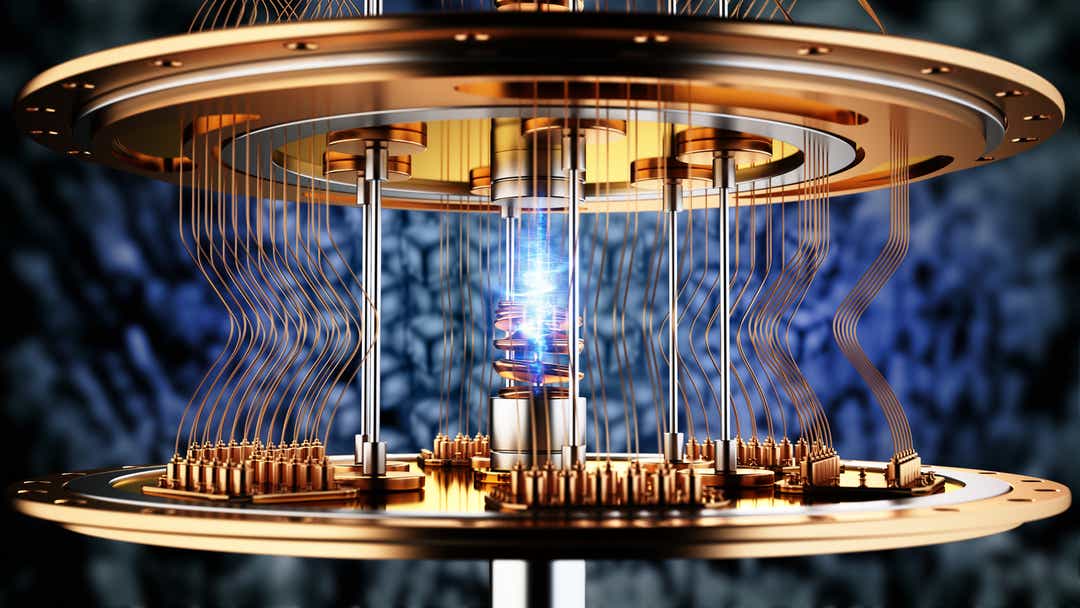

D-Wave Quantum (QBTS) Stock's Thursday Fall: Market Influences And Implications

Table of Contents

Market Influences Behind QBTS Stock's Fall:

Broad Market Downturn and Tech Sector Weakness:

Thursday's market witnessed a considerable downturn, impacting various sectors, including technology. The Nasdaq Composite, a key indicator of the technology sector's performance, also experienced a significant decline, indicating a broader market trend rather than an issue isolated to D-Wave Quantum.

- Rising Interest Rates: Increased interest rates have a chilling effect on growth stocks, like QBTS, as higher borrowing costs reduce profitability and investor appetite for riskier ventures.

- Inflationary Concerns: Persistent inflation and fears of an economic slowdown led investors to adopt a more conservative approach, shifting away from growth-oriented stocks like those in the quantum computing industry.

- Risk-Off Sentiment: A general risk-off sentiment prevailed in the market, pushing investors towards safer investments and away from more volatile assets, such as D-Wave Quantum stock.

Sector-Specific Factors Affecting Quantum Computing Stocks:

The quantum computing sector, while promising, is still relatively nascent. Several sector-specific factors might have contributed to the QBTS stock price fall.

- Intense Competition: The quantum computing landscape is becoming increasingly competitive, with several companies vying for market share. This competition can pressure stock prices, particularly for companies perceived as lagging behind.

- Slow Adoption Rate: The practical applications of quantum computing are still in their early stages, and the technology's adoption rate remains slow. This slow rollout can impact investor confidence in companies like D-Wave Quantum.

- Concerns about Quantum Annealing: D-Wave Quantum primarily utilizes quantum annealing, a specific approach to quantum computing. Concerns regarding the commercial viability and scalability of this approach compared to other methods (e.g., gate-based quantum computing) could also weigh on investor sentiment.

D-Wave Quantum Specific News and Announcements (if any):

[This section requires specific information. If any company-specific news (earnings reports, contract losses, etc.) influenced the stock price drop, details should be inserted here, along with links to relevant news sources. For example: "On Wednesday, D-Wave Quantum released its Q2 earnings report, showing lower-than-expected revenue growth. This news likely contributed to the subsequent stock price decline. [Link to news source]. Investors reacted negatively to the report's projections for the remaining year." ]

Implications of the QBTS Stock Price Drop:

Short-Term Implications:

The immediate impact of the QBTS stock price drop is felt by both investors and the company itself.

- Investor Confidence: The sharp decline has likely shaken investor confidence in D-Wave Quantum's short-term prospects.

- Further Price Declines: The possibility of further price declines in the short term cannot be ruled out, depending on market sentiment and any further news related to the company.

- Short-Term Trading Strategies: Short-term traders might react with different strategies, some opting to sell, while others may consider buying at a lower price point, anticipating a potential rebound.

Long-Term Implications:

The long-term consequences of this price drop could significantly impact D-Wave Quantum and the quantum computing industry.

- Funding and Investment: A lower stock price could make it more challenging for D-Wave Quantum to secure future funding and attract new investors.

- Strategic Adjustments: The company might be forced to adapt its business strategy in response to the market's negative reaction.

- Quantum Computing Market Outlook: The long-term outlook for the quantum computing market remains positive, but the QBTS stock price decline highlights the inherent risks and volatility associated with investing in this emerging technology.

Conclusion: Navigating the Volatility of D-Wave Quantum (QBTS) Stock

D-Wave Quantum (QBTS) stock's Thursday decline stemmed from a confluence of factors: a broader market downturn affecting the tech sector, sector-specific concerns regarding the quantum computing industry's growth, and potentially company-specific news. The short-term implications include decreased investor confidence and the potential for further price volatility. Long-term implications could include challenges in securing funding and necessitate strategic adjustments for D-Wave Quantum. Despite the challenges, the long-term prospects for the quantum computing sector remain promising. However, investing in D-Wave Quantum (QBTS) stock or any quantum computing stock requires careful consideration of the inherent volatility. Stay informed about D-Wave Quantum (QBTS) stock and the evolving quantum computing market to make informed investment decisions. Conduct thorough research and consult with a financial advisor before making any investment choices in this dynamic sector.

Featured Posts

-

Wayne Gretzky Fast Facts Records And Legacy

May 20, 2025

Wayne Gretzky Fast Facts Records And Legacy

May 20, 2025 -

D Wave Quantum Nyse Qbts Stock Drop Analyzing Kerrisdale Capitals Critique

May 20, 2025

D Wave Quantum Nyse Qbts Stock Drop Analyzing Kerrisdale Capitals Critique

May 20, 2025 -

Le Ivoire Tech Forum 2025 Accelerer La Transformation Digitale En Afrique

May 20, 2025

Le Ivoire Tech Forum 2025 Accelerer La Transformation Digitale En Afrique

May 20, 2025 -

Dusan Tadic Kariyerinin Yeni Bir Boeluemuene Hazirlaniyor

May 20, 2025

Dusan Tadic Kariyerinin Yeni Bir Boeluemuene Hazirlaniyor

May 20, 2025 -

Sell America Bonds Now Moodys Rating And Market Volatility

May 20, 2025

Sell America Bonds Now Moodys Rating And Market Volatility

May 20, 2025