EU Targets Russian Gas: Spot Market Phaseout Discussion

Table of Contents

<p>The European Union's dependence on Russian natural gas has been a significant vulnerability, exposed dramatically by geopolitical events. This article delves into the ongoing discussions surrounding a potential phaseout of the EU's reliance on Russian gas purchased through the spot market, exploring the challenges, opportunities, and implications for the energy landscape. We will examine the complexities involved in such a transition and assess the potential impacts on EU member states. Understanding the intricacies of the EU Russian Gas Spot Market is crucial for navigating this critical juncture.</p>

<h2>The Urgency for Diversification: Reducing Dependence on Russian Gas</h2>

<h3>Geopolitical Instability and Energy Security</h3>

<p>Relying on a single major supplier for a crucial resource like natural gas presents significant security risks, especially when geopolitical relations are volatile. The EU Russian Gas Spot Market has highlighted this vulnerability.</p>

<ul> <li>Increased vulnerability to supply disruptions</li> <li>Susceptibility to price manipulation</li> <li>Exposure to political leverage</li> </ul>

<p>Past disruptions, such as the 2006 and 2009 gas crises, demonstrated the severe consequences of dependence on Russian gas. These events led to sharp increases in household energy bills, disruptions to industrial production, and economic instability across the EU. Diversifying away from the EU Russian Gas Spot Market is essential to mitigate these risks.</p>

<h3>Accelerating Renewable Energy Sources</h3>

<p>Transitioning to renewable energy sources is a key component of reducing reliance on imported gas and strengthening energy independence. The EU Green Deal aims to accelerate this shift.</p>

<ul> <li>Massive investments in wind and solar power</li> <li>Development of other renewable energy technologies (geothermal, biomass, etc.)</li> <li>Addressing challenges related to intermittency and grid stability</li> </ul>

<p>Substantial investment is needed to achieve a significant shift towards renewables within a reasonable timeframe. This includes upgrading the existing energy infrastructure to accommodate the influx of renewable energy sources and ensuring their seamless integration into the energy grid. This long-term strategy is crucial for reducing dependence on the EU Russian Gas Spot Market.</p>

<h2>The Challenges of a Spot Market Phaseout</h2>

<h3>Immediate Supply Gaps and Price Volatility</h3>

<p>Replacing Russian gas supplies from the spot market immediately presents significant short-term challenges. The transition requires careful planning and strategic implementation.</p>

<ul> <li>Potential for energy shortages</li> <li>Increased energy prices impacting consumers and businesses</li> <li>Significant economic consequences for EU nations</li> </ul>

<p>Alternative suppliers may not possess the capacity to fully meet EU demand instantly. While LNG imports and pipeline diversification from other regions are vital, they require substantial investment and infrastructural development. Successfully navigating this transition requires a well-defined plan to mitigate the risks associated with exiting the EU Russian Gas Spot Market.</p>

<h3>Economic Impact on EU Member States</h3>

<p>The EU's member states exhibit varying levels of dependence on Russian gas. A complete phaseout will have diverse economic impacts across the region.</p>

<ul> <li>Impact on energy-intensive industries like manufacturing and chemicals</li> <li>Regional disparities in energy costs creating economic imbalances</li> <li>Potential for social unrest due to increased energy prices</li> </ul>

<p>Countries heavily reliant on Russian gas will face steeper economic challenges. Targeted support measures, diversification strategies, and energy efficiency programs are needed to mitigate the negative economic repercussions and ensure a just transition for all member states as the EU moves away from the EU Russian Gas Spot Market.</p>

<h2>Alternative Energy Strategies and Solutions</h2>

<h3>Strengthening LNG Infrastructure</h3>

<p>Expanding LNG import capabilities is essential for bridging the gap left by reduced Russian gas imports.</p>

<ul> <li>Investment in new LNG terminals and regasification facilities</li> <li>Development of pipeline infrastructure to distribute LNG</ul> <li>Securing long-term contracts with alternative LNG suppliers</li>

<p>This infrastructure expansion requires considerable investment and careful planning. Environmental considerations regarding LNG production and transportation must also be addressed to ensure a sustainable transition away from the EU Russian Gas Spot Market.</p>

<h3>Investing in Energy Efficiency Measures</h3>

<p>Reducing overall gas demand through energy efficiency measures is another crucial strategy.</p>

<ul> <li>Retrofitting buildings to improve insulation and reduce energy consumption</li> <li>Implementing energy efficiency improvements in industries</li> <li>Public awareness campaigns to promote energy conservation</li> </ul>

<p>Energy efficiency improvements can significantly reduce overall gas demand, thus lessening the impact of reducing reliance on the EU Russian Gas Spot Market. Policy incentives and financial support can accelerate the adoption of these measures.</p>

<h2>Conclusion</h2>

<p>The EU's phased reduction of its reliance on Russian gas through the spot market presents a monumental challenge requiring a multifaceted approach. Diversifying energy sources through renewables, strengthening LNG infrastructure, and implementing effective energy efficiency measures are crucial steps. While the transition may involve short-term economic difficulties, the long-term benefits of enhanced energy security and reduced geopolitical vulnerability are undeniable. The EU must continue its efforts to accelerate the transition, ensuring a secure and sustainable energy future. Further discussion and collaboration regarding the intricacies of the EU Russian Gas Spot Market are vital to navigate this complex undertaking successfully. A strategic and well-coordinated approach is essential for a successful transition away from the EU Russian gas spot market, ensuring energy security and a sustainable energy future for the EU.</p>

Featured Posts

-

Hollywood Shut Down Writers And Actors On Strike What It Means For Film And Tv

Apr 24, 2025

Hollywood Shut Down Writers And Actors On Strike What It Means For Film And Tv

Apr 24, 2025 -

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025 -

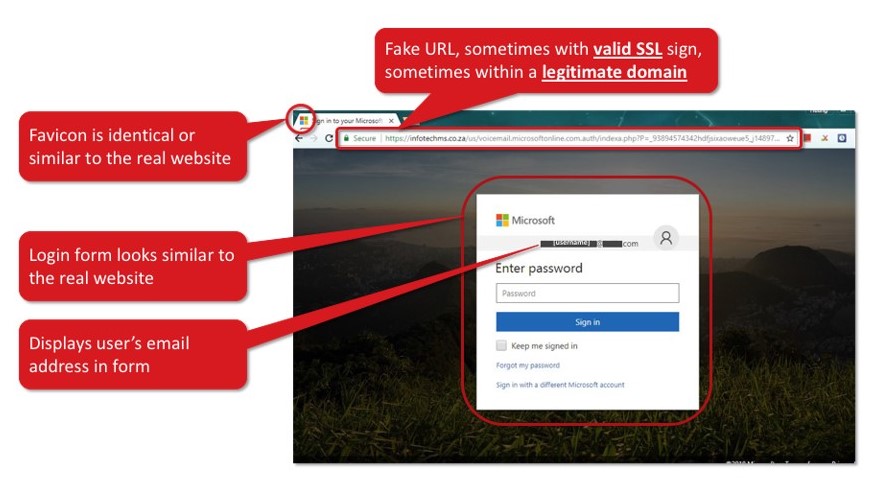

Office 365 Security Failure Leads To Multi Million Dollar Theft

Apr 24, 2025

Office 365 Security Failure Leads To Multi Million Dollar Theft

Apr 24, 2025 -

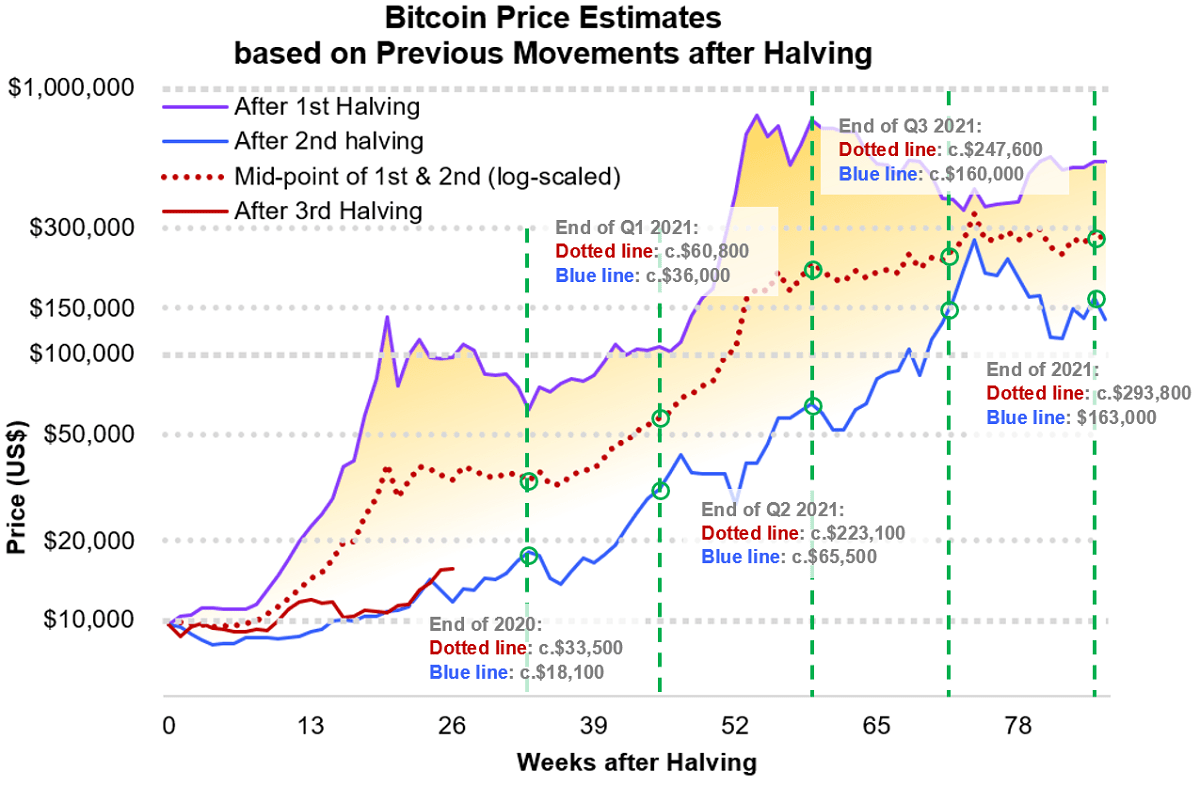

Trumps Trade Policy And The Federal Reserve How They Are Fueling Bitcoins Btc Growth

Apr 24, 2025

Trumps Trade Policy And The Federal Reserve How They Are Fueling Bitcoins Btc Growth

Apr 24, 2025 -

Klaus Schwab Under Scrutiny World Economic Forum Faces New Investigation

Apr 24, 2025

Klaus Schwab Under Scrutiny World Economic Forum Faces New Investigation

Apr 24, 2025