Crude Oil Price Report: April 23rd Market News And Insights

Table of Contents

Geopolitical Factors Influencing Crude Oil Prices on April 23rd

Geopolitical instability is a major driver of crude oil price fluctuations. On April 23rd, several events contributed to market uncertainty. Analyzing these events and their impact on supply and demand is crucial for understanding the price movements.

- Specific geopolitical event 1 and its effect on oil prices: (Example: Increased tensions in the Middle East led to concerns about potential supply disruptions, resulting in a price surge of approximately 2% in the early trading hours.) The keyword "geopolitical uncertainty" accurately describes the market sentiment at this time.

- Specific geopolitical event 2 and its effect on oil prices: (Example: The ongoing conflict in Eastern Europe continued to exert pressure on global energy markets, adding to existing "oil supply disruption" fears and keeping prices elevated.) This event further highlighted the impact of geopolitical instability on global oil markets.

- Potential future geopolitical risks and their likely impact on crude oil prices: Looking ahead, continued unrest in volatile regions could create significant "oil supply disruption," causing further price spikes. The overall "geopolitical uncertainty" surrounding global oil production is a significant risk factor for investors.

OPEC+ Decisions and Their Influence on Crude Oil Prices

OPEC+ decisions have a profound impact on crude oil supply and, consequently, prices. Any announcements or meetings around April 23rd needed to be considered when analyzing price movements.

- Summary of OPEC+ meeting outcomes: (Example: OPEC+ announced a modest increase in production quotas, less than anticipated by many analysts.) This decision directly influenced "crude oil supply" levels.

- Impact on global oil supply: The relatively small increase in production quotas failed to ease concerns about "crude oil supply" tightness, contributing to the ongoing upward pressure on prices.

- Analysis of market reaction to the OPEC+ decisions: The market reacted negatively to the perceived lack of substantial production increases, indicating that the OPEC+ decisions were not sufficient to counter existing market concerns. The "oil price forecast" models of several major financial institutions needed to be recalibrated following this announcement. This demonstrates the influence of OPEC+ production cuts on the global crude oil market.

Economic Data and Market Sentiment

Economic data releases and the overall market sentiment significantly impact investor decisions and, therefore, crude oil prices. The correlation between economic indicators and crude oil price movements is essential to consider.

- Specific economic data released and its effect on oil prices: (Example: A stronger-than-expected inflation report fueled concerns about potential interest rate hikes, which could dampen economic growth and subsequently reduce "oil demand," putting downward pressure on prices.) This demonstrates the impact of macroeconomic factors on the crude oil market.

- Analysis of investor sentiment (bullish or bearish): Overall, investor sentiment on April 23rd leaned slightly bearish due to inflation concerns and the relatively underwhelming OPEC+ announcement. This "investor confidence" in the short-term oil price outlook was subdued.

- Mention of key economic indicators affecting oil demand (e.g., industrial production, global trade): Strong "economic growth" typically boosts "oil demand," while indicators like weakening global trade can lead to a decline in oil consumption. Closely monitoring these factors is key to anticipating price changes.

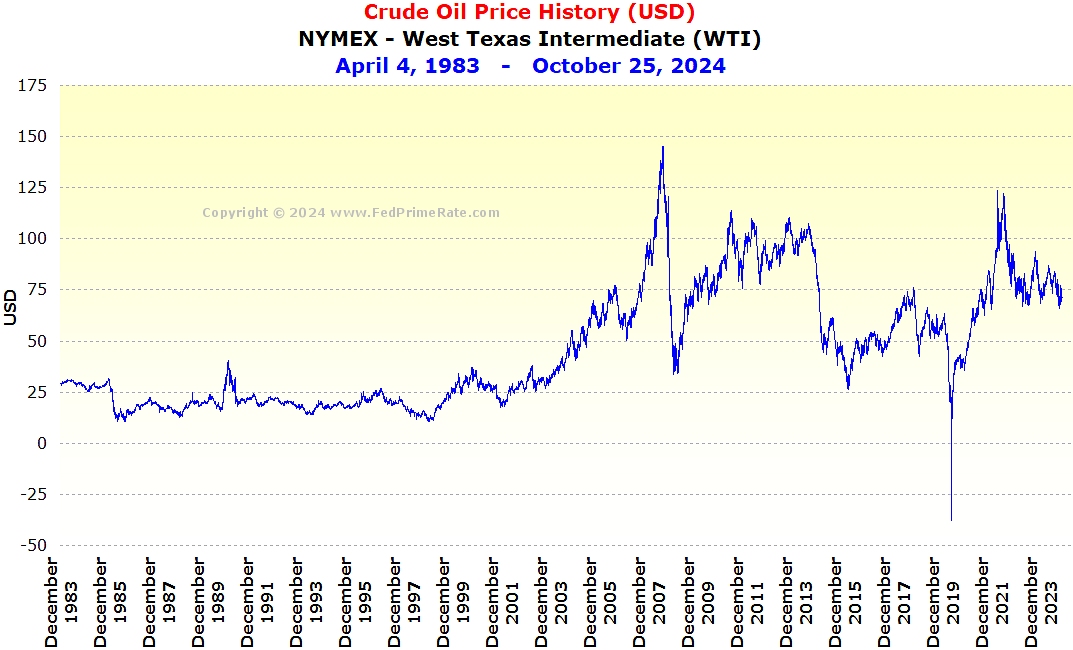

Technical Analysis of Crude Oil Price Movements on April 23rd

Technical analysis provides another layer of understanding of price movements. Examining the crude oil chart for April 23rd reveals important insights.

- Key support and resistance levels: (Example: The $80 per barrel level acted as significant support, while resistance was seen around $85.) Identifying these levels is crucial for short-term "price forecast" predictions.

- Trading volume analysis: (Example: High trading volume around the $80 support level indicated strong market interest in this price point.) Volume analysis confirms the significance of support and resistance levels.

- Key candlestick patterns observed: (Example: A bullish engulfing pattern suggested a potential reversal of the downward trend.) Candlestick patterns offer valuable insights into potential future price movements. This "technical analysis" helps confirm or refute other price predictions.

Crude Oil Price Report: Key Takeaways and Future Outlook

On April 23rd, crude oil prices experienced fluctuations driven by a complex interplay of factors. Geopolitical events created uncertainty, OPEC+ decisions fell short of market expectations, economic data pointed to potential headwinds, and technical analysis hinted at both support and resistance levels. Prices overall remained relatively stable, however.

Considering these factors, the short-term "crude oil price forecast" remains uncertain, influenced by ongoing geopolitical tension and economic data releases. For more in-depth "Crude Oil Price Reports" and to stay ahead of market fluctuations, subscribe to our email alerts or follow us on social media for daily updates. Regularly checking our "Crude Oil Price Reports" will allow you to make more informed investment decisions.

Featured Posts

-

Trump Administrations Response To Harvards Lawsuit Open To Negotiation

Apr 24, 2025

Trump Administrations Response To Harvards Lawsuit Open To Negotiation

Apr 24, 2025 -

Open Ais Chat Gpt Facing Scrutiny From The Federal Trade Commission

Apr 24, 2025

Open Ais Chat Gpt Facing Scrutiny From The Federal Trade Commission

Apr 24, 2025 -

Eu Targets Russian Gas Spot Market Phaseout Discussion

Apr 24, 2025

Eu Targets Russian Gas Spot Market Phaseout Discussion

Apr 24, 2025 -

Kako Izgleda Ella Travolta Danas

Apr 24, 2025

Kako Izgleda Ella Travolta Danas

Apr 24, 2025 -

Epa Crackdown On Tesla And Space X Elon Musk And Doges Response

Apr 24, 2025

Epa Crackdown On Tesla And Space X Elon Musk And Doges Response

Apr 24, 2025