David Rosenberg On Bank Of Canada: Too Timid, Too Late?

Table of Contents

Rosenberg's Criticism of the Bank of Canada's Monetary Policy

David Rosenberg, a highly respected voice in the financial world, has voiced strong concerns about the Bank of Canada's handling of inflation. His core argument centers on the belief that the central bank was slow to react to rising inflationary pressures, leading to a potentially more challenging situation down the line. He argues that this hesitancy could ultimately necessitate more drastic measures later, potentially leading to a deeper economic downturn.

His key criticisms include:

- Lagging behind inflation with interest rate hikes: Rosenberg contends that the Bank of Canada's interest rate increases have been too gradual and have not kept pace with the rapid rise in inflation. He suggests a more aggressive approach was needed earlier.

- Underestimating the persistence of inflation: He believes the Bank of Canada underestimated the stubbornness of inflation, failing to anticipate its prolonged impact on the Canadian economy. This miscalculation, he argues, delayed crucial interventions.

- Potential for policy errors leading to deeper economic consequences: Rosenberg warns that the Bank of Canada's delayed and measured response increases the risk of more severe economic consequences in the future, including a deeper and more prolonged recession.

- Comparison with other central banks’ approaches: Rosenberg often draws comparisons between the Bank of Canada’s approach and that of other central banks, such as the US Federal Reserve, highlighting what he perceives as a more decisive response from some of its counterparts. He suggests the Bank of Canada's comparatively cautious approach is flawed.

Analyzing the Bank of Canada's Actions and Rationale

The Bank of Canada, in its defense, maintains that its monetary policy decisions have been carefully considered and data-driven. They justify their approach with several arguments:

- Gradual approach to avoid triggering a recession: The Bank of Canada has emphasized its commitment to a gradual approach to avoid triggering a sharp economic contraction or a significant increase in unemployment. They argue that rapid interest rate hikes could have severe repercussions for the Canadian economy.

- Data-driven decision making and consideration of various economic indicators: They highlight their reliance on a wide range of economic data, including inflation rates, GDP growth, and unemployment figures, to inform their policy decisions. This data-driven approach, they claim, allows them to respond flexibly and avoid overly drastic measures.

- Potential risks of overreacting to short-term inflation spikes: The Bank of Canada has expressed concerns about the risks of overreacting to temporary or short-term inflation spikes, arguing that such reactions could unnecessarily harm economic growth.

The Potential Economic Consequences – Rosenberg's Predictions vs. Bank of Canada Forecasts

The divergence between Rosenberg's views and the Bank of Canada's projections leads to significantly different potential economic outcomes:

- Recessionary risks: Rosenberg predicts a higher likelihood of a recession, driven by the Bank of Canada's perceived slow response to inflation, while the Bank of Canada maintains that its approach minimizes the risk of a significant downturn.

- Inflation trajectory: Rosenberg anticipates inflation remaining higher for longer than the Bank of Canada's forecast suggests. This discrepancy highlights the disagreement in the assessment of how effectively monetary policy will bring inflation under control.

- Impact on employment and the Canadian job market: The differing perspectives also lead to varying forecasts regarding job creation and unemployment. Rosenberg's more pessimistic outlook implies potentially higher unemployment in the near future than the Bank of Canada’s more optimistic projections.

Alternative Monetary Policy Strategies and their Potential Impacts

Several alternative monetary policy strategies could have been adopted by the Bank of Canada. These include:

- More aggressive interest rate hikes: A more rapid increase in interest rates could have curbed inflation more swiftly, but might have also risked a sharper economic slowdown.

- Quantitative tightening: A more aggressive reduction of the Bank's balance sheet through quantitative tightening could have been implemented.

- Forward guidance: Clearer and more forceful forward guidance could have helped manage market expectations.

Each of these strategies carries both advantages and disadvantages. A more aggressive approach might have tamed inflation faster but at the cost of potentially triggering a deeper recession. A more gradual approach minimizes recession risks but risks allowing inflation to become entrenched.

Conclusion: Evaluating the Debate – Is the Bank of Canada's Approach Truly "Too Timid, Too Late?"

David Rosenberg's critique of the Bank of Canada's monetary policy highlights a crucial debate within the economic community. His concerns about a delayed response to inflation and potential policy errors are significant. Conversely, the Bank of Canada's defense rests on a data-driven approach aimed at mitigating the risks of a severe recession. The ultimate impact of the Bank of Canada's actions remains to be seen, and the unfolding economic situation will be a crucial test of their strategy. The complexity of monetary policy decision-making requires careful consideration of many factors, making a definitive judgment challenging.

Stay informed about the ongoing debate surrounding the Bank of Canada's monetary policy and share your thoughts on whether its approach is truly "too timid, too late."

Featured Posts

-

River Road Construction Cripples Louisville Restaurants A Call For Support

Apr 29, 2025

River Road Construction Cripples Louisville Restaurants A Call For Support

Apr 29, 2025 -

La Parita Sul Posto Di Lavoro Una Realta Ancora Lontana

Apr 29, 2025

La Parita Sul Posto Di Lavoro Una Realta Ancora Lontana

Apr 29, 2025 -

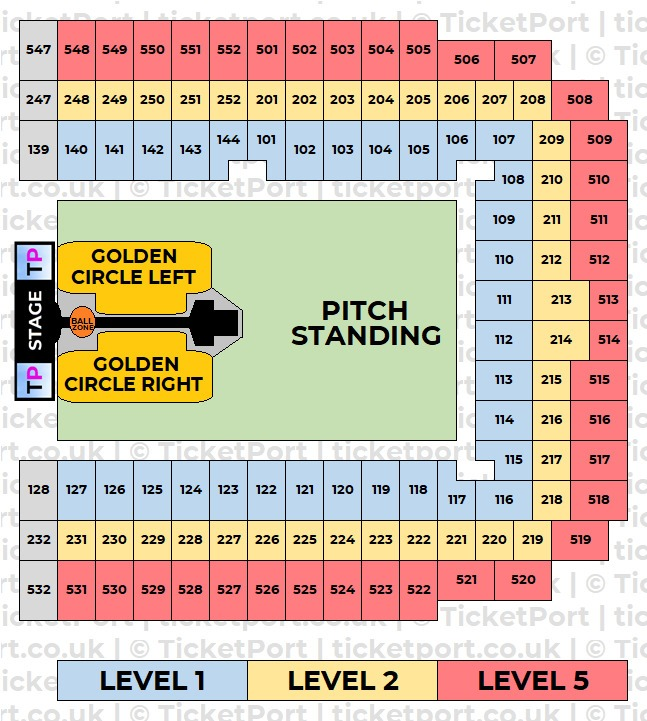

Your Guide To Obtaining Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Your Guide To Obtaining Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

Las Vegas Police Search For Missing British Paralympian A Week Of Uncertainty

Apr 29, 2025

Las Vegas Police Search For Missing British Paralympian A Week Of Uncertainty

Apr 29, 2025 -

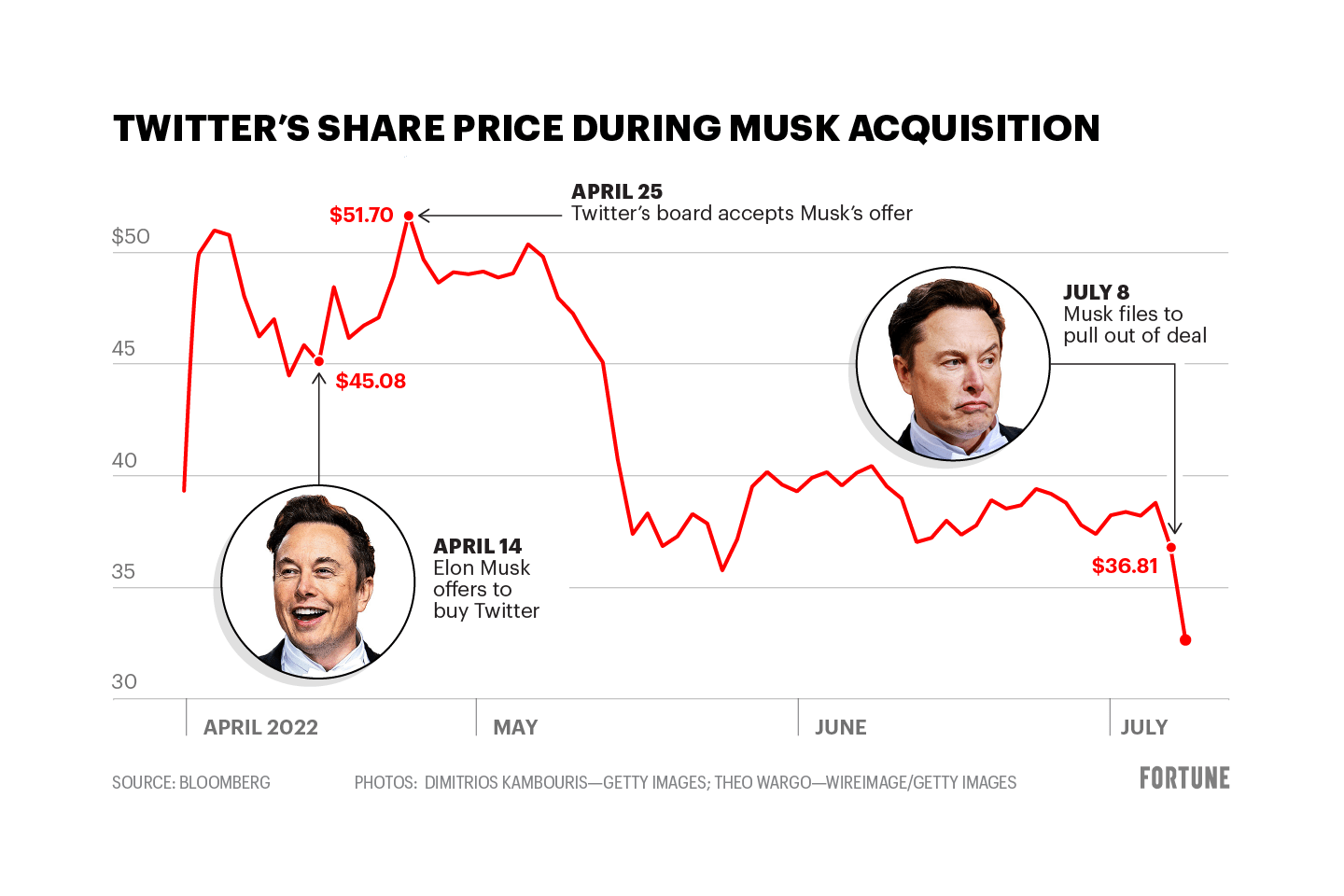

New X Financials After Musks Debt Sale A Detailed Look

Apr 29, 2025

New X Financials After Musks Debt Sale A Detailed Look

Apr 29, 2025