, 2025

Pakistani Market Instability Causes Stock Exchange Portal Outage

May 09, 2025 -

Did The Fentanyl Crisis Open Doors For Us China Trade Talks

May 09, 2025

Did The Fentanyl Crisis Open Doors For Us China Trade Talks

May 09, 2025 -

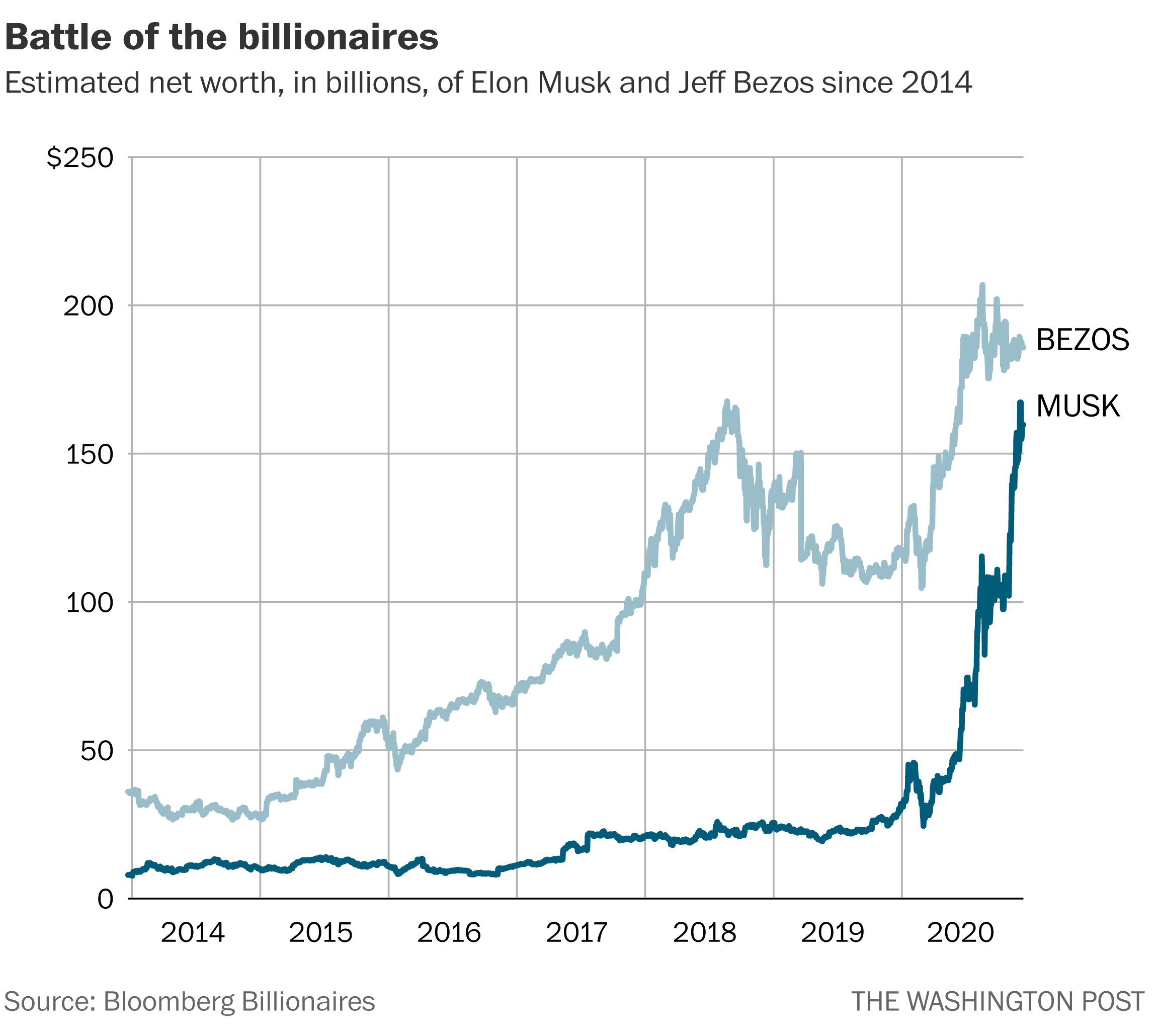

100 Days Of Trump Tracking The Changes In Elon Musks Net Worth

May 09, 2025

100 Days Of Trump Tracking The Changes In Elon Musks Net Worth

May 09, 2025 -

Red Bulls Driver Dilemma Colapinto Or Lawson

May 09, 2025

Red Bulls Driver Dilemma Colapinto Or Lawson

May 09, 2025 -

Russia Ukraine War Putins Victory Day Ceasefire Explained

May 09, 2025

Russia Ukraine War Putins Victory Day Ceasefire Explained

May 09, 2025